Dublin, March 14, 2024 (GLOBE NEWSWIRE) -- The "Southeast Asia Elevators and Escalators Market - Size & Growth Forecast 2024-2029" report has been added to ResearchAndMarkets.com's offering.

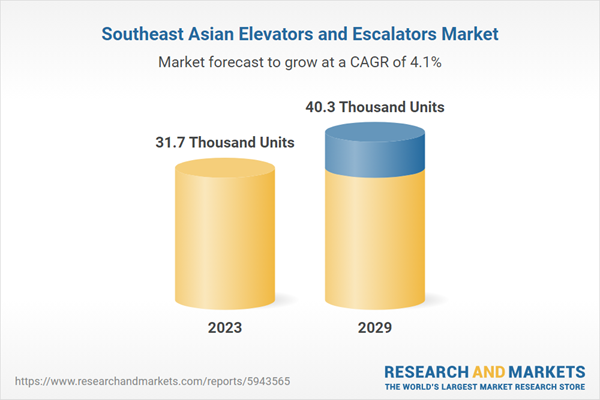

The Southeast Asia elevator and escalator market by new installations accounted for 31.7 thousand units in 2023 and is expected to grow at a CAGR of 4.05% from 2023-2029.

Otis, Schindler, TK Elevator, and KONE are the top 4 manufacturers in the Southeast Asia elevator and escalator market, with a market share of nearly 52%. By the end of 2019, Hyundai Elevator Philippines had installed over 6,500 units all over the Philippines and had 4,000 units under maintenance.

Mitsubishi Elevator (Singapore) Pte equips employees with the necessary skills and knowledge to provide safe people transportation systems in public and private housing and commercial complexes by establishing a new technical training center and strategic alliances with the Institute of Technical Education and the Building & Construction Authority.

In Indonesia, the need for elevators increases as more people choose public transportation over other modes. To achieve this, the target of 60% of Jakarta residents using public transit by 2030 will fuel the construction of public transportation. For instance, the government intends to expand the MRT network by adding 7.8 kilometers to the north-south line and 31.7 kilometers to the east-west line. JICA has suggested expanding Jakarta's rail-based public transportation system, with ten lines built by 2035.

In Singapore, HBD initiated a program to upgrade elevators in their buildings through a lift upgrade program. The Lift Upgrading Programme (LUP) is one of HDB's three programs to revitalize mature housing estates and provide residents with solutions to some of their more pressing needs. A major concern in HBD blocks older than 30 may be the absence of lift access on every floor, as older blocks tend to have lifts that only stop at particular floors. Through the LUP, older flats can be fitted with new lift shafts and lifts to allow residents on every floor to access the lifts, thereby relieving new buyers' worries about rest. The program will contribute to Southeast Asia elevator and escalator market growth.

The vertical transportation market in Cambodia is divided into two segments: the low-end and high-end markets. Local and Chinese companies dominate the low-end market, whereas high-end players include brands like Hitachi, Schindler, and Mitsubishi.

In October 2023, a proposal for an ASEAN-GCC free trade agreement was presented, signifying a significant step toward strengthening economic ties between Southeast Asia and the Gulf region. Malaysia's Prime Minister unveiled this groundbreaking proposal at the ASEAN-GCC Summit in Saudi Arabia, showcasing a commitment to fostering economic cooperation and leveraging the strengths of both blocs for mutual growth.

In the province of Chonburi, the Thai government plans to develop a smart city. On July 11, 2022, a plan to develop a USD 37 billion smart metropolitan area close to Bangkok was authorized. Around 160 km southeast of Bangkok, in the Huai Yai sub-district of Chonburi province, the smart city is slated to be built near an industrial area.

Nusantara, the new capital of Indonesia, spanning an area of 6.6 hectares, will house 184 residential building towers. The project was expected to start in Q2 2023. These residential buildings will accommodate ministries, the State Palace, the House of Representatives, and housing for some 50,000 civil servants and 500,000 residents. The project is predicted to significantly contribute to the Southeast Asia elevator and escalator market expansion. The project relies on around 80% of private investment, with an investment of USD 32 billion.

Denser Cities Resulting in the Construction of Skyscrapers Will Likely Lead to the Growth of Southeast Asia Elevator and Escalator Market

- Thailand's National Housing Authority (NHA) will provide financial assistance to about one-third of the targeted group of 2.27 million households (approximately 650,000) that cannot access housing financing from regular financial institutions. During the next five years (2022-2026), the NHA plans to raise B134 billion (about USD 4 billion) to fund 16 national projects.

- The Forest City project by Country Garden in Johor, neighboring Singapore, is a USD 100 billion development set to accommodate 700,000 residents by 2035. It encompasses four reclaimed islands over 30 square kilometers; the mixed-use project envisions the construction of office spaces, malls, clinics, schools, and various leisure facilities.

- The Indonesian government plans to invest roughly USD 430 billion in infrastructure development projects by 2024-2025. The project includes housing infrastructure, services, and amenities for 500,000 units, including 50,000 apartment units, 25,000 special housing units, 1.5 million single homes, and housing infrastructure, facilities, and utilities for 1.5 million single houses. The infrastructure development in Indonesia is projected to contribute to Southeast Asia elevator and escalator market expansion.

Enhanced Monitoring Services by Major OEMs and Equipment Standard-Setting in Asian Countries Are Pushing the Service Market

- The Ministry of Construction of Vietnam issued Circular 03/2021/TT-BXD, establishing national standards for apartment buildings due to numerous significant accidents using lifts in apartment complexes. By July 2021, there will be more specifications for lifts in residential buildings.

- Some nations, like Malaysia, also promoted the elderly using elevators rather than escalators. It was witnessed that elderly people were responsible for 30% of accidents on moving walkways, escalators, and elevators.

- In 2019, Hitachi introduced an advanced lift remote monitoring and maintenance service in Singapore, providing real-time operational data about the lifts and implementation of preventive maintenance.

- The Building and Construction Authority (BCA) revealed on November 27, 2023, that most escalator safety incidents in Singapore from January to October 2023 resulted from improper usage. Of 632 reported incidents, 97% (616 cases) were attributed to user behavior. Notably, individuals struggling with bulky items like prams, luggage, and shopping trolleys accounted for 17% of incidents, with more than half involving individuals aged 55 and older. Other causes included moving on the escalator without holding the handrail (16%), physical health conditions (12%), inattention (11%), and body parts getting trapped (9%). Per BCA, mechanical faults accounted for less than 3% of incidents.

Green Building and Certifications in the Building Sector Lead to the Adoption of Energy-Efficient Vertical Transportation Installations in Southeast Asia Elevator and Escalator Market

- Currently, only 1% of Indonesia's new homes annually meet the criteria for green housing. The Indonesian government has undertaken some steps toward promoting green construction by mandating green certification for multi-story commercial and residential buildings that meet specific standards. However, landed houses constitute 88% of the government's Public-Private Partnership Socialized Housing (PSR) program and are exempt from the green building requirements set forth by the Green Building Certification program launched in 2021.

- Under the 12th Malaysia Plan, 13 urban renewal projects have been authorized (12MP). Under the Ministry of Natural Resources and Urban Development, all of these projects are at varying levels of planning and execution. Increasing competition among township developers in Malaysia and their major focus on increasing property value has pushed them towards undertaking various multifunctional development projects in residential, commercial, institutional, and healthcare facilities.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 150 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value in 2023 | 31.7 Thousand Units |

| Forecasted Market Value by 2029 | 40.3 Thousand Units |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Asia Pacific |

Key Vendors

- Otis

- KONE

- Schindler

- Hitachi

- TK Elevator

- Mitsubishi Electric

- Fujitec

- Hyundai Elevator

Other Prominent Vendors

- Sigma Elevators

- Toshiba Elevator and Building Systems Corporation

- EITA Elevator

- Stannah Lifts Holdings Ltd

- Nippon Elevator

- Dover Elevators

- Kalea Elevators

- Gylet Elevator

- CA M&E Elevator

- MASHIBA - Elevators & Escalators

- Cibes Lift

- iTEK ELEVATOR

SEGMENTATION ANALYSIS

Elevator Market Segmentation

Machine Type

- Hydraulic and Pneumatic

- Machine Room Traction

- Machine Room Less Traction

- Others (Climbing, Elevators, Industrial Elevators

Carriage Type

- Passenger

- Freight

Capacity

- 2-15 Persons

- 16-24 Persons

- 25-33 Persons

- 34 Persons and Above

End-User

- Commercial

- Residential

- Industrial

- Others (Public Transit, Institutional, Infrastructural)

Escalator Market Segmentation

Product Type

- Parallel

- Multi Parallel

- Walkway

- Crisscross

End-User

- Public Transit

- Commercial

- Others (Institutional Sector, Infrastructure, Industrial)

Segmentation by Region

- Vietnam

- Thailand

- Indonesia

- Singapore

- Malaysia

- Philippines

- Cambodia

For more information about this report visit https://www.researchandmarkets.com/r/nf8f1c

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment