Dublin, Feb. 20, 2024 (GLOBE NEWSWIRE) -- The "Reverse Factoring Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028" report has been added to ResearchAndMarkets.com's offering.

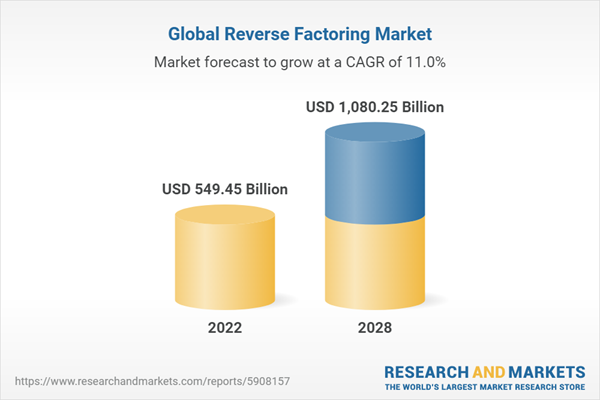

The global reverse factoring market has entered a period of accelerated growth, with cutting-edge technologies such as artificial intelligence (AI) and blockchain redefining the financial landscape. This research confirms a compound annual growth rate (CAGR) of 11.02% through to 2028, driven by a surge in demand for working capital optimization and supply chain financing solutions across diverse industries.

Harnessing the prowess of digital transformation, the market size - valued at USD 549.45 billion in 2022 - has gained significant traction through adoption in manufacturing, automotive, and IT sectors keen on fortifying their competitive edge. The innovation-led rise is echoed in the emergence and adoption of reverse factoring platforms, which have become indispensable for analyzing payment cycles, forecasting cash flow needs, and optimizing global supply networks' financial operations.

The trend of financial automation integration with enterprise resource planning (ERP) systems is making significant inroads, simplifying complex B2B financial transactions and consolidating payment data for enhanced working capital management. North America leads the charge in market share dominance, while AI and blockchain technologies promise a transformative future for supply chain finance.

Snapshot of Key Market Drivers and Challenges

Drivers:

- Increased emphasis on optimizing working capital amidst rising operational costs

- Greater focus on strategic supply chain financing for competitive supplier relationships

- Continuous digitization and integration of B2B payment networks with business systems

Challenges:

- Complex integration requirements with diverse, often legacy, IT systems

- Upsurge in the need for stringent data security measures and adherence to evolving compliance standards

Emerging Industry Trends

Artificial Intelligence Reshaping Reverse Factoring

AI innovations transform reverse factoring platforms, harnessing data to enhance financial solutions and predict liquidity requirements. This trend empowers businesses to make informed decisions rapidly and strengthens supplier relations through tailored financing options.

Intensified Focus on Supplier Financing Programs

With a spotlight on supplier financing programs, reverse factoring is helping organizations to reinforce supply chain stability through collaborative financing strategies. This new focus is seeing adoption beyond large corporations, reaching mid-market buyers and suppliers alike.

Seamless Integration with Corporate ERP Systems

The shift toward comprehensive integration of reverse factoring within core enterprise systems highlights a transformative era, promising streamlined financial processes and unprecedented efficiency in managing working capital.

Segmental Insights Offer a Glimpse into Market Nuances

Segment-wise, traditional reverse factoring remains predominant, but innovative blockchain and AI/ML-enhanced models are gaining prominence. Banks and financial institutions continue to corner the majority share in service provision, although fintech disruptors are quickly earning their stripes with advanced, nimble offerings.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 175 |

| Forecast Period | 2022-2028 |

| Estimated Market Value (USD) in 2022 | $549.45 Billion |

| Forecasted Market Value (USD) by 2028 | $1.08 Trillion |

| Compound Annual Growth Rate | 11% |

| Regions Covered | Global |

A selection of companies mentioned in this report includes:

- C2FO, Inc

- PrimeRevenue, Inc

- Tradeshift Holdings, Inc

- Taulia Inc

- Comdata Inc

- BNP Paribas SA

- Fidelity National Information Services, Inc

- SAP Ariba, Inc

- Euler Hermes SASAP Ariba, Inc

- Deutsche Bank Aktiengesellschaft

For more information about this report visit https://www.researchandmarkets.com/r/id86jv

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment