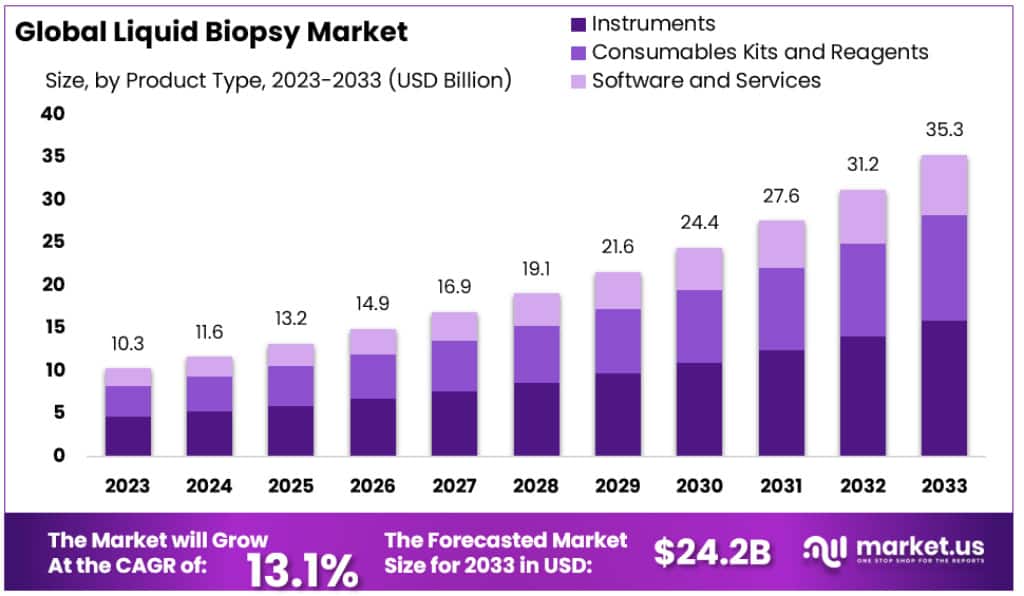

New York, Jan. 24, 2024 (GLOBE NEWSWIRE) -- According to Market.us, the Liquid Biopsy Market size is projected to exceed USD 35.3 Billion by 2033, with a promising CAGR of 13.1% from 2024 to 2033.

A blood test performed for the detection of cancer tumor is known as liquid biopsy. In case of tumor, some part within the body break and float in the blood, these floating part are easily detected by liquid biopsy. It is a very emerging medical process, and scientists are still involved to determine how effective it can be for cancer treatment. Many different types of cancers, such as lung cancer, breast cancer, can be detected and eliminated from the target population by liquid biopsy process in recent times.

Get PDF Sample for Technological Breakthroughs@ https://market.us/report/liquid-biopsy-market/request-sample/

Key Takeaway

- Based on technology, the Multi-Gene- parallel analysis segment dominated the market of liquid biopsy.

- Circular Nucleic acid segment accounted to hold the large market share, with respect to the biomarker analysis.

- Based on application analysis, the cancer segment hold a large market share of 77% in 2023.

- The presence of expert staff and availability of advanced procedures, makes hospitals and laboratories to make sky rocketing revenues.

Factors affecting the growth of the Liquid Biopsy industry

Several factors are affecting the growth of the liquid biopsy industry. These include:

- Technological advancements: Sophisticated technologies have empowered liquid biopsy related industries to develop exceptionally potent devices, leading to the expansion of the liquid biopsy market.

- Less invasive procedure: The liquid biopsy procedure is less invasive as compare to the other tissue biopsy procedures, helping the expansion of the market size.

- Frequency and ease: The ease and frequencyof the liquid biopsy test offer an advantage over the tissue biopsy. The test can be easily repeated if needed and can be used as often as necessary to monitor the patient's progress.

Top trends in the Liquid Biopsy Market

The newly emerging technologies are significantly playing an important role to upscale the liquid biopsy market. The introduction of guardant 360 response test helps the doctors to check if the cancer treatment is working or if the cancer is becoming resistant by checking changes in DNA found in the blood stream. In addition to this, the TruSight oncology 500 ctDNA test is a special kind of test that can find over 500 genetic changes linked to cancer in the DNA floating in the bloodstream.

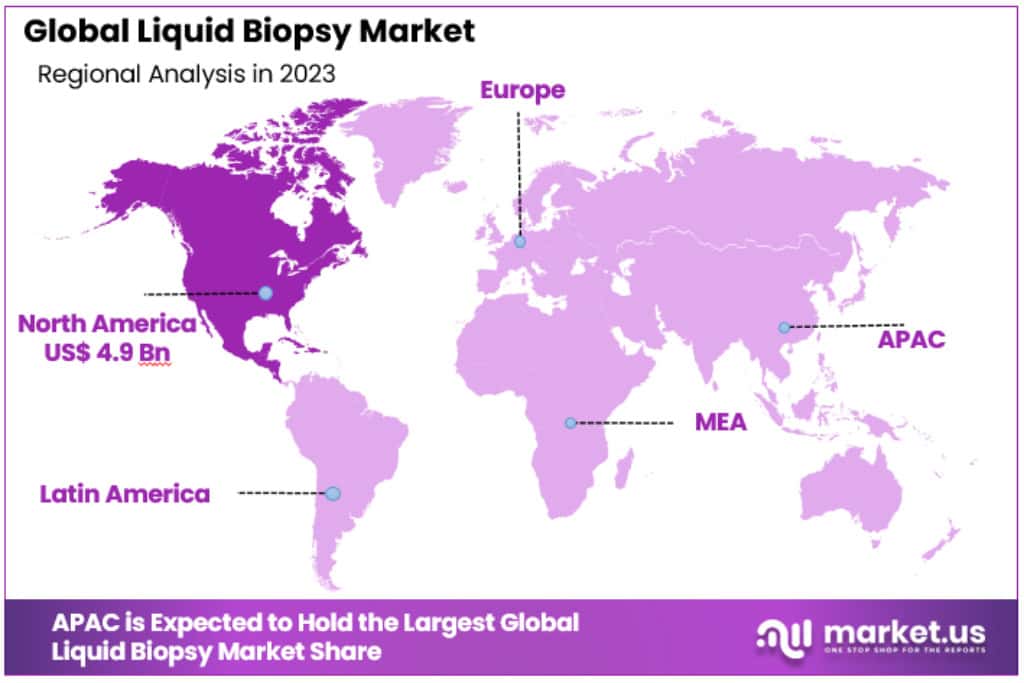

Regional Analysis

Owing to the higher investments by leading market players and the presence of number of biotechnology organizations producing the tests, North America is accounted to hold a large market share of 47.1%. The presence of American Society of Clinical Oncology supporting liquid biopsy is a major factor leading to the growth of liquid biopsy market in the region.

Canada, followed by United States, is the leading nation for expanding the liquid biopsy market. The nation is leveraged by government initiatives to increase subsidies and investments for the liquid biopsy development market, projected to strengthen the country’s market.

Explore the strategic advantages our report holds for your business. Request a brochure to find out more https://market.us/report/liquid-biopsy-market/#inquiry

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 10.3 Billion |

| Forecast Revenue 2033 | USD 35.3 Billion |

| CAGR (2024 to 2033) | 13.1% |

| North America Revenue Share | 47.1% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

Cancer awareness initiative is one of the major driving factor for the expansion of liquid biopsy market. For example, the WHO’s National Cancer Control program aims to reduce cancer deaths and improve patients’ lives. Furthermore, the breast cancer screening to low income patients is been offered by the National Breast and Cervical Cancer Early Detection Program (NBCCEDP), US.

Market Restraints

In certain kinds of cancer, such as sarcomas and gliomas, the shed level of ctDNA is very less, arising the problems for liquid biopsies to accurately detect the ctDNA. Thus, this factor is projected to impede the liquid biopsy market during the forecast period.

Opportunities

The more cancer cases in the countries like India, China, South Korea, Brazil, Turkey, Russia and South Africa offers great opportunities for the growth of Liquid biopsy market. In addition to this, these regions have large population, improved healthcare systems, rising incomes and enhanced medical tourism, boosting the market revenue during the foreseen period.

Instant Access Upon Purchase | Get This Premium Research Report Now https://market.us/purchase-report/?report_id=28756

Report Segmentation of the Liquid Biopsy Market

Technology Analysis

With respect to technology, the liquid biopsy market is bifurcated into multigene parallel analysis and single gene analysis. The Multigene parallel analysis(NGS) segment is accounted to hold a large global market revenue of 72.8%, dominating the liquid biopsy market in 2023. Mutations that lead to tumorigenesis can be easily detected by NGS. The scientists have made the recent advancement in NGS, which aids in more accurate and precise treatment outcomes, with declining costs. NGS also aids in detecting stage 1 and 2 lung cancer, with a MAF of 0.1%.

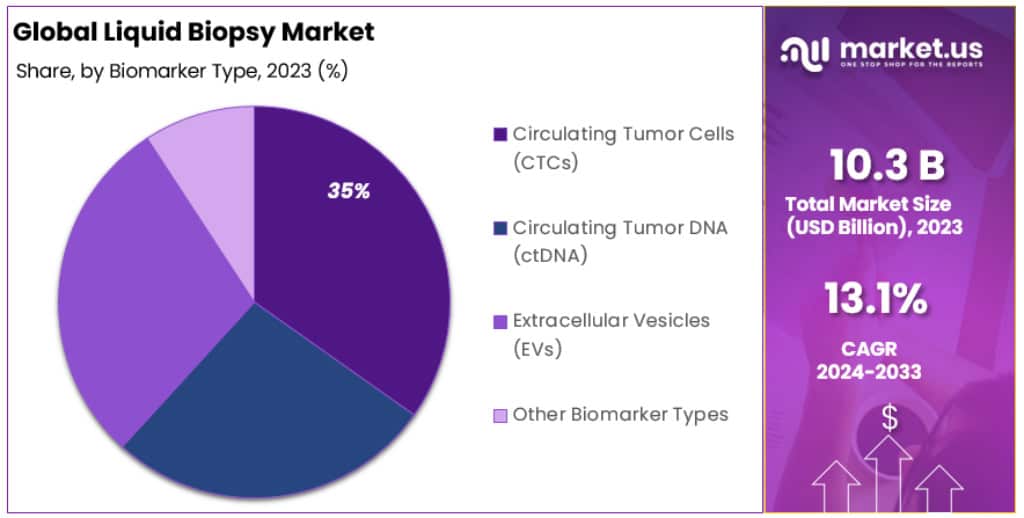

Biomarker Analysis

As far as Biomarker is considered, the market is segmented into Circular tumor cells, Circulating tumor DNA and extracellular vesicles. Amongst this, circular tumor DNA(ctDNA) accounted the large revenue share of 34.78%, dominating the liquid biopsy market in 2023. The circulating tumor DNA has a great potential in liquid biopsy process. For the detection of ctDNA, Academic and Research centers in translational cancer are now employing liquid biopsies to detect ctDNA in tumor cells. Using ctDNA, as a biomarker, the liquid biopsy applications will have a greater potential for the detection of various types of cancers.

Product Type Analysis

As far as product type is considered, the market is disjointed into instruments, consumable kits and reagents, software and services. The instrument segment played a major role to hold a strong market place, having a market share of 44.9% in 2023. Instruments are the most crucial part of liquid biopsy process, as these help to collect and study the liquid biopsy samples like blood. Furthermore, instruments also help the experts to precisely find circulating tumor cells and circulating tumor DNA, in the blood. Many advanced and automatic instruments are adopted by laboratories and healthcare facilities, leading to foster the liquid biopsy market.

Application analysis

With respect to applications, the liquid biopsy market is segmented into cancer, lung cancer, prostate cancer, breast cancer, colorectal cancer, leukemia, gastrointestinal cancer and reproductive health. In 2023, the cancer segment dominated the market by holding a large global revenue share of 77%. This owes to the fact that liquid biopsy is a valuable technology to diagnose and track cancer.

End User analysis

Based on end user analysis, the market is categorized into hospitals and laboratories, specialty clinics and academic and research centers. Owing to the primary place where liquid biopsy tests are conducted by virtue of advanced equipment and expert staff, hospitals and laboratories segment dominates the market by 47.2% in 2023.

Impact of Macroeconomic Factors

The arrival to two significant global changes, COVID 19 and Russia-Ukraine war had a profound impact on liquid biopsy market, leading to the complex set of factors reshaping the market trajectory in unforeseen ways. The onset of the COVID-19 pandemic brought about substantial changes in consumer behavior and business operations. Companies rushed to expand their online reach, resulting in a noticeable upswing in the Liquid Biopsy market as businesses sought to optimize their online content for greater visibility and engagement. Simultaneously, the Russia-Ukraine conflict introduced an additional layer of uncertainty and volatility into the global economic landscape. As businesses navigated these geopolitical challenges, the Liquid Biopsy market adapted to the evolving environment, with brands reevaluating their marketing strategies to align with shifting consumer sentiments.

Recent Development of the liquid biopsy Market

- In February 2023: Grail got special recognition from the FDA for its Galleri multi-cancer early detection test. This test can help find different types of cancer early on.

- In August 2023: The tests to check RNA and DNA for myeloid measurable residual disease assessment was introduced by Thermo fisher scientific.

Market Segmentation

By Technology

- Multigene parallel analysis

- Single gene analysis.

By Biomarker

- Circular tumor cells

- Circulating tumor DNA

- Extracellular vesicles.

By product type

- Instruments

- Consumable kits and reagents

- Software and services

By application

- Cancer

- Lung cancer

- Prostate cancer

- Breast cancer

- Colorectal cancer

- Leukemia

- Gastrointestinal cancer

- Reproductive health

By end use

- Hospitals and laboratories

- Specialty clinics

- Academic and research centers

By Geography

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Don't miss out on business opportunities | Get sample pages at https://market.us/report/liquid-biopsy-market/request-sample/

Competitive Landscape

The market leaders are working on a variety of approaches, including partnerships, product investments, mergers and acquisitions, etc.

Some of the major players include:

- ANGLE plc

- Oncimmune

- Guardant Health, Inc.

- Myriad Genetics, Inc.

- Biocept, Inc.

- Lucence Health Inc.

- Freenome Holdings, Inc.

- F. Hoffmann-La Roche Ltd.

- QIAGEN

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Epigenomics AG

Explore More Life Science Market Report Domain

- Health And Wellness Market size is expected to be worth around USD 4,332 Billion by 2023 from USD 8,379 Billion in 2032

- Healthcare Chatbots Market size was valued at USD 195.85 Million and is expected to reach USD 1168 Million in 2032

- Clinical Trial Imaging Market was valued at USD 1,067.3 Million. Between 2023 and 2032,

- Artificial Insemination Market size is expected to be worth around USD 4,784 Million by 2032

- Healthcare Market size is expected to be worth around USD 797.8 billion by 2032 from USD 369.3 billion in 2022

- Microfluidics Market size is expected to be worth around USD 102.9 Billion by 2033 from USD 32.2 Billion in 2023

- Amyotrophic Lateral Sclerosis Treatment Market was valued at USD 600 Million in 2022 and expected to grow USD 1021 Million in 2032

- Surgical Robotics Market size is expected to be worth around USD 25.7 Billion by 2032 from USD 6.2 Billion in 2022

- Animal Health Market size is expected to be worth around USD 239 Bn by 2032 from USD 150 Bn in 2022

- Tumor Ablation Market size is expected to be worth around USD 4,389 Million by 2032 from USD 1,333 Million in 2022

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn

Our Blog: