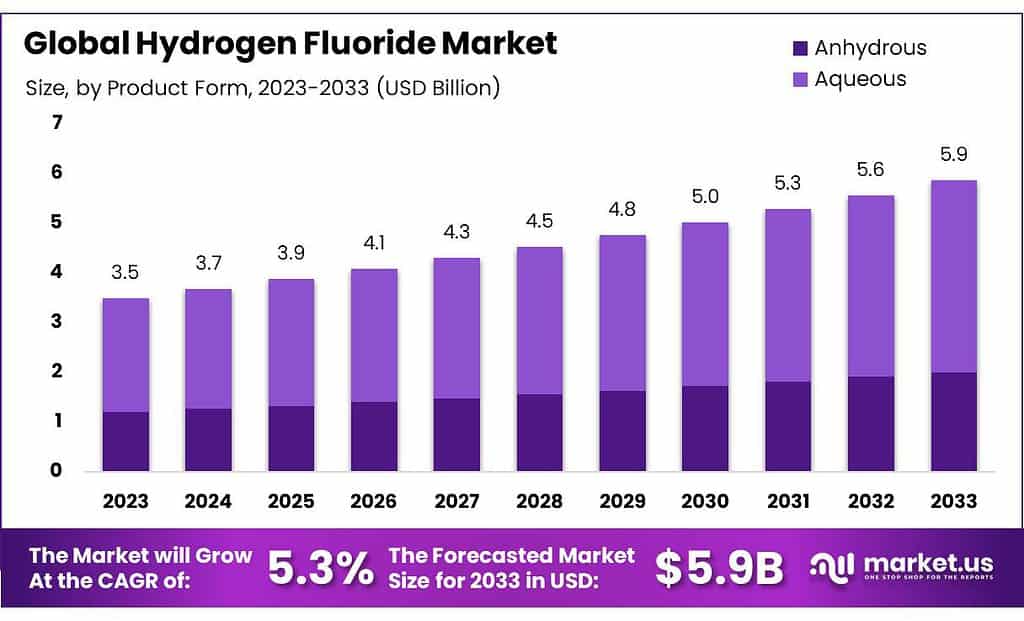

New York, Jan. 17, 2024 (GLOBE NEWSWIRE) -- According to the market.us, the Hydrogen Fluoride Market size is expected to reach around USD 5.9 billion by 2033, showing a significant increase from USD 3.5 Billion in 2023. This signifies a consistent growth rate of 5.3% from the year 2024 to 2033.

Hydrogen fluoride, often represented by its chemical formula HF, is an inorganic compound that is used as a key raw material in various industrial applications. The hydrogen fluoride market encompasses the production, distribution, and consumption of hydrogen fluoride in its various forms, including anhydrous (dry) hydrogen fluoride and aqueous solutions, commonly known as hydrofluoric acid.

Discover growth opportunities and assess market potential with a comprehensive market overview. Download our sample now and stay ahead of the curve: https://market.us/report/hydrogen-fluoride-market/request-sample/

Key Takeaway

- In 2023, the global hydrogen fluoride market was valued at US$ 3.5 Billion, with a projected 3% CAGR.

- Synthetic sources accounted for a significant 5% market share in 2023.

- The aqueous product form dominated, holding an 8% market share in 2023.

- Refrigerants were a major application, contributing to 5% of the market's revenue in 2023.

- Asia Pacific led the market, boasting the highest revenue share of 4% in 2023.

- China was the top global exporter, shipping over 272 thousand metric tons worth around USD 423 million in 2023.

- Germany followed closely, with hydrogen fluoride exports exceeding USD 95 million.

- South Korea was the leading global importer, with imports valued at approximately USD 191.7 million.

- The United States was the second-largest importer, bringing in around USD 170.44 million of hydrogen fluoride in 2023.

Factors affecting the growth of the Hydrogen Fluoride industry

- Demand from End-Use Industries: The HF industry's growth is significantly driven by demand from its primary consuming sectors, such as the chemical manufacturing industry, petroleum refining, electronics, and the pharmaceutical industry. Growth or decline in these sectors directly impacts HF demand.

- Technological Advancements: Innovations in production processes and applications of HF can lead to more efficient and cost-effective manufacturing methods, opening up new market opportunities and enhancing industry growth.

- Environmental Regulations and Safety Concerns: HF is a highly corrosive and toxic substance. Strict environmental and safety regulations regarding its handling, storage, and transportation can impact production costs and operational practices. Companies need to invest in safety measures, which can affect profitability and market dynamics.

