TORONTO, Feb. 06, 2024 (GLOBE NEWSWIRE) -- Home sales were up in January 2024 in comparison to January 2023. This annual increase came as some homebuyers started to benefit from lower borrowing costs associated with fixed rate mortgage products. New listings were also up year-over-year but by a lesser annual rate compared to sales. The resulting tighter market conditions when compared to the same period a year earlier, potentially points toward renewed price growth as we move into the spring market.

“We had a positive start to 2024. The Bank of Canada expects the rate of inflation to recede as we move through the year. This would support lower interest rates which would bolster home buyers' confidence to move back into the market. First-time buyers currently facing high average rents would benefit from lower mortgage rates, making the move to homeownership more affordable,” said TRREB President Jennifer Pearce.

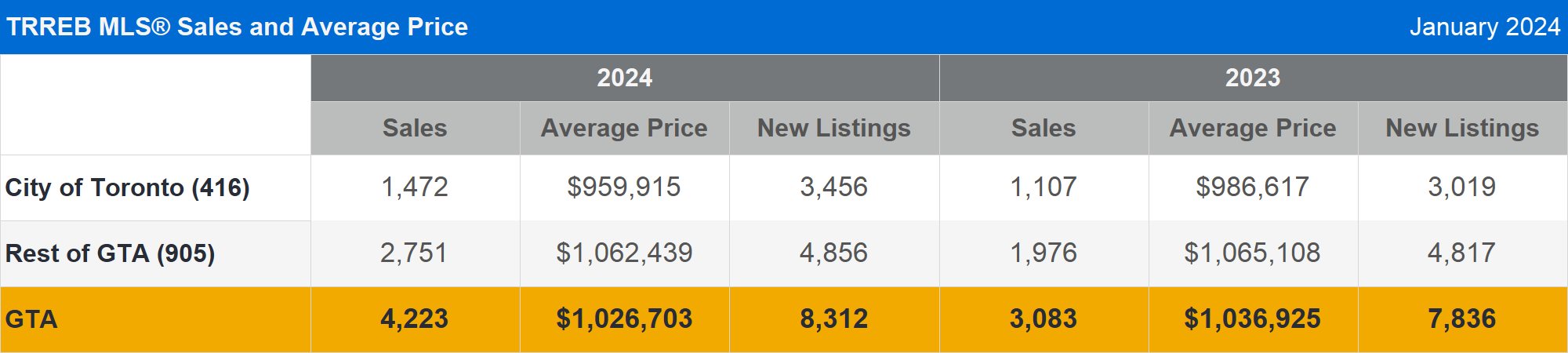

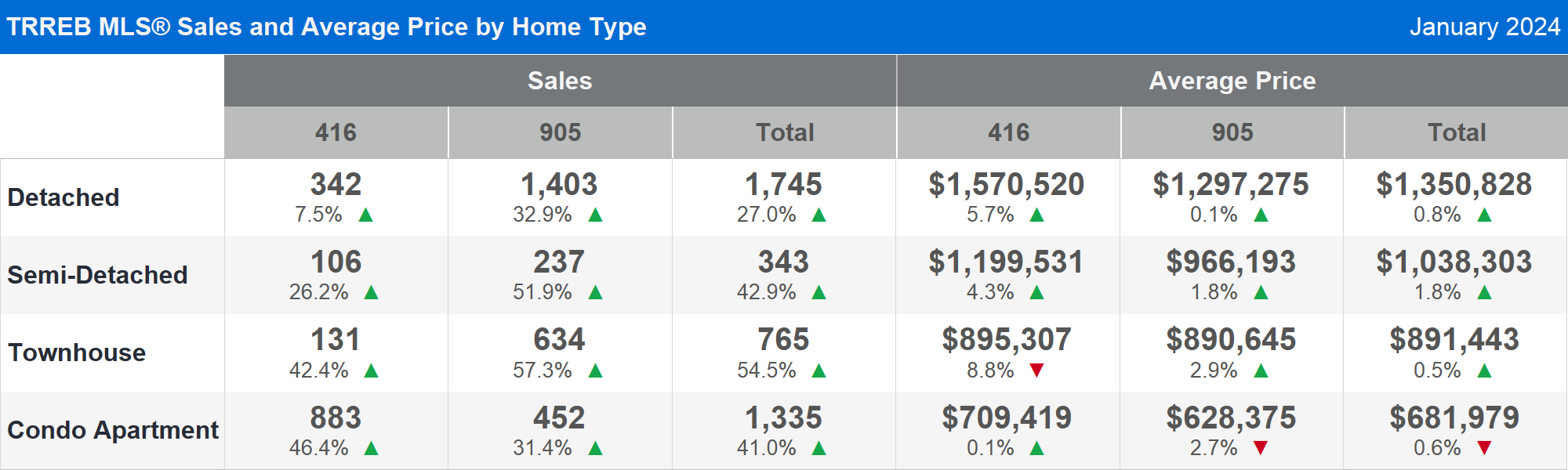

There were 4,223 sales reported through TRREB’s MLS® System in January 2024 – an increase of more than one-third compared to January 2022. The number of new listings was also up year-over-year but by a lesser annual rate of approximately six per cent. Stronger sales growth relative to listings suggests buyers experienced tighter market conditions compared to a year ago.

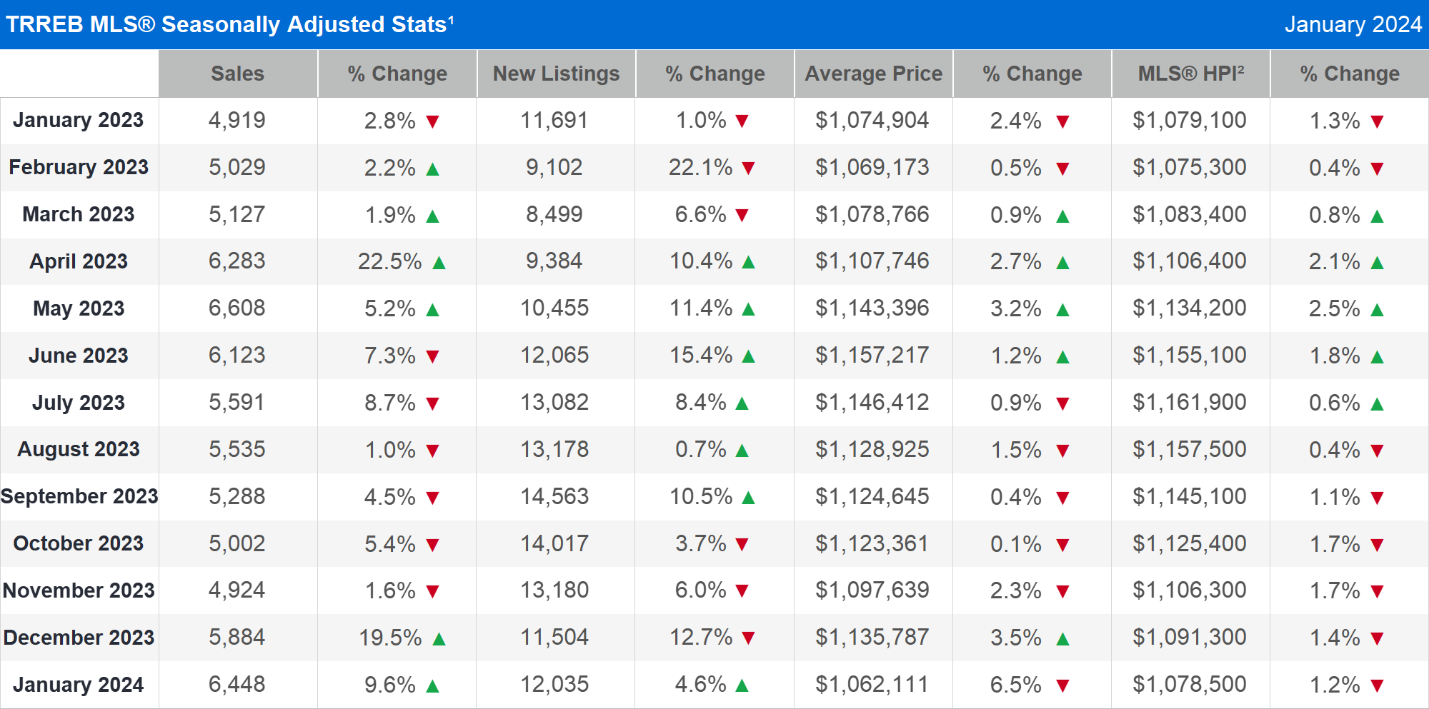

On a month-over-month seasonally adjusted basis, both sales and new listings were up. Sales increased more than listings which means market conditions tightened relative to December 2023.

“Once the Bank of Canada actually starts cutting its policy rate, likely in the second half of 2024, expect home sales to pick up even further. There will be more competition between buyers in 2024 as demand picks up and the supply of listings remains constrained. The end result will be upward pressure on selling prices over the next two years,” said TRREB Chief Market Analyst Jason Mercer.

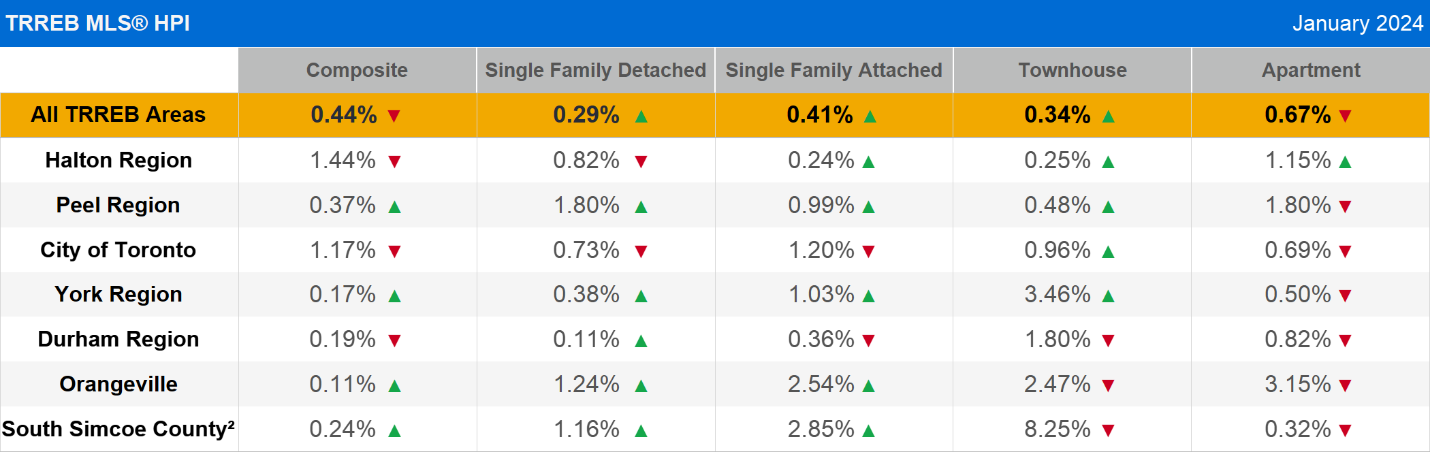

The MLS® Home Price Index Composite in January 2024 was down by less than one per cent year-over-year in January. The average selling price was down by one per cent year-over-year to $1,026,703. On a month-over-month seasonally adjusted basis, both the MLS® HPI Composite and the average selling price also trended lower.

“While housing market conditions are expected to improve with lower borrowing costs, there are still a number of policy issues that need to be addressed. At the federal level, more reflection on the Office of the Superintendent of Financial Institution (OSFI) mortgage stress test is required, especially to its application at different points in the interest rate cycle. The focus for the Province needs to remain on building 1.5 million new homes. At the municipal level, raising property taxes without consistent support from the federal and provincial governments won’t eliminate Toronto’s structural deficit. Helping first-time homebuyers get into the ownership market will ease movement across the entire spectrum and relieve pressure on the rental market,” said TRREB CEO John DiMichele.

On Thursday, February 8, TRREB is releasing its 2024 Market Outlook and Year in Review report and digital digest. This sought-after resource provides industry insights and forecasts what’s in store for the GTA real estate market. Readers will discover new research on the social implications of unaffordability and what’s required to adequately prepare for a rising population.

Media Inquiries:

Maria Karafilidis, Manager, Public Affairs maria.karafilidis@trreb.ca 416-443-8139

The Toronto Regional Real Estate Board is Canada’s largest real estate board with over 73,000 residential and commercial professionals connecting people, property and communities.

X Facebook LinkedIn Instagram YouTube Website Podcast

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/eae17721-7510-42e2-bec2-9c8fb9d8bc85

https://www.globenewswire.com/NewsRoom/AttachmentNg/0af4aaad-5057-4e51-9653-d5e348e3c5d7

https://www.globenewswire.com/NewsRoom/AttachmentNg/ab2cb6e5-79c4-4164-b6b2-50a119485e80

https://www.globenewswire.com/NewsRoom/AttachmentNg/f5876040-3d23-4dc8-bdd0-6e7d69bfd781