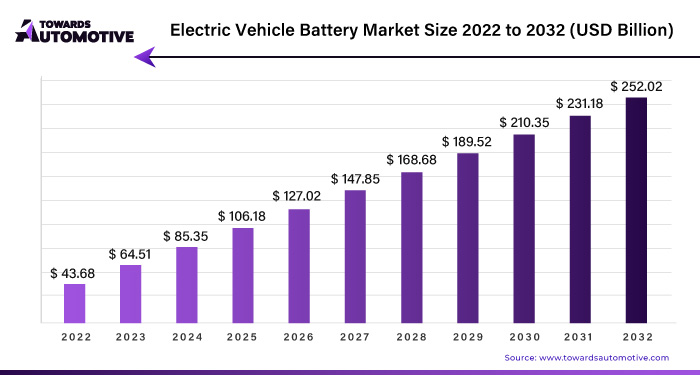

Hong Kong, April 24, 2024 (GLOBE NEWSWIRE) -- The global electric vehicle battery market size surpassed USD 64.51 billion in 2023 and is predicted to hit around USD 231.18 billion by 2031, a study published by Towards Automotive a sister firm of Precedence Research.

The battery serves as the heart of an electric vehicle (EV), acting as the primary source of power for propulsion and electrical systems. It functions by converting stored electrical energy into usable power for the vehicle's operation. In the realm of electronics, batteries facilitate electrical reactions by transferring charges between different components. In the context of EVs, batteries are engineered to meet the diverse energy demands of the vehicle's motor and charging infrastructure.

Typically, an electric car's battery pack comprises multiple cells, ranging from 18 to 30 cells, which are interconnected in series to achieve the requisite drive voltage. Automakers are actively engaged in advancing EV technologies, with a particular emphasis on refining motor and battery designs to mitigate emissions and reduce costs.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.towardsautomotive.com/insight-sample/1010

Among the various materials utilized in electric batteries, Lithium Nickel Manganese Cobalt Oxide (NMC) batteries represent the prevailing choice. Additionally, in the United States, Lithium Nickel Cobalt Aluminum Oxide (NCA) finds application in electric vehicles such as the Tesla Model X, S, and 3. Notably, companies like BYD Automobile Company have made significant strides in electric vehicle technology, exemplified by the launch of their electric conversion kit for cars in March 2020. These advancements are characterized by enhanced battery pack structures, which optimize performance by up to 50% compared to lithium metal phosphate batteries, thereby extending battery lifespan and efficiency.

Rechargeable batteries serve as the primary power source for electric and hybrid electric vehicles (EVs and HEVs). These vehicles are increasingly being adopted in many countries as part of efforts to reduce emissions and combat environmental degradation. The battery plays a crucial role in the electrical system of these vehicles, providing the necessary energy to power the engine.

Currently, lithium-ion and lithium-polymer batteries are the most commonly used types in electric vehicles due to their high energy density relative to their weight. These batteries utilize various chemical materials, including lithium, cobalt, manganese, iron, graphite, and nickel, to create efficient battery cells. The combination of these components enables lithium-ion batteries to deliver the performance required for electric vehicle applications.

Given the growing concerns over pollution and environmental impact, governments worldwide are implementing stringent regulations aimed at reducing carbon emissions and protecting the environment. As a result, there is a heightened focus on promoting the adoption of electric vehicles as a cleaner and more sustainable alternative to traditional gasoline-powered vehicles. This increased emphasis on reducing vehicle emissions is expected to drive up the demand for electric vehicles, consequently boosting the demand for EV batteries.

The emergence of business models such as battery swapping and battery-as-a-service (BaaS) represents a significant development in the electric vehicle (EV) industry. These models offer customers the convenience of replacing their EV batteries after use, addressing key challenges associated with fixed charging stations.

Compared to fixed charging stations, which require time-consuming recharging processes and expensive infrastructure, battery swapping and BaaS solutions allow for quick and efficient battery replacements. BaaS, in particular, is characterized by its asset-light nature, affordability, and speed, making it an attractive option for EV users.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

One of the primary benefits of these models is the reduction in upfront costs for EV ownership. For example, BaaS can lower the cost of two-wheeler EVs by up to 20%, making them more accessible to a broader range of consumers. Additionally, the ability to quickly swap batteries reduces the time users spend waiting for their vehicles to charge, leading to increased customer satisfaction and facilitating the widespread adoption of EVs.