- Global Economic Conditions: The overall economic climate affects industrial activity, which in turn impacts the demand for HF. Economic downturns may lead to reduced industrial production and a subsequent decrease in HF demand.

- Supply Chain and Raw Material Availability: The availability and cost of raw materials, such as fluorite (calcium fluoride), which is essential for HF production, are crucial. Disruptions in the supply chain or fluctuations in raw material costs can significantly impact the industry.

Buy Now this Premium Report to Grow your Business: https://market.us/purchase-report/?report_id=112760

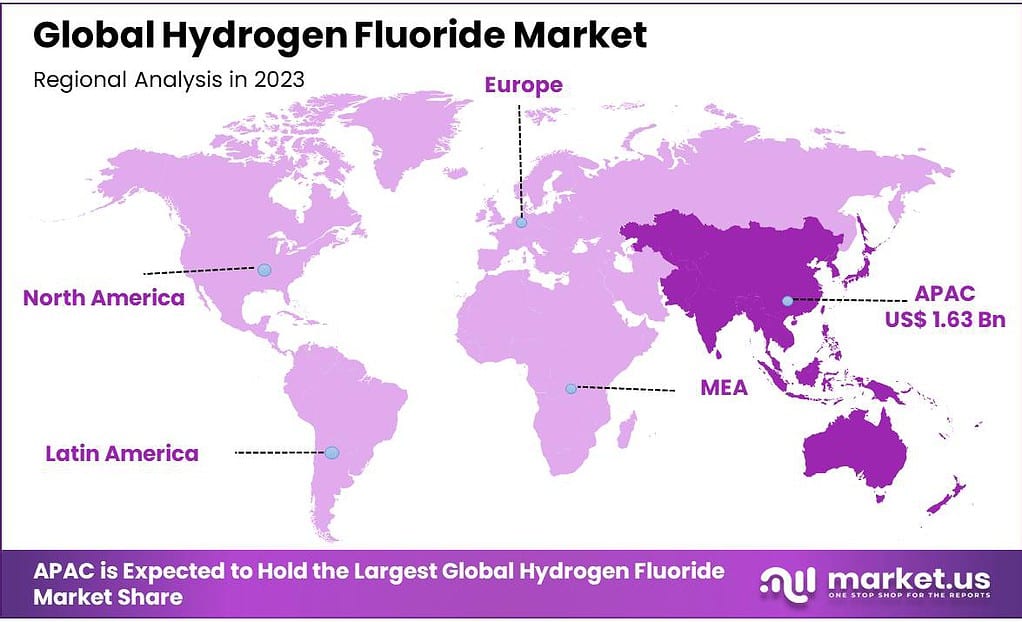

Regional Analysis

In 2023, the Asia Pacific region emerged as a pivotal player in the global hydrogen fluoride market, commanding approximately 46.5% of it. This prominence is largely attributed to the sustained expansion of the consumer goods and chemical industries within the region. The consumer goods sector, particularly the electronics and automotive industries, has seen rapid growth in Asia Pacific, fueling the demand for fluorine chemicals. These chemicals are crucial in metal extraction, metallurgical processes, and the manufacturing of diverse consumer products.

A key factor bolstering this regional dominance is China's position as the world's largest producer of acid-grade fluorspar, the primary raw material for producing anhydrous hydrogen fluoride. This abundance of raw materials underpins the region's leading stance in the hydrogen fluoride market. The demand for fluorine chemicals in the Asia Pacific is on the rise, finding extensive use in various industrial applications such as refrigeration, air conditioning systems, and the production of fluoropolymers and fluoro gases.

China's role is particularly noteworthy in the refrigerant manufacturing sector, where it has gained prominence largely due to the cost-effective feedstocks available from its extensive fluorspar mining operations. This development has been concurrent with an increase in the production of refrigeration and air-conditioning equipment within the country. Collectively, these elements - robust industrial growth, plentiful raw material supply, and escalating demand across numerous industrial sectors - solidify the Asia Pacific region's significant influence in the global hydrogen fluoride market.

To explore the transformative potential of our report for your business strategy, request a brochure at@ https://market.us/report/hydrogen-fluoride-market/#inquiry

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 3.5 Billion |

| Forecast Revenue 2033 | USD 5.9 Billion |

| CAGR (2024 to 2033) | 5.3% |

| Asia Pacific Revenue Share | 46.5% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

- Continuous Regional Growth: Asia Pacific experienced sustained growth in its consumer goods and chemical industries, providing a solid foundation for market leadership.

- Explosive Consumer Goods Sector: The rapid expansion of the consumer goods industry, encompassing electronics and automotive sectors, drove significant demand for hydrogen fluoride.

- Increasing Need for Fluorine Chemicals: Industrial growth in the region resulted in a heightened requirement for fluorine chemicals, essential for processes like metal extraction, metallurgical applications, and the production of various consumer products.

- China's Prominence: China, a pivotal player in the Asia Pacific region, stood as the world's largest producer of acid-grade fluorspar, a crucial raw material for anhydrous hydrogen fluoride production.

- Abundant Raw Material Resources: The region benefited from abundant reserves of essential raw materials, notably fluorspar, reinforcing its stronghold in the hydrogen fluoride market.

Market Restraints

- Environmental Concerns: Growing environmental consciousness led to increased scrutiny of industrial processes involving hydrogen fluoride, necessitating stricter regulations and compliance measures.

- Supply Chain Disruptions: The region experienced occasional disruptions in the supply chain, affecting the availability of raw materials, which impacted production and market stability.

- Price Volatility: Fluctuations in the prices of raw materials, particularly fluorspar, could create challenges for market players, affecting cost structures and competitiveness.

- Competitive Global Landscape: Asia Pacific faced competition from other global players, necessitating continuous innovation and cost-efficiency to maintain market share.

- Geopolitical Factors: Geopolitical tensions and trade disputes could influence the flow of hydrogen fluoride-related products, affecting market dynamics.

Market Opportunities

- Green Technologies: The increasing emphasis on green and sustainable practices opened doors for eco-friendly hydrogen fluoride production methods and applications, aligning with environmental goals.

- Research and Development: Investment in research and development allowed for the exploration of innovative applications of hydrogen fluoride in emerging industries, such as clean energy and advanced materials.

- Infrastructure Development: Rapid infrastructure development in the region, especially in sectors like construction and transportation, created a growing demand for hydrogen fluoride-based products like fluoropolymers and coatings.

- Electronics and Automotive: The thriving electronics and automotive industries offered substantial opportunities for hydrogen fluoride, as it is a key component in semiconductor manufacturing and automotive components.

- Supply Chain Optimization: Streamlining supply chain operations and ensuring a consistent supply of raw materials presented opportunities for cost efficiency and market competitiveness.

Report Segmentation of the Hydrogen Fluoride Market

By Source Analysis

In the global hydrogen fluoride market, the source segmentation includes natural fluorite and synthetic hydrogen fluoride. Remarkably, in 2023, the synthetic segment emerged as the market leader, commanding a substantial market share of 78.5%. Synthetic hydrogen fluoride stands out due to its controlled chemical production processes, guaranteeing unparalleled quality and exceptional purity levels.

These attributes render it highly attractive to industries that demand precise and consistent chemical properties, such as the electronics and semiconductor sectors. Synthetic hydrogen fluoride consistently boasts lower impurity levels compared to its natural fluorite-derived counterpart.

By Product Form Analysis

The global hydrogen fluoride market can be further divided by product form into anhydrous and aqueous variants. Remarkably, in 2022, the aqueous form asserted its dominance, capturing a significant market share of 65.8%. Aqueous hydrogen fluoride stands out for its remarkable versatility, making it a preferred choice across diverse industries.

Its applications span various sectors, including its use in semiconductor industry etching and cleaning processes, aluminum and alloy production, decorative glass etching, and industrial cleaning purposes. This extensive range of applications underpins its commanding position in the market.

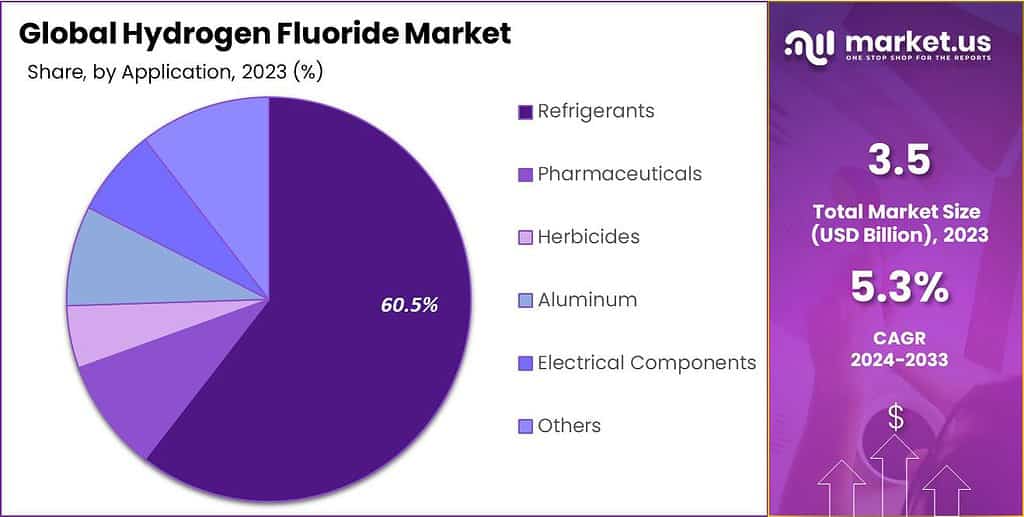

By Application Analysis

The hydrogen fluoride market further segments its applications into refrigerants, pharmaceuticals, herbicides, aluminum, electrical components, and others. Notably, refrigerants emerge as the dominant force, commanding a substantial revenue share of 60.5%. Refrigerants, crucial chemicals in cooling and air conditioning systems, boast widespread usage across diverse industries.

These systems play an indispensable role in maintaining comfortable indoor temperatures in residential spaces, commercial establishments, and vehicles, resulting in a consistent and high demand for refrigerants.

The HVAC (Heating, Ventilation, and Air Conditioning) and refrigeration sectors experience remarkable growth, driven by urbanization, rising temperatures, and the expansion of retail and food industries. This growth is intrinsically linked to the escalating demand for refrigerants.

Get PDF Sample for Technological Breakthroughs@ https://market.us/report/hydrogen-fluoride-market/request-sample/

Recent Developments in the Hydrogen Fluoride Market

- In April 2021, EcoGraf announced its acquisition of a contract for the establishment of a battery anode materials facility designed for the production of spherical graphite. Importantly, this facility is located outside of China and incorporates an environmentally friendly alternative to traditional hydrofluoric acid purification processes.

- In April 2021, Renascor Resources explored green finance alternatives for its Savior Battery Anode Material Project in South Australia. This project aims to facilitate the production of materials intended for electric vehicle manufacturing facilities, employing vertical integration strategies as part of its approach.

Key Market Segmentation

Based on Source

- Natural Fluorite

- Synthetic

Based on the Product Form

- Anhydrous

- Aqueous

Based on Application

- Refrigerants

- Pharmaceuticals

- Herbicides

- Aluminum

- Electrical Components

- Others

- Others

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

These companies are directing investments towards expanding production facilities, either by upgrading existing plants or constructing new ones. This approach aligns with the rising demand for hydrogen fluoride, especially in regions with significant market traction.

A paramount emphasis is placed on research and development efforts to optimize production processes and explore novel applications for hydrogen fluoride. This includes the pursuit of more efficient manufacturing methods and innovative solutions that minimize environmental impacts.

Market Key Players

- Solvay

- Honeywell International, Inc.

- Stella Chemifa Corp

- Arkema Group

- Lanxess AG

- Navin Fluorine International Limited

- Foosung Co Ltd

- Fluorchemie Dohna GmbH

- Orbia

- Derivados Del Fluor

- Sinochem Lantian Co., Ltd.

- Fluorsid S.p.A.

- Other Key Players

Browse More Related Reports

- Carbon Capture and Storage Market size was valued at USD 5.5 Billion. This market is estimated to reach USD 18.1 Billion in 2032 the highest CAGR of 13% between 2023 and 2032.

- Frozen Pizza market size is expected to be worth around USD 34.7 billion by 2033, from USD 17.0 billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2023 to 2033.

- Whey Protein Market was worth USD 9.4 billion and is predicted to reach USD 20.0 billion by 2032. It is estimated to grow a CAGR of 8.0% between 2023-2032.

- Baking Ingredients market size is expected to be worth around USD 30.9 billion by 2033, from USD 17.8 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

- Spices and Seasonings market size is expected to be worth around USD 39.1 billion by 2033, from USD 23.5 billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2023 to 2033.

- Smart Mirror Market size was valued at USD 3.8 Billion in 2022 and is expected to reach USD 9.1 Billion in 2032 growing at a CAGR of 9.4% during the forecast period of 2023-2032.

- Pet Food Ingredients market size is expected to be worth around USD 96.1 billion by 2033, from USD 60.15 billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

- Aramid Fiber Market size is expected to be worth around USD 10.4 billion by 2033, from USD 4.9 billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2023 to 2033.

- printing ink market size was valued at USD 21.2 billion and is expected to grow to around USD 30 billion by 2032 between 2023 and 2032, this market is estimated to register the highest CAGR of 3.8%.

- Advanced Ceramics Market size is expected to be worth around USD 19.9 billion by 2033, from USD 11.2 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn

Our Blog: