MISSION, KS--(Marketwired - Jan 28, 2014) - (Family Features) When it comes to managing their money, people often use the same banking provider for a number of years. Whether you're loyal to your current bank or are looking for a better option, it's important to review the available benefits to ensure your financial needs are fully met.

In an industry driven by technology, banks now serve up a platter of benefits to their account holders. From accounts that reimburse ATM fees to mobile apps, which allow up-to-date monitoring of funds, today's banking is better than ever before. By making smart choices and using new technologies and resources, account holders are able to minimize their banking costs and have a clearer understanding of their finances.

"Consumers should investigate what options are available to them," said Ryan Bailey, executive vice president of deposit and payments, TD Bank. "For example, certain checking accounts waive non-bank ATM fees and some, such as our Convenience Checking account, offer a low minimum balance. By doing a little bit of homework, consumers can choose a product and an institution that matches up with their banking needs."

Banking benefits

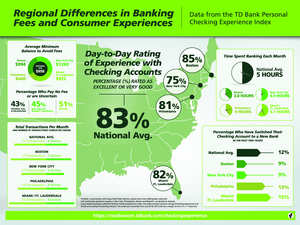

Getting the most from your bank involves a general knowledge of the products and services that are out there, which may exceed the offerings of your current provider. In fact, according to the TD Bank Checking Experience Index, a nationwide survey of more than 3,000 checking account holders at various banks, 83 percent stated that they are satisfied with their day-to-day experience. But the survey also revealed that 36 percent are extremely or very likely to switch banks to avoid fees. Armed with the proper information, account holders who share these feelings will be pleased to know of the various fee-free options available to them.

Here are some of the other benefits today's banking customer can receive:

Checking

All checking accounts are not created equal. Taking the time to find an account that aligns with individual needs improves the banking experience while minimizing costs. Some bank benefits include instantly issued free debit cards upon opening an account. For those looking for added convenience, free direct deposit may be just the ticket to make payday a breeze.

And, while technology may be top of mind to many, banks are finding that good old-fashioned customer service is an equally essential part of today's banking experience. Account holders seek branches that offer more hours in the evenings, on weekends and on holidays when banks are traditionally closed. The ability to speak with a live customer service representative 24/7 is also a highly valued asset.

Online Banking

The convenience of smartphone and tablet technology has made banking at your fingertips a daily ritual for many account holders. This ability to review the status of funds at any time, day or night, has proven to be essential for today's device-driven world. Forgetful account holders rejoice -- online bill pay is another helpful program offered by many banks. This organizational tool allows you to manage and pay all your monthly bills so they're always received on time. As an added bonus, this form of paper-free banking is the environmentally-friendly way to manage your money.

ATMs

Checking account holders who tend to use ATMs outside of their bank's network should look to financial institutions with more convenient locations and specific accounts that reimburse these costs. For example, the Premier Checking account from TD Bank waives fees at non-affiliated ATMs when the account holder keeps a low minimum daily balance. For more information, visit www.tdbank.com.

Protect Against Theft

It seems like every day the media reports another story about identity theft, security breaches and other situations of fraudulent behavior. While it may seem that thieves are always devising new ways to steal, there are ways to protect your funds and your family. Here are three helpful tips to keep your money safe and secure:

- Be Aware of Your Balance: While it may not be possible to write down every transaction that occurs throughout your busy day, having a good idea of your balance is essential. An awareness of this figure will keep you alert of any strange activity should you become a target.

- Monitor Your Account Daily: The tools of online and mobile banking apps can make checking funds simple. If you don't have online access, see if your bank offers a toll-free phone line to access your account information.

- Cover the Keypad: When using an ATM to check your balance or receive cash, always cover the keypad while entering your PIN number. Thieves are now using cameras and other tactics to steal this confidential information as you are pressing down on those buttons. Keeping it covered reduces the chance of having your account compromised.

About Family Features Editorial Syndicate

This and other food and lifestyle content can be found at www.editors.familyfeatures.com. Family Features is a leading provider of free food and lifestyle content for use in print and online publications. Register with no obligation to access a variety of formatted and unformatted features, accompanying photos, and automatically updating Web content solutions.

Contact Information:

Vickie Rocco

vrocco@familyfeatures.com

1-888-824-3337

http://editors.familyfeatures.com