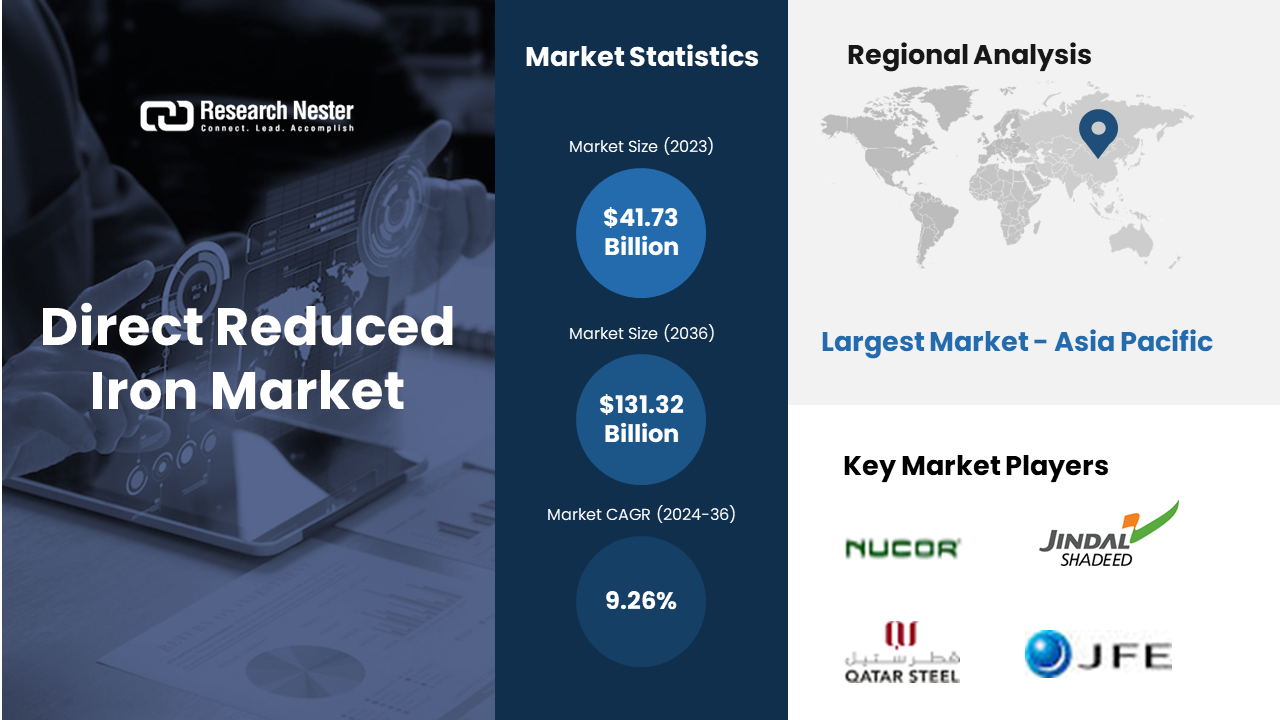

New York, Feb. 05, 2024 (GLOBE NEWSWIRE) -- The global direct reduced iron market size is slated to expand at ~9.26% CAGR between 2024 and 2036. The market is poised to garner a revenue of USD 131.32 billion by the end of 2036, up from a revenue of ~USD 41.73 billion in the year 2023.The growth can significantly be attributed to the growing production of direct reduced iron across the globe. For instance, with over 7% growth, the world's direct reduced iron output reached around 127 million tons in 2022. Particularly, roughly 6 million metric tons of direct reduced iron were produced in Saudi Arabia as of 2021 driven by an increase in steel production and infrastructure projects.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-4416

Moreover, over the past forty years, a new method of producing iron—Direct Reduction (DR) of iron ore to metallic iron—using natural gas has grown significantly because of the benefits offered in terms of output flexibility, low emissions, and low capital expenditures.

Increasing Sale of Automobiles to Boost Market Growth

Recent years have seen growth in the sale of vehicles due to government spending on infrastructure, new product introductions by automakers, and improved fleet operational conversion. Global auto sales increased from around 66 million vehicles in 2021 to approximately 67 million vehicles in 2022. As a result, there is an increasing demand for steel since it is utilized to construct the car's body and frame. High-carbon steel is frequently used by producers and designers in the automobile sector owing to its durability and strength. These factors are expected to fuel the demand for direct reduced iron (DRI), which is utilized to create a wide variety of steel products and is thought to have the ability to achieve carbon-neutral steelmaking since it consumes fewer scraps and can minimize CO2 emissions.

Direct Reduced Iron Market: Regional Overview

The market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa region.

Growing Production of Steel to Drive the Growth in the Asia Pacific Region

The direct reduced iron market in Asia Pacific region is estimated to garner the largest revenue by the end of 2036. The growth can be attributed to the growing production of steel in the region, which may result in higher demand for raw materials including direct reduced iron. India, is now the second-largest producer of crude steel in the world, which is predicted to produce over 200 MT by 2030, more than it did in 2023. The country has played a significant role in the world's steel manufacturing due to its access to inexpensive labor and the availability of iron ore resources. Moreover, India has become a major producer of finished steel due to its growing crude steel capacity and increasing demand which has greatly benefited the economy. For instance, more than 120 million tonnes of steel were produced in India in 2023 and this figure is estimated to increase by more than 250 million tonnes by 2030.

Make an Inquiry Before Buying this Report @ https://www.researchnester.com/inquiries-before-buying-4416

Growing Focus on Decarbonization to Drive the Growth in the 2nd Region

The Europe direct reduced iron market is estimated to garner the largest revenue by the end of 2036. In the European Union, a race to commercialize green steel is in progress which assists the EU in meeting its energy and climate goals for 2030. Moreover, driven by the increased focus on environmental issues, and in line with decarbonization efforts, the expanding penetration of low-carbon products is predicted to fuel the DRI market for green steel in Europe.

When linked to efficient furnaces powered by renewable energy and hydrogen instead of conventional natural gas, direct-reduced iron is thought to be the main player in the shift to a sustainable steel production process and the most efficient path to producing "green" steel. For instance, as part of the EU's overall 2030 greenhouse gas emissions reduction target, its emissions must be reduced by 43% from 2005 levels. Additionally, the rapid expansion of new steel projects in Europe aims to add more than 15 million metric tons of capacity for direct-reduced iron (DRI) using hydrogen and natural gas by 2030.

Direct Reduced Iron Segmentation by Forms

- Pellets

- Lumps

The pellets segment in direct reduced iron market is anticipated to hold the largest revenue by the end of 2036. This is largely due to the growing production of sponge iron. For instance, India is expected to produce over 45 million tonnes (mnt) of sponge iron by the fiscal year 2024–2025. Direct reduced iron is another name for sponge iron which is among the best substances to utilize as coolant in integrated steel plants' L.D. converters and has significantly aided in the steel industry's ongoing casting. Sponge iron is created in the DRI plant by utilizing a crucial raw material known as a pellet. Pellets are used as the feedstock to boost the production of sponge iron in place of lumps owing to their improved metallurgical and physical qualities. Moreover, it lessens the amount of accretion that forms in the kiln that is used in the sponge iron process to reduce high-grade lump ores. Additionally, by 2025, the amount of iron ore pellets produced worldwide is projected to increase by over 8% or more than 500 million tonnes.

Direct Reduced Iron Segmentation by Production Process

- Gas Based

- Coal Based

The gas-based segment in direct reduced iron market is anticipated to hold the largest revenue by the end of 2036. The growth can be attributed to the growing consumption of natural gas. After coal and crude oil, natural gas is the fuel that is used the most globally driven by the refinery and power-generating industries. For instance, by 2050, it is anticipated that natural gas output will increase by more than 25% while consumption will increase by over 30% globally. Particularly, about 14% of all-natural gas consumed in the United States in 2022 came from the residential sector, which supplied over 40% of the country's electricity. This has led to the expansion of direct reduced iron facilities as natural gas is a key feedstock, and an appropriate reducing gas, enriched with a mixture of H2 and CO, which are utilized in the gas-based direct reduced iron process whereby a shaft furnace is used to facilitate the reduction reaction.

A few of the well-known indsutry leaders in the global direct reduced iron market that are profiled by Research Nester are Gallantt Group of Industries, Nucor Corporation, Jindal Shadeed Iron & Steel, Tosyali Algerie, Suez Steel Co., Qatar Steel, JFE Steel Corporation, Tata Steel, JSW Group, ArcelorMittal, SABIC, Welspun Group, and other key market players.

Recent Development in the Direct Reduced Iron Market

- IBM partnered with JFE Steel to offer IBM Watson AL-supported JAVA's mAIster and fault recovery systems originally intended to be used with JFE steel in both domestic and foreign markets, but it has now been expanded to cover other uses as well.

- ArcelorMittal acquired Voestalpine to obtain the HBI facilities and to provide an annual HBI a premium feedstock used to make premium steel that is created by directly reducing iron ore.

Read our insightful Blogs and Data-driven Case Studies:

- Polyvinyl Chloride (PVC) - The Father of Plastics

Read this blog to know the current market value, growth rate and future scope of PVC market. Our guide discusses its features, applications and impact on environment along with recycling initiatives, developments.

- How a Ceramic Matrix Composites Company identified its Supply & Demand triggers and integrated them for Profitable & Sustainable Growth?

Our analysts provided a customized Advanced Ceramics Market Analysis solution that allowed the company ceramic matrix composites company to mitigate supply and demand risks and optimize inventory and manage supplies.

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.