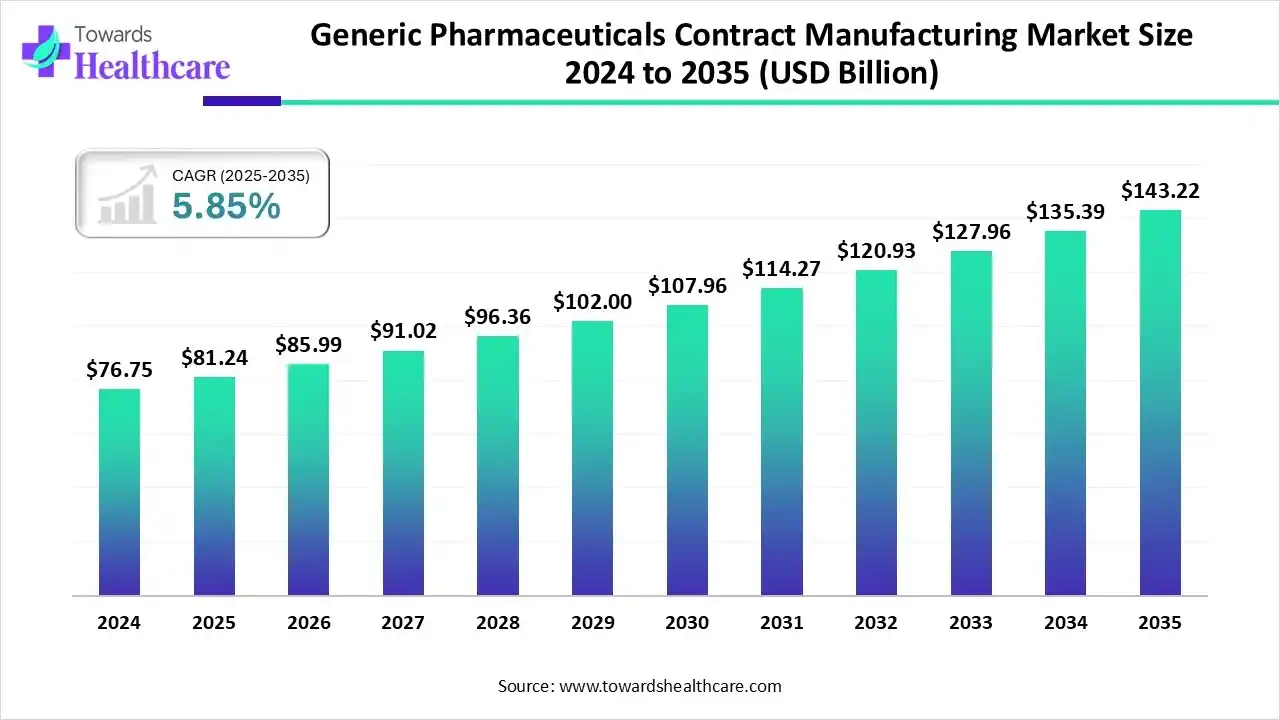

Ottawa, Dec. 19, 2025 (GLOBE NEWSWIRE) -- The global generic pharmaceuticals contract manufacturing market size is calculated at USD 85.99 billion in 2026 and is expected to reach around USD 143.22 billion by 2035, growing at a CAGR of 5.85% for the forecasted period, driven by its increasing demand and growing innovations.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6405

Key Takeaways

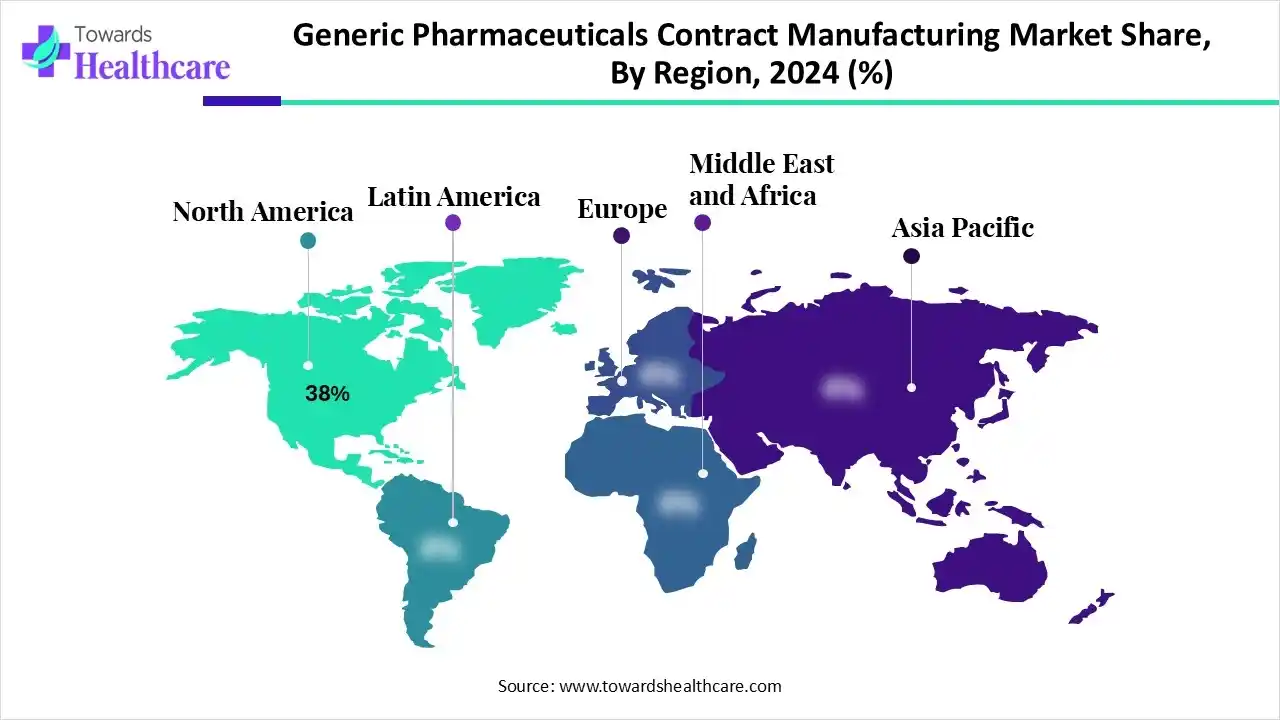

- North America held a major revenue share of the market by 38% in 2024.

- Asia Pacific is expected to witness the fastest growth in the generic pharmaceuticals contract manufacturing market during the forecast period.

- By service type, the API manufacturing segment held a major revenue share of the market in 2025.

- By service type, the integrated CDMO segment is expected to witness the fastest growth in the market during the forecast period.

- By drug type, the small-molecule generics segment held a major revenue share of the market in 2025.

- By drug type, the biosimilars & biologics segment is expected to witness the fastest growth in the market during the forecast period.

- By formulation, the solid oral segment held a major revenue share of the market in 2025.

- By formulation, the sterile injectables segment is expected to witness the fastest growth in the market during the forecast period.

- By end-user industry, the retail pharmacies & outpatient channels segment held a major revenue share of the market in 2025.

- By end-user industry, the hospitals & clinics segment is expected to witness the fastest growth in the market during the forecast period.

What is the Generic Pharmaceuticals Contract Manufacturing?

The generic pharmaceuticals contract manufacturing market is driven by increasing patent expiration of branded drugs and demand for affordable medicines. The generic pharmaceuticals contract manufacturing refers to the outsourcing of manufacturing services to a third-party organization by the generic drug companies. They provide affordable service, API, and finished dosage forms production, expertise, and other facilities.

What are the Major Growth Drivers in the Market?

The growing generic biologics act as the major driver in the generic pharmaceuticals contract manufacturing market. This increases the demand for specialized manufacturing facilities and expertise, which in turn encourages collaborations with the generic pharmaceuticals contract manufacturing facilities. Moreover, growing outsourcing trends, disease, and technological advancements are other market drivers.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Key Drifts in the Market?

The generic pharmaceuticals contract manufacturing market has been expanding due to the growing investments and agreements to launch and enhance the use of various generic services.

- In June 2025, to expand the U.S facility of Piramal Pharma Solutions, which is a leading contract development and manufacturing organization (CDMO) in India, located at Riverview, Michigan, and Lexington, Kentucky, the company announced a total of $90 million in investment.

- In February 2025, to acquire 80% equity capital in JASMIN, definitive transaction agreements with the affiliate entities and Pierre Fabre SA were announced by Jubilant Biosys Innovative Research Services Pte. Limited. With this agreement, areas like the antibody drug conjugate (ADC) and biologics will be expanded across Europe.

What is the Significant Challenge in the Market?

Stringent regulations act as the major challenge in the generic pharmaceuticals contract manufacturing market. Adherence to the GMP regulations, regular audits, and proper documentation are required, where their failure leads to product bans or recalls, limiting their acceptance rates. Moreover, quality risks, pricing pressures, and competition among the CDMOs are other market restraints.

Regional Analysis

Why did North America Dominate the Market in 2024?

In 2024, North America captured the biggest revenue share in the generic pharmaceuticals contract manufacturing market by 38%, due to the presence of robust industries. At the same time, the growth in the early adoption of advanced technologies and the shift towards affordable solutions also increased the manufacturing of generic products. The advanced healthcare and outsourcing tend also increased their use and innovations, which contributed to the market growth.

What Made the Asia Pacific Grow Rapidly in the Market in 2025?

Asia Pacific is expected to host the fastest-growing generic pharmaceuticals contract manufacturing market during the forecast period, due to affordable manufacturing facilities. The expanding industries and CDMOs are also driving their production, due to the growing demand for generic products across the healthcare sector, and patients are also increasing their manufacturing. Additionally, the growing generic advanced therapies and government support are also promoting the market growth.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By service type analysis

Why Did the API Manufacturing Segment Dominate in the Market in 2025?

By service type, the API manufacturing segment led the generic pharmaceuticals contract manufacturing market in 2025, as they are essential in the development of various therapeutics. This, in turn, increased their large-scale production. Additionally, the growth in the outsourcing trends has also increased their use.

By service type, the integrated CDMO segment is expected to show the highest growth during the forecast period, as it offers end-to-end services. At the same time, their fast production and affordability are also increasing their collaborations. The growing focus on complex products is also increasing their demand.

By drug type analysis

Which Drug Type Segment Held the Dominating Share of the Market in 2025?

By drug type, the small-molecule generics segment held the dominating share of the generic pharmaceuticals contract manufacturing market in 2025, due to growth in their approvals. Similarly, the growth in chronic disease has also increased its demand. This increased their manufacturing.

By drug type, the biosimilars & biologics segment is expected to show the fastest growth rate during the forecast period, due to their growing innovations. At the same time, their rising patent expiration is also driving their manufacturing and the outsourcing trends for expertise and specialized facilities.

By formulation analysis

What Made Solid Oral the Dominant Segment in the Market in 2025?

By formulation, the solid oral segment led the generic pharmaceuticals contract manufacturing market in 2025, due to its increased acceptance rate. They increased patient convenience, which promoted their use, driving their manufacturing. Furthermore, their affordability, stability, and a wide range of applications also increased their use.

By formulation, the sterile injectables segment is expected to show the highest growth during the forecast period, due to growing biologics. Additionally, the growing advanced therapies are also increasing their demand. Moreover, their enhanced bioavailability and fast onset of action are also increasing their use in emergency situations.

By end-user industry analysis

How the Retail Pharmacies & Outpatient Channels Segment Dominated the Market in 2025?

By end-user industry, the retail pharmacies & outpatient channels segment held the largest share of the generic pharmaceuticals contract manufacturing market in 2025, as they dispense large volumes of generic products. Their widespread availability and variety of products also increased their use.

By end-user industry, the hospitals & clinics segment is expected to show the fastest growth rate during the forecast period, due to the growing disease burden. This, in turn, is increasing the demand for affordable advanced therapies and injectables, which is encouraging their generic manufacturing.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments in the Market

- In October 2025, to enhance the domestic manufacturing of generic drugs, a pilot program called the abbreviated new drug application (ANDA) was launched by the FDA.

- In September 2025, the generic versions of Ozempic are expected to be launched globally at least by the end of 2026, as per the announcement made by the Managing Director and CEO Siddharth Mittal of the Bengaluru-based Biocon.

Generic Pharmaceuticals Contract Manufacturing Market Key Players List

- Jubilant Life Sciences/Jubilant Pharmova

- Boehringer Ingelheim

- Piramal Pharma Solutions

- Recipharm

- Aenova Group

- Siegfried Holding

- Fareva Group

- Cambrex Corporation

- Curia

- Almac Group

- Pfizer CentreOne

- Alcami Corporation

- Ajinomoto Bio-Pharma Services

- Vetter Pharma International

- PCI Pharma Services

Browse More Insights of Towards Healthcare:

The global generic sterile injectable market was estimated at US$ 42.42 billion in 2023 and is projected to grow to US$ 119.82 billion by 2034, rising at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2034.

The global inhalation and nasal spray generic drugs market size was US$ 25.18 billion in 2025, grew to US$ 27.44 billion in 2026, and is projected to reach around US$ 59.35 billion by 2035. The market is expected to expand at a CAGR of 8.99% between 2026 and 2035.

The global pharmaceutical grade melatonin market size is calculated at USD 479.9 million in 2024, grew to USD 521 million in 2025, and is projected to reach around USD 1044.3 million by 2034. The market is expanding at a CAGR of 8.56% between 2025 and 2034.

The global pharmaceutical spray drying market size is calculated at USD 2.37 in 2024, grew to USD 2.55 billion in 2025, and is projected to reach around USD 4.93 billion by 2034. The market is expanding at a CAGR of 7.67% between 2025 and 2034.

The global pharmaceutical secondary packaging market size is calculated at USD 43.11 in 2024, grew to USD 45.24 billion in 2025, and is projected to reach around USD 69.45 billion by 2034. The market is expanding at a CAGR of 4.94% between 2025 and 2034.

The global pharmaceutical filtration market size is projected to reach USD 30.09 billion by 2034, growing from USD 14.95 billion in 2025, at a CAGR of 8.08% during the forecast period from 2025 to 2034.

The pharmaceutical market size marked US$ 1772.65 billion in 2025 and is forecast to experience consistent growth, reaching US$ 1881.67 billion in 2026 and US$ 3219.76 billion by 2035 at a CAGR of 6.15%.

The global pharmaceutical water market size was estimated at US$ 38.70 billion in 2023 and is projected to grow to US$ 107.15 billion by 2034, rising at a compound annual growth rate (CAGR) of 9.25% from 2024 to 2034.

The global pharmaceutical stability & storage services market size is calculated at US$ 3.4 billion in 2024, grew to US$ 3.59 billion in 2025, and is projected to reach around US$ 5.92 billion by 2034. The market is expanding at a CAGR of 5.7% between 2025 and 2034.

The global pharmaceutical CDMO market size was estimated at US$ 146.05 billion in 2023 and is projected to grow to US$ 315.08 billion by 2034, rising at a compound annual growth rate (CAGR) of 7.24% from 2024 to 2034.

Segments Covered in The Report

By Service Type

- API Manufacturing

- Small-molecule API synthesis

- Custom/toll API production

- Finished Dosage Form (FDF) Manufacturing

- Tableting & encapsulation

- Liquid & sterile filling

- Integrated CDMO (Development + Manufacturing)

- Process development & scale-up

- Tech transfer & validation

- Packaging & Secondary Operations

- Blistering & bottle filling

- Labeling & serialization

- Analytical, QC & Stability Services

- Method development

- Stability testing & release testing

- Sterile/Biologics Fill-Finish

- Aseptic vial/syringe filling

- Lyophilization services

- Clinical Trial/Small-Batch Supplies

- Phase I–III clinical supply manufacturing

- Comparator sourcing

By Drug Type

- Small-molecule Generics

- Oral solids generics

- Generic injectables (non-sterile)

- Biosimilars & Biologics

- Monoclonal antibodies & recombinant proteins

- Biosimilar development services

- Sterile Injectables

- Multi-dose & single-dose vials

- Pre-filled syringes

- OTC & Consumer Health Products

- OTC tablets & syrups

- Self-care topicals

- Topicals & Transdermals

- Creams, gels, ointments

- Transdermal patches

- Others (Ophthalmic, Suppositories)

By Formulation

- Solid Oral

- Immediate release tablets

- Modified/controlled release capsules

- Sterile Injectables

- Aseptic vials & syringes

- Biologic parenterals

- Liquids & Syrups

- Oral suspensions & solutions

- Oral rehydration & pediatric formulations

- Topicals & Semisolids

- Creams, gels, ointments

- Transdermal systems

- Inhalation & Nasal

- MDIs, DPIs, nasal sprays

- Transdermal Patches

- Others (Ophthalmic, Suppositories)

By End-User Industry

- Retail Pharmacies & Outpatient Channels

- Retail prescription generics

- OTC retail lines

- Hospitals & Clinics

- Inpatient sterile injectables & parenterals

- Hospital formulary generics

- Institutional/Government Tenders

- Public health tenders

- Vaccine/essential medicine procurement

- Research Institutions & CROs

- Clinical trial supplies

- Comparator & reference products

- Export/International Distributors

- Third-party distribution hubs

- Private label export lines

- Animal Health/Veterinary

- Others (Cosmetics adjacent, Nutraceutical OEM)

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America

- Brazil

- Argentina

- Rest of South America

Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6405

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest