Abu Dhabi, Dec. 11, 2025 (GLOBE NEWSWIRE) --

- Smart Guardrails and Universal Access Schema (UAS) make access a property of the network, not a platform privilege

- onchain.money (BETA) debuts as the first public Gateway-powered search interface for verified on-chain assets

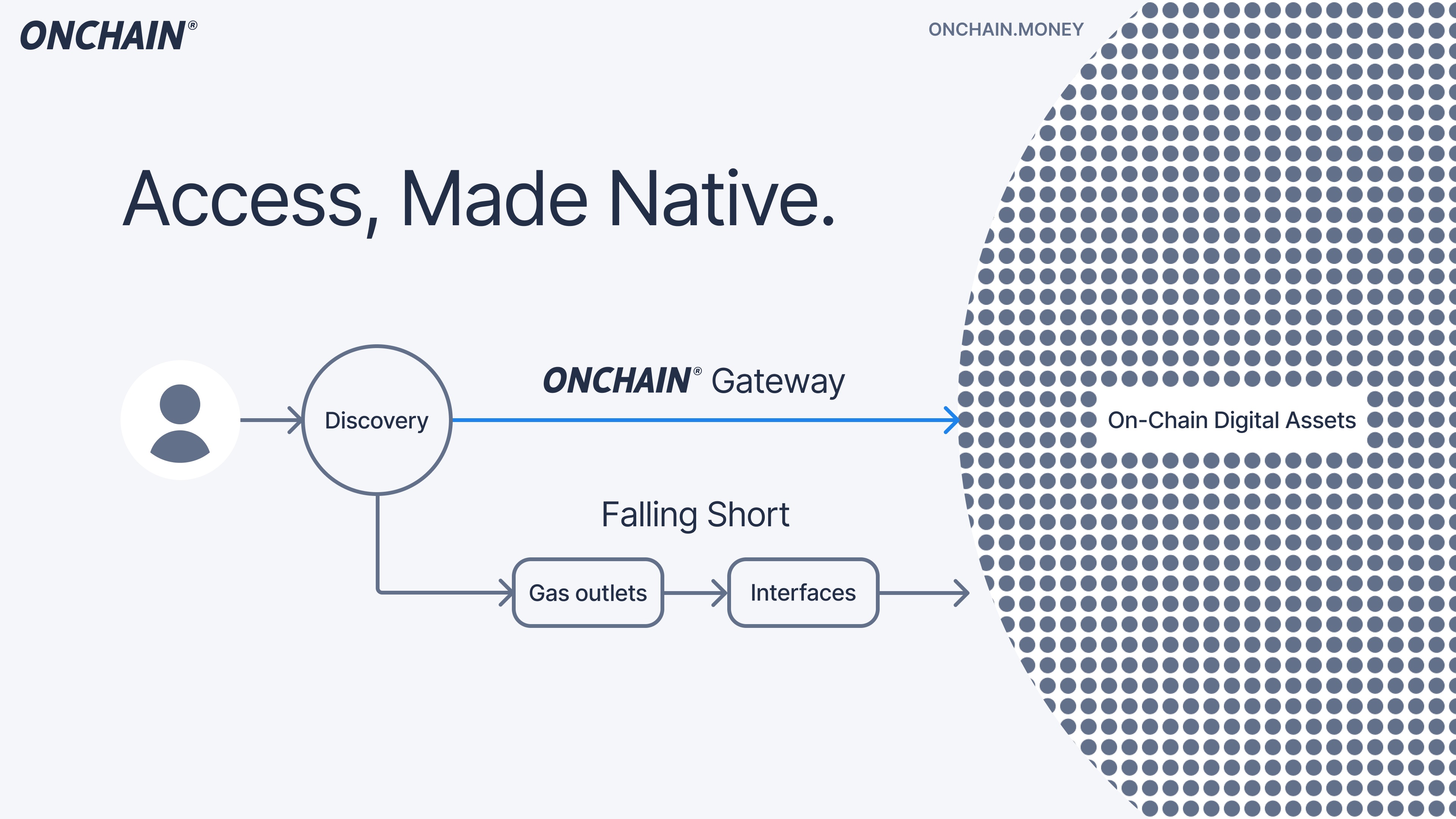

- New access layer targets 68% first-use drop-off and redirects on-ramp flows from “fuel assets” to user-intended ownership

Abu Dhabi, UAE, December 11, 2025 - ONCHAIN® Labs today announced ONCHAIN® Gateway, a new access and routing layer built on the ONCHAIN® Protocol Network (OPN, pronounced “open”). Gateway enables anyone to buy verified on-chain assets on demand, directly from fiat or crypto, without centralized listings, custodial intermediaries, or multi-step bridging flows.

Instead of treating access as a platform privilege, Gateway makes it a property of the network itself. Powered by real-time payment verification, deterministic routing, and automated Smart Guardrails, Gateway replaces today’s fragmented onboarding stack with a single coordinated flow from payment to on-chain settlement. In a phrase: Access, Made Native™.

As the first public Gateway-powered surface, ONCHAIN® Labs is releasing onchain.money (BETA), a simple, search-driven interface powered entirely by Gateway. At launch, users can search for supported on-chain assets and buy them instantly with fiat or crypto, paste a contract address to request instant availability, and discover verified assets via the Universal Access Schema (UAS) at buy.onchain.money/[chain]/[token]. Each UAS link functions as a live access node that can be embedded into wallets, bots, explorers, dashboards, centralized exchange off-boarding flows, and community surfaces, enabling permissionless distribution without the delays, negotiations, or politics of conventional listings.

Despite an explosion in on-chain liquidity, reaching assets remains unnecessarily complex for new users. The typical sequence to reach a desired asset - buy gas, wait for withdrawal, set up a wallet, transfer, bridge, connect to a DEX, approve, pay gas, and finally swap - produces an estimated 68 percent friction-induced drop-off before a first on-chain action is completed. Meanwhile, 88 percent of on-ramp volume flows into four “fuel assets” (ETH, SOL, USDC, and USDT), which users treat as tools to reach a destination rather than as the destination itself.

Over the past 12 months, stablecoin settlement has exceeded 46 trillion dollars, yet there is still no native access layer that turns this liquidity into direct, user-level ownership of on-chain assets. This fragmentation turns onboarding into gatekeeping, limiting participation and burying new assets and ecosystems behind unnecessary friction.

Gateway is designed to remove these chokepoints by shifting access from platform-level discretion to network-level determinism. Every asset passes Smart Guardrails that verify liquidity conditions, contract integrity, settlement behavior, and OPN execution compatibility. Assets that are cleared become instantly reachable from any surface that embeds a UAS link, with no additional negotiations, approvals, or custodial listings required. Access becomes portable and permissionless across the network.

“For over a decade, access has been controlled by a small circle of platforms deciding who gets listed, when, and at what cost ”said Jason Dominique, CEO and co-founder of ONCHAIN® Labs. “Gateway flips that model. Access becomes a network primitive, not a business arrangement. Users should reach on-chain value at the moment of discovery, safely, directly, and without asking for permission.”

Gateway and OPN work together as a two-layer system. Gateway operates the payments and verification layer: it compares multiple fiat providers, handles KYC, AML, and KYT checks, and Travel Rule requirements, confirms payment and settlement readiness, then broadcasts a BuyIntent to OPN for execution. OPN acts as the coordination and execution layer: it receives the intent from Gateway, selects optimal liquidity paths, executes chain-agnostic, non-custodial settlement, and guarantees deterministic delivery to the user’s wallet.

A transparent 1.5% end-to-end fee is applied on completed flows, split into a 1.0% Gateway Fee and a 0.5% OPN Network Fee, replacing hidden spreads, bridge friction, gas volatility, and failed-transaction risk. By embedding a UAS link, any button, bot, or URL becomes a high-intent, network-native access point rather than a platform-dependent integration.

ONCHAIN® Labs sees Gateway and OPN as foundational infrastructure for sovereign digital economies. On-chain value is global, but without a native access layer, chains remain isolated liquidity islands. Together, Gateway and OPN provide the missing layer, enabling permissionless access, network-native distribution, local settlement, and chains to function as sovereign digital economies with direct paths from user intent to verified ownership. Gateway positions OPN as the connective tissue of a new financial internet where moving from intent to ownership is as simple as making an online payment.

The onchain.money BETA experience is available at: https://onchain.money

About ONCHAIN® Labs

ONCHAIN® Labs builds the coordination and access layer for the on-chain economy. Its core infrastructure, the ONCHAIN® Protocol Network (OPN, “open”), is a stateless, chain-agnostic coordination layer that fulfills user intents locally without custody, bridges, or listings. The company developed ONCHAIN® Gateway, which provides a unified flow from payment to verified on-chain delivery using deterministic routing, Smart Guardrails, and the Universal Access Schema (UAS). By making access a network property – Access, Made Native™. – ONCHAIN® Labs enables a more open, permissionless, and interoperable financial internet. Learn more at https://onchain.money.