The implementation of battery swapping stations has seen significant growth, with companies like NIO leading the way. NIO has plans to install thousands of battery swapping stations both in China and internationally, providing EV users with convenient access to battery replacement services. Collaborations between companies like Shell and NIO further support the expansion of battery swapping infrastructure, creating new opportunities for electric vehicle charging solutions.

Overall, the rise of battery swapping and BaaS models represents a promising development in the EV industry, offering innovative solutions to address challenges related to charging infrastructure and EV adoption. These models have the potential to accelerate the transition to electric mobility and contribute to a more sustainable transportation ecosystem.

The spread of electric vehicles is significantly influenced by high production costs, particularly those associated with battery manufacturing. However, anticipated declines in battery costs, coupled with increased research and development (R&D) spending, have the potential to reduce the overall cost of purchasing electric vehicles (EVs) to a level comparable to internal combustion engine (ICE) cars, making them more economically viable options for consumers.

Raw materials such as cobalt, nickel, lithium, and magnesium are essential components of EV batteries, and their high costs directly impact the cost of battery production. The cost of the cathode, in particular, has a significant influence on overall battery costs. Additionally, the production process for EVs is inherently more expensive than that of hybrid vehicles, due to the specialized batteries required, as well as the advanced technology and materials used in EV manufacturing.

As the demand for electric vehicles continues to rise, the production of these vehicles becomes increasingly important but also more costly. The current cost of raw materials per EV is approximately $8,255, reflecting the significant expenses associated with sourcing materials like cobalt, nickel, and lithium. This cost has seen a substantial increase compared to March 2020, when it was $3,381 per car, representing a rise of over 140%.

Ongoing disruptions in product supply chains and escalating raw material prices further contribute to the challenges faced by the electric vehicle industry. The situation in Ukraine, for instance, has exacerbated these issues, as Russia, a major exporter of metals used in battery production, has faced disruptions due to geopolitical tensions.

High production costs remain a significant barrier to the widespread adoption of electric vehicles, advancements in battery technology, increased R&D investment, and efforts to mitigate supply chain disruptions are essential for driving down costs and making EVs more accessible to consumers.

Rising Need for Electric Vehicles

The growing demand for electric vehicles (EVs) stems from the imperative to reduce reliance on imported oil and fossil fuels. As production costs for oil rise and the prices of imported oil escalate, countries heavily reliant on petroleum products face the necessity of significant investments to transition their economies. EVs, powered by fuel cells, electricity, and batteries, offer a promising solution, substantially reducing dependence on foreign fuel sources.

The allure of EVs lies not only in their reduced reliance on imported fuel but also in their environmentally friendly nature. With lower emissions compared to traditional combustion engine vehicles, EVs have garnered widespread acceptance. This trend is poised to fuel further growth in the industry's revenue in the foreseeable future.

Rising Uses of Battery Swapping

The emergence of battery swapping and battery-as-a-service (BaaS) models represents innovative solutions to address the limitations of traditional fixed charging stations for electric vehicles (EVs). Unlike conventional charging stations, which require time and expensive infrastructure for recharging, battery swapping and BaaS offer customers the convenience of quickly replacing depleted batteries.

The BaaS model, in particular, is characterized by its asset-light nature, low cost, and rapid deployment capabilities. By outsourcing the ownership and maintenance of batteries to service providers, BaaS reduces the upfront cost of EVs for customers, making them more accessible. For instance, in the case of two-wheeled vehicles, BaaS could lead to cost savings of up to 20%.

Moreover, BaaS significantly reduces the time customers spend waiting for their batteries to charge, enhancing overall satisfaction and user experience. By eliminating one of the key barriers to EV adoption—the inconvenience of charging—BaaS has the potential to accelerate the transition to electric mobility and contribute to the widespread adoption of EVs.

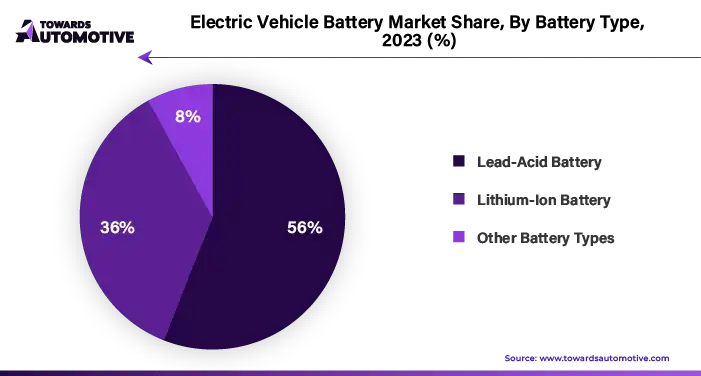

Lithium-ion batteries currently dominate the electric vehicle (EV) market, constituting over 70% of the rechargeable battery market, as reported by the US International Trade Commission in 2018. A significant driver of the growing adoption of EVs is the declining cost of lithium-ion batteries, with the price per kilowatt-hour (kWh) falling below $200. Further advancements in battery chemistry and manufacturing processes are expected to drive battery prices below $100/kWh in the coming years. This reduction in battery costs, which typically account for 35% to 45% of EV production costs, is poised to significantly expand the EV market.

Over the next decade, continuous investment in research and development (R&D) and increased production capacity will facilitate the development of new cathode materials and battery technologies, including silicon and lithium metal anodes, solid electrolytes, and more. These advancements aim to further reduce costs and enhance the performance of lithium-ion batteries, making EVs more accessible to consumers.

Despite global EV sales accounting for only around 3.2% of total vehicle sales in 2020, this figure is expected to increase significantly in the coming years. One contributing factor to this growth is the decreasing cost of EV fuel, driven by increased production and technological advancements in battery manufacturing. As battery costs continue to decline, electric cars are becoming increasingly competitive with traditional gasoline-powered vehicles, further incentivizing consumers to make the switch to EVs.

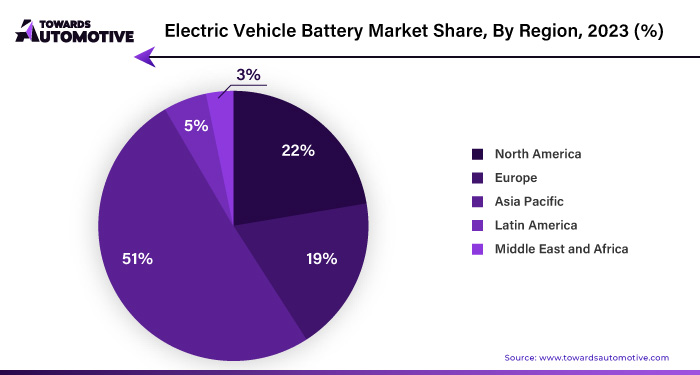

Asia-Pacific Is Expected to Be the Leading Market

The global electric vehicle battery market is segmented into several key regions, including North America, Europe, South America, Asia Pacific, and the Middle East and Africa. Among these regions, Asia Pacific has emerged as the largest market, accounting for a significant portion of market revenue by 2023.

Countries such as China and India within the Asia Pacific region offer favorable conditions for the electric vehicle battery market. These countries benefit from cheap labor and flexible production options, attracting substantial investments from large companies. Moreover, government economic policies aimed at promoting sustainable transportation further encourage investment in the electric vehicle sector.

The Asia Pacific region boasts a large customer base and is experiencing rising demand for both electric passenger and commercial vehicles. This growing demand is fueled by increasing awareness of environmental concerns and the need for cleaner transportation solutions.

Infrastructure financing initiatives and expanded government support for electric vehicles also contribute to the growth of the electric vehicle battery market in Asia Pacific. For instance, Tata Group's subsidiary, Agratas Energy Storage Solutions Private Limited, signed an agreement with the Gujarat government to establish India's first lithium-ion battery superfactory. This significant investment reflects the region's commitment to advancing electric vehicle technology and infrastructure.

In addition, companies like Amara Raja Batteries Limited (ARBL) are investing in research and development (R&D) and greenfield manufacturing of lithium-ion batteries. ARBL's plans to invest in rechargeable zinc-air batteries signify ongoing efforts to explore alternative battery technologies for electric vehicles, highlighting the region's dedication to innovation and sustainability in the automotive sector.

Electric Vehicle Battery Market Leaders

- Panasonic Corporation

- LG Energy Solution Ltd

- Contemporary Amperex Technology Co. Ltd

- Samsung SDI Co. Ltd

- BYD Co. Ltd

- Narada Power Source Co. Ltd

- East Penn Manufacturing Company

- GS Yuasa Corporation

- Clarios

- Hitachi Ltd

Electric Vehicle Battery Market News

- In October 2023, Panasonic Corporation announced a breakthrough in battery technology with the development of a new lithium-ion battery cell that offers significantly higher energy density and faster charging capabilities. This advancement represents a major step forward in the electric vehicle battery market, promising longer driving ranges and reduced charging times for EV owners.

- In December 2023, CATL (Contemporary Amperex Technology Co. Limited) unveiled plans to build a new mega-factory for lithium-ion batteries in Germany. This state-of-the-art facility will significantly increase CATL's production capacity and strengthen its position as a leading supplier of EV batteries in Europe, supporting the region's transition to electric mobility.

- LG Energy Solution announced in January 2023 its collaboration with Ford Motor Company to develop and supply batteries for Ford's upcoming lineup of electric vehicles. This partnership highlights LG Energy Solution's commitment to innovation and sustainability, providing Ford with cutting-edge battery technology to power its next-generation EVs.

- Tesla Inc. introduced in March 2023 its latest innovation in battery technology with the unveiling of the "4680" battery cell. This larger, more energy-dense cell is expected to revolutionize the electric vehicle industry, offering improved performance, increased range, and lower production costs for Tesla's electric cars and energy products.

- Volkswagen Group announced in April 2023 its strategic investment in Northvolt AB, a leading Swedish battery manufacturer, to secure a stable supply of lithium-ion batteries for its electric vehicle lineup. This partnership underscores Volkswagen's commitment to electrification and its efforts to establish a sustainable battery supply chain for its EV production.

Browse More Insights of Towards Automotive:

- The traffic signal recognition market size is projected to rise from USD 36.22 billion in 2023 to expand to USD 51.49 billion by 2032, reflecting 4.54% CAGR between 2023 and 2032.

- The automotive smart key market size is expected to increase from USD 18.25 billion in 2023 to an estimated USD 27.67 billion by 2032, with a compound yearly growth rate (CAGR) of 5.42% over the forecast period (2023-2032).

- The off-highway vehicle engine market size calculated USD 43.31 billion in 2023 and is projected to achieve USD 78.18 billion by 2032, with a CAGR of 6.78% during the forecast period.

- The automotive lighting market size is estimated at USD 39.25 billion in 2024 to calculate USD 58.25 billion by 2032, growing at a CAGR of 5.21% during the forecast period.

- The vehicle security systems market size was valued at USD 11.40 billion in 2023 and is expected to reach USD 18.74 billion by 2032, growing at CAGR of 4.86% during the forecast period.

- The automotive 3D printing market size is expected to rise from USD 2.8 billion in 2022 to reach an estimated USD 13.81 billion by 2032, increasing at a double digit CAGR of 19.40% between 2023 and 2032.

- The automotive relay market size is expected to grow from USD 16.62 billion in 2023 to USD 34.29 billion in 2032, expanding at a CAGR of 8.38% during the forecast period.

- The automotive electronic stability control system market size was valued at USD 40.65 billion in 2022 and is expected to expand to USD 106.91 billion by 2032, with an increase in CAGR of more than 11.34%.

- The automotive torque converter market size to rise from USD 3.72 billion in 2023 to reach USD 6.11 billion by 2032, increasing at CAGR above 5.56% between 2023 and 2032.

- The automotive gears market size to rise from USD 5.79 billion in 2023 and predicted to hit USD 10.27 billion by 2032, expanding at 6.58% CAGR during the forecast period.

Market Segmentation

By Battery Type

- Lead-Acid Battery

- Lithium-Ion Battery

- Other Battery Types

By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1010

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Explore the comprehensive statistics and insights on healthcare industry data and its associated segmentation: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journal@

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive