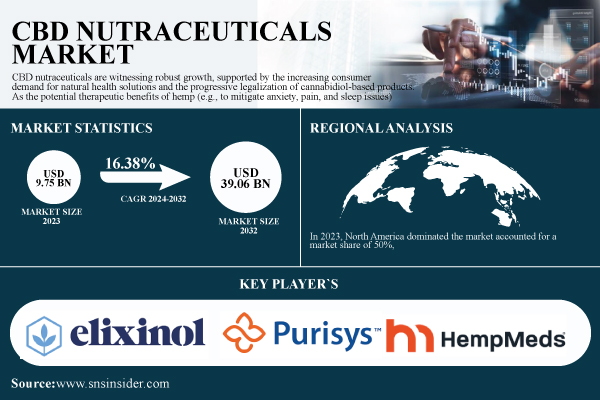

Austin, Dec. 06, 2025 (GLOBE NEWSWIRE) -- According to SNS Insider, The CBD Nutraceuticals Market was valued at USD 9.75 billion in 2023 and is expected to reach USD 39.06 billion by 2032, growing at a CAGR of 16.38% from 2024-2032.

The growing customer desire for natural health solutions and the gradual legalization of products containing cannabidiol are driving the strong rise of CBD nutraceuticals.

Get a Sample Report of CBD Nutraceuticals Market: https://www.snsinsider.com/sample-request/5479

Increased Consumer Awareness of the Need for Natural Wellness Solutions to Drive Market Growth Globally

Natural, plant-based substances are becoming more and more popular among modern consumers as a means of achieving their wellness and health objectives. CBD nutraceuticals made from hemp or cannabis are thought to be efficient, non-addictive remedies for problems with inflammation, anxiety, chronic pain, and sleep disturbances. This pattern is in line with a growing understanding of CBD's possible medical uses, which is backed by new research and wellness influencers.

Growing Advancements in the Legalization of CBD Products May Hinder Market Expansion

While some jurisdictions and nations have authorized CBD for use in medical and wellness contexts, others have severe restrictions or outright banned it. For manufacturers and distributors operating in different markets, compliance is a problem due to differences in the THC threshold level, labeling rules, and product classifications.

Segmentation Analysis:

By Product

CBD tinctures segment dominated the market with a market share of 40% in 2023 as these products helped in dealing with several medical conditions, such as chronic pain, depression, substance use disorders, and cancer-related symptoms. The capsules and soft gels segment is expected to grow at the fastest CAGR throughout the forecast period. This growth is fueled by a rising prevalence of health issues, an increased focus on health and nutrition, and the convenience these products offer.

By Distribution Channel

In 2023, the retail store's segment dominated the market for the largest market share with 42%. Multiple factors, such as enhanced accessibility, the availability of a wide range of products from various facilities, and moves by top companies to improve brand visibility. The online segment is expected to expand at the fastest CAGR throughout the forecast period. Expanding internet purchasing and marketing channels, an expanded offering of CBD products through e-commerce platforms, and suppliers’ and companies’ e-commerce e-store establishment will drive demand.

Purchase Single User PDF of CBD Nutraceuticals Market Report: https://www.snsinsider.com/checkout/5479

Regional Insights:

In 2023, North America dominated the market accounted for a market share of 50%, and led the CBD nutraceuticals market. Factors such as increasing consumer awareness, wide use of CBD in various applications, and the favorable regulatory scenario in countries such as the U.S. and Canada were responsible for this regional market share.

Asia Pacific will have the fastest compound annual growth rate of 18.48% during the forecast period. Factors, such as the potential for CBD legalization, growing acceptance of CBD for medicinal use, rising incidence of chronic and non-communicable conditions, and cultural awareness in nations such as India, where cannabis is revered, are the main drivers for this market.

Major Players Analysis Listed in the CBD Nutraceuticals Market Report are

- Charlotte's Web (CBD Oil Tinctures, CBD Gummies)

- CV Sciences (PlusCBD Oil Softgels, PlusCBD Oil Balm)

- Elixinol (Elixinol Hemp Oil Capsules, Elixinol CBD Oil Tincture)

- Green Roads (CBD Oil 100mg-1500mg, CBD Relax Bears)

- Medterra (Medterra CBD Gel Capsules, Medterra CBD Oil Tincture)

- PureKana (PureKana CBD Oil Tincture, PureKana CBD Capsules)

- HempFusion (HempFusion Full Spectrum Hemp Extract Softgels, HempFusion CBD Gummies)

- Lazarus Naturals (Lazarus CBD Oil Tinctures, Lazarus CBD Softgels)

- Joy Organics (Joy Organics CBD Softgels, Joy Organics CBD Oil Tinctures)

- FAB CBD (FAB CBD Oil Tinctures, FAB CBD Gummies)

- Sunday Scaries (Sunday Scaries CBD Gummies, Sunday Scaries CBD Oil Tincture)

- CBDFx (CBD Gummies with Turmeric and Spirulina, CBD Vape Pens)

- Koi CBD (Koi CBD Gummies, Koi CBD Tinctures)

- cbdMD (cbdMD CBD Oil Tinctures, cbdMD CBD Gummies)

- Green Gorilla (Organic CBD Oil Drops, CBD Capsules)

- NuLeaf Naturals (NuLeaf CBD Oil, NuLeaf CBD Softgels)

- Serenity CBD (Serenity CBD Capsules, Serenity CBD Oil)

- Vitality CBD (Vitality CBD Gummies, Vitality CBD Capsules)

- The CBDistillery (CBD Oil Tincture, CBD Isolate Powder)

- American Shaman (CBD Oil Tincture, CBD Topicals)

Recent Developments:

- In May 2024, CV Sciences Inc. acquired Elevated Softgels LLC, a prominent player in the encapsulated softgels and tinctures market. This acquisition enhances CV Sciences' global presence and solidifies its position in the CBD nutraceuticals industry.

- In November 2023, Charlotte's Web expanded its ReCreate brand by introducing a new line of CBD gummies formulated with functional botanicals, specifically targeting the sports and wellness sector. The newly launched products include endurance gummies, muscle recovery gummies, brain support gummies, and rest gummies.

For a Personalized Briefing with Our Industry Analysts, Connect Now: https://www.snsinsider.com/request-analyst/5479

Exclusive Sections of the Report (The USPs):

- REGIONAL PRODUCTION CAPACITY & UTILIZATION METRICS – helps you evaluate manufacturing scalability by identifying which regions are operating at optimal capacity and which face underutilization, guiding investment and expansion decisions.

- FEEDSTOCK PRICE VOLATILITY INDEX – helps you understand cost fluctuations across regions by tracking hemp-derived feedstock pricing trends, enabling better forecasting of production expenses and margin planning.

- REGULATORY IMPACT ASSESSMENT – helps you measure how evolving CBD-related regulations influence production, product formulation, market entry, and usage restrictions across different regions.

- REGIONAL ENVIRONMENTAL PERFORMANCE INDICATORS – helps you assess sustainability levels through metrics linked to cultivation practices, energy use, water consumption, and carbon footprint across key CBD-producing regions.

- CONSUMER DEMOGRAPHIC & BEHAVIOR INSIGHTS – helps you analyze evolving consumer profiles based on age, income, lifestyle, and health preferences, enabling targeted product positioning and market penetration strategies.

CBD Nutraceuticals Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.75 Billion |

| Market Size by 2032 | US$ 39.06 Billion |

| CAGR | CAGR of 16.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Segments | •By-products (CBD Tinctures, Capsules & Softgels, CBD Gummies, Others) •By Application (Edibles and Fortified Foods, Workout Supplements, Wellness, Others) •By Distribution Channel (Retail Stores, Online, Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Related Reports

Nutraceutical Excipients Market

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.