Dublin, Nov. 03, 2023 (GLOBE NEWSWIRE) -- The "Global Mutual Fund Assets Market Size, Share & Trends Analysis Report, 2023-2030" report has been added to ResearchAndMarkets.com's offering.

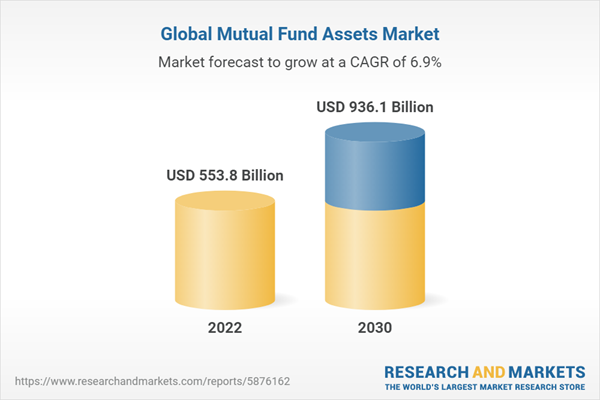

The global mutual fund assets market is on a trajectory for impressive growth, with projections indicating it will reach a market size of USD 936.1 billion by 2030. This growth is driven by a substantial compound annual growth rate (CAGR) of 6.9% from 2023 to 2030, underpinned by several key factors.

One of the primary drivers of this growth is the advancements in technology and the proliferation of online investment platforms. These platforms have revolutionized the investment landscape, making it easier for investors to research, compare, and invest in mutual funds. The convenience of online investing, combined with features like automated portfolio management and goal-based investing, has not only attracted a broader investor base but also expanded the reach of mutual funds. Furthermore, the growth of retirement savings and pension plans has added significant momentum to the market, as individuals and organizations prioritize long-term financial planning and wealth accumulation.

The popularity of mutual funds as a wealth accumulation tool is further reinforced by their accessibility through retirement plans, such as 401(k) plans in the United States. This accessibility has made mutual funds a go-to choice for retirement savers. Regulatory frameworks and investor protection measures also play a pivotal role in driving market growth by enhancing investor confidence. Regulators establish guidelines and requirements for mutual funds, ensuring transparency, accountability, and fair treatment of investors, which in turn fosters trust and encourages more individuals and institutions to invest in mutual funds.

Additionally, the economic stimulus measures implemented by governments globally in response to the COVID-19 pandemic have had a positive impact on the global market. Measures such as reduced interest rates and fiscal stimulus packages have created a favorable investment environment, resulting in increased inflows into mutual funds. The recovery of financial markets after the initial pandemic-induced volatility has boosted investor confidence and spurred them to allocate their funds to mutual funds for potential returns.

Key Highlights of the Mutual Fund Assets Market:

- Equity Strategy Dominance: The market was led by the equity strategy segment in 2022, reflecting the appeal of equity investments for investors seeking long-term capital appreciation. Equity mutual funds provide exposure to company stocks, allowing investors to benefit from potential market gains.

- Open-Ended Versatility: The open-ended segment took the lead in 2022 due to its ability to offer a broader range of investment options, including equity, fixed-income, balanced, and specialty funds. This diversity empowers investors to create customized portfolios aligned with their risk tolerance and investment preferences.

- Rise of Financial Advisors: The financial advisor segment is poised for significant growth from 2023 to 2030. Financial advisors play a pivotal role in guiding fund selection, portfolio diversification, and ongoing management, providing investors with informed decision-making support.

- Active Management Confidence: Active management dominated the market in 2022, offering a sense of accountability and responsibility as fund managers actively monitor and make investment decisions on behalf of investors. This active approach instills confidence and trust in the fund management team.

- Institutional Recognition: The institutional segment is witnessing notable growth as institutional investors increasingly recognize the benefits of outsourcing investment management to professional fund managers.

- North American Dominance: In 2022, North America established itself as the market leader, primarily due to its robust regulatory framework and investor protection measures. These regulations ensure transparency, accountability, and fair treatment of investors, solidifying the dominance of mutual funds in the region.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 130 |

| Forecast Period | 2022-2030 |

| Estimated Market Value (USD) in 2022 | $553.8 Billion |

| Forecasted Market Value (USD) by 2030 | $936.1 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

Key Topics Covered

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Market Variables, Trends, and Scope

Chapter 4. Mutual Fund Assets Market: Investment Strategy Estimates & Trend Analysis

Chapter 5. Mutual Fund Assets Market: Type Estimates & Trend Analysis

Chapter 6. Mutual Fund Assets Market: Distribution Channel Estimates & Trend Analysis

Chapter 7. Mutual Fund Assets Market: Investment Style Estimates & Trend Analysis

Chapter 8. Mutual Fund Assets Market: Investor Type Estimates & Trend Analysis

Chapter 9. Mutual Fund Assets Market: Regional Estimates & Trend Analysis

Chapter 10. Competitive Landscape

Companies Mentioned

- BlackRock, Inc.

- The Vanguard Group, Inc.

- Charles Schwab & Co. Inc.

- JPMorgan Chase & Co.

- FMR LLC

- State Street Corporation

- Morgan Stanley

- BNY Mellon Securities Corporation

- Amundi US

- Goldman Sachs

- Franklin Templeton

For more information about this report visit https://www.researchandmarkets.com/r/r511hf

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment