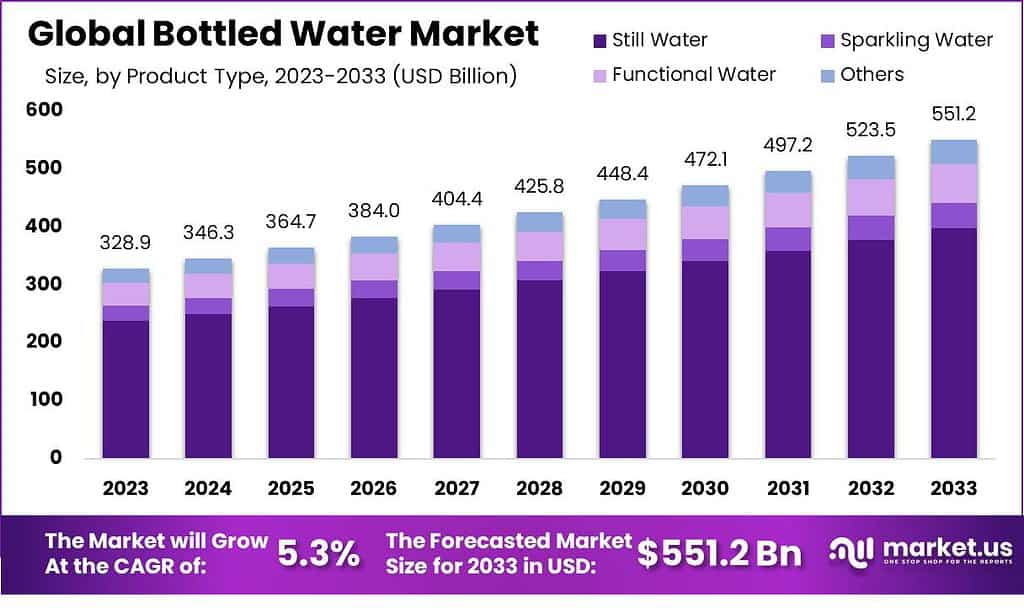

New York, Dec. 12, 2023 (GLOBE NEWSWIRE) -- As per a newly released report by Market.us, the Bottled Water Market size is poised to cross USD 328.9 billion in 2023 and is likely to attain a valuation of USD 551.2 billion by 2033. The Bottled Water Market industry share is projected to develop at a CAGR of 5.3% from 2022 to 2032.

The bottled water market encompasses all industries involved with producing, packaging, distributing, and selling packaged water such as still, sparkling, or enhanced (containing vitamins or other active ingredients) in bottles or containers for consumption. This industry includes still water; sparkling water; flavor enhanced (still or sparkling); and functionally enhanced or enhanced waters which may include vitamins/mineral supplements/other ingredients for functional enhancement or functional enhancement of health or other forms.

Gain expert insights and supercharge your growth strategies. Request our market overview sample now: https://market.us/report/bottled-water-market/request-sample

Key Takeaway:

- Market Size and Growth: Expected market valuation: USD 551.2 billion by 2033. Projected growth rate: CAGR of 5.3% from 2023 to 2033. Anticipated total value in 2023: USD 328.9 billion.

- Product Types: Dominant segment in 2023: Still Water (holding 72.3% market share). Other significant segments are sparkling Water and Functional Water.

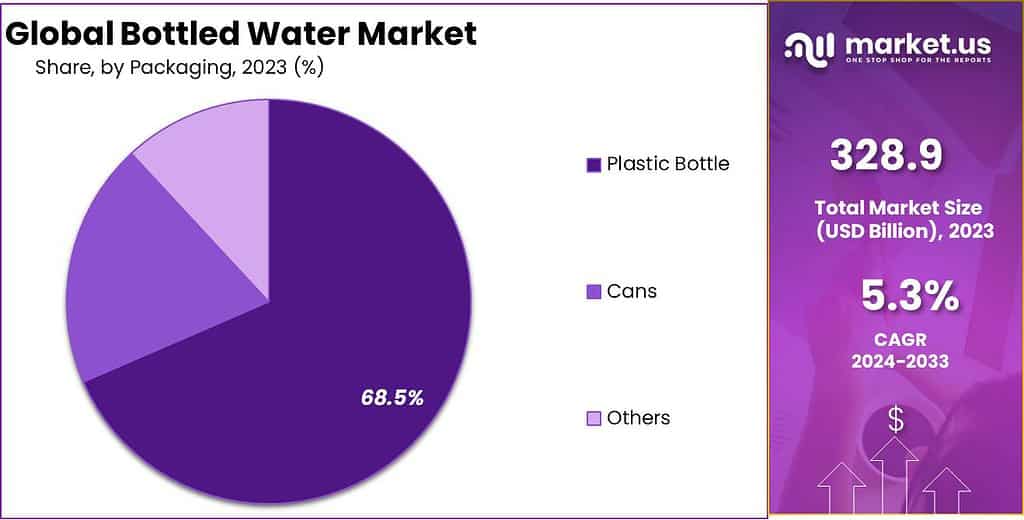

- Packaging: Dominant packaging choice: Plastic Bottles (with a market share of 68.5% in 2023). Notable presence: Cans (considered more eco-friendly).

- Distribution Channels: Dominance: Offline distribution channel (holding 90.1% market share in 2023). Growing segment: Online distribution due to convenience and home delivery.

- Driving Factors: Increased health consciousness among consumers driving demand. Convenience and portability as key factors for choosing bottled water. Growing awareness and concern for environmental impact.

- Challenges: Environmental impact due to plastic waste generation. Competition from cheaper tap water affects market growth in some regions. Stringent regulations impact manufacturers' costs and profitability.

- Growth Opportunities: Premium and functional water segments offer significant growth avenues. E-commerce expansion provides convenience to consumers. Emerging markets with improving disposable incomes represent untapped potential.

- Key Market Trends: Shift towards plant-based and recyclable packaging. The rising popularity of flavored and functional water varieties. Premium water brands gaining traction with unique stories and branding.

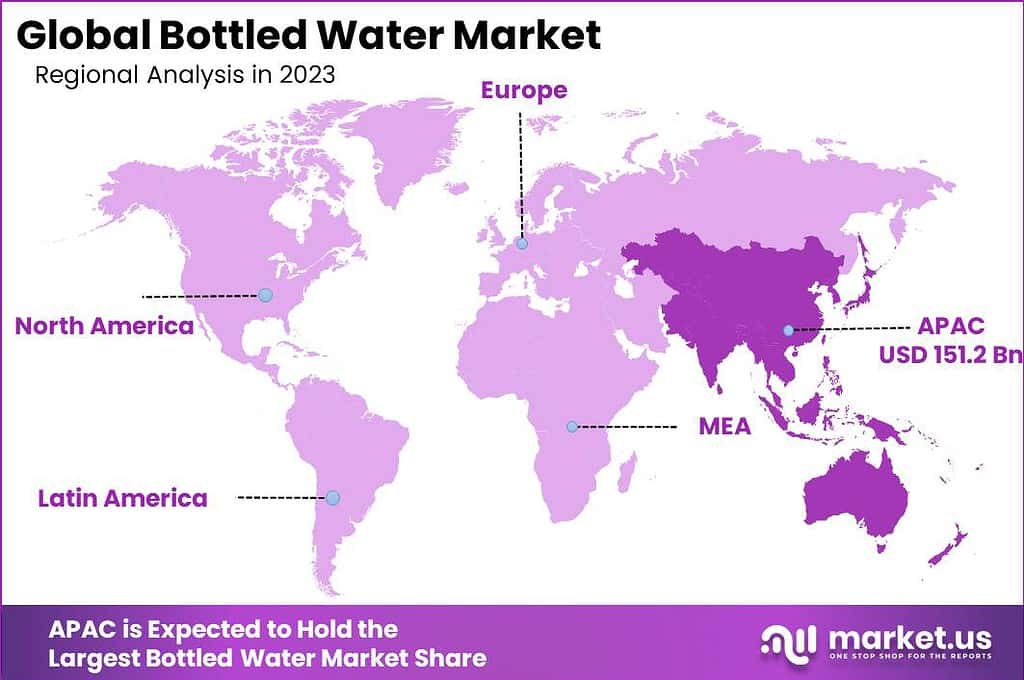

- Regional Analysis: Asia Pacific (APAC) dominates, followed by North America, Europe, Latin America, and MEA. APAC's growth is attributed to a large population, rapid urbanization, and health awareness.

- Key Players: Major global players: Nestlé, PepsiCo, Coca-Cola, DANONE, and others.

Factors are contributing to the growth and revolution of the Bottled Water industry

- Health and Wellness Trends: Increasing health consciousness and a shift toward healthier lifestyles have driven the demand for bottled water as a preferred alternative to sugary beverages. Consumers perceive bottled water as a healthier hydration choice.

- Convenience and On-the-Go Lifestyle: The convenience factor associated with bottled water, especially in portable and easily accessible packaging, aligns with modern on-the-go lifestyles, catering to consumer demand for convenience and mobility.

- Rising Disposable Income and Urbanization: As economies develop and urbanization accelerates, disposable incomes rise, leading to increased spending on convenience products like bottled water. Urban populations often seek convenient, ready-to-consume products.

- Environmental Concerns and Sustainability Initiatives: Plastic waste poses a substantial environmental concern, yet its popularity has led to an unprecedented revolution in sustainable packaging solutions. Many companies now invest in eco-friendly options such as biodegradable or recyclable packaging to satisfy consumer and regulatory worries about environmental impacts.

- Innovation in Product Offerings: Continuous innovation in bottled water offerings, including flavored water, and functional or enhanced water with added nutrients, vitamins, and minerals, attracts diverse consumer segments and boosts market growth.

Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy the full report here

Top Trends in the Global Bottled Water Market

- Health and Wellness Focus: Consumers are increasingly prioritizing health, driving the demand for functional and enhanced waters. Beverages fortified with vitamins, minerals, electrolytes, and other functional ingredients are gaining popularity as consumers seek hydration with added health benefits.

- Sustainable Packaging Solutions: Environmental consciousness has spurred a focus on sustainable packaging within the bottled water industry. Companies are innovating with eco-friendly materials, such as biodegradable plastics, recycled PET, and compostable packaging, to reduce the environmental impact of plastic waste.

- Rise of Premium and Specialty Waters: The market is seeing a surge in premium and specialty waters, including alkaline, mineral, and artisanal waters. These offerings cater to specific consumer preferences for taste, mineral content, and perceived health benefits.

- Flavored and Infused Waters: Flavored and infused waters are gaining traction, appealing to consumers seeking variety and taste. Natural flavors, such as fruit infusions or herbal blends, are being used to enhance the drinking experience without added sugars or artificial ingredients.

- Innovation in Packaging Formats: Bottled water companies are exploring innovative packaging formats, including more sustainable and convenient options such as pouches, aluminum cans, paper-based cartons, and resealable bottles, to meet diverse consumer needs and reduce environmental impact.

Regional Analysis

- Asia Pacific (APAC): Market Dominance: Held over 46% of the global market share in 2023. Market Value: Valued at USD 151.2 billion in 2023. Key Drivers: Rapid urbanization, growing population, and increased awareness of clean drinking water. Consumer Trends: Shift towards convenient and safe bottled water options in single-use and bulk packaging due to health concerns and urbanization.

- North America: Market Presence: Significant share in the industry driven by health and wellness trends. Consumer Preference: Increasing favoritism towards bottled water as a healthier beverage option. Environmental Focus: Investments in eco-friendly packaging solutions to address consumer concerns.

- Europe Robust: Market Share: Notable presence with a focus on premium and natural bottled water varieties. Quality and Safety: Strict regulations governing the industry ensure product quality and safety. Consumer Willingness: European consumers are willing to pay more for premium bottled water products.

- Latin America: Market Growth: Significant rise in demand due to increased disposable income and health consciousness. Consumer Behavior: Growing preference for bottled water over carbonated beverages and other alternatives. Continued Trend: People prioritize drinking more water and seek healthier drink options.

- Middle East and Africa (MEA): Emerging Market: Witnessed growth due to rising temperatures, urbanization, and the need for portable drinking water. Consumer Demand: Bottled water offers a reliable solution to water scarcity and quality issues in the region. Innovative Offerings: Brands introducing flavored and vitamin-enriched water to cater to diverse preferences.

Figure:

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Some of the major players include:

- Nestlé

- PepsiCo

- The Coca-Cola Company

- DANONE

- Primo Water Corporation

- FIJI Water Company LLC

- Gerolsteiner Brunnen GmbH & Co. KG

- VOSS WATER

- Nongfu Spring

- National Beverage Corp.

- Keurig Dr Pepper Inc.

- Other Key Players

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 328.9 Billion |

| Forecast Revenue 2032 | USD 551.2 Billion |

| CAGR (2023 to 2032) | 5.3% |

| Asia Pacific Revenue Share | 46% |

| Base Year | 2022 |

| Historic Period | 2016 to 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

- Health Consciousness - 5.3% CAGR: Increasing consumer awareness about health is driving the growth of the bottled water market. With a projected 5.3% Compound Annual Growth Rate (CAGR) from 2023 to 2033, health-consciousness has spurred demand for healthier hydration alternatives.

- Dominance of Still Water - 72.3% Market Share: Still water holds the majority market share at 72.3%. This reflects the enduring preference for pure, uncarbonated hydration among health-conscious individuals seeking simplicity and natural solutions.

- Plastic Bottle Packaging - 68.5% Market Share: Convenience and availability propel plastic bottles to the forefront with a 68.5% market share. Their lightweight nature and durability make them a preferred choice for both manufacturers and consumers.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights: https://market.us/purchase-report/?report_id=24488

Market Restraints

- Environmental Impact due to Plastic Waste Generation: The industry faces criticism for contributing to plastic waste, impacting the environment. Annually, around 8 million metric tons of plastic waste enter the oceans, significantly affecting marine life and ecosystems.

- Growing Concerns over Plastic Pollution: Increasing awareness about plastic pollution has led to calls for more sustainable packaging alternatives. Approximately 500 billion plastic bottles are used globally each year, with a low recycling rate of only 20-30%.

- Competition from Tap Water: In regions with reliable and high-quality tap water infrastructure, bottled water encounters competition. Tap water, easily accessible and cheaper, presents a challenge for bottled water sales, impacting market growth in certain areas.

Market Opportunities

- Health and Wellness Trends Driving Demand Value: Increasing health consciousness among consumers fuels the demand for healthier alternatives. Opportunity: Bottled water is seen as a healthier choice over calorie- and sugar-laden drinks.

- Convenience and Portability Preferences Value: Consumers seek convenience in hydration options, especially for those on the move. Opportunity: Bottled water offers easily accessible hydration solutions in regions with tap water quality concerns.

- Environmental Sustainability Focus Value: Growing environmental awareness demands eco-friendly packaging solutions. Opportunity: Shift towards recyclable materials, addressing concerns about plastic waste generation.

Report Segmentation of the Bottled Water Market

Product Types:

Still Water This segment takes the lead, holding a significant market share of 72.3% in 2023. It continues to be a preferred choice for health-conscious individuals seeking pure, uncarbonated water. Sparkling Water While not surpassing Still Water, Sparkling Water maintains a substantial market presence, offering consumers the effervescence and crispness they enjoy. It doesn't lead but maintains a noteworthy share in the Bottled Water market. Functional Water This segment shows promising growth due to its enhanced attributes, such as added minerals, vitamins, or other health-related benefits. Although it doesn't command the largest share, it caters to consumers with specific health and wellness preferences, carving a niche in the market.

By Packaging:

The section "By Packaging" in the Bottled Water Market report outlines the various packaging options used in the industry. In 2023, Plastic Bottles emerged as the dominant choice, capturing a substantial market share of 68.5%. Plastic bottles are favored for their convenience, portability, and wide availability. They are lightweight and durable, making them a preferred option for both manufacturers and consumers.

Cans also maintained a notable presence in the market, particularly among environmentally conscious consumers. They are considered more eco-friendly and recyclable compared to certain plastic options, resonating with a specific segment of the market. As sustainability gains importance, the demand for canned bottled water is expected to grow.

By Distribution Channel

Offline Distribution: Dominated the market in 2023 with a substantial share of 90.1%. It includes brick-and-mortar stores, supermarkets, convenience stores, and other physical retail locations. Offline distribution offers consumers the chance to physically examine products and make immediate purchases.

Online Distribution: Held a significant share of 9.9% in 2023. This channel involves e-commerce platforms and online retail stores. Consumers opt for online purchases due to the convenience of home delivery, a wide product range, and the ability to compare and choose products.

Key Market Segments

By Product Type

- Still Water

- Sparkling Water

- Functional Water

- Others

By Packaging

- Plastic Bottle

- Cans

- Others

Distribution Channel

- Online

- Offline

By Geography

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Recent Developments

- Nestlé’s Sustainable Packaging: In April 2023, Nestle joined forces with Acreto, a company dedicated to sustainable packaging, to introduce a fresh range of bottled water crafted entirely from plant-based materials.

- PepsiCo Taps into Captured Carbon Emissions: In February 2023, PepsiCo collaborated with biotech firm LanzaTech to pioneer a novel method for crafting bottled water derived from captured carbon emissions.

Browse More Related Reports

- Global water treatment chemicals market size is expected to be worth around USD 62.0 billion by 2033, from USD 37.7 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

- Global Water and Wastewater Treatment Equipment Market size is expected to be worth around USD 89.7 Billion by 2032 from USD 54.7 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2022 to 2032.

- Global flavored water market accounted for USD 15.2 billion and is expected to grow to around USD 40.6 billion in 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 10.6%.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: