Dublin, Nov. 16, 2023 (GLOBE NEWSWIRE) -- The "Ethiopia Data Center Market - Investment Analysis & Growth Opportunities 2023-2028" report has been added to ResearchAndMarkets.com's offering.

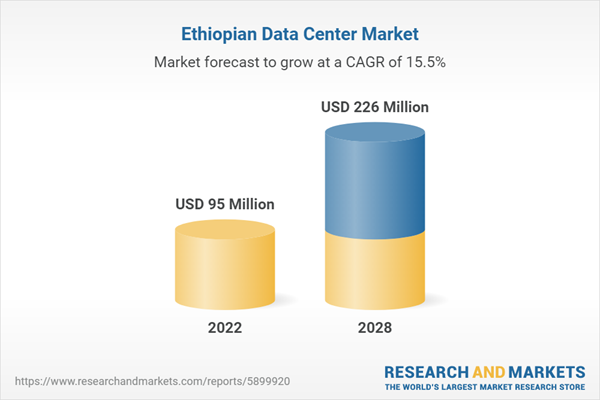

The Ethiopia data center market is expected to reach a value of $226 million by 2028 from $95 million in 2022, growing at a CAGR of 15.54% from 2022-2028

This report analyses the Ethiopian data center market share. It elaboratively analyses the existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction, and tier standards. It discusses market sizing and investment estimation for different segments.

Data center development in Ethiopia has gained momentum with investments from notable operators like Raxio Data Centres and Safaricom, marking a steady growth trajectory for the country's data center infrastructure.

The push for smart city initiatives has spurred the development and adoption of digital platforms in Ethiopia. Collaborations such as the one between Ethio Telecom and the Addis Ababa city administration to build a smart city in Addis Ababa underscore this digital transformation. An important milestone was reached in July 2023 when a memorandum of understanding (MoU) was signed between The Federal Democratic Republic of Ethiopia and the Republic of Korea to embark on a "Smart City" project in Ethiopia.

In terms of connectivity, Ethiopia is gearing up for the expansion of 4G and 5G networks, with telecom operators like Ethio Telecom committed to enhancing service quality to meet the growing demands of end-users. For instance, in June 2023, the World Bank made significant investments in Africa to support Safaricom Ethiopia in building and operating advanced 4G and 5G mobile networks.

The increasing demand for digitalization, a rising number of internet users, and the drive for digital transformation across various sectors are fueling the demand for colocation data centers, thereby contributing to the growth of the data center market in Ethiopia.

In the realm of mechanical infrastructure, the Ethiopia data center market is experiencing a surge in the adoption of air-based cooling solutions with robust redundancy (N+1). Additionally, operators are implementing power backup solutions with on-site fuel storage to ensure uninterrupted operations.

The adoption of renewable energy sources is gaining traction in the market, with the Ethiopian government spearheading initiatives to expand green energy resources. Notably, the government has ambitious plans to generate over 35,000 MW through geothermal energy by 2037.

The Ethiopia data center market is set to become more competitive, attracting new investors starting from 2022. Foreign investors have already begun entering the market, with key players including Raxio Data Centres, Safaricom, and wingu.africa. wingu.africa, for instance, inaugurated its inaugural facility in Addis Ababa, boasting an impressive 161 thousand square feet of space and a power capacity of approximately 10 MW when fully developed.

Addis Ababa has emerged as the preferred location for major investments from colocation service providers like wingu.africa and Safaricom.

WHY SHOULD YOU BUY THIS RESEARCH?

- An assessment of the data center investment in Ethiopia by colocation, hyperscale, and enterprise operators.

- Investments in the area (square feet) and power capacity (MW) across locations in the country.

- A detailed study of the existing Ethiopia data center market landscape, an in-depth industry analysis, and insightful predictions about market size during the forecast period.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 73 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value (USD) in 2022 | $95 Million |

| Forecasted Market Value (USD) by 2028 | $226 Million |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Ethiopia |

REPORT COVERAGE

Snapshot of existing and upcoming third-party data center facilities in Ethiopia

I. Facilities Covered (Existing): 02

II. Facilities Identified (Upcoming): 01

III. Coverage: 1 City

IV. Existing vs. Upcoming (Area)

V. Existing vs. Upcoming (IT Load Capacity)

Data Center Colocation Market in Ethiopia

I. Market Revenue & Forecast (2022-2028)

II. Retail Colocation Pricing

VENDOR LANDSCAPE

IT Infrastructure Providers

- Cisco Systems

- Huawei Technologies

- Hitachi Vantara

- IBM

Support Infrastructure Providers

- ABB

- Cummins

- Legrand

- Schneider Electric

- Vertiv

Data Center Investors

- Raxio Data Centres

- Safaricom

- wingu.africa

EXISTING VS. UPCOMING DATA CENTERS

- Existing Facilities in the Region (Area and Power Capacity)

- Addis Ababa

- List of Upcoming Facilities in the region (Area and Power Capacity)

REPORT COVERAGE:

IT Infrastructure

- Servers

- Storage Systems

Network Infrastructure

Electrical Infrastructure

- UPS Systems

- Generators

- Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Other Cooling Units

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

For more information about this report visit https://www.researchandmarkets.com/r/xlsoh1

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment