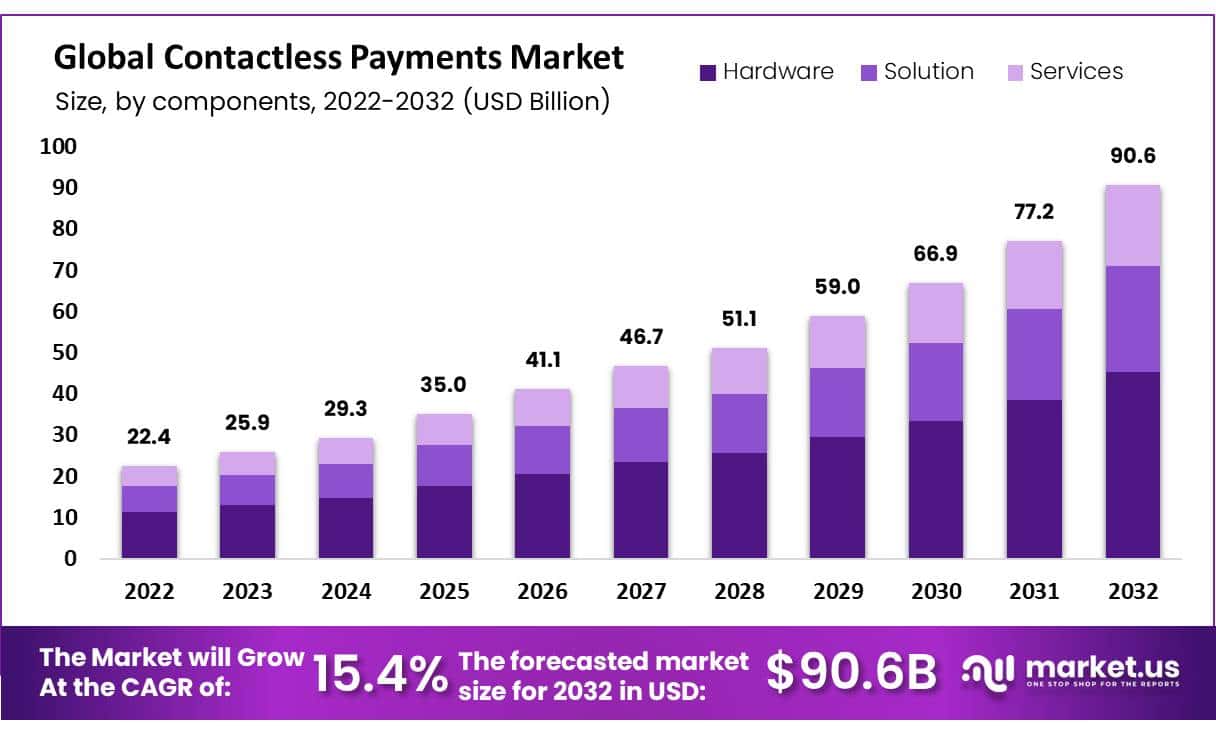

New York, April 11, 2023 (GLOBE NEWSWIRE) -- The global contactless payments market is estimated to be valued at USD 90.6 billion by 2032 from USD 22.4 billion in 2022 and is expected to exhibit a CAGR of 15.4% during the forecast period 2023 to 2032. Contactless payments refer to payment methods that enable customers to complete transactions without physically touching a payment terminal or exchanging cash.

Instead, customers can take advantage of digital payment instruments like mobile wallets or credit/debit cards with contactless capabilities for convenient purchases. Contactless payments can be enabled by various payment technologies, such as Near Field Communication (NFC) and Radio Frequency Identification (RFID). With contactless payments, customers only need to enter their PIN number for speedy processing. Contactless payments have become increasingly commonplace across BFSI, retail, IT & telecom, transportation, hospitality services, and government organizations alike.

Get additional highlights on major revenue-generating segments, Request a Contactless Payments Market sample report at https://market.us/report/contactless-payments-market/request-sample/

Key Takeaway:

- By component, in 2022, the contactless payments market was dominated by the hardware segment due to its increased usage.

- By application, the retail segment dominated the largest market share in application type analysis and accounted for the largest revenue share.

- In 2022, North America dominated the market with the highest revenue share of 30%.

- APAC is expected to grow at a greater pace owing to the increasing prevalence of contactless payment methods due to mobile payments and e-wallets

Factors affecting the growth of the Contactless Payments industry

There are several factors that are affecting the growth of the contactless payments industry. These include:

- Technological Advancements: Due to advances in Near Field Communication (NFC), radio-frequency identification (RFID), and biometric authentication, contactless payments have become safer and more feasible, allowing this industry to expand.

- Changing Consumer Behaviour: Due to the COVID-19 pandemic, customers are increasingly seeking more practical and contactless payment options. As a result, there has been an uptick in demand for contactless payment systems, which is aiding business expansion.

- Government Policies and Regulations: Government policies and regulations can have a major impact on the growth of contactless payment systems by creating an advantageous regulatory climate and offering incentives.

- Collaborations and Partnerships: Financial institutions, retailers, and payment providers have all played an integral role in the growth of this industry by increasing the variety and accessibility of contactless payment options available to consumers.

- Increased Merchant Acceptance: As more shops adopt contactless payments, consumers will find the process simpler and more convenient, potentially encouraging growth in this sector.

- Security Issues: Consumers' concerns about the security of their financial information can have a major influence on whether and how contactless payments are adopted and used. Fortunately, these concerns have been alleviated through advances in security technologies that have restored consumer faith in contactless payments.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/contactless-payments-market/#inquiry

Market Growth

Customers are looking for quick and secure payment options on a growing basis, particularly because of the COVID-19 pandemic, which has increased demand for contactless payments. Also, Consumers can now make contactless payments more easily due to the growing use of smartphones and mobile payments, which have increased the use of these payment methods. Consumers now find it becoming more and more convenient to use contactless payments owing to the spread of NFC-enabled devices such as smartphones, smartwatches, and contactless payment cards. Governments across the globe are actively promoting contactless payments by establishing laws and programs that encourage companies to accept them, thus making it easier for customers to use these options. Contactless payments are now more secure because of EMV (Europay, Mastercard, and Visa) technology, which has increased consumer sentiment toward these payment options.

Regional Analysis

North America is forecast to be the most lucrative market in the global contactless payments market, with a share of 30% during the forecast period. With growing interest in digitization, IoT, and big data processing, contactless payment solution providers across North America are expected to see increased demand for advanced hardware and software solutions. The Asia-Pacific region has seen a rapid rise in contactless payment methods thanks to mobile payments and e-wallets; countries such as China, India, and Japan are key players in this space. Europe has been a pioneer in contactless payment adoption, with countries like the UK, Poland, and Germany boasting high penetration rates for contactless payment cards due to favorable regulatory policies such as raising the contactless payment limit and encouraging mobile payments and e-wallets.

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 22.4 billion |

| Market Size (2032) | USD 90.6 Billion |

| CAGR (from 2023 to 2032) | 15.4% |

| North America Revenue Share | 30% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

Contactless payments offer customers a faster and more convenient way to make purchases, especially small ones. Customers appreciate being able to tap their card or mobile device instead of having to carry cash or enter their PIN code manually. Contactless payments tend to be more secure than other payment methods, as they use advanced encryption technology to safeguard sensitive financial data. This gives customers peace of mind and helps reduce fraudulence and other security risks. Due to the rising popularity of smartphones for making payments, businesses are increasingly adopting contactless payment solutions in an effort to stay ahead of this trend. Furthermore, many credit card issuers have started issuing contactless cards in an effort to further accelerate the adoption of this technology.

Market Restraints

One of the primary barriers to contactless payments is that businesses must invest in infrastructure to support them. Payment terminals, software upgrades, and other hardware or software components can be expensive and time-consuming to implement. Although contactless payments have seen a meteoric rise in popularity recently, some consumers remain wary. They may feel insecure using contactless transactions, while others might prefer traditional payment methods. Regulations and standards regarding contactless payments are constantly changing, creating uncertainty for businesses and consumers alike. Furthermore, contactless payments require strong internet connectivity in order to function properly; in areas with slow connections, these methods may not be as reliable or efficient, potentially limiting their usefulness in certain regions.

Market Opportunities

Over the forecast period, digitalized payment options are expected to drive market growth. To enhance security and gain greater control when making offline purchases, the payment industry is transitioning toward EMV (Europay, MasterCard, and Visa) chip cards. Contactless payment cards offer greater security compared to cash payments, and many consumers are transitioning away from traditional methods towards contactless options like Google Pay and Samsung Pay. Payment industries are adopting contactless payment technologies in an effort to protect consumers from fraudulence and identity theft. Cards through EMV (Europay, MasterCard, and Visa), loyalty offers on payment methods as well as cardholder verification methods plus reports based on spending are expected to fuel the growth of this market.

Grow your profit margin with Market.us - Purchase This Premium Report at https://market.us/purchase-report/?report_id=60952

Report Segmentation of the Contactless Payments Market

Component Insight

Component analysis indicates that the hardware sector, currently holding 50% market share, will be the most lucrative segment in the global contactless payments market by 2022. This can be further divided into POS, Cards, and Other segments for analysis. Technology companies and payment service providers offer comprehensive end-to-end solutions, from managing devices to contactless mobile payment options, payment terminal solutions, managing transactions, and data securely; to combatting security threats and fraud. With the rising adoption of contactless payment methods across industries such as banking & finance institutions, retail outlets, transportation businesses, hospitality establishments, and government organizations, there is expected to be significant growth across these sectors.

Application Insight

Retail is expected to be the most lucrative segment in the global contactless payments market by 2022, with a market share of 56%. Contactless payments have become increasingly commonplace in retail stores - both physical and online - due to their convenience and speed which allow customers to complete purchases quickly and effortlessly. Furthermore, hospitality establishments like restaurants, bars, and hotels have adopted contactless payments due to the COVID-19 pandemic when customers sought ways to pay without physically touching a payment terminal; this trend is forecast to grow during this timeframe.

Recent Development of the Contactless Payments Market

- In June 2022 - Giesecke+Devrient, a leader in security technology, announced the acquisition of Valid USA's payment and identification solutions division With increased scale at their disposal, clients will be able to address ongoing supply chain issues that impact all industries globally.

- In May 2022, Giesecke+Devrient unveiled a revolutionary banknote type: the "Green Banknote". This innovative paper currency uses eco-friendly materials and efficient production processes to produce durable notes with advanced security features for an eco-friendly cash cycle.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at https://market.us/report/contactless-payments-market/request-sample/

Market Segmentation

Based on Component

- Hardware

- POS

- Cards

- Others

- Solution

- Payment Terminal Solution

- Device Management Solution

- Contactless Mobile Payment Solution

- Transaction & Data Management

- Security and Fraud Management

- Services

- Consulting

- Integration & Deployment

- Support & Maintenance

Based on the Application

- Retail

- Transportation

- Healthcare

- Hospitality

- Other Applications

By Geography

- North America

-

- The US

- Canada

- Mexico

- Western Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

-

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

Majority of the businesses are implementing various strategies to attract users and customers towards contactless payments, such as offering cash back, rewards, and discounts for paying through contactless payment gateways. Furthermore, companies like Samsung Electronics Co. Ltd. and Starbucks are offering discounts and rewards for those who such types of payment methods. Network-providing companies are working closely with different payment technology vendors.

Some of the major players include:

- Gemalto

- Infineon

- Ingenico

- Wirecard

- Verifone

- Giesecke+Devrient

- IDEMIA

- On Track Innovations

- Identiv

- CPI Card Group

- Bitel

- Seomatic Systems

- Valitor

- PAX Global Technology

- MYPINPAD

- Mobeewave

- Alcineo

- Castles

- SumUp

- PayCore

- Other Key Players

Related Reports:

- Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032 from USD 65.6 Billion in 2022, growing at a CAGR of 12.00% during the forecast period from 2023 to 2032.

- Smart card market size was valued at USD 10.02 billion in 2021 and is expected to grow at a CAGR of 5.7% from 2023 to 2032.

- Digital transaction management was valued at USD 7,954 million in 2021. It is projected to grow at a CAGR of 25.0% between 2023 and 2032.

- Automated fare collection market was valued at USD 11,950 million in 2021. It is expected to grow at a CAGR of 13.2% between 2022 and 2032.

- Blockchain Technology Market size was valued at USD 72 billion in 2022 and is estimated to grow at a CAGR of 68% between 2023-2032.

- Identity and Access Management Market was valued at USD 14.7 Billion in 2022. Between 2023 and 2032, this market is estimated to register the highest CAGR of 13.7%.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: