Dublin, Nov. 06, 2023 (GLOBE NEWSWIRE) -- The "Global In-vehicle Infotainment Market by Component (Display Unit, Control Panel, TCU, HUD), OS (Linux, QNX, MS), Service (Entertainment, Navigation, e-Call, Diagnostic), Connectivity, Form, Display Size, Location, Vehicle Type Region - Forecast to 2028" report has been added to ResearchAndMarkets.com's offering

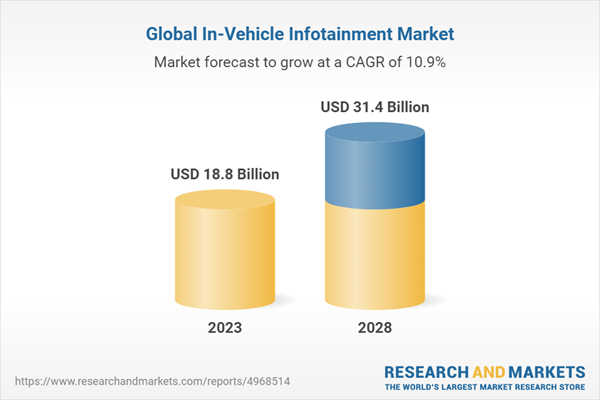

The in-vehicle infotainment market is expected to experience significant growth, with its valuation projected to increase from USD 18.8 billion in 2023 to USD 31.4 billion by 2028, at a compound annual growth rate (CAGR) of 10.9%

Several factors are contributing to this growth. First, there is an increasing demand for luxury vehicles equipped with advanced connectivity and safety features, offering consumers enhanced in-cabin experiences with various entertainment services at affordable costs.

Second, government regulations and mandates related to vehicle safety and connectivity are driving the adoption of in-vehicle infotainment systems. Lastly, the expansion of premium electric and hybrid vehicle ranges, particularly in China, Europe, and North America, is contributing to the development of the in-vehicle infotainment market.

North America is a dominant market in this industry, with the United States and Canada leading the way. Several factors contribute to the growth of the North American market. High demand for mid-size and large-size SUVs and pick-up trucks is a notable factor, as these vehicles often come equipped with advanced in-vehicle infotainment systems.

The region also enjoys a solid economic position, with higher disposable income levels, allowing consumers to invest in vehicles with advanced technologies. The presence of major original equipment manufacturers (OEMs) like Ford Motor Company, General Motors, and Tesla, along with infotainment system providers, contributes to market growth. Additionally, the region's robust telecom infrastructure enables connectivity and infotainment features in vehicles, enhancing the overall consumer experience.

Furthermore, the growth of the North American market is expected to be driven by stringent safety regulations. Authorities such as the US National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) have made features like automatic emergency braking (AEB) standard for vehicles.

This increased focus on safety features is expected to drive the demand for in-vehicle infotainment systems. Additionally, the adoption of Advanced Driver Assistance Systems (ADAS) features is higher in North America, driven by the demand for premium electric vehicles (EVs) that come equipped with ADAS features. This trend is expected to continue, further boosting the demand for in-vehicle infotainment systems.

Leading players in the in-vehicle infotainment market include Harman International (US), Panasonic Corporation (Japan), Alps Alpine Co Ltd (Japan), Robert Bosch GmbH (Germany), and Continental AG (Germany). These established companies are at the forefront of developing and providing advanced infotainment solutions for vehicles.

The display unit/infotainment unit segment is expected to lead the component segment

During the forecast period, the infotainment unit is expected to lead the in-vehicle infotainment market under the components segment. These front infotainment touchscreens provide a user-friendly interface, allowing drivers and passengers to easily access and control various vehicle functions and settings.

The convenience, interactivity, and intuitive navigation central touch screens offer significantly enhance the overall user experience. The display screen size of the infotainment varies based on vehicle class. For instance, entry-level car display unit ranges from 3-5", whereas most mid-segment cars have an average screen size of 8-10".

Nowadays new SUVs are incomplete without an all-encompassing infotainment system, the demand for SUVs is rising, hence rising the in-vehicle infotainment system market. SUVs offer some pretty impressive infotainment systems for instance, Lincoln Navigator has one of the most impressive infotainment systems is capable of wireless Android Auto and Apple CarPlay integration with a 13.2-inch touchscreen, has easy-to-read graphics and organizes apps and notifications perfectly.

The car sound system in the Lincoln SUV is a 14-speaker Revel stereo system which can be modified up to a 28-speaker Revel Ultima 3D system. Hyundai TUCSON comes with an 8.8-inch touchscreen with the option to make it a 10.3-inch display which is integrated into the dash. Therefore, the rapid advancement in in-car technology has resulted in manufacturers offering bigger and bigger infotainment screens which will create futuristic opportunities for the growth of the in-vehicle infotainment market in the upcoming years.

Thus, automotive OEMs are increasing the mass offering of infotainment systems irrespective of vehicle class along with rising integration of advanced features like navigation, media playback, weather update, route planning, smartphone connectivity, etc., which would continue to fuel the market demand for the infotainment system.

Passenger Cars are estimated to be the largest and fastest-growing segment for in-vehicle infotainment systems during the forecast period

The passenger car segment would lead and will also grow at the fastest pace for the in-vehicle infotainment system market. This is mainly due to the large share of passenger cars in total vehicle production in 2022, with more than 75%. Factors driving the demand for the in-vehicle infotainment system is the rising adoption of front infotainment units in lower-range cars, mainly in developing countries such as China and India.

OEMs have started offering features like small display screens, digital instrument clusters, and HUD even in some economy and mid-priced passenger cars to gain a competitive edge and attract customer attention. Additionally, growing luxury vehicle sales and demand for screens for rear passengers to offer a more personalized experience and comfort are factors expected to fuel the rear-row in-vehicle infotainment system market during the forecast period.

The emergence of 5G is also expected to contribute to developing the in-vehicle infotainment market. Hence the in-vehicle infotainment system market is expected to grow significantly.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 312 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value (USD) in 2023 | $18.8 Billion |

| Forecasted Market Value (USD) by 2028 | $31.4 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

Use Cases

- Development of Modern In-Vehicle Infotainment System

- Platform for Futuristic Connected Car Infotainment Demonstration

- Automotive Hmi Infotainment System

- Tier-1 Automotive Software Provider Creates Smarter In-Car Infotainment System

- Design and Development of Car Telematics Platform

Market Dynamics

Drivers

- Growth in Entertainment, Safety & Security, and Navigation Services

- Increasing Demand for Rear-Seat Entertainment

- Growth of Smartphone Industry and Use of Cloud Technologies

- Growth of Smartphone Industry

- Use of Cloud Technologies in Vehicular Communications

Restraints

- Additional Cost for Annual Subscriptions to Infotainment Systems

- Lack of Seamless Connectivity

Opportunities

- Government Mandates on Telematics and Other Safety-Related Laws

- Emergence of Various Technologies, Such as 5G and Ai

- Enhanced User Experience Using 5G

- Use of Ai for In-Vehicle Infotainment System

Challenges

- Security Issues and Challenges

Supply Chain Analysis

- In-Vehicle Infotainment Market Ecosystem

- Trends/Disruptions Impacting Customer Business

- Regulatory Analysis: In-Vehicle Infotainment Market

Average Selling Price Analysis

- Average Price Range: In-Vehicle Infotainment Systems, by Region, 2022 Vs. 2023 (USD)

- Average Price Range: In-Vehicle Infotainment Systems, by Vehicle Type, 2022 Vs. 2023 (USD)

- Average Price Range: In-Vehicle Infotainment Systems, by Component, 2022 Vs. 2023 (USD)

- Bill of Materials

Technology Analysis

- Future of Head-Up Displays

- 3D Visualization for Enhanced User Experience

- Growing Trend for Head-Up Displays

- Innovations in Audio Systems

Analyst's Recommendations

- Asia-Pacific to Lead Market During Forecast Period

- Key Focus Areas: Growing Demand for Android Os

- Conclusion

Company Profiles

Key Players

- Alps Alpine Co., Ltd.

- Garmin Ltd

- Pioneer Corporation

- Harman International

- Panasonic Corporation

- Robert Bosch GmbH

- Mitsubishi Electric Corporation

- Tomtom International Nv

- Continental Ag

- Visteon Corporation

Other Players

- Desay Sv Automotive

- Denso Corporation

- Jvckenwood Corporation

- Fujitsu Limited

- Foryou Corporation

- Hyundai Mobis

- Ford Motor Company

- Aptiv plc

- Magneti Marelli S.P.A

- General Motors

- Audi Ag

- Bmw Ag

- Aisin Corporation (Formerly Aisin Seiki Co., Ltd.)

- Allegro Microsystems Inc.

- Faurecia

For more information about this report visit https://www.researchandmarkets.com/r/u7htvg

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment