Dublin, Jan. 24, 2024 (GLOBE NEWSWIRE) -- The "U.S. Integrated Delivery Network Market Size, Share & Trends Analysis Report, By Integration Model (Vertical, Horizontal), By Service Type (Acute Care/Hospitals, Primary Care, Long-term Health, Specialty Clinics), And Segment Forecasts, 2023 - 2030" report has been added to ResearchAndMarkets.com's offering.

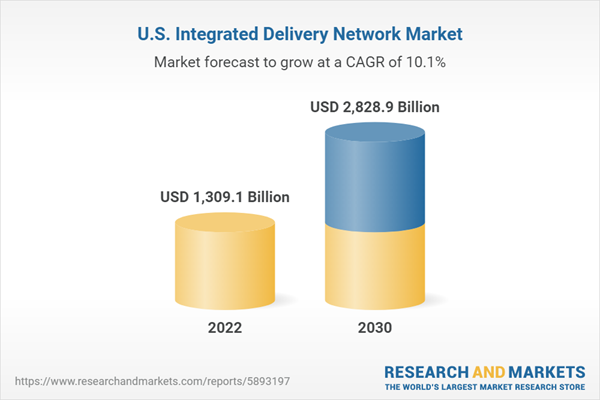

The U.S. integrated delivery network market size is anticipated to reach USD 2, 828.9 billion by 2030, registering a CAGR of 10.1%

The market growth is attributed to the rising demand for various healthcare services owing to increased prevalence of chronic diseases and growing geriatric population. According to a recent study published by the U.S. Department of Health and Human Services and Population Reference Bureau, the population aged 65 years and above is likely to double up from 52 million in 2018 to 95 million by 2060. This will result in the growing adoption of healthcare-related services.

The IDN is one of the key solutions to the healthcare burden in U.S., the consolidation among the various healthcare providers have improved the profit margin for all the healthcare institutes by reducing the operating cost and attaining economies of scale. With growing number of target population, the U.S. healthcare industry is going through rapid and continuous expansion, in terms of healthcare facilities, adoption of advanced technologies, and rise in the number of pharmaceutical companies, med-surg product manufacturers, and insurance providers in country.

The ongoing strategic initiatives by healthcare network to merge, partner, and expand the healthcare ecosystem, have allowed them to reach economies of scale, and thus is expected to drive the integrated delivery network market growth in U.S. IDN can be formed by a large and small number of hospital groups. Many integrated delivery networks dominate the market through strategic initiatives such as acquisitions and mergers, partnerships, and expansion of healthcare facilities.

In 2019, the acute care/hospital service segment held the largest market share owing high preference of acute care/hospital facilities among patients and rise in the number of surgeries performed in hospital infrastructure. In addition, various initiatives undertaken by IDNs to improve their service capability are propelling the segment growth.

U.S. Integrated Delivery Network Market Report Highlights

- Acute care/hospital services emerged as the largest segment with a revenue share of 49.5% in 2022

- Growing focus of healthcare institutes to reduce overall treatment cost and improve quality of care is one of the key factors driving the market growth

- Vertical integration segment is expected to be the largest and fastest-growing segment from 2022 to 2030

- The horizontal integration model involves grouping of organizations that offer a similar type of care; whereas, vertical integration involves grouping of healthcare systems, which are offering different levels of care under one umbrella

Company Profiles

- HCA Healthcare

- Ascension

- Kaiser Foundation Health Plan, Inc.

- UNITEDHEALTH GROUP

- Providence

- UPMC

- Trinity Health

- TH Medical

- CHSPSC, LLC

- CommonSpirit Health

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 85 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value (USD) in 2022 | $1309.1 Billion |

| Forecasted Market Value (USD) by 2030 | $2828.9 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | United States |

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. U.S. Integrated Delivery Network Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.4. U.S. Integrated Delivery Network Market Analysis Tools

3.4.1. Industry Analysis - Porter's

3.4.2. PESTEL Analysis

Chapter 4. U.S. Integrated Delivery Network Market: Integration Model Estimates & Trend Analysis

4.1. U.S. Integrated Delivery Network Market: Key Takeaways

4.2. U.S. Integrated Delivery Network Market: Movement & Market Share Analysis, 2022 & 2030

4.3. Vertical

4.4. Horizontal

Chapter 5. U.S. Integrated Delivery Network Market: Service Type Estimates & Trend Analysis

5.1. U.S. Integrated Delivery Network Market: Key Takeaways

5.2. U.S. Integrated Delivery Network Market: Movement & Market Share Analysis, 2022 & 2030

5.3. Acute Care

5.4. Primary Care

5.5. Long-Term Health

5.6. Specialty Clinics

5.7. Other Services

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis, By Key Market Participants

6.2. Market Participant Categorization

6.2.1. Company overview

6.2.2. Financial performance

6.2.3. Product benchmarking

6.2.4. Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/9i3cpn

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment