SANTA ANA, Calif., Feb. 24, 2022 (GLOBE NEWSWIRE) -- A new analysis from Polygon Research and Homeownership Council of America shows the states with the largest and smallest homeownership gaps by race and ethnicity compared to the statewide rate.

Homeownership is the most significant driver of wealth. Ensuring equal access to it remains crucial to economic stability. The gap between Black and White homeownership rates is nearly the same today as in the 1970s when the Fair Housing Act (FHA) and Equal Credit Opportunity Acts (ECOA) were enacted. Another Federal law, the Community Reinvestment Act (CRA), enacted in 1977 to encourage banks to invest in low-income communities, has not brought more parity to homeownership in race and ethnicity.

This information helps organizations like the Homeownership Council of America (HCA) focus a lens on areas of greatest need in the nation. HCA is a Santa Ana, CA-based national nonprofit dedicated to delivering better credit access in America's underserved communities. HCA has been working to establish Special Purpose Credit Programs with nonprofit and corporate mortgage lenders. Special Purpose Credit Programs (SPCPs) are described under the Equal Credit Opportunity Act statute. According to HUD, SPCPs are special lending programs that allow lenders and other groups to direct financial aid to groups historically locked out of homeownership, helping to reduce the racial and ethnic gap in homeownership.

"The need to fill the gap is especially pressing in a time when home costs are rising, and the supply is not keeping pace with the demand. Ensuring communities of color attain homeownership as soon as possible provides them with the most equity gain," said Gabe del Rio, CEO and President of Homeownership Council of America. "We are prioritizing our work in Special Purpose Credit Programs based on this information. We want to share it widely with the industry so others can establish SPCP programs as well."

The data analysis was prepared by Polygon Research, a Washington, DC-based mortgage data science company focused on providing data analytics consulting services and leveraging open data. Polygon Research serves leading housing and real estate finance stakeholders with multiple market intel apps addressing every aspect of a mortgage transaction.

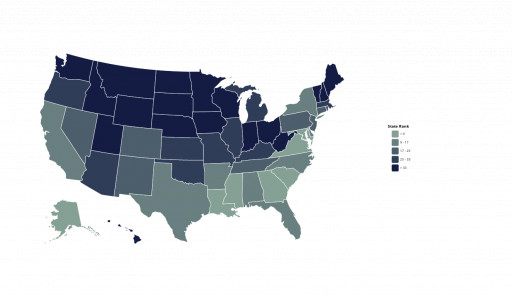

Polygon Research used their product CensusVision, which compiles information from the 2019 one-year American Community Survey (ACS). Polygon's methodology compares race and ethnicity with the state's overall homeownership rate at the household level.

Lyubomira Buresch, Polygon Research's Founder and CEO, explains the analysis' methodology, "Our approach was to look at homeownership levels by race and ethnicity within each state and to compare this with the state's overall homeownership rate. This information gives us a snapshot of the balance between renting and owning for each group regardless of the size of that group within a state. We believe this is an important starting point for stakeholders who are working to change this balance."

Where does your state rank? https://homeownershipcouncil.org/racial-homeownership-gap

###

Press Contacts

Homeownership Council of America

Gabe del Rio

(202) 577-6751

Polygon Research

Lyubomira Buresch

(202) 844-2720

Related Images

Image 1: Black Homeownership Map

Heat map showing states by black homeownership rates

This content was issued through the press release distribution service at Newswire.com.

Attachment