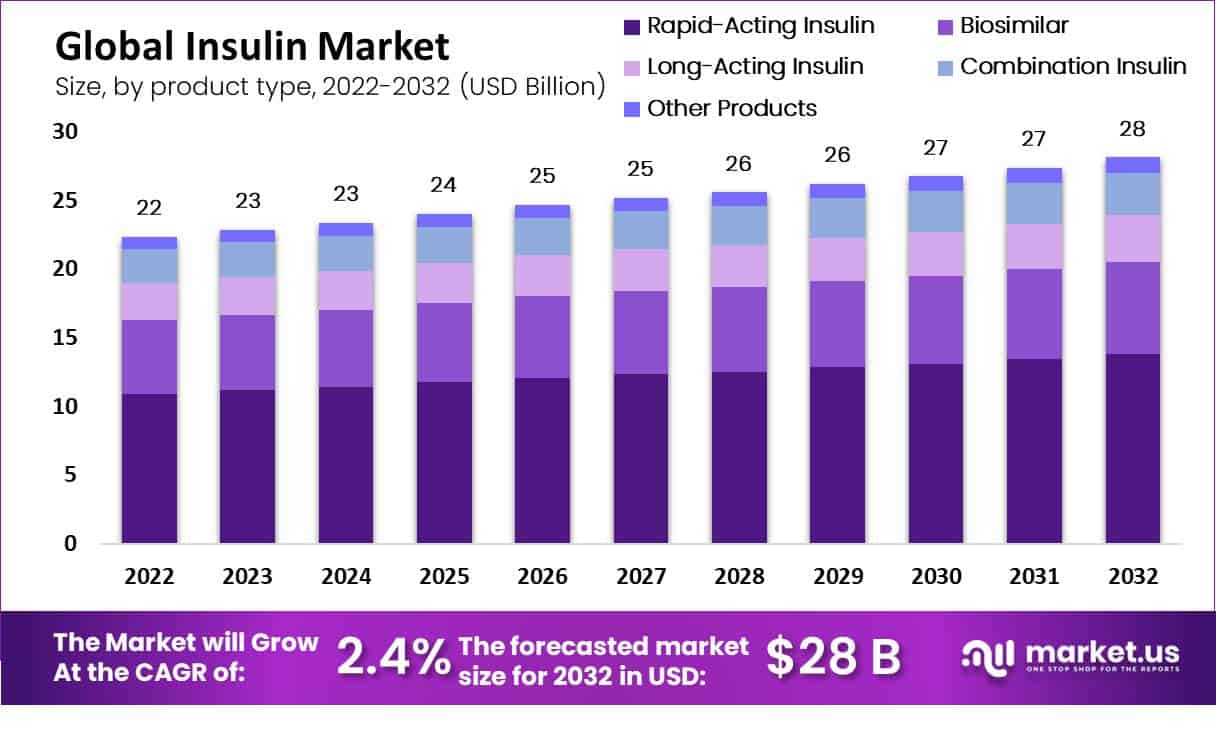

New York, May 08, 2023 (GLOBE NEWSWIRE) -- The global insulin market size was estimated at USD 22 billion in 2022 and is expected to reach around USD 28 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 2.4% during the forecast period 2022 to 2032. The insulin market is a rapidly growing segment of the pharmaceutical industry, as insulin is a critical medication for the treatment of diabetes. Diabetes is a chronic disease characterized by high blood sugar levels, and insulin is a hormone that helps regulate blood sugar levels. The insulin market is dominated by large companies, notably Novo Nordisk, Sanofi, and Eli Lilly and Company. These businesses manufacture a variety of insulin products, such as intermediate-acting, rapid-acting, and long-acting insulin.

To remain ‘ahead’ of your competitors, request a sample @ https://market.us/report/insulin-market/request-sample/

Key Takeaway:

- By product type, in 2022, long-acting insulin dominates the market with a 49% market share. Long-acting insulin helps them maintain a constant level of insulin in the body

- By type, the analogy insulin segment dominates the market with 84% market share.

- By application, type 1 Diabetes Mellitus segment dominates the market with a 75% market share.

- By Distribution Channel, the retail pharmacy segment dominates the market with a 48% market share. retail pharmacies are the most common distribution channel for insulin product

- In 2022, North America is estimated to be the most lucrative market in the global insulin market, with the largest market share of 38%

- APAC is anticipated to have the highest CAGR among all the regions.

- APAC is expected to grow at a greater pace owing to the growing diabetes population, bettering healthcare infrastructure as well rising disposable income.

Factors Affecting the Growth of the Insulin Market

There are several factors that can have an impact on the growth of the insulin market industry. Some of these factors include:

- Rising Diabetes Prevalence: A significant factor in the growth of the global insulin market is the growing incidence of diabetes.

- Technological Developments: The development of enhanced insulin formulations and technological developments in insulin delivery systems are fuelling the expansion of the insulin market. For example, the introduction of insulin pens, pumps and inhalers has improved the convenience of administering insulin’s well growing the use of insulin therapy.

- Increasing Obesity Levels: Sedentary lifestyles and rising obesity rates are major factors in the rise in diabetes prevalence, which is propelling the insulin market's expansion.

- Government initiatives: The expansion of the insulin industry is being fuelled by government programs targeted at enhancing diabetes management and expanding access to insulin. To enhance diabetes care also treatment, for instance, some nations have created programs and policies for diabetes control.

- Rising R&D Investments: The pharmaceutical industry's rising R&D expenditures on creating cutting-edge insulin medicines are propelling the expansion of the insulin market. For example, there is more demand for insulin therapy as a result of the introduction of long-acting as well as ultra-rapid-acting insulins.

Interested to Procure the Data? Inquire here at https://market.us/report/insulin-market/#inquiry

Top Trends in the Insulin Market

- Growing demand for faster-acting insulin’s: The demand for Faster-acting insulin’s from patients as they can better control postprandial glucose levels as well as low risk of hypoglycaemia.

- The rising popularity of insulin pens: Insulin pens are getting increasing because of how simple and convenient they are to use.

- Increasing focus on biosimilar insulins: Biosimilar insulins are receiving more attention as a result of their more affordable price compared to branded insulin products.

- The growing use of digital technologies: including insulin pumps or continuous glucose monitoring devices, is on the rise as a way to improve insulin delivery also monitoring.

- Increasing investment in research and development: To create fresh, cutting-edge insulin products, many pharmaceutical companies are spending considerably on research and development.

Market Growth

Over the past few years, the global market for insulin has grown consistently and it is anticipated that this trend would continue in the coming years. The expanding aging population, the rising prevalence of diabetes globally, and rising sedentary lifestyle adoption are some of the factors propelling the growth of the insulin market.

The market for insulin is also anticipated to rise as more people use insulin pens, insulin pumps, also continuous glucose monitors (CGMs). Precision, ease, and flexibility are provided by these devices, which is crucial for diabetics who must regularly monitor as well as control their blood glucose levels. With the creation of new formulations and delivery systems that address specific patient needs, the insulin industry is similar to observing a shift toward personalized treatment. More people have access to individualized therapies; this is anticipated to further fuel market expansion.

Regional Analysis

North America is estimated to be the most lucrative market in the global insulin market, with the largest market share of 38%, Owing to the region's high prevalence of diabetes, the existence of significant market participants, and supportive government programmers to improve diabetes control.

The Asia-Pacific area is anticipated to develop at the fastest rate, partly because of the region's growing diabetes population, bettering healthcare infrastructure as well rising disposable income.

Get a glance at the market contribution of various segments including country and region wise - Download a Sample Report

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 22 billion |

| Market Size (2032) | USD 28 billion |

| CAGR (from 2023 to 2032) | 2.4% |

| North America Revenue Share | 38% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The demand for insulin products is being driven by the fast-rising diabetes prevalence in the world. The World Diabetes Federation estimates that there were 463 million people with diabetes worldwide in 2019 and that number will rise to 700 million by 2045. Growing public knowledge of diabetes also its management has led to an increase in the number of people searching for medical advice as well as care for the condition. The need for insulin products is being driven by this. The development of novel cutting-edge insulin delivery technologies is propelling the expansion of the global insulin market. These devices are becoming more popular among patients because they are more helpful and offer better glycaemic control. Bio-similar insulin products are coming more widely used as a result of their reduced price when compared to branded insulin products. This is encouraging both patients and healthcare professionals to use them. Governments all around the world are implementing initiatives to enhance diabetes management also care. Because of their importance in the management of diabetes, this is increasing the need for products containing insulin.

Market Restraints

The rising price of insulin products is one of the biggest issues the insulin market is now facing. Concern over the high price of insulin has persisted for a while, and calls for more patient-friendly solutions have followed. Along with this, there is a rising demand for insulin as a result of the global rise in diabetes prevalence, which could exert pressure on manufacturers to boost output also lower costs. The regulatory landscape presents another difficulty for the insulin market. Companies must adhere to stringent laws and criteria to sell their insulin products because it is a highly regulated medication. The availability of insulin products may be impacted by regulatory delays or revisions, which can be a time-consuming and expensive procedure.

Market Opportunities

The worldwide insulin market presents a huge range of opportunities for growth and innovation. Type 1 and type 2 diabetes, a serious disorder that affects millions of people worldwide, are treated mostly with insulin. For example, it is anticipated that as the prevalence of diabetes grows, so demand for insulin will increase

One area of opportunity for the global insulin market is the development of fresh and cutting-edge insulin formulations and delivery technologies. For instance, the development of long-acting insulin analogs has fundamentally altered how diabetes is managed, enabling everyday doses and improved blood sugar control. There is a chance that more cost insulin alternatives will be developed, improving access to treatment for people in low-income countries.

Immediate Delivery Available | Buy This Premium Research Report@ https://market.us/purchase-report/?report_id=20942

Report Segmentation of the Insulin Market

Product Type Insight

Based on product type, long-acting insulin dominates the market with a 49% market share. Long-acting insulin helps maintain a constant level of insulin in the body for an extended period usually 24 hours or more. Type 1 also type 2 diabetics both are frequently treated with this drug. Long-acting insulin helps to keep blood sugar constant across the day and night, potentially reducing the risk of diabetic complications. Insulin therapy helps ensure a consistent supply of insulin to the body, decreasing the risk of hypoglycemia or low blood sugar. It can be more convenient to inject long-acting insulin once on daily basis as opposed to many times throughout the day.

The Biosimilar insulin segment is expected to expand during the forecasting period. Clinical experiments are carried out to show that biosimilar insulin is equally secure and efficient at treating diabetes as the reference insulin product. These tests must be planned to find clinically significant variations between the reference and bio-similar products in patients with various types and stages of diabetes.

Type Insight

By type, the analog insulin segment dominates the market with an 84% market share. Insulin analogs are a type of insulin that is created to closely resemble the natural insulin produced by the pancreas in comparison to traditional insulin formulations. They are produced by making minor adjustments to the human insulin molecule's amino acid sequence, resulting in a molecule with modified pharmacokinetic also pharmacological features.

In comparison to conventional insulin formulations, insulin analogies provide a number of benefits, such as more controlled absorption and fewer hypoglycaemias spell. These may not be covered by all insurance policies as well they are also more expensive.

Application Insight

Based on application, the type 1 Diabetes Mellitus segment dominates the market with a 75% market share. Insufficient insulin production occurs as a result of Type 1 Diabetes Mellitus (T1DM) is a long-term autoimmune condition that affects the pancreas' insulin-producing cells. The amount of blood sugar in the body is managed by the hormone insulin. Without enough insulin, blood sugar levels can raise to risky levels and also cause several issues. Insulin therapy is necessary for T1DM patients to survive. The number of people with T1DM diagnoses is predicted to rise and more people with T2DM are expected to utilize insulin therapy, which will fuel the growth of the worldwide insulin market.

Distribution Channel Insight

Based on the distribution channel, the retail pharmacy segment dominates the market with a 48% market share. Retail pharmacies are the most common distribution channel for insulin products. Retail pharmacies buy insulin products from wholesalers as well as producers, these pharmacies included the drug, independent pharmacies, and supermarkets. Retail pharmacies are open longer hours to provide clients with convenience as well as make it simple for patients to get insulin products.

Market Segmentation

Based on Product Type

- Rapid-Acting Insulin

- Long-Acting Insulin

- Combination Insulin

- Biosimilar

- Other Products

Based on Type

- Human Insulin

- Insulin Analog

Based on Application

- Type 1 Diabetes Mellitus

- Type 2 Diabetes Mellitus

Based on Distribution Channel

- Hospitals

- Retail Pharmacies

- Other Distribution Channel

By Geography

- North America

-

- The US

- Canada

- Mexico

- Western Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

-

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

This competitive landscape of the insulin market provides information about a competitor. Information includes company overview, financials, revenue generated, and investment in research and developing new markets. Production capacities, production sites, Global presence, facilities, strengths and weaknesses of the company, product launch, product breadth and width, and application dominance. This is boosting the target market growth.

Some of the major players include:

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Biocon Ltd

- Wockhardt Ltd

- Boehringer Ingelheim International GmbH

- Julphar

- United Laboratories International Holdings Limited

- Tonghua Dongbao Pharmaceutical Co. Ltd.

- Ypsomed AG

- Braun Melsungen AG

- Biodel Inc

- Shanghai Fosun Pharmaceutical Co Ltd

- Tonghua Dongbao

- Other key Players

Recent Development of the Insulin Market

- In Aug 2021- The U.S. Food and Drug Administration (FDA) approved an expanded label for Lyumjev, a rapid-acting insulin from Eli Lilly and Company that is indicated to improve glycemic control in adults with type 1 and type 2 diabetes. This label now includes instructions for administration using an insulin pump and continuous subcutaneous insulin infusion.

- In July 2021- The United States approves Semglee, a groundbreaking insulin product manufactured by Biocon in India. Semglee, created by Bengaluru-based Biocon Biologics, is interchangeable with and biosimilar to Lantus, a long-acting insulin product that has already received US approval.

Browse more related reports

- Automated Insulin Delivery Devices Market is projected to reach a valuation of USD 28.87 billion by 2032 at a CAGR of 7.9%

- CIS Insulin Market is expected to be worth around USD 593.62 million by 2032 from USD 466 million in 2022, growing at a CAGR of 2.45%

- Mobile Hospitals Market is projected to reach a valuation of USD 786,620 Mn by 2032 at a CAGR of 22.3%, from USD 859,20 Mn in 2021.

- Compounding Pharmacies Market is expected to grow at a CAGR of 6.2%.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: