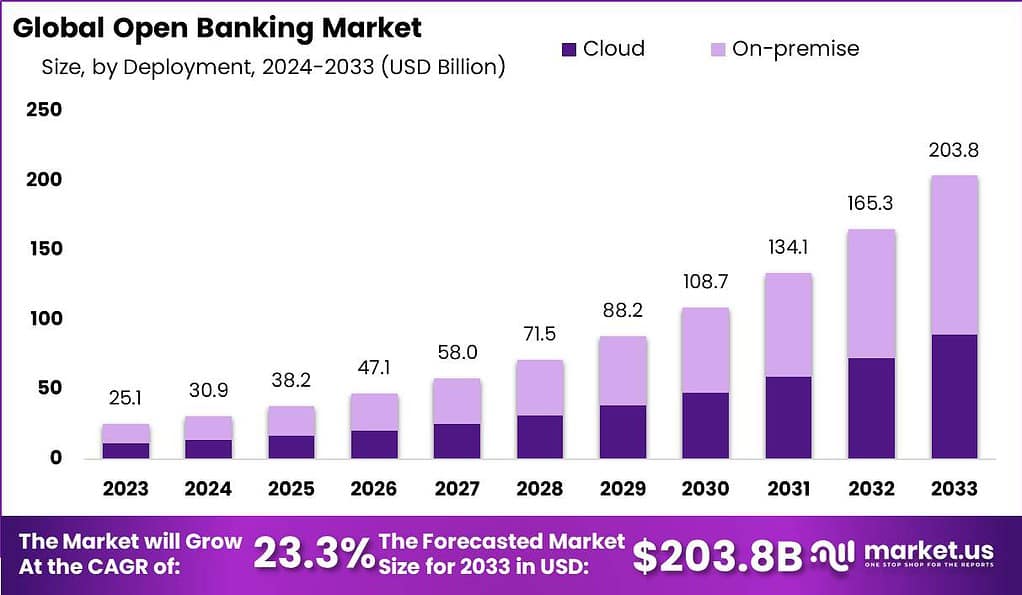

New York, Feb. 15, 2024 (GLOBE NEWSWIRE) -- According to Market.us, The Open Banking Market is experiencing remarkable growth, poised to reach a projected value of USD 203.8 billion by 2033, with a projected compound annual growth rate (CAGR) of 23.3% from 2024 to 2033.

Open banking refers to the practice of sharing financial data and allowing third-party providers to access banking information and initiate transactions on behalf of customers. It is facilitated through the use of open APIs (Application Programming Interfaces) that enable secure data sharing between banks and authorized third-party providers. Open banking aims to foster competition, innovation, and customer-centric financial services by enabling the integration and collaboration of various financial service providers.

The open banking market encompasses the ecosystem of banks, fintech companies, and other financial institutions that participate in open banking initiatives. This market has gained significant traction in recent years, driven by various factors. Firstly, regulatory initiatives such as the Revised Payment Services Directive (PSD2) in Europe and similar regulations in other regions have mandated the implementation of open banking frameworks, creating a favorable environment for market growth.

Tap into Market Opportunities and Stay Ahead of Competitors - Get Your Sample Report Now

Furthermore, the increasing demand for personalized and integrated financial services has fueled the adoption of open banking. Customers seek seamless and customized experiences that bring together various financial products and services from different providers. Open banking enables this integration by allowing customers to access and manage their financial data through a single platform, facilitating personalized recommendations and tailored solutions.

Additionally, the rise of fintech companies and their innovative solutions has been a driving force in the open banking market. Fintech firms leverage open banking APIs to develop innovative products and services, such as payment initiation, account aggregation, and financial management tools. These solutions provide enhanced convenience, efficiency, and value to customers, further accelerating the growth of the open banking market.

Key Takeaways

- The Open Banking Market is anticipated to witness substantial expansion, reaching a projected value of USD 203.8 billion by 2033, with a remarkable compound annual growth rate (CAGR) of 23.3% from 2024 to 2033.

- In 2023, the Open Banking Market witnessed the Banking & Capital Markets Segment leading the way, securing a dominant position with over a 44% share.

- In 2023, the On-premise segment held a dominant position in the Open Banking Market, capturing more than a 56% share.

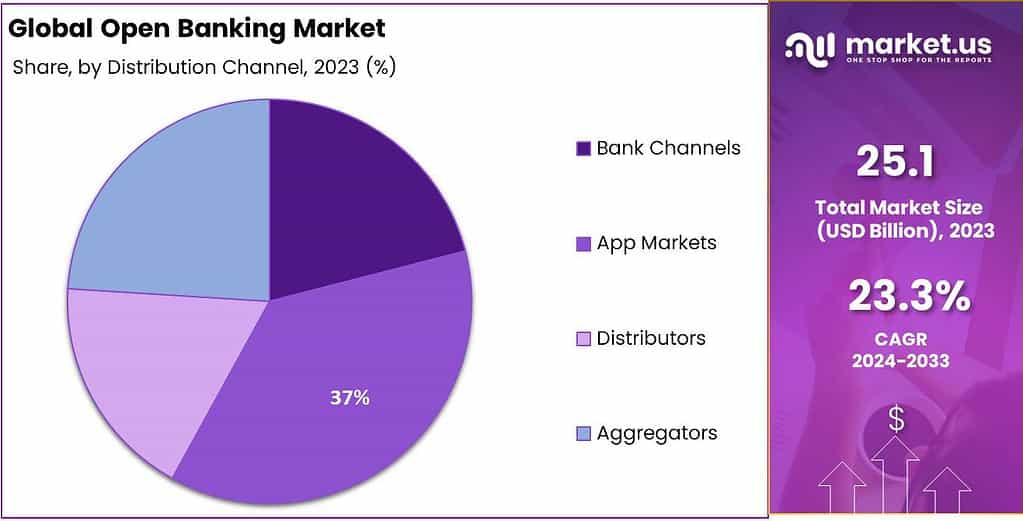

- In 2023, the App Markets segment led the Open Banking Market, capturing over a 37% share.

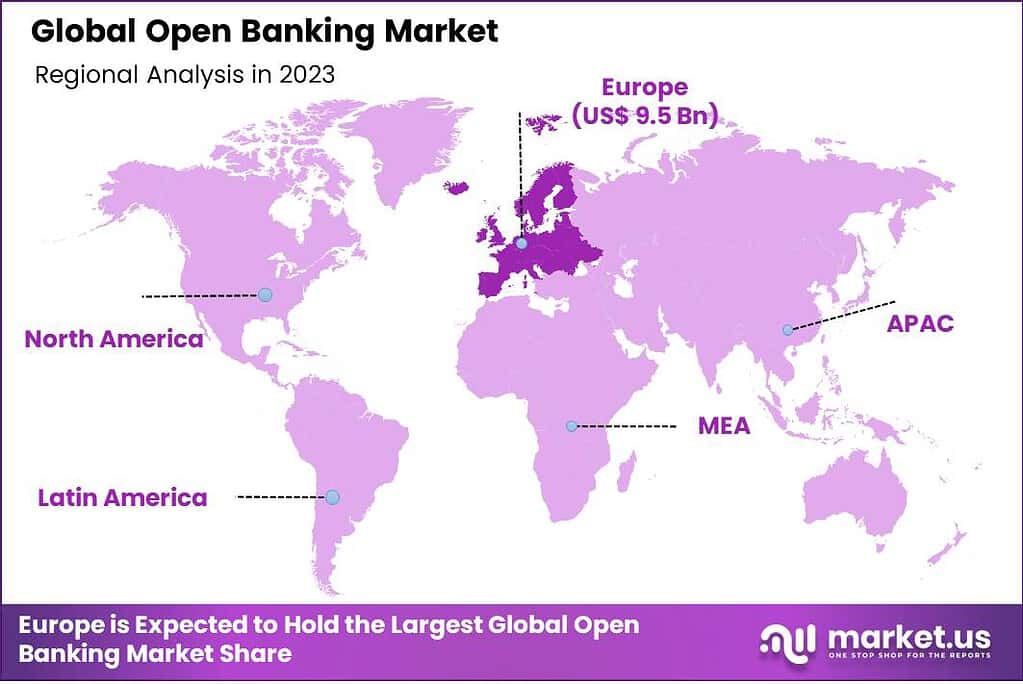

- In 2023, Europe led the Open Banking Market, commanding a dominant 38% share.

Plan your Next Best Move. Purchase the Report for Data-driven Insights: https://market.us/purchase-report/?report_id=110461

Analyst Viewpoint

The expansion of the Open Banking market can be attributed to the growing consumer demand for more tailored banking services and financial products. Technological advancements, particularly in API technologies, have facilitated seamless integration and data sharing between banks and third-party providers. Furthermore, regulatory initiatives aimed at promoting financial data portability and competition, such as the Payment Services Directive 2 (PSD2) in Europe, have significantly contributed to the adoption of Open Banking principles.

The Open Banking framework presents substantial opportunities for innovation in financial services. One notable opportunity lies in the development of more personalized and efficient personal financial management tools. These tools can leverage access to a wide range of financial data to offer users comprehensive insights into their financial health, personalized budgeting advice, and tailored financial product recommendations.

Factors Affecting the Growth of the Open Banking Market

- Regulatory Support and Compliance: Governments and regulatory bodies around the world are implementing regulations that mandate banks to open up their data to third parties. Regulations such as the European Union's Payment Services Directive 2 (PSD2) and the UK's Open Banking standards are pivotal in promoting the adoption of Open Banking by ensuring a standardized framework for data sharing.

- Technological Advancements: The rapid advancement in technology, especially in API (Application Programming Interfaces) development, cloud computing, and data security, plays a crucial role in facilitating the secure and efficient sharing of financial data between banks and third-party providers, thus driving the growth of Open Banking.

- Demand for Personalized Financial Services: There is an increasing consumer demand for personalized and convenient financial services. Open Banking allows for the development of innovative financial services and products that cater to the unique needs of individuals, contributing to its growth.

- Increased Competition and Innovation: Open Banking fosters a competitive environment by enabling fintech startups and non-traditional financial service providers to offer alternative financial services. This competition stimulates innovation within the financial sector, leading to the development of new business models and services.

- Consumer Data Control and Transparency: Open Banking empowers consumers with greater control over their financial data and offers enhanced transparency regarding how their data is used. This increased control and transparency can improve consumer trust and adoption of Open Banking services.

- Security and Privacy Concerns: While Open Banking offers numerous benefits, concerns related to data security and privacy pose significant challenges. Ensuring the secure transmission and storage of sensitive financial information is crucial to mitigate risks and promote consumer confidence in Open Banking services.

Methodology Details Just a Click Away: https://market.us/report/open-banking-market/request-sample/

Report Segmentation

Services Insights

The Banking & Capital Markets segment emerged as the frontrunner in the Open Banking Market, securing a dominant position with over a 44% share. This substantial market share underscores the pivotal role of Open Banking in transforming traditional banking and capital market operations. The integration of Open Banking APIs has enabled banks and financial institutions within this segment to offer enhanced digital services, improve customer experience, and facilitate seamless financial transactions. The leadership position of the Banking & Capital Markets segment indicates a strong demand for Open Banking services in facilitating digital innovation, improving operational efficiency, and fostering competitive advantage in the financial sector.

Deployment Outlook

Regarding deployment methods, the On-premise segment held a commanding position in the Open Banking Market, capturing more than a 56% share. This preference for on-premise solutions highlights the emphasis on security, control, and customization that many financial institutions prioritize. On-premise deployment allows banks and financial service providers to maintain direct oversight of their Open Banking infrastructure, ensuring that data handling and integration processes meet stringent regulatory, security, and privacy standards. Despite the growing trend towards cloud-based solutions, the significant share of on-premise deployment reflects the cautious approach of many institutions in managing sensitive financial data and systems within their controlled environments.

Distribution Channel Analysis

In the realm of distribution channels, the App Markets segment led the Open Banking Market, capturing over a 37% share. This indicates a robust demand for Open Banking applications and services distributed through app marketplaces, where consumers and businesses can easily discover and access innovative financial products. The prominence of the App Markets segment reflects the consumer-driven nature of Open Banking, where ease of access, user experience, and the ability to offer tailored financial solutions are critical. The success of app markets as a distribution channel underscores the importance of platform-based ecosystems in the Open Banking landscape, enabling fintech startups and established financial institutions alike to reach a broader audience and deliver personalized, value-added services.

Key Market Segments

Services

- Banking & Capital Markets

- Payments

- Digital Currencies

- Value Added Services

Deployment

- Cloud

- On-premise

Distribution Channel

- Bank Channels

- App Markets

- Distributors

- Aggregators

Driver:

One driver in the open banking market is regulatory initiatives mandating data sharing. Regulations such as PSD2 in Europe have compelled banks to open up their APIs and share customer data with authorized third-party providers, driving the adoption of open banking practices.

Restraint:

One restraint in the open banking market is concerns regarding data privacy and security. The sharing of financial data with third-party providers raises concerns about data breaches and unauthorized access. Ensuring robust security measures and building trust among customers and stakeholders are critical challenges for the open banking ecosystem.

Opportunity:

One opportunity in the open banking market is the development of personalized financial solutions. Open banking enables the aggregation of customer data from various sources, allowing for the creation of tailored financial products and services that better meet customer needs and preferences.

Challenge:

One challenge in the open banking market is the complexity of integrating disparate systems and technologies. Banks and fintech firms need to ensure seamless connectivity and interoperability between different platforms and APIs to enable smooth data sharing and transaction initiation. Overcoming technical challenges and ensuring standardized protocols are necessary for the successful implementation of open banking initiatives.

Regional Analysis

In 2023, Europe stood at the forefront of the Open Banking Market, commanding a dominant 38% share, highlighting its leading position in the global landscape. This prominence is largely attributed to the region's early and robust regulatory framework, particularly the Revised Payment Services Directive (PSD2), which mandates banks to open their data to third-party providers.

This regulatory push, combined with a strong focus on innovation and consumer protection, has accelerated the adoption of Open Banking services across Europe. The region's financial institutions and fintech companies have been quick to leverage the opportunities presented by Open Banking, leading to the development of innovative financial products and services that cater to the diverse needs of consumers and businesses

By Geography

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Top 10 Biggest Key Players

- Tink

- Societe Generale

- Nordigen Solutions

- Deposit Solutions

- Yapily Ltd.

- Jack Henry & Associates Inc.

- Credit Agricole

- Finestra

- BBVA SA

- Revolut Ltd.

- Other Key Players

Explore Extensive Ongoing Coverage on Technology Research Reports Domain:

- AI-Powered Storage Market is anticipated to surpass a valuation of USD 282.9 Billion by 2033, expected to develop at an 26.5% CAGR.

- Generative AI in Autonomous Vehicles Market is likely to attain a valuation of USD 20.3 Billion by 2033, rise at an astounding CAGR of 21.1%.

- Employee Engagement Software Market is anticipated to be USD 3.8 Bn by 2033. It is estimated to record a steady CAGR of 14.2%.

- Cloud Billing Market is anticipated to be worth USD 5,709 Billion in 2023 and exceed USD 24,882.6 Billion by 2033, expand at a 15.86% CAGR.

- IoT device management market reaching a substantial size of USD 45 billion by 2033, at CAGR of 32.0% during the forecast period 2024-2033.

- Laser Displacement Sensor Market is expected to witness substantial growth, reaching USD 8.7 billion by 2033, record a steady CAGR of 8.1%.

- Ultra low power microcontroller market is estimated to reach USD 14.4 billion by 2033 with a CAGR of 10.5% during forecast period 2024-2033.

- Casino Management Systems Market is estimated to reach USD 31.8 billion by 2033 with a CAGR of 14.5% throughout the forecast period.

- Life Sciences Software Market is estimated to reach USD 40.4 bn by 2033, increase at 10.5% CAGR throughout the forecast period 2024-2033.

- Hydrogen Aircraft Market is estimated to reach USD 3,434 M by 2033, increase at 27.7% CAGR throughout the forecast period 2024-2033.

- Anti-money Laundering Software Market is estimated to reach USD 10.3 billion by 2033, increase at 14.8% CAGR throughout the forecast period.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: