MELBOURNE, Australia, Sept. 24, 2021 (GLOBE NEWSWIRE) -- According to a leading finance broker, National Loans, a borrower's credit report plays an important role in the car finance approval process. Lenders will examine the credit report of a potential borrower when they apply for a car loan or other asset finance, including motorbike finance, using the information to determine a credit score. Poor credit history makes it more likely the application will be rejected.

National Loans explains there are things a borrower can do to improve their credit score, such as paying down any outstanding debts by making more than the minimum monthly repayment, paying bills and other repayments on time and avoiding making multiple applications for credit over a short period of time.

Saving up a bigger deposit will also work in a borrower's favour, says National Loans. Applying for a smaller loan makes a borrower less risky, which improves their chances of getting approved. Additionally, it can also reduce monthly repayments and the rate charged on the loan.

Other options for those with a poor or limited credit history include having a relative or friend go guarantor on the loan. National Loans advises that the guarantor needs a good credit history and stable income. Borrowers should also only be applying for loans they can afford as lenders will look at their income and outgoings to help make an assessment. National Loans provides a car loan calculator on their website that borrowers can use to run the numbers. The car's running and maintenance costs should be factored into the budget.

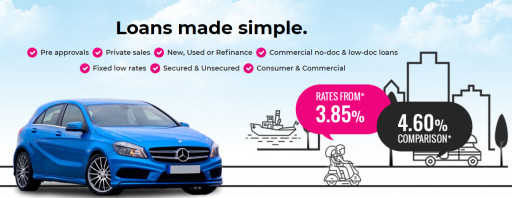

As National Loans points out, there are different types of car loans available, including secured or unsecured, fixed-rate or variable. Balloon payment car loans are another option. It's important for borrowers to choose the right type of loan that suits their circumstances.

As an expert broker, National Loans can help borrowers get first-time approval on finance applications, like balloon car loans, even if their credit score isn't perfect.

National Loans is the trusted expert for car loans and asset finance, working with Australia's top lenders to offer low-rate car loans and fast approvals to borrowers. To get a free quote, contact National Loans.

MELBOURNE (HEAD OFFICE)

Related Images

Image 1: National Loans

National Loans

This content was issued through the press release distribution service at Newswire.com.

Attachment