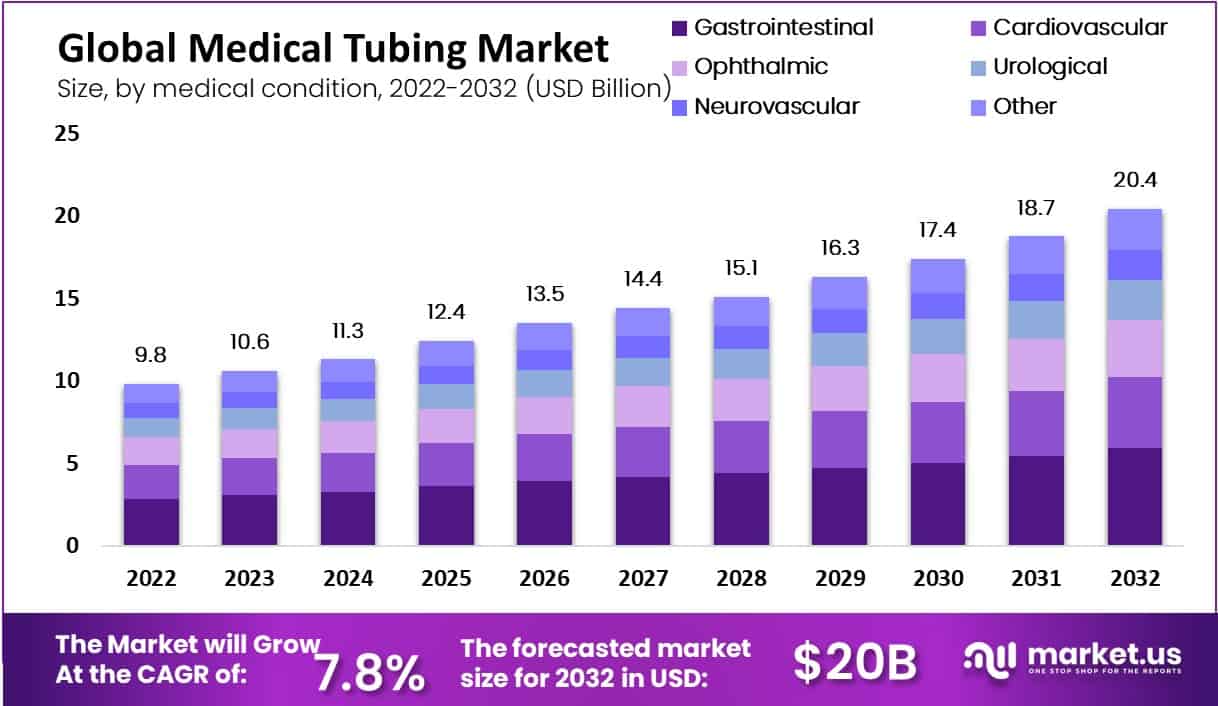

New York, April 28, 2023 (GLOBE NEWSWIRE) -- Market.us predicts that the medical tubing market will exceed USD 20.4 billion by 2032, up from USD 9.81 billion in 2022, with a projected compound annual growth rate (CAGR) of 7.8% from 2023 to 2032.

The global medical tubing market is composed of companies that manufacture and sell flexible tubes and hoses used in various medical applications. These tubes can be made from materials such as silicone, PVC, TPE, and polyurethane, among others, and found in a range of applications like drug delivery systems, catheters, respiratory equipment, and anesthesia equipment as well as diagnostic devices. The demand for medical tubing is being driven by various factors, such as the rising prevalence of chronic diseases, aging populations, and advances in medical technology. The market for this product type is highly regulated; manufacturers must adhere to stringent quality standards and regulations in order to guarantee its safety and efficacy.

Get additional highlights on major revenue-generating segments, Request a Medical Tubing Market sample report at https://market.us/report/medical-tubing-market/request-sample/

Key Takeaway:

- By material, in 2022, Polyvinyl Chloride (PVC) segment dominates the market with a 29.3% market share.

- By the material condition analysis, the gastrointestinal segment dominates the market with a 29% market share.

- By application analysis disposable tubing segment dominate the market with a 31% market share.

- By end-user analysis, Hospitals dominate the market with 43% market share.

- In 2022, North America dominated the market with the highest revenue share of 39%.

- APAC is expected to grow at a greater pace owing to affordable prices, increasing medical tourism, as well as hospitals and clinics, among other factors.

Factors affecting the growth of the Medical Tubing Market

- Increasing demand for minimally invasive medical procedures: As the demand for minimally invasive surgeries continues to increase, so too does the need for medical tubing products that deliver drugs and fluids directly into specific body areas. This has fuelled an uptick in demand for these items - which analysts predict will drive growth across this industry over the coming years.

- Technological Advancements: The development of advanced polymers and biocompatible materials in medical tubing is spurring growth within the industry. These innovations have improved the performance and safety of these products, leading to their adoption across a variety of medical applications.

- Growing Aging Population: The global aging population is fuelling growth in the medical tubing industry. Older adults typically require more medical attention and treatments, which often involve using medical tubing products.

- Increased Prevalence of Chronic Diseases: With the rising incidence of chronic illnesses like diabetes, cardiovascular disease, and cancer, demand for medical tubing products is on the rise. These tubings are commonly employed in delivering medications and treatments for these conditions.

- Regulatory Environment: The regulatory environment for medical tubing products is becoming more stringent, creating both a challenge and an opportunity for the industry. Companies that can successfully meet these regulations will likely enjoy a competitive edge and be well-positioned for growth within this space.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/medical-tubing-market/#inquiry

Market Trends

There is an increasing trend toward using custom medical tubing that meets patients' individual needs. Modern manufacturing technologies, such as 3D printing, enable manufacturers to craft products tailored to each patient's anatomy. Biocompatible materials, such as silicone, are increasingly being employed in medical tubing products due to their non-toxicity and lack of reaction with body fluids. This reduces the risk of adverse reactions and enhances patient safety by eliminating potential hazards. Antimicrobial tubing products are being developed that can reduce the risk of infection and enhance patient outcomes. These items prevent bacteria from growing on the surface of the tubing, thus decreasing exposure to infection. Miniature invasive surgeries such as endoscopy and laparoscopy are becoming increasingly popular. To access the affected area through small incisions, medical tubing products like catheters and guidewires must be used. With the growing demand for these minimally invasive operations is expected to drive demand for these tubing products. Home healthcare, which involves the delivery of medical care directly to patients' homes, is on the rise. This demand has resulted in increased sales of tubing products designed specifically for this purpose, such as infusion sets, enteral feeding tubes, and urinary catheters.

Market Growth

The medical tubing market is experiencing tremendous growth due to several factors, such as increasing demand for minimally invasive surgeries, chronic disease prevalence, and an aging population. Furthermore, technological developments within this field of medical tubing - like using advanced polymers and biocompatible materials - are fueling expansion within this industry. The market is expected to benefit from the growing adoption of single-use medical tubing products, which offer cost efficiency and reduced risks of infection transmission. However, high raw material costs associated with production as well as stringent regulatory requirements for medical devices could potentially hinder market expansion.

Regional Analysis

Regionally, North America leads the market with a 39% share. North America and Canada's healthcare industries are propelled by an aging population, sophisticated healthcare infrastructure, and relatively higher disposable income levels among patients. Countries such as the U.S. and Canada boast large geriatric populations that combine to form one of the biggest drivers of demand within this region. Europe's advanced medical infrastructure and rising healthcare expenditures are expected to further fuel product demand within this region. Miniature surgical devices and diagnostic tubes used in healthcare procedures are expected to experience steady growth over the forecast period.

Asia Pacific is expected to experience rapid growth due to an increasing need for quality healthcare products, prompting medical equipment manufacturers to devise creative ways of reaching a wider audience. Furthermore, an aging geriatric population will further exacerbate the demand for healthcare services. The demand for healthcare services in Central & South America is on the rise due to several factors, such as an aging population with longer life expectancies and lower birth rates, along with an increasing prevalence of chronic diseases. Furthermore, public-private partnerships are blossoming within this sector; therefore, improved infrastructure along with an expanding healthcare industry should fuel regional market expansion.

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 9.81 billion |

| Market Size (2032) | USD 20.4 billion |

| CAGR (from 2023 to 2032) | 7.8% from 2023 to 2032 |

| North America Revenue Share | 39% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

- Growing Demand for Minimally Invasive Surgery Procedures: With advances in medical technology, there has been an uptick in minimally invasive surgeries. These require using medical tubing products like catheters and guidewires to access the affected area through small incisions. As a result, demand for these items is expected to grow significantly over the coming years.

- Increased Prevalence of Chronic Diseases: Chronic diseases such as diabetes, cancer, and cardiovascular issues are on the rise around the world. To effectively treat them, medical tubing products like infusion sets and insulin pumps must be used for administering medications and fluids. With chronic diseases set to increase further in prevalence over time, demand for these types of tubing products will likely expand significantly.

- Technological Advances in Medical Tubing Materials: Technological advances in medical tubing materials, such as the development of biocompatible and antimicrobial materials, have significantly enhanced the safety and efficacy of these products. As a result, medical tubing products have become more durable, flexible, and resistant to kinking or puncture. The rising use of advanced materials is expected to drive growth within the medical tubing market.

- Global Aging Population: Global geriatric populations are expected to expand significantly in the coming years, making them increasingly vulnerable to chronic illnesses and necessitating higher levels of medical care - often including medical tubing products. This demographic will likely drive demand for these items over several years.

- Growing Demand for Home Healthcare: Home healthcare, which involves the direct delivery of medical care directly to a patient's home, is on the rise. This has necessitated an increase in demand for tubing products such as infusion sets, enteral feeding tubes, and urinary catheters that can be utilized in these settings. Forecasts anticipate this rising demand will fuel growth in the medical tubing market over the coming years.

Market Restraints

- Stringent Regulatory Requirements: Medical tubing products must meet stringent regulatory standards, which may present significant obstacles for new market entrants. These standards include conforming to quality standards like ISO 13485 and following guidelines for product safety and efficacy. Failure to abide by these regulations could increase the cost of producing and marketing medical tubing products.

- Competition from Alternative Treatment Methods: In some instances, non-invasive or minimally invasive procedures can replace surgery and eliminate the need for medical tubing products.

- Price Pressure: Buyer demands and fierce competition within the medical tubing market can put immense pressure on manufacturers to reduce prices. This may reduce profit margins and leave fewer funds for the research and development of new products.

- Product Recalls: Medical tubing products may need to be recalled due to defects, potentially having an adverse effect on the market. Recalls come at a costly expense for manufacturers and damage their reputations as well.

- Environmental Aspects: Disposing of medical tubing products, which are often made from plastic materials, can have negative effects on the environment. This may lead to regulatory pressure to reduce waste and promote recycling - leading to higher manufacturing costs and diminished profit margins.

Market Opportunity

- Development of Innovative Products: There is great potential for the creation of revolutionary medical tubing products that can improve patient outcomes and reduce healthcare expenses. For instance, tubing with advanced coatings to prevent infection or tubing equipped with sensors for monitoring patient health could provide new market opportunities.

- Rising Demand from Emerging Markets: Emerging economies such as India, China, and Brazil are experiencing rapid economic development with an uptick in medical device demand. This provides manufacturers with exciting growth prospects.

- Growing Demand for Home Healthcare: As the population ages, there is an increasing trend towards in-home care. This demand has resulted in the need for medical tubing products that can be used at home, such as enteral feeding tubes and oxygen tubing.

- Technological Advances in Manufacturing: Modern manufacturing technology, such as 3D printing and automation, has significantly enhanced the efficiency and speed of medical tubing production. These improvements can reduce costs while increasing product development speed.

- Consolidation of the Market: The medical tubing market is highly fragmented, with numerous small and mid-sized players. Consolidating it through mergers and acquisitions can create economies of scale for larger companies and increase their share in the marketplace. This leads to improved efficiencies and cost savings which can be passed along to customers.

Grow your profit margin with Market.us - Purchase This Premium Report at https://market.us/purchase-report/?report_id=13298

Report Segmentation of the Medical Tubing Market

Material Insight

Based on the material analysis, Polyvinyl Chloride(PVC) segment dominates the market with a 29.3% share. PVC-based medical equipment has seen an uptick in demand due to the growing use of pre-sterilized single-use medical devices. You can sterilize PVC using both ethylene oxide and radiation. Silicone tubing used in medical devices is typically of higher quality, produced through continuous vulcanization, extrusion, and other processes. This ensures enhanced stability over a wider temperature range as well as chemical resistance and numerous sterilization options. Polycarbonates are becoming more and more common in medical tubing due to their versatility in sterilization methods such as irradiation, electron beam, ethylene dioxide, or steam autoclaving. Device manufacturers now have a range of options when selecting the most economical way to manufacture a product. Fluoropolymers are non-toxic and inert, making them ideal materials for next-generation medical devices such as sutures, needles, biocontainment vessels, and catheters.

Medical condition Insight

Based on material condition analysis, the gastrointestinal segment dominates the market with a 29% share. Gastrointestinal medical tubing is commonly used in applications like feeding tubes, endoscopes, and colonic stents. Cardiovascular medical tubing can also be found in catheters, guidewires, and vascular grafts; ophthalmic medical tubing is utilized in lacrimal duct tubes, intravitreal injection devices, and vitreoretinal surgery devices while urological medical tubing consists of catheters, drainage bags, and stents; neurovascular medical tubing also finds use with catheters, guidewires, and embolic coils - all dependent upon the specific application and condition being addressed.

Overall, medical tubing is essential in a range of medical specialties and conditions; its materials and requirements differ depending on the application. Biocompatibility, sterilization resistance, and chemical resistance - are all critical requirements for all applications of medical tubing. Furthermore, certain medical specialties may have additional requirements such as kink resistance, transparency, or lubricity specific to them.

Application Insight

Based on application analysis, disposable tubing dominates the market with a 31% share. Bulk disposable devices such as urological products, surgical instruments, syringes, and needles are among the most frequently used. Due to an increasing emphasis on preventing infection spread from patient to patient, bulk disposables are expected to drive segment growth over the forecast period. Catheters are flexible tubes made of medical-grade materials that can be inserted into patients to treat diseases or perform surgeries. The demand for catheters has been driven up due to an escalating number of chronic illnesses requiring hospitalization worldwide, coupled with COVID-19's spread in biopharmaceutical laboratory equipment demand. Additionally, ongoing vaccination research into this virus globally has added fuel to the steady supply of laboratory supplies. Together, these factors are expected to have a beneficial effect on the global medical tubing market growth. The drug delivery systems segment is expected to experience the fastest compound annual growth rate of 6.8% between 2022-2030. Drug delivery systems deliver therapeutic drugs through medical tubes; injectable, respiratory, and connected delivery systems all utilize medical tubes for drug distribution.

End User Insight

Analysis of end-user preferences reveals that Hospitals command the majority share of the market with 43% share. Hospitals are the major consumers of medical tubing products. Hospitals require a variety of devices that can be utilized during various medical procedures, which has driven up demand for this type of tubing. Medical tubing is widely used in hospitals for various functions, such as delivering fluids and medications to patients, draining bodily wastes, and providing respiratory support. Medical tubing used in hospitals is made from materials such as PVC, polyurethane, silicone, and other specialized materials that can withstand high pressure and temperature.

Ambulatory surgical centers are specialized medical establishments that offer same-day surgical care to patients. Medical tubing is essential in these settings due to its safety, dependability, and cost-efficiency when performing various surgical procedures. Medical tubing is commonly used in ambulatory surgical centers for fluid management, drainage, and irrigation during surgeries. Common materials used for this purpose include PVC, polyurethane, and silicone. The medical tubing market also encompasses other end users like clinics, nursing homes, and home healthcare settings. While these clients typically have lower demand for tubing products compared to hospitals or ambulatory surgical centers, medical tubing products remain essential for various medical procedures like wound care, catheterization, and enteral feeding. In these settings, the material of choice usually falls within PVC, polyurethane, or silicone categories.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at https://market.us/report/medical-tubing-market/request-sample/

Market Segmentation

Based on Product

- Polyethylene (PE)

- Silicone

- Engineering Plastics

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polyolefin

- Other Materials

Based on Medical Condition

- Gastrointestinal

- Cardiovascular

- Ophthalmic

- Urological

- Neurovascular

- Other Conditions

Based on Application

- Drug Delivery Systems

- Catheters

- Special Applications

- Disposable Tubing

- Cannulas

- Other Applications

Based on End-User

- Ambulatory Surgical Centers

- Hospitals

- Other End-Users

By Geography

- North America

-

- The US

- Canada

- Mexico

- Western Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

-

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

Manufacturers employ various strategies, such as acquisitions, mergers, joint ventures, new product developments, and geographical expansions to increase market share and meet the evolving technological demands of various end-use industries.

Due to the COVID-19 pandemic, medical tubing manufacturers have been spurring on online marketplaces for services and spare part availability. For example, Nordson Corporation acquired NDC Technologies in August 2021 with the purpose of expanding the former's test and inspection platform into new end markets and adjacent technologies. Notable players in this global medical tubing market include:

- Asahi Tec Corp.

- MDC Industries

- Nordson Corp.

- ZARYS International Group

- Hitachi Cable America Inc.

- NewAge Industries, Inc.

- TE Connectivity

- Freudenberg & Co. KG

- Spectrum Plastics Group

- ATAG SpA

- Vanguard Products Corp.

- Other key players

Recent Development of the Medical Tubing Market

- In September 2020, Saint-Gobain Life Sciences acquired MS Techniques and Transluminal and expanded the medical components capabilities, and established a European Medical Centre for Excellence.

- In May 2021, Freudenberg Medical expanded its manufacturing operations in Alajuela, Costa Rica. About 8,600 square feet were added to the existing facility under this project. This helped the company in increasing its catheter manufacturing and assembly, moulding, extrusion, and packaging capacities.

Browse More Related Reports:

- Medical tubing packaging market was valued at USD 3759.7 million in 2019 and is expected to reach USD 4838.9 million by the end of 2026, growing at a CAGR of 3.6 %

- Medical copper tubing market is expected to have a CAGR of 4% from USD 1,395 Million in 2022 to USD 1,841.7 Million in 2029.

- Blood tubing set market size is estimated to be worth USD 1,001.36 million in 2022 and is forecast to a readjusted size of USD 1,511.01 million by 2032 with a CAGR of 4.2% during the forecast period 2022-2032

- Heat shrink tubing market is projected to reach USD 2.3 billion by 2024 from an estimated USD 1.8 billion in 2019, at a CAGR of 5.3%

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn | Facebook | Twitter

Our Blog: