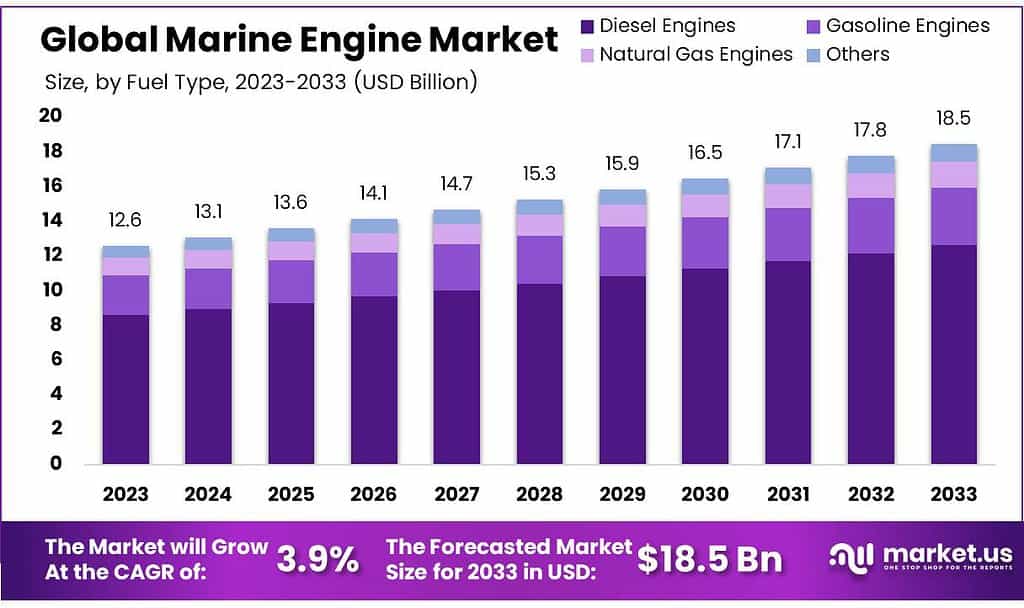

New York, Feb. 19, 2024 (GLOBE NEWSWIRE) -- According to Market.us, the Global Marine Engine Market size is expected to be worth around USD 18.5 billion by 2033, from USD 12.6 Bn in 2023, and it is poised to reach a registered CAGR of 3.9% from 2024 to 2033.

The marine engine market refers to the industry that encompasses the manufacturing, distribution, and maintenance of engines specifically designed for use in watercraft. Marine engines are specialized power units that provide propulsion and other necessary functions for various types of vessels, ranging from small boats to large ships and naval vessels. The marine engine market involves the production of these engines, as well as the associated components, systems, and services related to their installation, operation, and maintenance.

Request our sample report for critical market insights and emerging trends: https://market.us/report/marine-engine-market/request-sample/

Key Takeaway

Factors Affecting the Growth of the Global Marine Engine Industry

- Global Economic Trends: Economic conditions, including global trade volumes, GDP growth, and industrial activity, impact the demand for shipping and maritime services. A strong economy tends to drive demand for the transportation of goods, positively affecting the marine engine industry.

- Shipping and Trade Patterns: The volume of international trade and shipping routes affects the demand for new vessels and, consequently, marine engines. Changes in trade patterns or the opening of new shipping routes can influence market dynamics.

- Regulatory Standards: Stringent environmental regulations, particularly those related to emissions and fuel efficiency, impact the design and manufacturing of marine engines. Compliance with international and regional standards shapes the industry's direction and stimulates innovation.

- Technology Advancements: Ongoing advancements in engine technology, including improvements in fuel efficiency, reduced emissions, and the integration of alternative fuels or electric propulsion, influence market trends. Technological innovation is a key driver of competitiveness in the industry.

- Environmental Concerns: Growing environmental awareness and the push for sustainable practices in the maritime sector drive the development of eco-friendly and energy-efficient marine engines. Companies that can offer solutions aligning with these concerns may gain a competitive edge.

Market Growth

- Demand for New Vessels: The growth of the marine engine market is closely linked to the demand for new vessels across various segments, including commercial shipping, fishing, defense, and offshore industries. Shipbuilding activities and new orders for vessels can positively impact the market for marine engines.

- Technological Advancements: Ongoing advancements in marine engine technology play a crucial role in market growth. Innovations focusing on fuel efficiency, reduced emissions, and the integration of alternative propulsion systems contribute to the market's competitiveness.

- Environmental Regulations: Stringent environmental regulations, particularly those addressing emissions and pollution from maritime activities, influence the design and adoption of marine engines. Compliance with these regulations often drives investment in cleaner and more sustainable propulsion solutions.

- Alternative Fuels and Electrification: The exploration and adoption of alternative fuels, such as liquefied natural gas (LNG) and biofuels, as well as the development of electric and hybrid propulsion systems, are trends that can impact the marine engine market. The industry's response to emerging environmental concerns contributes to market growth.

- Global Trade and Shipping Trends: Changes in global trade patterns, shipping routes, and the overall health of the global economy influence the demand for marine engines. Growth in international trade often leads to increased demand for vessels and, subsequently, marine engines.

Regional Analysis

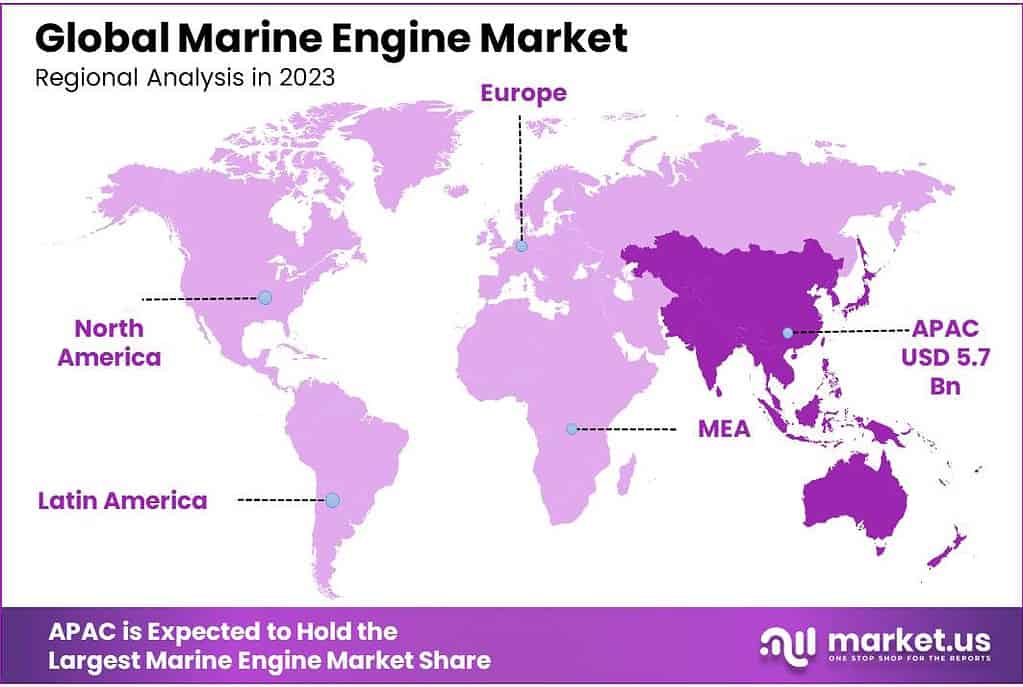

In 2023, the Asia Pacific (APAC) region dominated the global marine engine market with a revenue share exceeding 45.6%. It is expected to maintain its leading position with a projected Compound Annual Growth Rate (CAGR) of 5.7 billion throughout the forecast period. The region's growth is attributed to increasing demand in key sectors like commercial shipping, naval operations, recreational boating, and fishing industries. The surge in marine vessel production and procurement in countries such as China, India, Korea, Thailand, Malaysia, and Vietnam is a significant driver.

North America is experiencing economic progression that is boosting the marine industries, leading to heightened demand for marine engines. This growth is particularly driven by the expansion of the commercial shipping sector, increased leisure boating activities, and naval fleet modernization.

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Discover tailored insights for your business strategy https://market.us/report/marine-engine-market/request-sample/

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | US$ 12.6 Billion |

| Forecast Revenue 2033 | US$ 18.5 Billion |

| CAGR (2024 to 2033) | 3.9% |

| Asia Pacific Revenue Share | 45.6% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The global demand for shipping services is rising due to increased trade, economic growth, and urbanization. As cities expand, the need for efficient and reliable ships to transport goods, food, and energy resources across oceans has grown, driving the demand for marine engines. Engine manufacturers are continually innovating, developing engines that are more fuel-efficient, environmentally friendly, and technologically advanced. These improvements, including electronic fuel injection and exhaust gas cleanup systems, contribute to smoother operation and lower environmental impact, encouraging market growth as more people seek these advancements.

Stringent environmental regulations worldwide, particularly for ships, have led to the adoption of cleaner engines that produce fewer emissions and consume less fuel. Governments globally are imposing stricter rules to safeguard the environment, prompting ship owners to invest in engines that comply with these regulations. This shift towards cleaner technologies further propels the growth of the marine engine market.

Restraints

The global demand for shipping services is rising due to increased trade, economic growth, and urbanization. As cities expand, the need for efficient and reliable ships to transport goods, food, and energy resources across oceans has grown, driving the demand for marine engines. Engine manufacturers are continually innovating, developing engines that are more fuel-efficient, environmentally friendly, and technologically advanced. These improvements, including electronic fuel injection and exhaust gas cleanup systems, contribute to smoother operation and lower environmental impact, encouraging market growth as more people seek these advancements.

Stringent environmental regulations worldwide, particularly for ships, have led to the adoption of cleaner engines that produce fewer emissions and consume less fuel. Governments globally are imposing stricter rules to safeguard the environment, prompting ship owners to invest in engines that comply with these regulations. This shift towards cleaner technologies further propels the growth of the marine engine market.

Opportunities

A significant opportunity in the marine engine market lies in the growing demand for cleaner and more sustainable propulsion solutions. The heightened awareness of environmental concerns and stricter regulations have increased the need for engines with lower emissions and reduced environmental impact. This trend opens doors for manufacturers to innovate and market advanced technologies, including hybrid systems, alternative fuels, and electric propulsion. The expansion of offshore renewable energy projects, such as wind farms and tidal installations, creates a demand for specialized support vessels, providing manufacturers the chance to tailor engines to meet these unique requirements.

The maritime industry's increasing focus on digitalization and connectivity presents opportunities for integrating smart and IoT-enabled marine engines. By incorporating sensors, data analytics, and remote monitoring capabilities, manufacturers can offer advanced predictive maintenance solutions, optimize performance, and enhance vessel efficiency. This digital transformation not only improves operational efficiency but also creates new revenue streams through value-added services.

Challenges

A significant challenge facing the marine engine market is the increasing stringency of environmental regulations and emission standards imposed by governments globally. Ship owners are compelled to invest in cleaner, more fuel-efficient engines, resulting in substantial costs for upgrades and compliance measures. The complexity of regulatory frameworks across regions poses compliance challenges for both ship owners and engine manufacturers.

The cyclical nature of the marine industry, coupled with vulnerability to economic downturns and trade fluctuations, can lead to deferred or canceled engine purchases during periods of uncertainty, impacting market growth. The transition to alternative fuels, despite growing interest, faces technical and logistical hurdles, including underdeveloped infrastructure and the complexities of alternative propulsion systems. Geopolitical tensions and regulatory uncertainties further contribute to market volatility and influence demand for marine engines.

Access Now for Quick Delivery | Buy Our Premium Research Report https://market.us/purchase-report/?report_id=115251

Market Trends

- Demand for Sustainable Solutions: There is a growing demand for environmentally sustainable marine propulsion solutions. Shipowners and operators are increasingly seeking engines that produce fewer emissions and have lower environmental impacts, driven by stricter environmental regulations and a broader emphasis on sustainability.

- Alternative Fuels and Propulsion: The industry is witnessing increased interest and experimentation with alternative fuels such as liquefied natural gas (LNG), hydrogen, and biofuels. Additionally, there's a focus on developing and adopting alternative propulsion systems, including electric and hybrid technologies, to reduce the environmental footprint of marine engines.

- Digitalization and Connectivity: The integration of digital technologies and connectivity features in marine engines is a notable trend. This includes the incorporation of sensors, data analytics, and remote monitoring capabilities to enable predictive maintenance, optimize performance, and enhance overall operational efficiency.

- Offshore Renewable Energy: The expansion of offshore renewable energy projects, such as offshore wind farms and tidal energy installations, is driving demand for specialized support vessels with powerful and reliable propulsion systems. This trend presents opportunities for marine engine manufacturers to provide tailored solutions for offshore operations.

Report Segmentation of the Global Marine Engine Market

By Fuel Type

As of 2023, diesel engines dominated the marine engine market, holding over 68.4% market share due to their widespread use in various applications, including commercial shipping, fishing vessels, cruise ships, and recreational boats. Known for reliability, durability, and fuel efficiency, diesel engines are preferred for their high torque output and compatibility with different fuel types.

Gasoline engines constituted a smaller market share, primarily used in smaller recreational boats and light commercial vessels, valued for their ease of use and quick start-up. Natural gas engines, emerging as an alternative, offer environmental benefits and cost advantages, primarily used in specialized applications.

Despite their potential, limited infrastructure and availability constrain their widespread adoption. The category "Others" encompasses innovative technologies like alternative fuel engines, hybrid, and electric propulsion systems, gaining attention for their potential to reduce emissions and enhance environmental sustainability in the marine industry, responding to evolving environmental regulations and sustainability initiatives.

By Capacity

In 2023, the marine engine market saw the dominance of the 0 – 10000 HP segment, constituting over a 22.4% share, indicating the prevalence of engines with power capacities ranging from 0 to 10,000 horsepower. These smaller engines find widespread use in various vessels, including small boats, yachts, and recreational crafts, due to their versatility, compact size, and affordability.

The 10000 – 20000 HP segment held another significant market share, commonly employed in medium-sized commercial vessels like ferries, tugboats, and offshore supply vessels, striking a balance between performance and operating costs. The 20000 – 50000 HP segments collectively addressed larger and more specialized marine vessels, including cargo ships, tankers, and bulk carriers.

The More than 50000 HP segment, representing ultra-high-power marine engines, served specialized vessels like cruise ships and supertankers, providing exceptional power output for the operation of some of the largest vessels globally.

By Stroke

In 2023, 2 Strokes held a dominant market position, capturing more than a 62.3% share. This means that marine engines using the two-stroke combustion cycle were the most commonly used in the market during that time. Two-stroke engines are known for their simplicity, high power-to-weight ratio, and cost-effectiveness. They are widely used in various marine applications, including outboard motors, small boats, and some commercial vessels.

Two-stroke engines are favored for their lightweight design, compact size, and ease of maintenance, making them suitable for a wide range of marine environments and operating conditions. The 4 Strokes segment represented a smaller portion of the market share, accounting for the remaining share of marine engine installations.

Four-stroke engines operate on a more complex combustion cycle, requiring separate strokes for intake, compression, power, and exhaust. While four-stroke engines offer advantages such as higher fuel efficiency, lower emissions, and smoother operation compared to two-stroke engines, they are typically heavier, more expensive, and require more maintenance.

Four-stroke engines are commonly used in larger vessels, including commercial ships, yachts, and some high-performance boats, where fuel efficiency and environmental considerations are paramount. The dominance of 2 Strokes in the marine engine market reflects the widespread use and popularity of two-stroke engine technology in the marine industry.

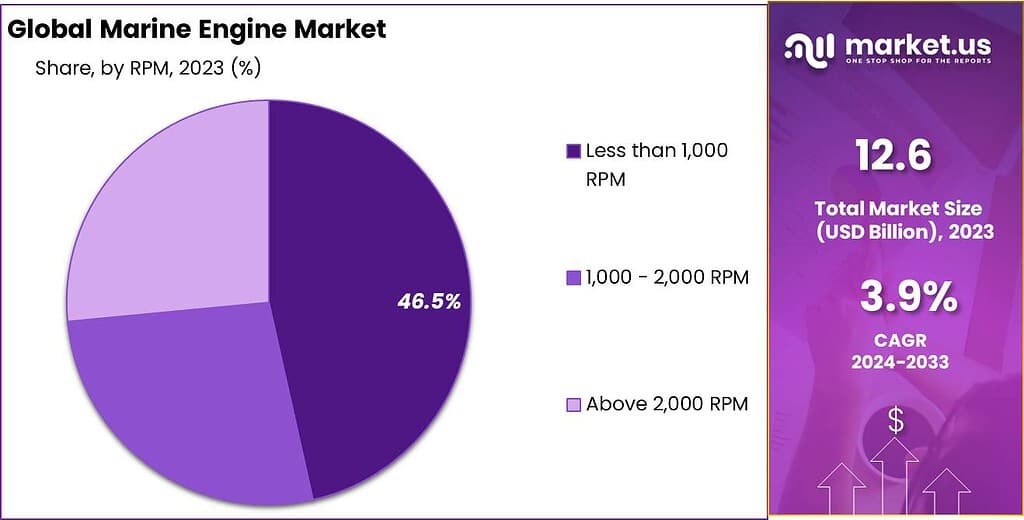

By RPM

In 2023, marine engines operating at less than 1,000 RPM dominated the market with over a 46.5% share, primarily used in large and heavy-duty vessels like cargo ships and tankers due to their high torque output at low speeds. The 1,000 – 2,000 RPM segment held a substantial market share, finding application in passenger ferries and medium-sized cargo ships, offering a balance between power and fuel efficiency.

The Above 2,000 RPM segment catered to high-speed vessels like ferries and racing boats, providing rapid acceleration and high-speed performance for applications where speed is crucial. The distribution across RPM segments reflects the diverse needs of the maritime industry, accommodating various vessel types and operating conditions. Each RPM range offers unique performance characteristics to meet specific requirements.

By Ship Type

In 2023, cargo ships commanded a dominant market share of over 21.6%, indicating the prevalence of marine engines used in these vessels for transporting goods globally. Cargo ships encompass various types, including container ships and bulk carriers, necessitating powerful and reliable marine engines for efficient propulsion.

Oil tankers held a substantial market share, requiring robust engines for transporting crude oil and petroleum products across long distances. Gas carriers, comprising LNG and LPG carriers, represented a notable segment, demanding specialized marine engines for handling liquefied and compressed gases. Support vessels, including offshore support and supply ships, played a significant role in the market, relying on versatile and reliable marine engines for tasks such as towing, firefighting, and personnel transfer to offshore installations.

Market Key Segments

By Fuel Type

- Diesel Engines

- Gasoline Engines

- Natural Gas Engines

- Others

By Capacity

- 0 – 10000 HP

- 10000 – 20000 HP

- 20000 – 30000 HP

- 30000 – 40000 HP

- 40000 – 50000 HP

- More than 50000 HP

By Stroke

- 2 Strokes

- 4 Strokes

By RPM

- Less than 1,000 RPM

- 1,000 – 2,000 RPM

- Above 2,000 RPM

By Ship Type

- Oil Tankers

- Bulk Carriers

- Cargo Ships

- Gas Carriers

- Tankers

- Support Vessel

- Ferries and Passenger ships

- Others

Access the Complete Report Methodology Now: https://market.us/report/marine-engine-market/request-sample/

Competitive Landscape

The marine engine market is characterized by key players such as MAN Energy Solutions, Wärtsilä, Caterpillar Inc., and Rolls-Royce Power Systems. These industry giants are recognized for their technological innovations, diverse product portfolios, and global strategic presence.

Their leadership positions are attributed to continuous research and development endeavors, focusing on improving engine efficiency, lowering emissions, and extending engine lifespans. These companies not only provide a comprehensive range of marine engines suitable for diverse vessel types but also offer robust after-sales services, consolidating their dominance in the market.

Market Key Players

- Caterpillar Inc.

- Cummins Inc.

- Hyundai Heavy Industries Co., Ltd

- MAN Energy Solutions

- Mitsubishi Heavy Industries Ltd

- Rolls Royce plc

- Volvo Penta

- Wartsila

- Yanmar Holdings Co., Ltd

- Mahindra Powerol

- Daihatsu Diesel Mfg., Ltd

- Deutz AG

- WinGD

- Siemens Energy

- Volkswagen Group

Recent Developments

- In 2023 Caterpillar Inc., Launched a 3512E high-speed diesel engine for high-performance workboats

- In 2023 Cummins Inc., Collaborated with Ballard Power on hydrogen fuel cell systems for marine applications

- In 2023 Hyundai Heavy Industries Co., Ltd, Developed IMO Tier III-compliant HiMSEN engines for commercial vessels.

Explore Extensive Ongoing Coverage on Chemical Market Research Reports Domain

- Carbon Nanotubes Market was valued at USD 7.6 Billion, and is expected to reach USD 31.3 Billion in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 15.2%.

- Rare Earth Metals Market was valued at USD 12,753.8 Million, and is expected to reach USD 33,464.1 Million in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 10.4. %.

- Gum Hydrocolloid Market was valued at USD 10.5 billion and is expected to reach USD 17.7 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 5.5%.

- Nanomaterials Market was valued at USD 12.4 Billion, and is expected to reach USD 45.6 Billion in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 13.9%.

- Ethyl Lactate Market was valued at USD 3.1 billion, and is expected to reach USD 6.3 Billion in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 7.5%.

- Controlled-Release Fertilizers Market was valued at USD 2.9 Billion, It is expected to reach USD 6.1 billion by 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 7.9%.

- Green and Bio-Solvents Market was valued at USD 3.8 Billion, and is expected to reach USD 6.7 Billion in 2032, From 2023 to 2032, this market is estimated to register a CAGR of 5.9%.

- Carbon Concrete Market was valued at USD 2.1 Billion, and is expected to reach USD 5.4 Billion in 2032 from 2023 to 2032, this market is estimated to register a CAGR of 10.2%.

- one-way vision films market was valued at USD 1,366 Million. In 2023 and 2032, this market is estimated to register the highest CAGR of 5.2%.

- Nanosized Alumina Market was valued at USD 3.0 Billion, and is expected to reach USD 4.4 Billion in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 4.1%.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn

Our Blog: