Dublin, Feb. 12, 2024 (GLOBE NEWSWIRE) -- The "Neobanking Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028F" report has been added to ResearchAndMarkets.com's offering.

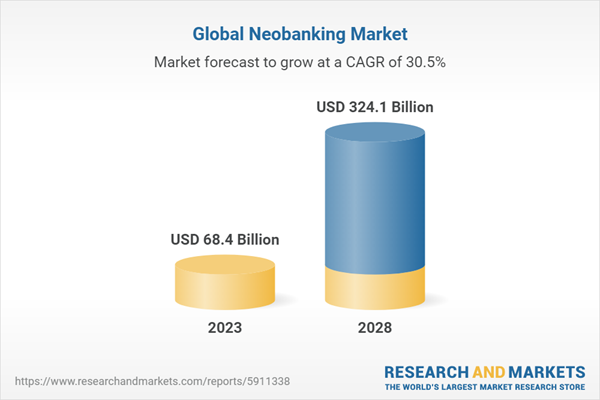

The expanding horizons of the financial sector are witnessing transformative surges with the Global Neobanking Market as it progresses with a formidable Compound Annual Growth Rate (CAGR) of 30.46% between the years 2022 to 2028.

The neobanking landscape, currently valued at USD 68.4 Billion in 2022, is noted for its innovative customer-centric approaches and digital ingenuity which have been pivotal in revolutionizing the traditional banking models. The emergence of neobanks responds to the intensifying demand for seamless, efficient, and accessible financial solutions.

These digital banks - also widely recognized as challenger banks - are characterized by their strategic use of technology to offer a plethora of services such as account management, payments, savings, and investment options through mobile and online platforms.

High Consumer Demand Propels Neobanking Movement

Embracing the digital transformation, consumers across the globe are inclining towards banking solutions that promise convenience and efficiency. Neobanks have responded to this call by offering 24/7 services accessible through smartphones and computers, thus aligning perfectly with today's fast-paced lifestyles.

Technological Advancements at the Core of Neobanking

The neobanking market thrives on technological advancement, utilizing the power of cloud computing, artificial intelligence (AI), and data analytics to provide streamlined operations and personalization at scale which traditional banking entities struggle to deliver.

Fintech Startup Agility Captures Market Sentiments

The agility and innovative capacity of fintech startups have allowed them to readily adapt to technological progress, resulting in a consistent cycle of innovation that caters to consumer demands for responsive and state-of-the-art services.

Geographical Expansion Leads to Market Growth

While neobanks were originally concentrated in specific regions, there has been a marked shift in their geographic outreach. Asia-Pacific, in particular, stands out as a fertile ground for the proliferation of neobanks due to the junction of supportive regulations, a burgeoning middle-class population, and its embracement of digital adoption.

Complex Challenges in the Neobanking Sector

Despite the considerable opportunities, neobanks confront formidable challenges including stringent regulatory compliance demands, cybersecurity threats, and customer acquisition and retention. Moreover, establishing profitability remains an intense challenge for neobanks due to their customer-centric operational tenets that often feature low to zero fees.

Emerging Trends in the Neobanking Landscape

- Expansion of Financial Services Offerings: Neobanks are diversifying their financial services to include investment accounts, insurance, and loans, aiming to offer a comprehensive financial experience to their customers.

- Focus on Personalization and AI-Driven Insights: Leveraging artificial intelligence, neobanks offer personalized financial services and insights by analyzing spending habits and financial goals.

- Green Banking Initiatives: Sustainability and eco-friendly practices have become integral to the operations of many neobanks, appealing to environmentally-conscious consumers.

The report breaks down the Global Neobanking Market into detailed segments, providing a comprehensive analysis that captures industry-specific dynamics. It delves deep into account type insights, separating personal and business accounts, and application insights, focusing particularly on the enterprise and personal segments.

This market analysis brings to light the potential held by the neobanking industry, a market that is dynamically shaping the future of personal and business banking around the world.

As it evolves and responds to consumer demands and technological advancements, the Global Neobanking Market is poised to redefine the banking experience for millions of customers globally. With insights into regional shifts and market drivers, the report stands as a critical resource for stakeholders looking to understand the trajectory of neobanks in contemporary financial ecosystems.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 182 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value (USD) in 2023 | $68.4 Billion |

| Forecasted Market Value (USD) by 2028 | $324.1 Billion |

| Compound Annual Growth Rate | 30.4% |

| Regions Covered | Global |

Report Scope:

In this report, the Global Neobanking Market has been segmented into the following categories:

Neobanking Market, By Account Type:

- Business Account

- Savings Account

Neobanking Market, By Application:

- Enterprise

- Personal

Companies Profiled

- Atom Bank PLC

- Fidor Bank Ag

- Monzo Bank Ltd.

- Movencorp Inc.

- Mybank

- N26

- Revolut Ltd.

- Simple Finance Technology Corp.

- Ubank Limited

- Webank, Inc.

For more information about this report visit https://www.researchandmarkets.com/r/hh7p1u

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment