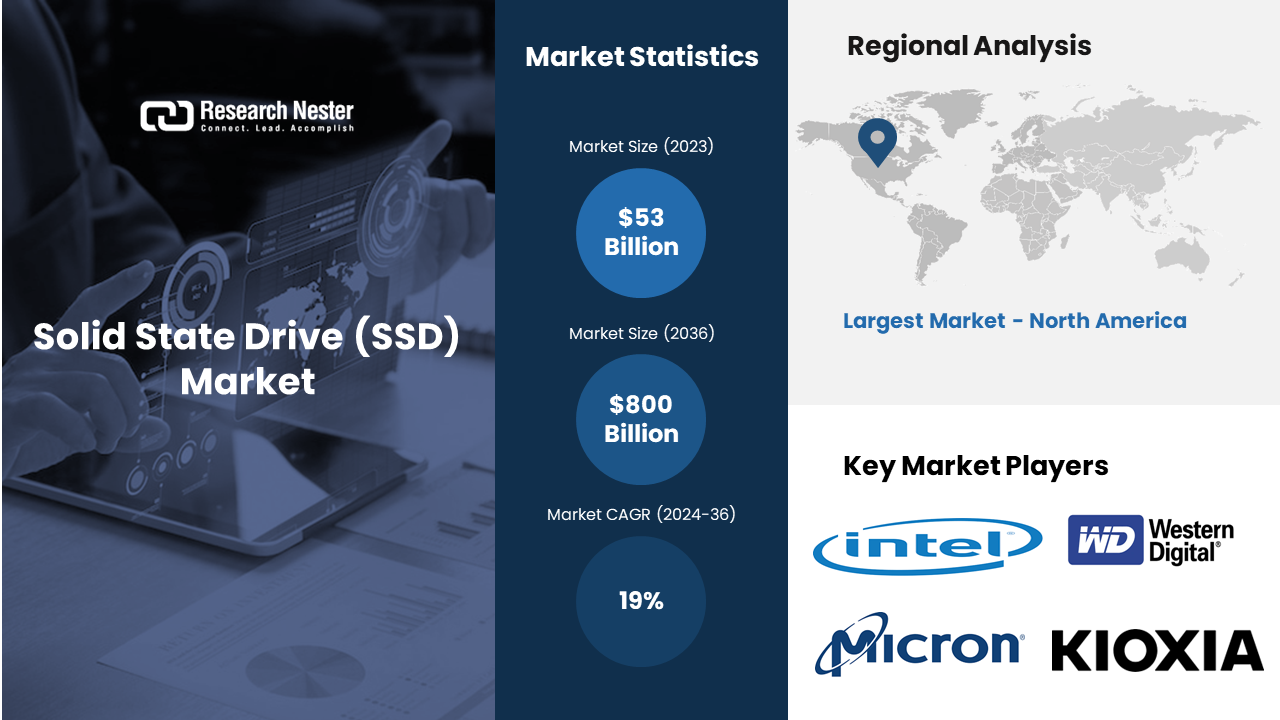

New York , Jan. 08, 2024 (GLOBE NEWSWIRE) -- The global solid state drive market size is poised to grow at a CAGR of over 19% from 2024 to 2036. The market is anticipated to garner a revenue of USD 800 billion by the end of 2036, up from a revenue of USD 53 billion in the year 2023. Cloud computing is quickly gaining popularity among users as a data preservation tool, followed by the increasing use by a wide range of people and businesses. By 2027, more than 50% businesses all across the globe are going to take up cloud computing program for improved results. The demand for solid state drives has increased globally due to the availability of a wide range of cloud platforms, including new public clouds, conventional private clouds, and personal clouds at home.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-5389

The market for solid state drives is driven by the increasing need for data storage across a range of end applications. The need for data storage has grown significantly in recent years, and it is anticipated that this trend will continue in the near future, propelling the global SSD market expansion. Solid-state drives have surfaced as a more advanced substitute for hard disk drives. They are high in demand worldwide due to their outstanding read and write capabilities. SSDs are better than hard disk drives because of their fast data accessibility. Ongoing technological advancements, such as the development of 3D NAND technology, have increased the storage capacity of SSDs while maintaining or improving performance.

Solid State Drive Market: Key Takeaways

- Market in North America to propel highest growth

- The enterprise segment to garner the highest growth

- Market in Europe to grow at a highest rate

Increasing Internet Presence of Users all across the Globe to Boost Market Growth

Increasing social media usage, e-commerce expansion, and media content growth will all play a key role in driving the solid state drive market throughout the projected period. Due to the widespread use of tablets and smartphones, which have enabled customers to create huge amounts of digital data, average household memory consumption is likely to increase in the coming years. As a result, the need for sufficiently large storage capacity is increasing. It has also been observed that the use of SSDs in data centers has increased due to various factors, including improved performance compared to conventional HDD storage, increasing demand for storage media increases and advances in the reliability and performance of enterprise-class SSDs. Businesses prefer SSDs because they require less power, which further allows for less dispersion, leading to reduced environmental impact. As organizations increasingly migrate their operations to cloud-based platforms and witness an exponential growth in data volumes, the traditional storage solutions, such as Hard Disk Drives (HDDs), are proving inadequate in meeting the demands of modern data center architectures. According to a report, the global enterprise SSD sales are projected to reach USD 22.4 billion by 2025. This robust growth is indicative of the rising adoption of SSDs in enterprise environments, with data centers playing a pivotal role in this upward trajectory.

Solid State Drive Industry: Regional Overview

The global solid state drive market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa region.

Enterprise Data Centers Demand to Drive the Market Growth in North America Region

The solid state drive market in North America region is estimated to garner the largest revenue by the end of 2036. Owing to the increasing uptake of cutting-edge technologies like cloud, IoT, big data, and high-end cloud computing, North America is anticipated to be a significant market. The region's market is growing because of the rising need for storage brought on by the widespread use of these technologies. Strong vendor presence in the area supports the expansion of the solid state drive market. In order to boost product penetration, boost revenues, and accelerate the demand for the item in the area, regional producers are also concentrating on invention and product differentiation. For example, Micron released the 5400 SATA SSD Advanced Memory System for Critical Infrastructure in June 2022. With the 5400 SSD, the company provides 176-layer NAND innovation to its data center SATA SSD. The increasing demand for faster and more reliable storage solutions in enterprise data centers was a significant driver. As businesses in North America continued to expand their digital footprint, the need for high-performance storage solutions, such as SSDs, in data centers became crucial.

Emphasis on Data Security and Compliance to Propel the Growth in the Europe Region

The Europe solid state drive market is estimated to garner the highest CAGR by the end of 2036. The implementation of the General Data Protection Regulation (GDPR) has heightened the focus on data security and compliance across European industries. SSDs, with their advanced encryption capabilities and secure data erasure features, are becoming the storage solution of choice for organizations aiming to adhere to GDPR requirements. The robust security features of SSDs provide a critical layer of protection against data breaches, aligning with Europe's stringent data protection standards. A survey found that 92% of European companies increased their cybersecurity budgets in response to GDPR. This investment includes the adoption of advanced storage solutions like SSDs, contributing to the market's growth as organizations prioritize data security compliance. The paradigm shift towards remote work has accelerated the need for efficient and reliable end-user devices. European businesses are investing in upgrading employee laptops and desktops with SSDs to enhance overall system performance and support the demands of remote collaboration. The faster boot times, quicker application launches, and improved multitasking capabilities of SSD-equipped devices contribute to a more seamless remote work experience.

Make an Inquiry Before Buying this Report @ https://www.researchnester.com/inquiries-before-buying-5389

Solid State Drive Segmentation by End User

- Enterprise

- Client

- Industrial

- Automotive

Amongst these segments, the solid state drive market enterprise segment is anticipated to hold the largest share over the forecast period. Enterprise SSDs leads the way over client SSDs with power loss protection for data stored in DRAM, higher performance, stronger error correcting code (ECC), consistent and durable quality of service, and longer warranty. The first enterprise-class SSD to use single-level cell (SLC) NAND flash memory, which stores one bit per cell and provides the highest endurance and performance, with a typical life cycle of 100,000 writes per cell. Additionally, NAND-based flash storage solutions are in high demand among organizations due to their long durability, low cost, and faster storage with low error rates, which increases the demand for SSD solutions in businesses around the world. The growing use of SSDs in data centers is driven by many factors, including higher performance compared to conventional HDD storage, increasing demand for storage capacity, as well as advances in the durability and performance of enterprise SSDs.

Solid State Drive Segmentation by Interface

- Serial ATA (SATA)

- Serial Attached SCSI (SAS)

- Peripheral Component Interconnect Express (PCIe)

Amongst these segments, the solid state drive market serial ATA segment is anticipated to hold a significant share over the forecast period. The persistent growth of digital data and the increasing reliance on data-centric applications have fueled the expansion of enterprise data centers. As organizations across industries scale their operations, there is a parallel demand for storage solutions that offer a balance between performance and cost-effectiveness. SATA SSDs, with their compatibility and widespread use, are witnessing substantial adoption in enterprise data centers for storage upgrades and expansions. According to IDC's Worldwide Quarterly Enterprise Storage Systems Tracker, as of 2021, the global enterprise storage industry, including SATA SSDs, witnessed a year-over-year growth of 16.4%. This growth indicates the sustained investment in storage infrastructure, with SATA SSDs being a significant contributor. Technological advancements, particularly in 3D NAND flash memory technology, have significantly enhanced the storage capacity and performance of SATA SSDs. The evolution from traditional planar NAND to 3D NAND allows for greater data density and improved reliability. As manufacturers adopt and refine 3D NAND technology, SATA SSDs can offer higher capacities at competitive price points, catering to the growing storage needs of both enterprises and consumers.

Solid State Drive Segmentation by Type

- External

- Internal

Solid State Drive Segmentation by Form Factor

- 1.8”/2.5”

- 3.5”

- M.2/mSATA

- U.2 (SFF 8639)

- FHHL and HHHL

Solid State Drive Segmentation by Storage

- Under 500 GB

- 500 GB–1 TB

- 1 TB – 2 TB

- Above 2 TB

Solid State Drive Segmentation by Technology

- TLC 3D

- TLC Planar

- MLC 3D

- MLC Planar

- SLC

Few of the well-known market leaders in the global solid state drive market that are profiled by Research Nester are KIOXIA Corporation, Seagate Technology LLC, LITE-ON Technology Corporation, SK HYNIX INC., Viking Technology, Kingston Technology Europe Co LLP, and other key market players.

Request for Customization of this Report @ https://www.researchnester.com/customized-reports-5389

Recent Development in the Solid State Drive Market

- Seagate introduced the FireCuda 120 SATA SSD. It has sequential read/write speeds of 560/540 MB/s. Capacity varies from 500 GB to 4 TB. It is aimed at gamers and offers speed, durability, and large storage capacity.

- Samsung introduced a new professional SSD with improved performance. They have produced high-performance industrial SSDs featuring the latest Serial ATA (SATA) interface. According to Samsung, the PM1653 is the industry's first 24G SAS SSD manufactured to use sixth-generation V-NAND memory devices, with storage capacities ranging from 800 GB to 30.72 TB for enterprise server systems.

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.