Dublin, Feb. 28, 2024 (GLOBE NEWSWIRE) -- The "South Africa Data Center Market - Investment Analysis & Growth Opportunities 2024-2029" report has been added to ResearchAndMarkets.com's offering.

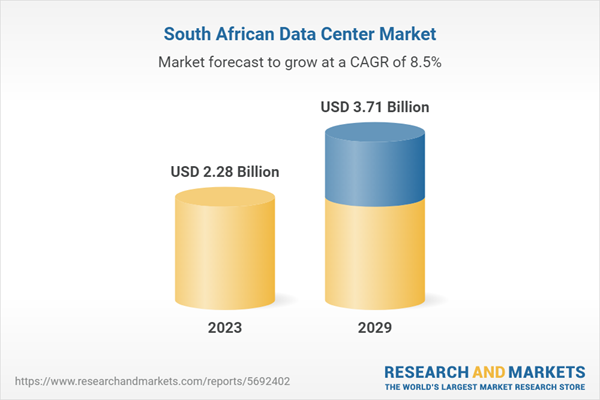

The South Africa data center market exhibits significant growth potential, with a projected compound annual growth rate (CAGR) of 8.44% from 2023 to 2029. Recent investments highlight Johannesburg and Cape Town as leading development hubs within this sector, establishing a robust foundation for market expansion.

Following substantial investments from colocation data center operators and cloud providers, the South Africa data center landscape is poised for substantial growth and capacity additions in key urban centers. In the dynamic cities of Johannesburg and Cape Town, investments are culminating in an ambitious expansion of IT infrastructure, power capacity, and service offerings. The investments from global giants like AWS, Google, Microsoft, Huawei, and Oracle spotlight the region's importance as a strategic node for data and cloud services.

Strategic Investments and Infrastructure Development Spur Growth

- Operators have made concrete steps toward embracing sustainability by investing in renewable energy sources, which contribute to the environment and local communities.

- With the ICT sector anticipated to flourish beyond USD 60 billion by 2028, enterprise migration to the cloud adds vitality to the colocation market.

- Digital connectivity initiatives like the 2Africa and T3 submarine cables denote an infrastructure prepared for burgeoning demand and reduced latency, directly benefitting end users.

The surge in data center capabilities is enabled by strategic efforts from established players and new entrants alike, bolstering the resilience and competitiveness of the South African digital economy.

Data Center Market Insights Guide Investment Decisions

- The market's landscape, trends, and forecasts provide valuable intelligence to stakeholders examining South Africa's data center market sizing in terms of investment, area, power capacity, and revenue.

- Critical analysis and data-driven insights furnish a panoramic understanding of the infrastructure investments segmented by IT infrastructure, power, cooling, and general construction.

The report detects the scope and dynamic nature of the market, including the profiles of prominent IT infrastructure providers, construction contractors, and investors that contribute to the vigor of the South Africa data center market.

Vendor Landscape and Opportunities

The competitive market environment might lower infrastructure prices, further catalyzing market growth. Esteemed infrastructure providers and construction contractors, both local and global, have shown commitment through contributions to major projects, underscoring the fertile ground for future data center expansions.

Anticipated Market Growth and Investment Patterns

Within the sector, numerous initiatives are driving forward investments into IT and support infrastructure, constructing a resilient and future-ready data center landscape. The South African economy stands poised to benefit from these strategic market developments, with potential ripple effects across the entire African continent.

WHY SHOULD YOU BUY THIS RESEARCH?

- Market size regarding investment, area, power capacity, and South Africa colocation market revenue is available.

- An assessment of the data center investment in South Africa by colocation, hyperscale, and enterprise operators.

- Investments in the area (square feet) and power capacity (MW) across cities in the country.

- A detailed study of the existing South Africa data center market landscape, an in-depth industry analysis, and insightful predictions about market size during the forecast period.

- Snapshot of existing and upcoming third-party data center facilities in South Africa:

- I. Facilities Covered (Existing): 53

- II. Facilities Identified (Upcoming): 10

- III. Coverage: 29+ Cities

- IV. Existing vs. Upcoming (Area)

- V. Existing vs. Upcoming (IT Load Capacity)

- Data Center Colocation Market in South Africa:

- I. Colocation Market Revenue & Forecast (2023-2029)

- II. Wholesale vs. Retail Colocation Revenue (2023-2029)

- III. Retail Colocation Pricing

- IV. Wholesale Colocation Pricing

- The South Africa data center market investments are classified into IT, power, cooling, and general construction services with sizing and forecast.

- A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

- Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the market.

- A transparent research methodology and the analysis of the demand and supply aspects of the market.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 125 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value (USD) in 2023 | $2.28 Billion |

| Forecasted Market Value (USD) by 2029 | $3.71 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | South Africa |

IT Infrastructure Providers

- Atos

- Cisco Systems

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Hitachi Vantara

- Huawei Technologies

- IBM

- Juniper Networks

- Lenovo

- ZTE

Data Center Construction Contractors & Sub-Contractors

- Abbeydale

- AECOM

- Arup

- b2 Architects

- EDS Engineers

- H&MV Engineering

- Ingenium

- ISF Group

- ISG

- LYT Architecture

- MWK Engineering

- Rider Levett Bucknall (RLB)

- Royal HaskoningDHV

- Tri-Star Construction

Support Infrastructure Providers

- ABB

- Alfa Laval

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- EVAPCO

- Enlogic

- Johnson Controls

- Legrand

- Master Power Technologies

- Piller Power Systems

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Data Center Investors

- Africa Data Centres

- Digital Parks Africa

- Equinix

- NTT Global Data Centers

- Open Access Data Centres (OADC)

- Teraco (Digital Realty)

- Vantage Data Centers

New Entrants

- Paratus Namibia

EXISTING VS. UPCOMING DATA CENTERS

- Existing Facilities in the Region (Area and Power Capacity):

- Johannesburg

- Cape Town

- Other Cities

- List of Upcoming Facilities in the region (Area and Power Capacity):

- Johannesburg

- Cape Town

- Other Cities

For more information about this report visit https://www.researchandmarkets.com/r/3z64dn

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment