New York, NY, Feb. 07, 2024 (GLOBE NEWSWIRE) -- The latest research report [115+] pages with 360-degree visibility, titled “Artificial Intelligence in Banking Market Share, Size, Trends, Industry Analysis Report, By Component (Service, Solution); By Technology; By Enterprise Size; By Application; By Region; Segment Forecast, 2024 - 2032" published by Polaris Market Research in its research repository.

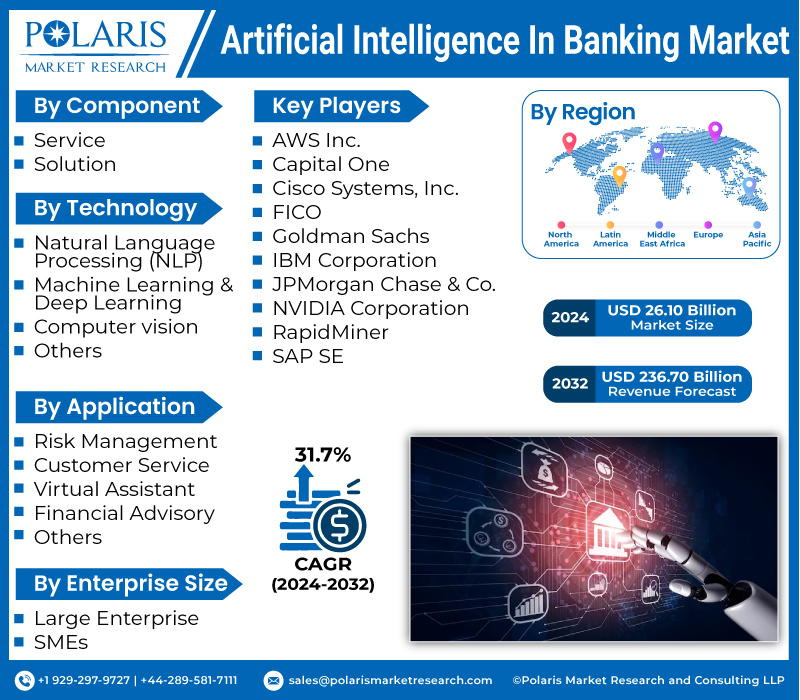

The global artificial intelligence (AI) in banking market size and share is currently valued at USD 19.84 billion in 2023. It is anticipated to generate an estimated revenue of USD 236.70 billion by 2032, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 31.7% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024-2032.

Market Definition

- How is Artificial Intelligence Used in Banking Sector? How Big is Artificial Intelligence (AI) in Banking Market Share?

Artificial Intelligence, generally referred to as AI, stands as a powerful catalyst compelling transformative transformations across different industries. And one of the industries undergoing a profound AI-driven revolution is the domain of banking. Banks can now handle record-level high-speed data and gain insightful information due to artificial intelligence. A wide range of technologies are included in artificial intelligence, such as robotics, natural language processing, machine learning, expert systems, speech, vision, planning, and more.

Moreover, digital payment advisors, Artificial intelligence (AI) bots, and biometric fraud detection systems are some of the features that help provide more customers with higher-quality services. The combined effect of these developments results in higher income, lower expenses, and a notable increase in profits. As a result, the demand for artificial intelligence in banking market is increasing.

Request Free Sample Copy of “Artificial Intelligence (AI) in Banking Market “ Research Report @ https://www.polarismarketresearch.com/industry-analysis/artificial-intelligence-in-banking-market/request-for-sample

(The sample of this report is readily available on request. The report sample contains a brief introduction to the research report, Table of Contents, Graphical introduction of regional analysis, Top players in the market with their revenue analysis, and our research methodology.)

OR

Purchase a Full Report With Complete TOC, Key Player Analysis, and Regional Insights @ https://www.polarismarketresearch.com/buy/3325/2

Market’s Key Companies

- Amazon Web Services, Inc.

- Capital One

- Cisco Systems, Inc.

- FAIR ISAAC CORPORATION (FICO)

- Goldman Sachs

- International Business Machines Corporation

- JPMorgan Chase & Co.

- NVIDIA Corporation

- RapidMiner

- SAP SE

Request for a Discount on this Report Before Purchase @ https://www.polarismarketresearch.com/industry-analysis/artificial-intelligence-in-banking-market/request-for-discount-pricing

Key Highlights

- The development of AI in the banking sector and the evolution of data-gathering technologies among banks and other financial institutions are what are propelling the market's expansion.

- The artificial intelligence in banking market analysis is primarily based on technology, components, application, enterprise size, and region.

- North America dominated the market with the largest share in 2023.

Market Developments

Growth Drivers:

- Increasing Investments in Artificial Intelligence: Banks are investing more in artificial intelligence technology in an effort to improve user experience and transform the FinTech management process. Furthermore, there is a growing need for specialized solutions that are suited to the objectives of the banking business as it grows more competitive and sophisticated. Thus, many financial institutions and FinTech businesses are investing in AI solutions to suit client needs, which is driving the expansion of AI in the banking industry.

- Automated Investment Advisors: To create automated investment advisors and train systems to detect money laundering and other illicit behaviors, big financial institutions are heavily investing in artificial intelligence (AI) technology. Proactive financial monitoring aids in the prevention of illicit practices, which supports the general expansion of artificial intelligence in banking market growth.

Industry Trends:

- Advancements: The integration of artificial intelligence in banking market has been emphasized by continuous developments propelled by swift technology improvements. This includes enhanced processing power, the availability of vast volumes of big data, and developments in machine learning methods. This advancement makes new AI applications possible, upending established banking practices and fostering the creation of creative financial services and solutions.

- Increased Digital Transactions: The rising volume of routine digital transactions, such as online deposits and withdrawals, bill payments, and withdrawals, means that banks must enhance their fraud detection strategies. Due to this, artificial intelligence in banking market demand is increasing. When paired with machine learning, artificial intelligence becomes even more valuable because of its capacity to identify fraud, reduce risks, find weaknesses in banking systems, and safeguard online financial transactions.

Restraints:

- Data Security: Banking experts assert that the primary obstacles to the deployment of AI technologies are privacy and security issues. Due to the widespread usage of AI platforms and solutions that thoroughly analyze client data to extract insightful knowledge for well-informed decision-making and operational efficiency, financial institutions are more susceptible to cyber threats. One of the biggest challenges in deep learning and machine learning algorithms is maintaining data integrity.

Inquire more about this report before purchase @ https://www.polarismarketresearch.com/industry-analysis/artificial-intelligence-in-banking-market/inquire-before-buying

(Inquire a report quote OR available discount offers to the sales team before purchase.)

Segmentation Overview

- Solution Sector Holds the Largest Market Share

Continuous developments in AI technology are leading to more accurate and efficient solutions that are more precisely customized to meet particular banking needs. Additionally, there is a growing trend of investment in AI-based solutions as banks seek to modernize their processes. The goal of this effort is to enhance decision-making skills, optimize workflows, and deliver better customer experiences. The rise of the solution sector in the artificial intelligence in banking market is being driven by the broad application of AI solutions across different banking operations.

Moreover, the service sector witnessed the fastest growth during the forecast period. Banks are realizing more and more how important it is to have expert advice and support when integrating AI technologies into their existing systems.

- Customer Service Sector Witnesses the Fastest Growth

Providing customers with efficient and customized experiences is becoming more and more important to the banking sector. Customized chatbots, virtual assistants, and speech recognition systems are just a few of the AI-powered technologies that provide automated yet highly personalized customer care. This approach successfully takes into account the unique needs of each customer. Rapid inquiry resolution and round-the-clock help are increasingly necessary due to shifting consumer expectations, and AI-powered customer care solutions are well-suited to address these needs effectively.

Artificial Intelligence (AI) in Banking Market: Report Scope & Dynamics

| Report Attribute | Details |

| Revenue Forecast in 2032 | USD 236.70 Billion |

| Market size value in 2024 | USD 26.10 Billion |

| Expected CAGR Growth | 31.7% from 2024 – 2032 |

| Base Year | 2023 |

| Forecast Year | 2024 – 2032 |

| Top Market Players | Amazon Web Services, Inc., Capital One, Cisco Systems, Inc., FAIR ISAAC CORPORATION (FICO), Goldman Sachs, etc, among others |

| Segments Covered | By Component, By Technology, By Enterprise Size, By Application, By Region |

| Customization Options | Customized purchase options are available to meet any research needs. Explore customized purchase options |

Browse Detail Press Release: Artificial Intelligence in Banking Market Size Worth USD 236.70 Billion By 2032 | CAGR: 31.7%

Regional Insights

North America: North America is ideally positioned to see the broad use of artificial intelligence (AI) technology due to its robust technological infrastructure and considerable digitization of banking processes. When it comes to implementing AI solutions, banks have set the standard. They use them to enhance client experiences, offer customized services, and carry out advanced analytics. The early adoption of AI in the North American banking sector has been expedited by the involvement of key AI technology suppliers, which has also sped up its integration and expansion.

Asia Pacific: The fintech sector is growing, digitization initiatives are accelerating, and a significant portion of the population is gaining access to digital financial services, all of which are driving the expansion of artificial intelligence in banking market in Asia-Pacific. The two main rising economies in the region that are incorporating AI into their banking systems at a rapid pace are India and China. This expansion is being driven by strategic investments from well-established financial institutions and the efforts of creative fintech startups.

Browse the Detail Report “Artificial Intelligence in Banking Market Share, Size, Trends, Industry Analysis Report, By Component (Service, Solution); By Technology; By Enterprise Size; By Application; By Region; Segment Forecast, 2024 - 2032” with in-depth TOC: https://www.polarismarketresearch.com/industry-analysis/artificial-intelligence-in-banking-market

For Additional Information OR Media Enquiry, Please Mail At: sales@polarismarketresearch.com

Key Questions Addressed in the Report:

- What is the estimated and current market value during the forecast?

Ans: The artificial intelligence in banking market size is currently valued at USD 19.84 billion in 2023 and is anticipated to generate an estimated revenue of USD 236.70 billion by 2032.

- At what rate is the market expected to grow?

Ans: The market exhibits a robust 31.7% CAGR over the forecasted timeframe, 2024-2032.

- Which segments are covered by the report?

Ans: The artificial intelligence in banking industry segmentation is primarily based on technology, components, application, enterprise size, and region.

- Which region is holding the highest market share?

Ans: North America dominated the artificial intelligence in banking share in 2023.

Polaris Market Research has segmented the artificial intelligence in banking market report based on component, technology, enterprise size, application, and country:

By Component Outlook

- Service

- Solution

By Technology Outlook

- Natural Language Processing (NLP)

- Machine Learning & Deep Learning

- Computer vision

- Others

By Enterprise Size Outlook

- Large Enterprise

- SMEs

By Application Outlook

- Risk Management

- Customer Service

- Virtual Assistant

- Financial Advisory

- Others

By Region Outlook

- North America (U.S., Canada)

- Europe (France, Germany, UK, Italy, Netherlands, Spain, Russia)

- Asia Pacific (Japan, China, India, Malaysia, Indonesia, South Korea)

- Latin America (Brazil, Mexico, Argentina)

- Middle East & Africa (Saudi Arabia, UAE, Israel, South Africa)

Browse More Research Reports:

- Europe Textile Chemicals Market Size, Share 2024 Research Report

- Nitrile Butadiene Rubber Market Size, Share 2024 Research Report

- Esomeprazole Market Size, Share 2024 Research Report

- Antibiotic Resistance Market Size, Share 2024 Research Report

- Liver Metastases Treatment Market Size, Share 2024 Research Report

About Polaris Market Research:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR’s clientele spread across different enterprises. We at Polaris are obliged to serve PMR’s diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR’s customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR’s customers.

Contact:

Likhil G

30 Wall Street

8th Floor,

New York City, NY 10005,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Follow Us: LinkedIn | Twitter

Blog: https://polarismarketresearch.medium.com