New York, USA, Feb. 08, 2024 (GLOBE NEWSWIRE) -- Epilepsy Market to Observe Stunning Growth by 2032, Predicts DelveInsight | Key Players in the Market - Xenon Pharmaceuticals, Aquestive Therapeutics, Takeda, Ovid Therapeutics, Eisai, Biohaven Pharmaceuticals, UCB Pharma

The dynamics of the epilepsy market are anticipated to change in the coming years owing to the improvement in the diagnosis methodologies, rising awareness of the disease, incremental healthcare spending across the world, and the expected launch of emerging therapies during the forecast period.

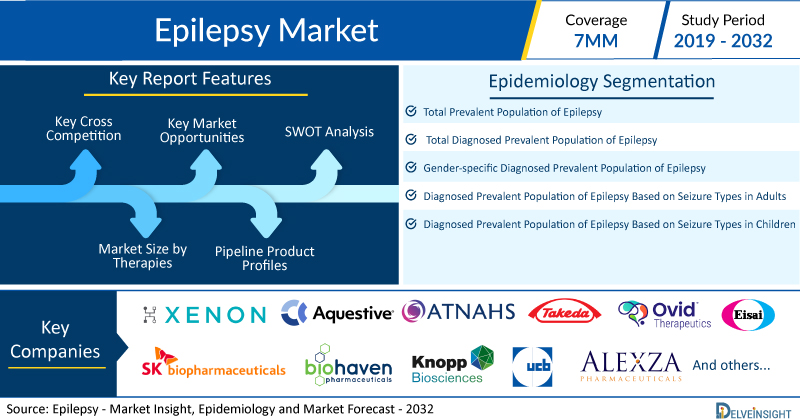

DelveInsight’s Epilepsy Market Insights report includes a comprehensive understanding of current treatment practices, epilepsy emerging drugs, market share of individual therapies, and current and forecasted epilepsy market size from 2019 to 2032, segmented into 7MM [the United States, the EU-4 (Italy, Spain, France, and Germany), the United Kingdom, and Japan].

Key Takeaways from the Epilepsy Market Report

- According to DelveInsight's analysis, the market size for epilepsy reached USD 8.5 billion in 2022 across the 7MM and is expected to grow with a significant CAGR by 2032.

- DelveInsight's analysis reveals that the overall diagnosed prevalent population of epilepsy in the 7MM was reported as 7 million in 2022. Within this, the diagnosed prevalent population of epilepsy patients in the United States specifically was identified to be 48% in the same year.

- Prominent companies working in the domain of epilepsy, including Xenon Pharmaceuticals, Aquestive Therapeutics, Atnahs Pharma (Pharmanovia), Takeda, Ovid Therapeutics, SK Biopharmaceuticals (SK Life Science), Eisai, Biohaven Pharmaceuticals, Knopp Biosciences, UCB Pharma, Alexza Pharmaceuticals, Idorsia Pharmaceuticals, Neurocrine Biosciences, Equilibre Biopharmaceuticals, and others, are actively working on innovative drugs for epilepsy. These novel epilepsy therapies are anticipated to enter the epilepsy market in the forecast period and are expected to change the market.

- Some of the key therapies for epilepsy treatment include XEN1101, LIBERVANT (diazepam buccal film), Soticlestat (TAK-935), COMFYDE (carisbamate), Lorcaserin (E2023), BHV-7000 (KB-3061), STACCATO alprazolam (benzodiazepine), NBI-827104 (ACT-709478), NBI-921352, Ivermectin (EQU-001), and others.

- In September 2023, Aquestive Therapeutics made an announcement regarding the acceptance of its New Drug Application (NDA) for Libervant (diazepam) Buccal Film by the US FDA. This NDA is intended for the treatment of seizure clusters in children aged between two and five years. The assigned PDUFA goal date for a decision on this application is April 28, 2024.

Discover which therapies are expected to grab the epilepsy market share @ Epilepsy Market Report

Epilepsy Overview

Epilepsies encompass a range of brain disorders, spanning from severe, life-threatening, and disabling conditions to those that are more benign. In epilepsy, the normal pattern of neuronal activity is disrupted, leading to unusual sensations, emotions, and behaviors, or in some cases, convulsions, muscle spasms, and loss of consciousness. The causes of epilepsy are diverse, including brain injury, structural abnormalities during brain development, genetic factors, infectious diseases such as meningitis and AIDS, as well as prenatal injury.

Seizures, the primary signs and symptoms of epilepsy, manifest as temporary confusion, staring spells, uncontrollable jerking movements of the arms and legs, loss of consciousness or awareness, and psychic symptoms. Diagnosis involves determining whether an individual has epilepsy and identifying the specific type of seizures they experience. Diagnostic tests include various brain scans like CT, PET, and MRI, as well as blood tests, developmental assessments, neurological examinations, and behavioral tests.

Epilepsy Epidemiology Segmentation

The epilepsy epidemiology section provides insights into the historical and current epilepsy patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The epilepsy market report proffers epidemiological analysis for the study period 2019–2032 in the 7MM segmented into:

- Total Prevalent Population of Epilepsy

- Total Diagnosed Prevalent Population of Epilepsy

- Gender-specific Diagnosed Prevalent Population of Epilepsy

- Diagnosed Prevalent Population of Epilepsy Based on Seizure Types in Adults

- Diagnosed Prevalent Population of Epilepsy Based on Seizure Types in Children

Download the report to understand which factors are driving epilepsy epidemiology trends @ Epilepsy Epidemiological Insights

Epilepsy Treatment Market

The management of epilepsy involves the use of antiepileptic medications (AEDs), dietary interventions, and, in certain cases, surgical procedures. In adults, the initiation of anticonvulsant therapy typically occurs after experiencing two unprovoked epileptic seizures. Given that a significant number of patients respond effectively to a single medication, there is widespread agreement that treatment should commence with the selection of a primary antiepileptic drug. Currently, the preferred approach involves the use of AEDs as monotherapies or in combination, serving as the primary line of treatment. These medications belong to different classes, such as sodium channel inhibitors, calcium channel inhibitors, GABA A receptor agonists, modulators of synaptic vesicle protein SV2A, Na/Ca channel modulators, and blockers of AMPA receptors.

ZTALMY (ganaxolone) stands as the first and omly FDA-approved remedy explicitly designed for seizures linked to CDD in patients aged two and above. Administered orally thrice a day, ZTALMY, a neuroactive steroid functioning as a positive allosteric modulator of the GABAA receptor, has been accessible through a designated specialty pharmacy since July 2022. Notably, in March 2023, the company reported that the US FDA bestowed Orphan Drug Designation (ODD) upon ganaxolone for addressing Lennox-Gastaut syndrome (LGS).

EPIDIOLEX represents the first prescription medication in the form of an oral cannabis derivative, developed by GW Pharmaceuticals (acquired by Jazz Pharmaceuticals in May 2021). This innovative category of antiepileptic drugs operates through a distinct mechanism. It has received approval for addressing seizures linked to Lennox-Gastaut Syndrome or Dravet Syndrome in patients aged 2 years and above, as well as for managing seizures associated with tuberous sclerosis complex (TSC) in patients one year and older.

Learn more about the FDA-approved drugs for epilepsy @ Drugs for Epilepsy Treatment

Key Epilepsy Therapies and Companies

- XEN1101: Xenon Pharmaceuticals

- LIBERVANT (diazepam buccal film): Aquestive Therapeutics/Atnahs Pharma (Pharmanovia)

- Soticlestat (TAK-935): Takeda/Ovid Therapeutics

- COMFYDE (carisbamate): SK Biopharmaceuticals (SK Life Science)

- Lorcaserin (E2023): Eisai

- BHV-7000 (KB-3061): Biohaven Pharmaceuticals/Knopp Biosciences

- STACCATO alprazolam (benzodiazepine): UCB Pharma/Alexza Pharmaceuticals

- NBI-827104 (ACT-709478): Neurocrine Biosciences/Idorsia Pharmaceuticals

- NBI-921352: Neurocrine Biosciences/Xenon Pharmaceuticals

- Ivermectin (EQU-001): Equilibre Biopharmaceuticals

To know more about epilepsy clinical trials, visit @ Epilepsy Treatment Drugs

The epilepsy market dynamics are anticipated to change in the coming years. Several epilepsy centers are actively working to recognize and address pseudo-pharmaco-resistance faced by patients due to AEDs, and the epilepsy pipeline boasts several high-phase drugs, with Libervant and Ganaxolone emerging as the most promising ones, yielding the best results. Despite the availability of several approved therapies, there remains a significant opportunity for novel treatments that can effectively combat the high rate of pharmaco-resistance in epileptic patients. Recent advancements in the understanding of specific rare variations of epilepsy have empowered developers to test novel mechanisms, particularly in high-need patient populations such as Dravet syndrome and LGS.

Furthermore, many potential therapies are being investigated for the treatment of epilepsy, and it is safe to predict that the treatment space will significantly impact the epilepsy market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate are expected to drive the growth of the epilepsy market in the 7MM.

However, several factors may impede the growth of the epilepsy market. The rare epileptic syndromes, such as LGS, Dravet syndrome, and CDD, pose significant challenges due to their extreme complexity and heterogeneity, with multiple etiologies. This complexity results in difficulties in diagnosing the diseases as they evolve over time. Currently, the antiepileptic drugs (AEDs) available in the market offer only symptomatic relief, leaving the diseases incurable and severely impacting the patients' quality of life. Despite the approval of multiple therapies for epilepsy, a majority of patients exhibit resistance to treatment, leading to an increasing burden through polypharmacy practices. The generic nature of the epilepsy market and the rise of non-pharmacological interventions further create obstacles for the entry of novel therapies.

Moreover, epilepsy treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the epilepsy market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the epilepsy market growth.

| Epilepsy Report Metrics | Details |

| Study Period | 2019–2032 |

| Epilepsy Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Epilepsy Market Size in 2022 | USD 8.5 Billion |

| Key Epilepsy Companies | Xenon Pharmaceuticals, Aquestive Therapeutics, Atnahs Pharma (Pharmanovia), Takeda, Ovid Therapeutics, SK Biopharmaceuticals (SK Life Science), Eisai, Biohaven Pharmaceuticals, Knopp Biosciences, UCB Pharma, Alexza Pharmaceuticals, Idorsia Pharmaceuticals, Neurocrine Biosciences, Equilibre Biopharmaceuticals, and others |

| Key Epilepsy Therapies | XEN1101, LIBERVANT (diazepam buccal film), Soticlestat (TAK-935), COMFYDE (carisbamate), Lorcaserin (E2023), BHV-7000 (KB-3061), STACCATO alprazolam (benzodiazepine), NBI-827104 (ACT-709478), NBI-921352, Ivermectin (EQU-001), and others |

Scope of the Epilepsy Market Report

- Epilepsy Therapeutic Assessment: Epilepsy current marketed and emerging therapies

- Epilepsy Market Dynamics: Attribute Analysis of Emerging Epilepsy Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Epilepsy Market Access and Reimbursement

Discover more about epilepsy drugs in development @ Epilepsy Clinical Trials

Table of Contents

| 1. | Epilepsy Market Key Insights |

| 2. | Epilepsy Market Report Introduction |

| 3. | Epilepsy Market Overview at a Glance |

| 4. | Epilepsy Market Executive Summary |

| 5. | Disease Background and Overview |

| 6. | Epilepsy Treatment and Management |

| 7. | Epilepsy Epidemiology and Patient Population |

| 8. | Patient Journey |

| 9. | Epilepsy Marketed Drugs |

| 10. | Epilepsy Emerging Drugs |

| 11. | Seven Major Epilepsy Market Analysis |

| 12. | Epilepsy Market Outlook |

| 13. | Potential of Current and Emerging Therapies |

| 14. | KOL Views |

| 15. | Unmet Needs |

| 16. | SWOT Analysis |

| 17. | Appendix |

| 18. | DelveInsight Capabilities |

| 19. | Disclaimer |

| 20. | About DelveInsight |

Related Reports

Epilepsy Epidemiology Forecast

Epilepsy Epidemiology Forecast – 2032 report delivers an in-depth understanding of the disease, historical and forecasted epilepsy epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

Epilepsy Pipeline Insight – 2023 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key epilepsy companies, including Alexza Pharmaceuticals, Xenon Pharmaceuticals, GW Pharmaceuticals, Equilibre Biopharmaceuticals, Takeda Pharmaceuticals, Abide therapeutics, Otsuka pharmaceutical, H. Lundbeck A/S, Spark Therapeutics, Equilibre Biopharmaceuticals, ES Therapeutics, Supernus Pharmaceuticals, Inc., MGC Pharmaceuticals, Engrail Therapeutics INC, SK biopharmaceuticals, Longboard Pharmaceuticals, Janssen Research & Development, LLC, Equilibre Biopharmaceuticals, Cerevel Therapeutics, LLC, Neurona Therapeutics, Praxis Precision Medicines, UCB Pharma, Receptor Life Sciences, NeuroPro Therapeutics, Inc., Avicanna, Amring Pharmaceuticals Inc., Ovid Therapeutics, Addex Therapeutics, IAMA Therapeutics, CODA Biotherapeutics, Cerebral Therapeutics, Engrail Therapeutics, among others.

Refractory Epilepsy Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key refractory epilepsy companies including Eisai Co.LTD., Alexza Pharmaceuticals, Xenon Pharmaceuticals, among others.

Partial Epilepsy Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key partial epilepsy companies, including GW Pharmaceuticals, Equilibre Biopharmaceuticals, among others.

Refractory Epilepsy Pipeline Insight – 2023 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key refractory epilepsy companies, including Eisai Co.LTD., Alexza Pharmaceuticals, Xenon Pharmaceuticals, among others.

Partial Epilepsy Pipeline Insight – 2023 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key partial epilepsy companies, including GW Pharmaceuticals, Equilibre Biopharmaceuticals, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter