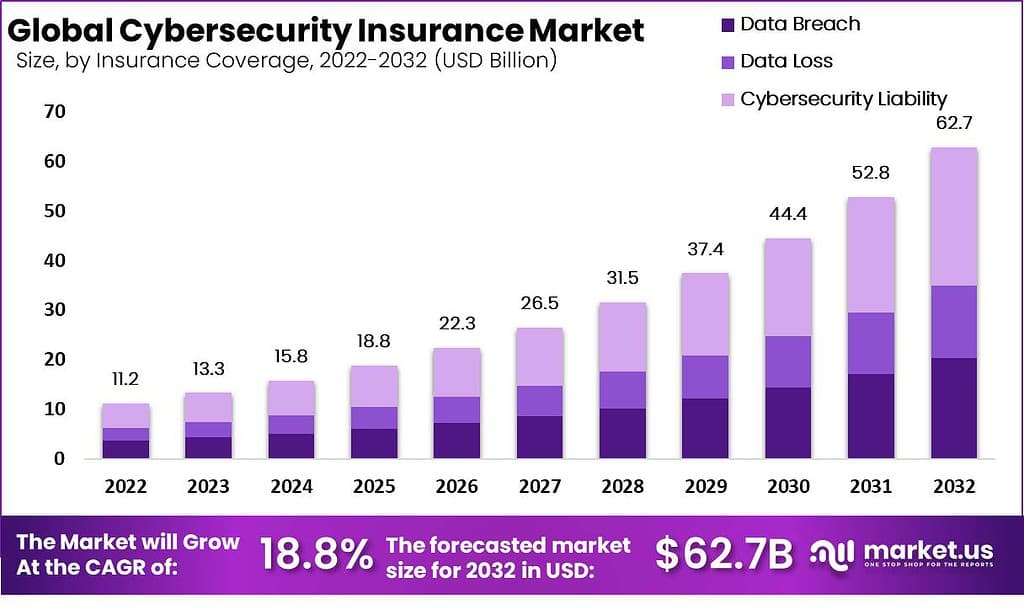

New York, Feb. 07, 2024 (GLOBE NEWSWIRE) -- The projected value of the Cybersecurity Insurance Market is anticipated to be USD 13.3 billion in 2023 and is expected to witness substantial growth, reaching USD 62.7 billion by 2032. The market is poised for a remarkable surge, with a projected Compound Annual Growth Rate (CAGR) of 18.8% during the forecast period from 2023 to 2032.

Cybersecurity insurance is a type of insurance product that helps organizations manage the costs associated with data breaches and cyber attacks. It typically covers expenses like legal liabilities, investigation costs, extortion payments, loss of income due to system downtime, and costs involved with notifying affected parties.

The global cybersecurity insurance market has grown rapidly in recent years, driven by the increasing frequency and severity of cyber attacks. The evolving and complex cyber threat landscape is a major driving factor for the cybersecurity insurance market. With the proliferation of digital technologies and interconnected systems, cyber threats such as data breaches, ransomware attacks, and network intrusions have become more sophisticated and frequent. Organizations are becoming increasingly aware of the potential financial and reputational damages caused by cyber incidents, leading them to seek insurance coverage to mitigate the risks.

Request Sample Report and Drive Impactful Decisions: https://market.us/report/cybersecurity-insurance-market/request-sample/

Governments and regulatory bodies worldwide are introducing stricter data protection and privacy regulations, compelling organizations to enhance their cybersecurity measures. Compliance with these regulations often requires organizations to have adequate cybersecurity insurance coverage as part of their risk management strategy. This regulatory environment is driving the demand for cybersecurity insurance, especially in industries handling sensitive customer data, such as healthcare, finance, and e-commerce.

The growing awareness of cyber risks among businesses and individuals is driving the demand for cybersecurity insurance. High-profile cyber attacks and data breaches have heightened the perception of cyber threats and their potential consequences. Organizations are now more willing to invest in cybersecurity insurance to safeguard their operations, protect their assets, and demonstrate to stakeholders that they have proactive risk management strategies in place.

Important Revelation:

- Market Valuation: The global cybersecurity insurance market is predicted to reach a valuation of USD 62.7 billion by 2032, demonstrating robust growth potential.

- Annual Growth Rate: The market is forecasted to expand at a Compound Annual Growth Rate (CAGR) of 18.8% from 2023 to 2032, indicating a significant upward trajectory.

- Dominant Segment: Cybersecurity liability coverage holds a predominant position within the market, commanding a substantial revenue share of 44.6%. This underscores the critical role of cybersecurity liability insurance in mitigating financial risks associated with cyber incidents.

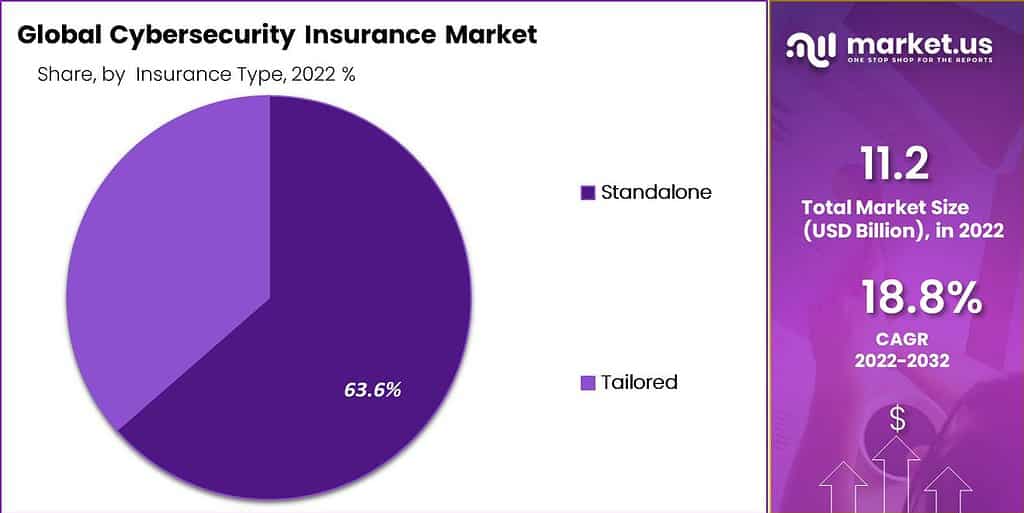

- Insurance Type Preference: Standalone insurance policies dominate the market, capturing the largest revenue share of 63.6%. Businesses increasingly favor specialized coverage that addresses the unique challenges and financial risks posed by cyber threats.

- Sector Dominance: The Banking, Financial Services, and Insurance (BFSI) sector significantly dominate the cybersecurity insurance market, holding a major revenue share of 26.4%. This underscores the critical importance of cybersecurity measures within sensitive sectors due to the valuable data they handle and financial operations they conduct.

- Geographical Influence: North America leads the global cybersecurity insurance market, holding a major revenue share of 39.6%. The region's proactive approach to cybersecurity risk management, robust insurance infrastructure, and stringent regulatory environment contribute to its dominance.

- Opportunities in Emerging Markets: Emerging economies present significant growth opportunities for the cybersecurity insurance market. Rapid digitalization in these regions increases exposure to cyber risks, driving demand for insurance products to mitigate financial losses from cyber incidents.

- Challenges: The lack of historical data for accurate risk assessment poses a significant restraint in the cybersecurity insurance market. Insurers struggle to accurately model risks and estimate potential losses due to the dynamic nature of cyber threats.

- Geopolitical Impact: Cybersecurity insurance indirectly contributes to national security by encouraging organizations to invest in robust cybersecurity measures. It also supports economic stability by providing a mechanism for transferring financial risk associated with cyber incidents.

Build a Future-proof Business! Buy our Premium Insights at Affordable Prices Now: https://market.us/purchase-report/?report_id=73692

Factors Affecting the Growth of the Cybersecurity Insurance Market

- Rising Cyber Threat Landscape: The growing frequency and sophistication of cyber threats pose significant risks to organizations across industries. Cyberattacks, data breaches, ransomware, and other malicious activities can cause financial losses, reputational damage, and legal liabilities. The increasing awareness of these risks drives organizations to seek cybersecurity insurance as a means to transfer and mitigate potential financial losses.

- Stringent Regulatory Environment: Governments and regulatory bodies worldwide are imposing stricter data protection and privacy regulations. Compliance with these regulations often requires organizations to demonstrate adequate cybersecurity measures, including having cybersecurity insurance coverage. The need for regulatory compliance drives the demand for cybersecurity insurance, especially in industries handling sensitive customer data.

- Cost of Cyber Incidents: The financial impact of cyber incidents can be substantial. Organizations face costs related to incident response, investigation, legal expenses, customer notification, public relations, and potential fines or legal settlements. Cybersecurity insurance helps organizations manage these costs by providing coverage for various expenses associated with cyber incidents. The increasing realization of the potential financial burden drives organizations to invest in cybersecurity insurance.

- Evolving Cybersecurity Landscape: The cybersecurity landscape is constantly evolving, with new attack vectors, vulnerabilities, and emerging technologies. Insurers need to stay updated on the latest cybersecurity trends and adapt their policies and coverage accordingly. The dynamic nature of the cybersecurity landscape creates opportunities for insurers to develop innovative coverage options and services that address emerging risks and challenges.

Regional Analysis:

North America solidifies its dominance in the global cybersecurity insurance market by capturing a significant revenue share of 39.6%. This commanding market position underscores the region's leading role in shaping the landscape of cybersecurity insurance worldwide.

Several factors contribute to North America's preeminence in this market. Firstly, the region is home to a large number of technologically advanced businesses across diverse industries, including finance, healthcare, technology, and retail. These industries are prime targets for cyber attacks, driving the demand for comprehensive cybersecurity insurance coverage.

Secondly, North America boasts a mature insurance industry with well-established insurers offering a wide range of cybersecurity insurance products tailored to the needs of businesses. These insurers leverage advanced risk assessment methodologies and underwriting practices to provide comprehensive coverage against a broad spectrum of cyber risks.

Download Exclusive Sample of this Premium Report@ https://market.us/report/cybersecurity-insurance-market/request-sample/

Report Segmentation

Offering Analysis

The market analysis of service offerings reveals a notable dominance in the services segment. Within this segment, various subcategories and specialized services exist, each catering to specific industry needs and compliance requirements. Service offerings encompass a spectrum ranging from industry reports to customized research services and consulting solutions. Understanding the dynamics of this segment provides insights into the market landscape and strategic opportunities for stakeholders.

Insurance Type Analysis

In the realm of cybersecurity insurance, the standalone insurance type segment emerges as the dominant force, capturing the largest revenue share. Standalone cybersecurity insurance policies offer comprehensive coverage tailored specifically to cyber risks, distinct from traditional insurance policies. Unlike add-on or endorsement options, standalone policies provide dedicated coverage for cyber threats, including data breaches, ransomware attacks, and business interruption losses. The robust protection offered by standalone policies resonates with organizations seeking specialized coverage against evolving cyber risks, thus driving the dominance of this segment in the market.

Compliance Requirement Analysis

Among the diverse compliance requirements across industries, healthcare compliance emerges as a leading segment. Compliance in healthcare is imperative due to stringent regulations aimed at safeguarding patient privacy, data security, and ensuring ethical practices within the industry. Healthcare organizations face complex regulatory frameworks, including HIPAA (Health Insurance Portability and Accountability Act) in the United States, which mandate stringent data protection measures. As a result, compliance solutions tailored to the healthcare sector witness significant demand, driving growth in this segment.

Insurance Coverage Analysis

Within the landscape of cybersecurity insurance, the segment related to cybersecurity liability holds a predominant position. In an era marked by escalating cyber threats and data breaches, organizations increasingly prioritize mitigating financial risks associated with cybersecurity incidents. Cybersecurity liability insurance provides coverage against legal liabilities arising from data breaches, network intrusions, and other cyber incidents. With the proliferation of cyber attacks across industries, the demand for cybersecurity liability insurance surges, propelling growth in this segment.

End-User Analysis

Within the cybersecurity insurance sector, the Banking, Financial Services, and Insurance (BFSI) segment stands out prominently, holding a major revenue share. The BFSI sector operates in a highly regulated environment and handles vast amounts of sensitive financial data, making it a prime target for cyber attacks. Financial institutions face multifaceted cyber threats ranging from financial fraud to system disruptions, necessitating robust risk mitigation strategies. Consequently, the BFSI sector exhibits a strong inclination towards cybersecurity insurance to mitigate financial exposures arising from cyber incidents. The sector's significant contribution to the cybersecurity insurance market underscores its pivotal role in driving market growth and shaping industry dynamics.

Buy Now this Premium Report to Grow your Business: https://market.us/purchase-report/?report_id=73692

Top Market Leaders

- BitSight

- AIG

- The Travelers Companies

- Hiscox

- Security Scorecard

- Liberty Mutual

- Axa XL

- The Hartford

- Zurich Insurance Group

- Aon

- Allianz

- Axa

- Berkshire Hathaway

- HSB

- Munich Re

- RedSeal

- CyberArk

- Other Key Players

Recent Developments

Hiscox:

- May 2023: Launched "Hiscox Cyber Resilience Hub," offering educational resources and tools to help businesses manage their cyber risks.

- June 2023: Expanded its cyber insurance offerings to include coverage for ransomware attacks and business interruption.

- November 2023: Partnered with "CyberArk" to offer combined cyber insurance and privileged access management solutions.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 13.3 Billion |

| Forecast Revenue 2033 | USD 62.7 billion |

| CAGR (2024 to 2033) | 18.8% |

| North America Revenue Share | 39.6% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Key Market Segments

By Offering

- Solution

- Services

By Insurance Type

- Standalone

- Tailored

By Compliance Requirement

- Healthcare Compliance

- Financial Services Compliance

- GDPR Compliance

- Data Privacy Compliance

- Other Compliance

By Insurance Coverage

- Data Breach

- Data Loss

- Cybersecurity Liability

By End-User

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

- Government agencies

- Other End-Users

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Explore Extensive Ongoing Coverage on Technology and Media Reports Domain:

- Telecom Cloud Market is estimated to reach USD 127.6 billion by 2032, growing at a impressive CAGR of 18.9%.

- Dental Practice Management Software Market size is projected to surpass at USD 6.88 Billion by 2032; growing at a CAGR of 11.89%.

- Payment gateway market is expected to reach USD 161 billion in 2032. This market is estimated to register the highest CAGR of 20.5%.

- Digital content creation market size is expected to be worth around US$ 181.4 Bn by 2032 from US$ 24.5 Bn in 2023, at a CAGR of 25.7%.

- Point of Sale Software Market size is expected to reach USD 74.7 billion, exhibiting an impressive CAGR of 15.1% between 2022 and 2032.

- 3D Display Market size is expected to be worth around USD 560.5 Billion by 2032, growing at a CAGR of 18.40% during the forecast period

- Commercial Printing Market size is expected to be worth around USD 586.2 Billion by 2032, growing at a CAGR of 2.3%.

- Automotive Sensors Market is set to reach USD 55.0 bn by 2032, It is estimated to record a steady CAGR of 10.1% in the review period.

- Gas Sensors Market size is expected to be worth around USD 5,302 Billion by 2032, growing at a CAGR of 7.80%.

- Interactive KIOSK market size reached at 52.3 billion by 2032; register a growth rate of CAGR of 6.3% during forecast period.

- Educational Robots market size is projected to surpass at USD 5.1 Billion by 2032 and it is growing at a CAGR of 16% from 2022 and 2032.

- eDiscovery market size is projected to surpass at USD 32.5 Billion by 2032 and it is growing at a CAGR of 9.1% from 2023 and 2033.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: