New York, USA, March 27, 2024 (GLOBE NEWSWIRE) -- Hemophilia B Drug Market Size and Share to Grow by 2032, Assesses DelveInsight | Key Emerging Therapies - CSL222, SerpinPC, AskBio009, PF-06838435/fida, Marstacimab, FLT180a, Concizumab, Fitusiran

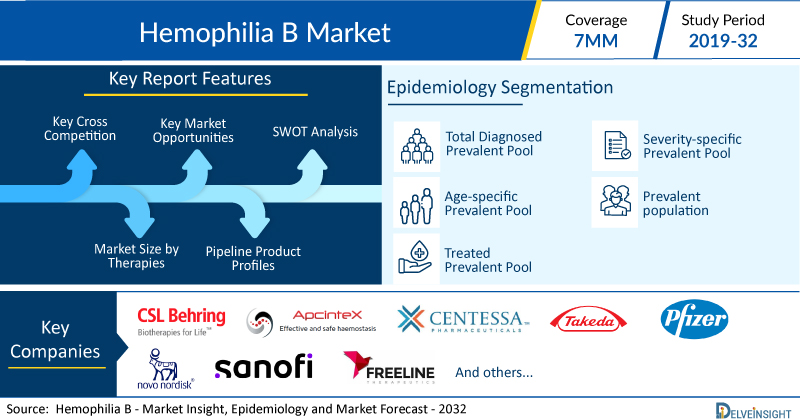

The current therapeutic landscape of hemophilia B in the 7MM is driven by several approved therapies. The hemophilia B market is estimated to grow for the period 2023–2032. The major reason behind the hemophilia B market upsurge is the launch of the most anticipated gene therapies by key companies such as CSL Behring, ApcinteX Ltd, Centessa Pharmaceuticals plc, Takeda, Pfizer, and others, which are considered a threat to the current hemophilia B market.

DelveInsight’s Hemophilia B Market Insights report includes a comprehensive understanding of current treatment practices, hemophilia B emerging drugs, market share of individual therapies, and current and forecasted hemophilia B market size from 2019 to 2032, segmented into 7MM [the United States, the EU-4 (Italy, Spain, France, and Germany), the United Kingdom, and Japan].

Key Takeaways from the Hemophilia B Market Report

- According to DelveInsight’s analysis, the market size for hemophilia B reached USD 3.2 billion in 2022 across the 7MM and is expected to grow with a significant CAGR by 2032.

- DelveInsight’s analysis reveals that the overall diagnosed prevalent population of hemophilia B in the US was reported as ~14K in 2022 which will reach ~15K by 2032.

- Some of the key therapies for hemophilia B treatment include CSL222 (AAV5-hFIXco-Padua), SerpinPC, AskBio009, PF-06838435/fidanacogene elaparvovec, Marstacimab, FLT180a, Concizumab, Fitusiran, and others.

- In December 2023, Centessa Pharmaceuticals announced new data Phase IIa study of SerpinPC for the treatment of hemophilia. Part 5 data from the Phase IIa study (AP-0101) showed a continued favorable safety and tolerability profile for SerpinPC, as well as sustained long-term efficacy results, as measured by a 96% reduction in the median all-bleed annualized bleeding rate (ABR) from the prospective baseline.

- Sanofi is anticipating the submission timeline of fitusiran in 2024 for hemophilia A and B, and 2025+ for hemophilia A and B pediatric.

Discover which therapies are expected to grab the hemophilia B market share @ Hemophilia B Market Report

The hemophilia B market dynamics are anticipated to change in the coming years. Premium-priced agents dominate the hemophilia B market, benefiting from its status as an orphan indication, which facilitates accelerated approval time, seven years of market exclusivity, clinical trial subsidies, and reduced regulatory fees, among other advantages. The increasing prevalence of hemophilia B opens a significant window of opportunity for new treatments, particularly in addressing the substantial unmet need within the severe segment, which constitutes approximately 35% of the total hemophilia B population, where treatment options are currently very limited.

Furthermore, many potential therapies are being investigated for the treatment of hemophilia B, and it is safe to predict that the treatment space will significantly impact the hemophilia B market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate are expected to drive the growth of the hemophilia B market in the 7MM.

However, several factors may impede the growth of the hemophilia B market. Due to factors such as the clinical presentation closely resembling other hemorrhagic disorders and the delayed onset of symptoms, diagnosis often faces delays. The predominant treatment modalities involve intravenous administration, a method that proves discomforting and troublesome for many patients, particularly children. Moreover, the considerable expense associated with treating hemophilia B, along with the anticipated higher costs of emerging options like gene therapies and extended half-life products, is expected to prompt healthcare authorities to regulate both the pricing and utilization of these high-cost agents.

Moreover, hemophilia B treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the hemophilia B market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the hemophilia B market growth.

Hemophilia B Epidemiology Segmentation

The hemophilia B report takes into the account of historical, current, and forecasted hemophilia B patient pool. In 2023, there were around 1,500, 1,600, and 1,100 cases of mild, moderate, and severe cases of Hemophilia B respectively in the US.

The hemophilia B market report proffers epidemiological analysis for the study period 2019–2032 in the 7MM segmented into:

- Total Diagnosed Prevalent Pool of Hemophilia B

- Severity-specific Prevalent Pool of Hemophilia B

- Age-specific Prevalent Pool of Hemophilia B

- Prevalent population of Hemophilia B with or without Inhibitors

- Treated Prevalent Pool of Hemophilia B

As per DelveInsight’s analysis, the prevalent cases of hemophilia B without inhibitors are more than those with inhibitors. According to DelveInsight’s estimates, in the US, the 19-44 age group contributes the most in the Hemophilia B patient pool in 2023.

Download the report to understand what epidemiologists are saying about how hemophilia B patient trends in 7MM @ Hemophilia B Epidemiological Insights

Hemophilia B Treatment Market

Presently, the primary approaches for addressing hemophilia B involve Recombinant Factor IX Concentrates, Plasma-Derived Factor IX Concentrates, and Fresh Frozen Plasma. Fresh frozen plasma, derived from human blood, is employed as a fallback option when factor IX concentrate is unavailable for treating individuals with factor IX deficiency. However, it is ineffective in efficiently elevating factor IX activity to a hemostatic level.

In November 2022, the FDA approved HEMGENIX (etranacogene dezaparvovec), a gene therapy created by uniQure Pharmaceuticals. This therapy utilizes an adeno-associated virus vector and is designed to address Hemophilia B in adults. Specifically, it targets individuals who are currently undergoing Factor IX prophylaxis therapy, have a history of life-threatening hemorrhages, or experience recurrent and severe spontaneous bleeding episodes due to congenital Factor IX deficiency.

Learn more about the FDA-approved drugs for hemophilia B @ Drugs for Hemophilia B Treatment

Hemophilia B Emerging Drugs and Companies

Some of the drugs in the pipeline include fitusiran (Sanofi (Genzyme)/Alnylam Pharmaceuticals), marstacimab (Pfizer), SerpinPC (Centessa Pharmaceuticals), FLT180a (Freeline Therapeutics), and others.

Fitusiran, an RNA-based therapy, is being developed for preventing hemophilia A or B in individuals, whether or not they have inhibitors. Administered subcutaneously, it aims to decrease antithrombin levels, a protein that impedes blood clotting, thereby encouraging clot formation, balancing hemostasis, and averting bleeding episodes. According to Sanofi's development plan, fitusiran is anticipated to be submitted for approval in 2024 for hemophilia A and B and in 2025 or later for pediatric cases of these conditions. In January 2018, Sanofi and Alnylam Pharmaceuticals restructured their partnership to enhance the development and commercialization of RNA-based therapies targeting rare genetic diseases. As part of this agreement, Sanofi gained global rights for the development and commercialization of fitusiran.

SerpinPC, a new inhibitor of APC administered under the skin, is being developed as a possible remedy for hemophilia, irrespective of its severity or the presence of inhibitors. Additionally, it might be tailored to prevent bleeding linked to various other bleeding disorders. Centessa Pharmaceuticals is progressing with the regulatory process for SerpinPC in hemophilia B. In May 2023, the US FDA provided Fast Track Designation to SerpinPC for treating individuals with hemophilia B.

Marstacimab (PF-06741086) is a type of human monoclonal immunoglobulin G (IgG1) that specifically targets the Kunitz 2 domain of tissue factor pathway inhibitor (TFPI). It is being developed as a preventive treatment to decrease the occurrence of bleeding episodes in people with severe hemophilia A or B, where their factor VIII or factor IX activity is less than 1%, with or without inhibitors. In September 2019, the US Food and Drug Administration (FDA) gave Marstacimab fast-track designation (FTD) for potential use alongside inhibitors to treat hemophilia A and B. As of December 2023, Pfizer has announced that the FDA has accepted Pfizer’s Biologics License Application (BLA) for marstacimab, based on results from the Phase III BASIS trial. This trial focused on individuals with hemophilia A or B who do not have inhibitors to Factor VIII (FVIII) or Factor IX (FIX).

Etranacogene dezaparvovec, also known as CSL222 and formerly referred to as AMT-061, employs a particular AAV type known as AAV5 as its carrier. This AAV5 carrier contains the Padua gene variation of Factor IX (FIX-Padua), producing FIX proteins that exhibit 5 to 8 times higher activity levels than usual. Both preclinical and clinical evidence indicate that gene therapies based on AAV5 could prove to be clinically beneficial for a significant portion of hemophilia B individuals with existing antibodies to AAV vectors, potentially broadening the scope of patients eligible for treatment.

Some other pipeline therapies for hemophilia B include

- AskBio009: Takeda

- PF-06838435/fidanacogene elaparvovec: Pfizer

- FLT180a: Freeline Therapeutics

- Concizumab: Novo Nordisk A/S

As these innovative therapies continue to undergo clinical trials and gain regulatory approval, they have the potential to revolutionize hemophilia B treatment paradigms, offering patients and healthcare providers new avenues for improved disease management and quality of life. Consequently, the market for hemophilia B treatments is expected to experience significant shifts as these advancements become more widely available and adopted.

To know more about hemophilia B clinical trials, visit @ Hemophilia B Treatment Drugs

Hemophilia B Overview

Hemophilia B is a rare genetic disorder characterized by insufficient levels of factor IX, a blood protein crucial for clotting. The severity of the condition is determined by the quantity of factor IX in the bloodstream. The primary cause of hemophilia B is a mutation in the Factor IX gene, responsible for producing clotting factor proteins. This genetic defect is located on the X chromosome, leading to X-linked inheritance, where mothers pass the mutation to their children.

Approximately 3 in 100 individuals with hemophilia B develop an inhibitor, an antibody that hinders the effectiveness of factor IX replacement therapy, used to treat or prevent bleeding episodes. The presence of an inhibitor complicates efforts to prevent bleeding episodes. Screening tests, including a complete blood count (CBC), activated partial thromboplastin time (APTT) test, prothrombin time (PT) test, and fibrinogen test, are employed to assess blood clotting functionality.

| Hemophilia B Report Metrics | Details |

| Study Period | 2019–2032 |

| Hemophilia B Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Hemophilia B Market Size in 2022 | USD 3.2 Billion |

| Key Hemophilia B Companies | CSL Behring, ApcinteX Ltd, Centessa Pharmaceuticals plc, Takeda, Pfizer, Novo Nordisk A/S, Sanofi, Freeline Therapeutics, and others |

| Key Hemophilia B Therapies | Lumasiran, DCR-PHXC, Oxabact (OC5-DB-02), Reloxaliase (ALLN-177), Stiripentol (Diacomit), Marstacimab, FLT180a, and others |

Scope of the Hemophilia B Market Report

- Hemophilia B Therapeutic Assessment: Hemophilia B current marketed and emerging therapies

- Hemophilia B Market Dynamics: Attribute Analysis of Emerging Hemophilia B Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Hemophilia B Market Access and Reimbursement

Discover more about hemophilia B drugs in development @ Hemophilia B Clinical Trials

Table of Contents

| 1. | Hemophilia B Market Key Insights |

| 2. | Hemophilia B Market Report Introduction |

| 3. | Hemophilia B Market Overview at a Glance |

| 4. | Hemophilia B Market Executive Summary |

| 5. | Disease Background and Overview |

| 6. | Hemophilia B Treatment and Management |

| 7. | Hemophilia B Epidemiology and Patient Population |

| 8. | Patient Journey |

| 9. | Hemophilia B Marketed Drugs |

| 10. | Hemophilia B Emerging Drugs |

| 11. | Seven Major Hemophilia B Market Analysis |

| 12. | Hemophilia B Market Outlook |

| 13. | Potential of Current and Emerging Therapies |

| 14. | KOL Views |

| 15. | Unmet Needs |

| 16. | SWOT Analysis |

| 17. | Appendix |

| 18. | DelveInsight Capabilities |

| 19. | Disclaimer |

| 20. | About DelveInsight |

Related Reports

Hemophilia B Epidemiology Forecast

Hemophilia B Epidemiology Forecast – 2032 report delivers an in-depth understanding of the disease, historical and forecasted hemophilia B epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

Hemophilia B Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key hemophilia B companies, including ASC Therapeutics, Spark Therapeutics, Roche, Pfizer, among others.

Hemophilia Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key Hemophilia companies, including Intellia tx, Amarna therapeutics, Expressi Ontherapeutics, GC Pharma, Chameleon Biosciences, Pfizer, UBI Pharma, GeneVentiv, Chia Tai Tianqing Pharmaceutical Group, Bayer, ASC Therapeutics, Catalyst Biosciences, Staidson Beijing BioPharmaceuticals, Spark Therapeutics, CSL Behring, Sanofi, Novo Nordisk, Centessa Pharmaceuticals, OPKO Health, among others.

Hemophilia Market Insights, Epidemiology, and Market Forecast – 2032 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key hemophilia companies, including ApcinteX, ASC Therapeutics, Ultragenix Pharmaceutical, BioMarin Pharmaceutical, CSL Behring, Freeline Therapeutics, Genentech, Inc., Novo Nordisk, Pfizer, Sanofi, Shire, Spark Therapeutics, Amarna therapeutics, Asklepios BioPharmaceutical, Bayer, Belief Biomed, Bioverativ, Catalyst Biosciences, Centessa Pharmaceuticals, Chameleon Biosciences, Chia Tai Tianqing Pharmaceutical Group, Expression Therapeutics, GC Pharma, GeneVentiv, Intellia tx, OPKO Health, Sangamo Therapeutics, Staidson Beijing BioPharmaceuticals, UBI Pharma, uniQure, among others.

Hemophilia A Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key hemophilia A companies, including Takeda, Marinus Pharmaceuticals, SK biopharmaceuticals, CuroNZ, TAHO Pharmaceuticals, Axium Pharmaceuticals, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter