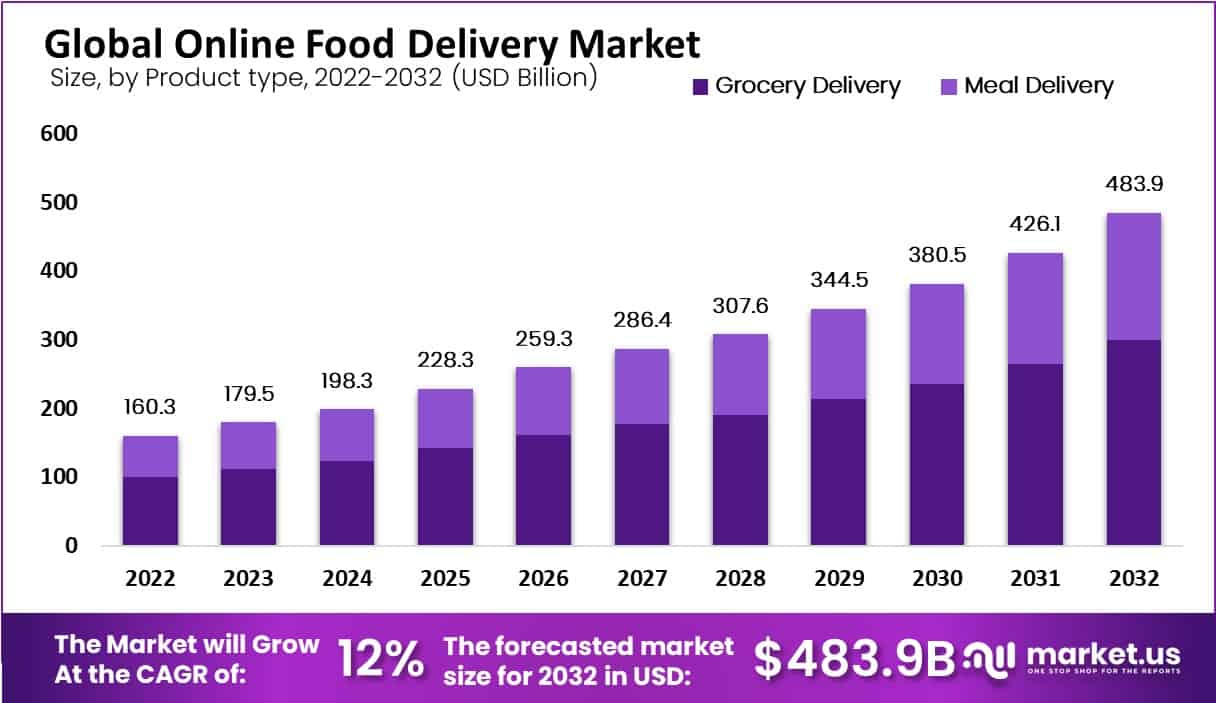

New York, April 26, 2023 (GLOBE NEWSWIRE) -- The Online Food Delivery Market generated a value of USD 160.3 billion in 2022 and is estimated to reach USD 483.9 billion by 2032. The industry is expected to achieve a compounded annual growth rate (CAGR) of 12% from 2023 to 2032.

Customers may use a digital platform to buy meals from their preferred restaurants in the constantly expanding online food delivery business. Customers frequently explore a range of restaurants and menus on a meal delivery app or website, select their favorite goods, and then make an order. The platform's users often make payments with a credit card or another kind of electronic payment. Platforms for ordering meals online have limited advantages for both customers and establishments. Customers may quickly search for and order meals from a range of eateries, and those establishments can grow their clientele and boost sales without having to invest in delivery infrastructure. The market for online food delivery is not without its difficulties, though.

To get additional highlights on major revenue-generating segments, Request an Online Food Delivery Market sample report at https://market.us/report/online-food-delivery-market/request-sample/

Key Takeaway:

- By product type, the grocery delivery segment held the largest market share in 2022.

- By type, the platform-to-consumer delivery segment held the largest market with a 65% share.

- By platform type, the mobile applications segment held the largest market share in 2022.

- By business model, the order-focused food delivery system segment is estimated to dominate the global online food delivery market.

- In 2022, Asia Pacific dominated the global online food delivery market with a 37% market share.

- Europe is anticipated to have the highest CAGR among all the regions.

Factors affecting the growth of the online food delivery market

The development of the online food delivery market is impacted by a number of variables, including:

- Convenience: Thanks to online food delivery services, customers can place food orders from their favorite restaurants without ever leaving their homes or places of business. For consumers who are too busy to prepare or go out to eat, this element is especially crucial.

- Restaurant sector growth: A broader client base and more options for customers have been made possible by the rise in restaurant partnerships with online food delivery services.

- Technology improvements: Customers may now make orders and receive their meals more quickly and easily thanks to improvements in the efficiency of online food delivery services.

- COVID-19 pandemic: COVID-19 has led to a surge in demand for online food delivery services as people avoid public places and opt for home delivery instead. More individuals are turning to food delivery services as a safer option for eating out as a result of lockdowns and social isolation policies. Due to the increase in demand for food delivery caused by this, several companies had to act rapidly to satisfy it.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/online-food-delivery-market/#inquiry

Top Trends in The Online Food Delivery Market

With growing up awareness of the impact of food on health and the environment, there is an increasing demand for healthy & sustainable food options. This trend is driving more restaurants and food delivery companies to offer many plant-based, organic, and locally sourced food options. Technology is playing a growingly crucial role in the online food delivery market, with the use of AI, machine learning, and data analytics to optimize the delivery process and improve the user experience. This includes the use of chatbots, voice assistants, and mobile apps to create ordering and delivery more seamless.

Market Growth

The growth of the online food delivery market can be attributed to various factors, including the increasing adoption of smartphones and the internet, busy lifestyles, and changing eating habits. Additionally, the COVID-19 pandemic has accelerated the shift towards online food delivery services as people avoid public places and opt for home delivery instead. The research also emphasizes the rising demand for online food delivery services in the Asia Pacific region, where markets in nations like China, India, and Southeast Asia have experienced rapid expansion. In addition to other factors, it is anticipated that rising demand, growing restaurant alliances, and technological developments will propel the expansion of the worldwide online food delivery market.

Regional Analysis

With a market share of 37% and the highest projected CAGR during the projection period, Asia Pacific is predicted to be the most lucrative region in the global online food delivery market. Due to the market's emphasis on accessibility and ease, many customers favor smartphone payments. Europe's food transportation industry is varied, with each nation having its distinctive traits. Companies like Just Eat, Deliveroo, and Uber Eats control the industry. In the European market, there is a tendency towards tastier and more environmentally friendly food choices.

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 160.3 Billion |

| Market Size (2032) | USD 483.9 Billion |

| CAGR (from 2023 to 2032) | 12% |

| Asia Pacific Revenue Share | 37% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

Online food delivery firms have made substantial investments in technology, such as smartphone apps, robotics, and artificial intelligence, to provide customers with a seamless and simple experience. Customers may easily access online food delivery services and make food orders while on the go thanks to the widespread usage of smartphones. To draw and keep consumers, online food delivery companies frequently run sales and promos, which has fueled the market's expansion. Online food delivery services make it simple for customers to discover and try new cuisines by providing a broad range of culinary choices, from regional meals to foreign cuisine.

Market Restraints

There are many companies vying for market share in the fiercely competitive Internet food service industry. Due to the rivalry, profit margins may be low and development prospects may be few. To transport food to customers swiftly and effectively, online food service companies depend on delivery logistics. For lesser market participants, delivery logistics can be difficult and costly because of their complexity. It can be difficult to ensure food quality and safety during transportation, particularly for eateries and delivery services that receive a lot of orders. It can be challenging for online food delivery platforms to keep customers because consumers might not be loyal to a specific platform or eatery and might move to a rival based on price or convenience.

Market Opportunities

The market for online food delivery is a consistently expanding sector that offers substantial business potential. This industry is anticipated to expand over the future years due to the growing popularity of meal service apps and internet orders. The possibility for companies to reach a larger audience is another benefit of the online food delivery service industry.

Grow your profit margin with Market.us - Purchase This Premium Report at https://market.us/purchase-report/?report_id=100603

Report Segmentation of the Online Food Delivery Market

Product Type Insight

In the worldwide internet food delivery industry, the shopping delivery sector is the most profitable. In 2022, the market for internet food delivery will have a total revenue share of 62% for the grocery service variety. Customers who use this transportation service will receive groceries and other domestic necessities. The food delivery businesses Instacart, Shipt, and Amazon Fresh are a few examples. Customers who use food delivery services receive pre-measured, prepared materials and recipes, which they then use to prepare the dishes themselves. Meal packages delivery services like Blue Apron, HelloFresh, and Home Chef are a few examples.

Type Insight

Platform-to-consumer delivery and eatery-to-consumer delivery are two types of market segments. With the biggest revenue share of 65% for the forecast period, the platform-to-consumer distribution sector is anticipated to be the most lucrative one in the global online food delivery market. This kind of service entails a platform that collaborates with numerous eateries to give customers transportation of their menus. The purchasing, handling of payments, and logistics of transportation are handled by the website.

Platform Insight

Mobile applications and websites make up the two main segments of the online food delivery market, according to platform type. In the global online food delivery market, the mobile applications category is the most profitable of these. In 2022, the market for online food delivery will have a total revenue share of 73% for mobile applications. Owing to mobile apps are the most popular platform for online food delivery services. Users can obtain an app from a delivery company like Uber Eats, DoorDash, or Grubhub to explore restaurants, place orders, and monitor deliveries on their devices.

Business Model Insight

The market is segmented into three categories based on business models: order-focused, logistics-focused, and restaurant-specific meal transportation systems. The market for Internet food service is dominated by business models that order focused. A meal delivery service that focuses on taking orders and works with several eateries to give consumers their options. The restaurants handle the logistics of food preparation and transportation, while the website manages the purchasing and payment handling.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at https://market.us/report/online-food-delivery-market/request-sample/

Market Segmentation

Based on Product Type

- Grocery Delivery

- Meal Delivery

Based on the Type

- Platform To Consumer Delivery

- Restaurant To Consumer Delivery

Based on the Platform Type

- Mobile Applications

- Websites

Based on the Business Model

- Logistics-focused Food Delivery System

- Order-focused Food Delivery System

- Restaurant-specific Food Delivery System

By Geography

- North America

-

- The US

- Canada

- Mexico

- Western Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

-

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The food delivery market is highly competitive, with the highest number of players operating in different regions of the world. Uber Eats is one of the biggest players in the food delivery industry, with a global market share of around 30%. The company operates in over 6,000 cities worldwide and partners with over 500,000 restaurants.

Some of the major players include:

- Doordash Inc.

- com Group B.V.

- Roofoods Limited (Deliveroo)

- Grubhub Inc.

- Delivery Hero SE

- Uber Technologies Inc.

- com Inc.

- Zomato Limited

- Domino’s Pizza Inc.

- Papa John's International Inc.

- Pizza Hut

- McDonald's Corp.

- Other Key Players

Recent Development of the Online Food Delivery Market

- March 2022, Zomato, an Indian food delivery company, acquires drone startup TechEagle Innovations to develop a drone delivery network.

- In February 2022, Uber Eats announces a partnership with Sainsbury's, a UK-based supermarket chain, to offer grocery delivery services.

Browse More Related Reports:

- Fresh Food Market size was USD 3,200 Bn in 2022 and is expected to reach USD 4,828.7 Bn by 2032 at a CAGR of 4.2% over the forecast period of 2023-2032.

- Meal Kit Delivery Services Market was valued at USD 16,121 million in 2022. It is estimated to experience a compound annual growth rate of 16.8% between 2023 and 2032.

- Delivery and Takeaway Food Market size was valued at USD 192.22 Billion in 2021 and is projected to reach USD 466.01 Billion by 2030

- Same-day Delivery Market is expected to grow at a CAGR of 20% over the next ten years and will reach USD 42.26 Bn in 2032, from USD 6.66 Bn in 2022.

- Ready Meals Market is expected to grow at a CAGR of roughly 5.2%. It will reach USD 244.6 Bn in 2032, from USD 149.2 Bn in 2022.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: