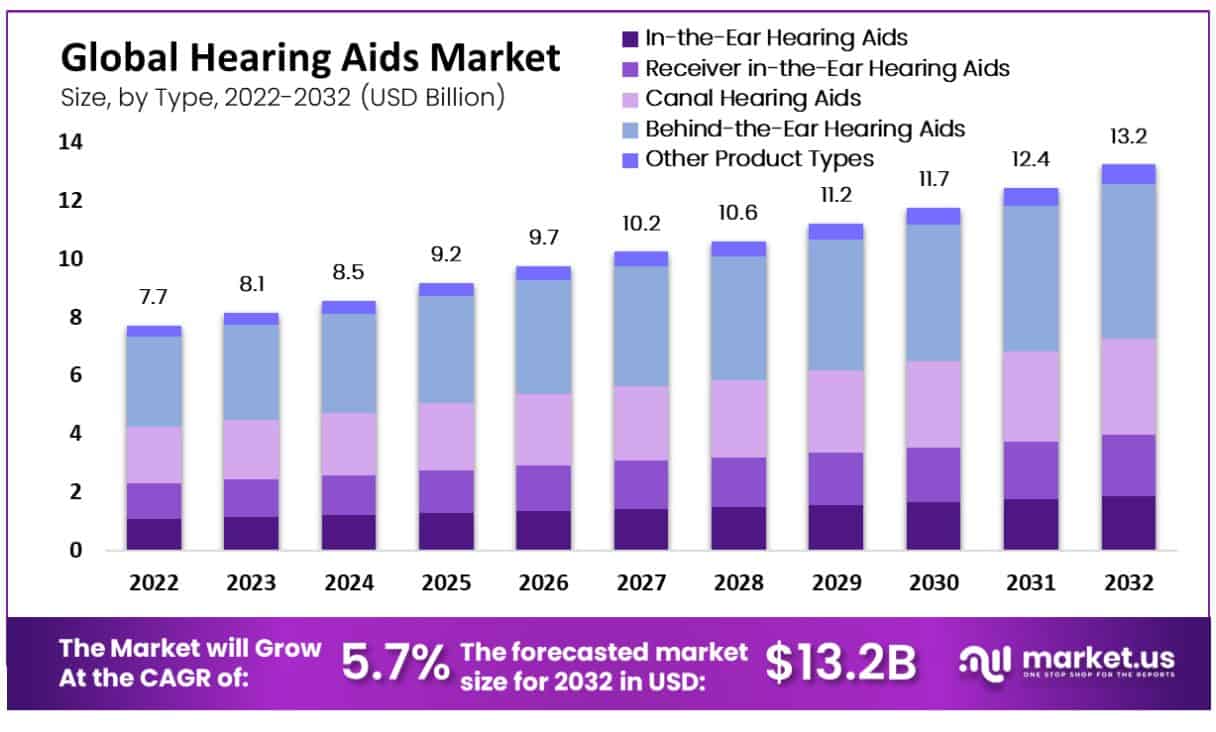

New York, Dec. 06, 2023 (GLOBE NEWSWIRE) -- According to Market.us, The global Hearing Aids Market is anticipated to be USD 13.2 billion by 2032. It is estimated to record a steady CAGR of 5.7% in the forecast period 2023 to 2032. It is likely to total USD 8.5 billion in 2024.

The hearing aids are electronic devices that amplify and modify sound to help people with hearing loss hear better. The market is driven by a number of factors, including the growing prevalence of hearing loss, the increasing affordability of hearing aids, and the rising demand for high-quality hearing aids. The growing prevalence of hearing loss is a major driver of the hearing aids market.

The World Health Organization reports that currently, over 466 million people globally suffer from serious hearing loss. This figure is projected to rise to 700 million by 2035. The increase is linked to aging populations, loud noise exposure, and certain health conditions. Notably, of those affected by severe hearing loss, 34 million are children. Severe hearing loss is defined as a loss above 40dB in adults and above 30dB in children, measured in the ear with better hearing.

Click to Request Sample Report and Drive Impactful Decisions: https://market.us/report/hearing-aids-market/request-sample/

The increasing affordability of hearing aids is another major driver of the market. Hearing aids have become more affordable in recent years due to advances in technology and economies of scale. This has made hearing aids more accessible to people with hearing loss. The rising demand for high-quality hearing aids is also driving the market. People with hearing loss are increasingly demanding high-quality hearing aids that are comfortable to wear, provide excellent sound quality, and have features such as Bluetooth connectivity.

Key Takeaways about Hearing Aids Market

- The Hearing Aids Market is projected to reach around USD 13.2 billion by 2032, up from USD 7.7 billion in 2022.

- This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 5.7% from 2023 to 2032.

- The global Hearing Aids Market's growth is primarily driven by the expanding elderly population, which is more susceptible to hearing loss.

- Financial constraints and reluctance to undergo hearing tests are factors hindering market growth.

- Behind-the-ear (BTE) hearing aids accounted for over 40% of revenue share in 2023.

- Canal hearing aids are expected to grow rapidly due to their discreet nature, appealing to young adults.

- Retail sales, including over-the-counter hearing aids, constituted over 70% of the market in 2023.

- Emerging markets are offering lucrative opportunities, driven by competitive prices and healthcare infrastructure improvements.

- Manufacturers are increasingly focusing on securing raw materials at competitive prices.

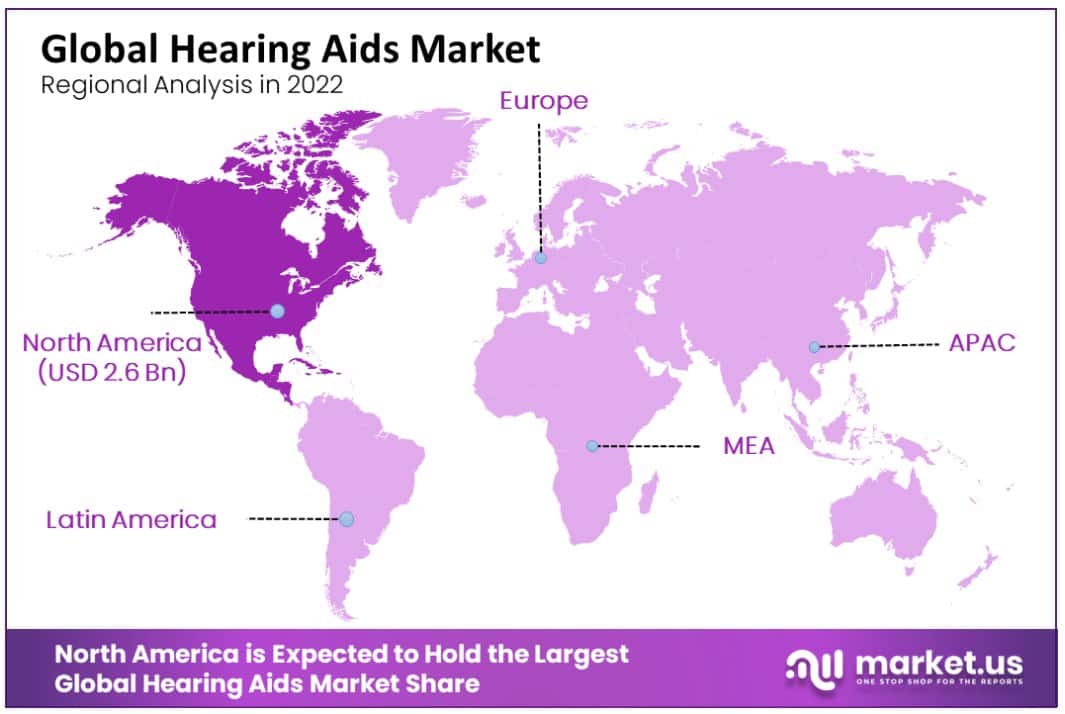

- The North American market dominates the global Hearing Aids Market with value USD 2.6 Billion in 2023.

- Sonova Holding AG is a major player in the industry with over 80% market share.

Drive Your Business Growth Strategy: Purchase the Report for Key Insights!

Factors Affecting the Growth of the Hearing Aids Market

Rising Prevalence of Hearing Loss:

- Aging Population: As people grow older, hearing loss becomes more common. The increasing number of elderly people leads to more cases of hearing loss.

- Noise-Induced Hearing Loss: Loud sounds, especially in cities, loud music, and personal audio devices, are causing more hearing damage. This type of hearing loss is permanent.

- Awareness Boost: More people now understand how hearing loss affects life. This leads to more people getting checked and using hearing aids.

Technological Developments:

- Smaller, Smarter Hearing Aids: Hearing aids are getting tinier, lighter, and easier to wear. They are also more digital, offering advanced sound control and features.

- Better Connectivity: These devices now connect with phones and computers. This means easier communication and streaming of sound.

- Use of AI: Artificial intelligence helps make hearing aids more tailored and effective. It analyzes hearing loss and adjusts the devices for better performance.

Economic Elements:

- More Disposable Income: With more money in hand, people can buy hearing aids more easily.

- Government Support: Many governments are helping pay for hearing aids, making them affordable for more people.

- Higher Health Spending: More money is going into healthcare, including treatments for hearing loss. This increases access to hearing aids.

Other Influences:

- Health Campaigns: Public health efforts are making more people aware of hearing loss and the need for early treatment. This raises the demand for hearing aids.

- Changing Social Views: As attitudes shift, more people are willing to get treatment for hearing loss and use hearing aids without feeling embarrassed.

Top Trends in the Global Hearing Aids Market

- Smaller and Smarter: Hearing aids are getting tinier and more comfortable, with advanced tech for better sound. They even have features like turning speech into text and blocking out noise.

- Easy Connections: Now, hearing aids can link up with phones and computers, making it easy to talk hands-free or listen to music and podcasts.

- AI-Powered: Artificial intelligence is making hearing aids smarter, customizing them to focus on important sounds like voices or music.

- Buy Direct: You can now get hearing aids directly, without a prescription. They're cheaper but might not suit everyone.

- Over-the-Counter Options: Soon, you'll be able to buy hearing aids in stores without a prescription, helping those with mild to moderate hearing loss.

- Made Just for You: Personalized hearing aids are on the rise, using AI to match each person's specific hearing needs.

- Remote Care: With the pandemic, remote services for hearing aids have become popular. You can get help with your device without leaving home.

- Hearables: These are wearable tech devices that also work as hearing aids, offering extra features like tracking your fitness and reducing noise.

- Smart Hearing Aids: These are part of the Internet of Things, connecting with devices like smartphones and smart homes for a more integrated experience.

- Hearing Aids Meet Cochlear Implants: The lines are blurring between hearing aids and cochlear implants, making each more advanced and affordable.

Ready to Dive Deeper? Request Our Comprehensive Report Methodology Now: https://market.us/report/hearing-aids-market/request-sample/

Regional Analysis

In 2022, North America led the global market for hearing aids, holding a significant market value of USD 2.6 billion. This dominance is due to the strong preference for smaller, less noticeable devices, along with active research into advanced hearing aid technologies and solid government backing.

Europe followed closely, securing the second-highest market share. Key factors driving this include the presence of major players like GN Store Nord A/S, Senovo, Demant A/S, and WS Audiology. The market's strength in Europe also reflects in its 2022 revenue share of over 39.1%. The region's focus on hearing aid technology and supportive reimbursement policies contribute to its position. As per the WHO’s 2021 report, around 196 million people in Europe experienced some hearing impairment, with 57.3 million facing severe challenges. This number is projected to escalate to 236 million by 2050, further boosting the market due to the rising elderly population. Germany, in particular, has launched initiatives to improve hearing care, like the State Care Benefits Act, which is likely to propel market growth.

Asia-Pacific is poised for the fastest growth from 2023 to 2030, spurred by an increasing elderly population and a higher incidence of hearing loss. For instance, Australia's hearing-impaired population, currently at 3.6 million, is expected to double to 7.8 million by 2060. This surge in demand is a key driver for the region's expanding market.

Lastly, North America, with its significant investment in hearing aid technology and strong market presence, held the second-largest revenue share in 2022, underscoring its pivotal role in the global market.

Key Regions Covered In The Report

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy the full report here

Key Market Segments

Based on Product Type

- In-the-Ear Hearing Aids

- Receiver in-the-Ear Hearing Aids

- Canal Hearing Aids

- Behind-the-Ear Hearing Aids

- Other Product Types

Based on the Technology Type

- Digital

- Analog

Based on the Distribution Channel

- E-commerce

- Government Purchases

- Retail Sales

Product Type Analysis

In 2023, behind-the-ear (BTE) hearing aids dominated the market, holding over 40% of the share. These devices, worn behind the ear, are favored for their comfort and advanced features. They cater to a wide range of hearing loss levels, making them a popular choice among users.

In-the-ear (ITE) hearing aids also hold a significant market position. These devices are custom-made to fit inside the ear, offering a discreet option for users. Their compact design makes them less visible, appealing to those who prioritize aesthetics alongside functionality.

Receiver-in-the-ear (RITE) hearing aids are gaining popularity as well. These combine the comfort of BTE devices with the aesthetic appeal of ITE models. The speaker or receiver sits inside the ear canal, providing clear sound quality, and they are suitable for a wide range of hearing impairments.

Canal hearing aids, which are inserted into the ear canal, are known for their near-invisibility and are favored by users seeking an even more discreet option. These aids are custom-fitted and ideal for mild to moderate hearing loss.

Other product types in the market include a variety of innovative designs that cater to specific user preferences and hearing loss needs. This segment includes newer technologies and specialized hearing aids that might target niche segments of the market, driven by user demand for more personalized solutions.

Distribution Channels Analysis

In 2023, retail sales led the distribution channels for the White Biotechnology market, securing over 70% of the market share. This dominance is largely due to the personalized service and hands-on experience customers receive at retail outlets. These stores allow customers to try products, receive immediate assistance, and get customized fittings, making them a preferred choice for many.

E-commerce, although holding a smaller share, is rapidly growing as a distribution channel. The convenience of online shopping, coupled with the increasing availability of a wide range of products and consumer reviews, is driving its popularity. This platform is particularly appealing to tech-savvy consumers who value the ease of comparing products and prices online.

Government purchases represent a significant yet distinct segment of the market. These are typically bulk purchases made for public health initiatives or to supply government-funded health programs. This channel plays a crucial role in making these technologies accessible to a broader population, particularly in regions with strong government support for healthcare services.

Competitive Landscape

Sonova Holding AG, a leading name in hearing brands, holds a dominant position with over 80% of the market share. In March 2022, Sonova expanded its reach by acquiring Sennheiser Electronic GmbH & Co. KG’s Consumer Division. This move broadens Sonova’s customer base and diversifies its product offerings.

Meanwhile, GN Store Nord A/S made its mark by launching the ReSound Key in February 2021. This addition to their hearing aid collection opens doors for people worldwide to experience cutting-edge hearing technology. This new product allows the company to connect with more customers and enhance its variety of hearing solutions.

Report Scope:

| Report Attributes | Details |

| Market Value (2023) | US$ 8.1 Billion |

| Forecast Revenue 2032 | US$ 13.2 Billion |

| CAGR (2023 to 2032) | 5.7% |

| North America revenue holding share | 2.6 Bn |

| Base Year | 2022 |

| Historic Period | 2016 to 2022 |

| Forecast Year | 2023 to 2032 |

Market Key Players

- Sonova Group

- Demant A/S

- GN Store Nord A/S

- WS Audiology

- Starkey

- MED-EL (Medical Electronics)

- Cochlear Ltd

- RION Co., Ltd

- SeboTek Hearing System LLC

- Widex USA, Inc

- Sivantos Pte LTD

- Phonak Hearing Systems

- Other Key Players

Recent Developments

- October 2023: Starkey Hearing Technologies launches Livio Edge AI 2.0 hearing aids, featuring improved artificial intelligence and machine learning capabilities.

- September 2023: Signia launches Charge&Go Nx hearing aids, the world's first rechargeable hearing aids with a charger that also doubles as a cleaning station.

- August 2023: ReSound launches ONE hearing aids, the world's first hearing aids to combine dual hybrid processing with machine learning.

- July 2023: Widex launches MOMENT range of hearing aids, featuring a new dual microphone technology that improves sound quality and directionality.

- June 2023: Phonak launches Marvel 2 hearing aids, the world's first hearing aids with integrated RogerDirect technology for direct streaming of Roger microphones.

- December 2022: Cochlear launches latest Nucleus 22 cochlear implant system, featuring improved sound quality and battery life.

- November 2022: Oticon launches More 3 hearing aids, the world's first hearing aids to feature Deep Neural Network (DNN) technology for enhanced sound processing.

- October 2022: GN Hearing launches ReSound ONE hearing aids, the world's first hearing aids to feature dual hybrid processing with machine learning.

- September 2022: Sonova launches Phonak Marvel hearing aids, the world's first hearing aids to feature integrated RogerDirect technology for direct streaming of Roger microphones.

- August 2022: WS Audiology launches Signia Nx hearing aids, the world's first hearing aids to feature a new dual microphone technology that improves sound quality and directionality

Explore More Reports

- Hearing Protection Devices Market size is expected to be worth around USD 5639.0 Million by 2033 from USD 2214.0 Million in 2023

- Patient Registry Software Market size is expected to be worth around USD 3632 Million by 2032 from USD 1,200 Million in 2022

- Remote Patient Monitoring Software and Services Market Size Is Expected To Be Worth Around USD 78.4 Bn By 2032 From USD 6.7 Bn In 2022

- Patient Portal Market size is expected to be worth around USD 21.9 Billion by 2033 from USD 3.5 Billion in 2023, growing at a CAGR of 20.1%

- Patient Engagement Solutions Market size is expected to be worth around USD 113.4 billion by 2033, from USD 20.6 billion in 2023

- Ear syringe Market is expected to grow at a CAGR of 10.27% over the next ten years and will reach USD 127.49 million in 2032.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: