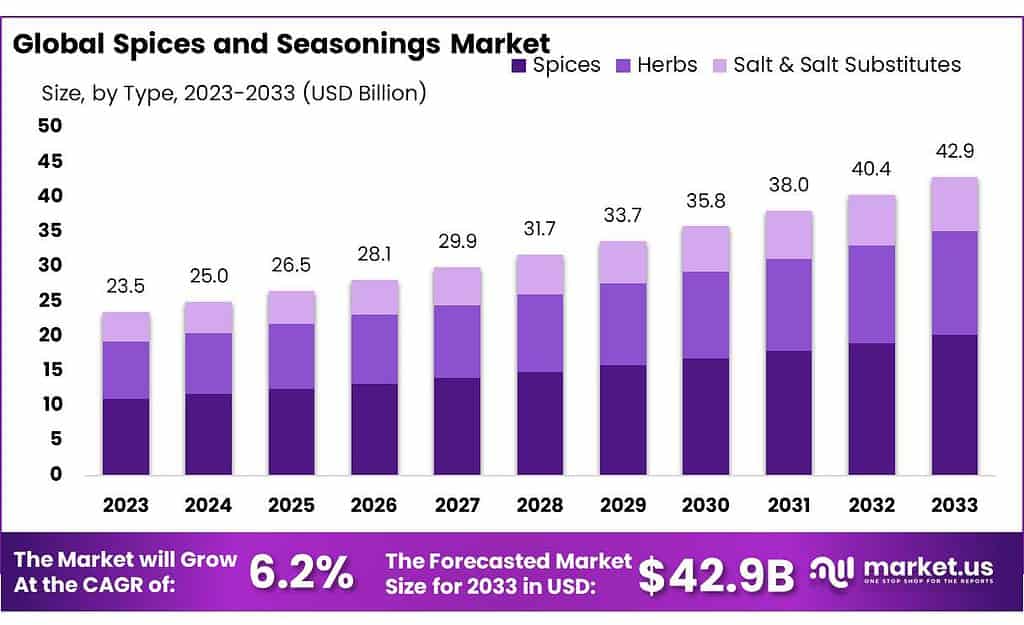

New York, Feb. 08, 2024 (GLOBE NEWSWIRE) -- According to a recent report by Market.us, the Global Spices and Seasonings Market size is expected to be worth around USD 42.9 Billion by 2033 from USD 23.5 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

The spices and seasonings market comprises entities involved in the processing, distribution, and sale of a diverse range of spices and seasonings. These products are essential ingredients used to enhance the flavor, aroma, and color of food. Spices are usually derived from various parts of plants, including seeds, berries, roots, and bark, while seasonings are often blends of spices and other flavor-enhancing ingredients.

This market caters to a wide array of sectors, including but not limited to, the sustenance and beverage industry, culinary establishments, household consumers, and food processing companies. The market encompasses a broad spectrum of products, from individual spices such as turmeric, pepper, and cinnamon to complex seasoning blends designed for specific culinary applications.

Prepare your business for future expansion with a custom report catered to your unique requirements. Request yours now@ https://market.us/report/spices-and-seasonings-market/request-sample/

Important Revelation:

- The Spices and Seasonings market is forecasted to grow from USD 23.5 billion in 2023 to USD 39.1 billion by 2033, with a CAGR of 6.2%.

- This growth is driven by increasing consumer awareness of the health benefits of spices and a surge in home cooking. Demand for ethnic and innovative flavors is rising, with spices like turmeric, cinnamon, and pepper leading in popularity.

- Powdered spices are favored in food services, while whole spices are preferred for their aroma in cooking. The market sees the highest spice usage in meat, poultry, and convenience foods.

- The food service sector is a major revenue contributor, but retail channels are expected to grow more rapidly. The trend towards clean-label, natural products is notable, although challenges such as potential digestive issues from excessive spice consumption exist.

- Technological advances like encapsulation are improving spice usability. The Asia Pacific region leads the market, driven by increasing incomes and local brands, with North America following due to its diverse culinary landscape.

- Key market players include Ajinomoto Co, McCormick & Company, and Kerry Group, focusing on innovation and expansion.

Buy Now this Premium Report to Grow your Business: https://market.us/purchase-report/?report_id=18213

Factors Affecting the Growth of the Spices and Seasonings Market

- Consumer Health Awareness: Increasing awareness about the health benefits and medicinal properties of spices and herbs significantly drives consumer demand. Spices such as turmeric, known for their anti-inflammatory and antioxidant properties, are particularly sought after.

- Culinary Trends and Home Cooking: The rise in home cooking, partly fueled by digital media and cooking platforms, has led to a heightened interest in experimenting with new flavors and cuisines. This trend encourages the exploration of diverse spices and seasonings.

- Ethnic Cuisines and Globalization: The globalization of food culture has brought ethnic cuisines to the forefront, creating a demand for authentic and traditional flavors. This, in turn, stimulates the demand for specific spices and seasonings associated with these cuisines.

- Clean Label and Natural Products: The shift towards clean-label, organic, and natural products influences consumer preferences in the spices and seasonings market. Consumers are increasingly seeking products without additives, leading to a demand for pure and unadulterated spices.

- Innovations in Food Processing and Technology: Advances in food processing and packaging technology, such as encapsulation, help extend the shelf life and enhance the flavor profile of spices, thus making them more appealing to both manufacturers and consumers.

Report Segmentation of the spices and seasonings Market

Product Type Analysis

In 2023, spices dominated the baking ingredients market, securing over 47.5% market share, primarily due to their essential role in enhancing flavors in baked goods. The versatility of spices, allowing for a wide range of flavors, has driven their rapid demand growth globally. Among the most sought-after spices are turmeric, cinnamon, and pepper, with others like cloves, garlic, cardamom, ginger, chili, vanilla, and cumin seeds also gaining popularity.

The herbs segment is anticipated to experience significant growth, ranking second in terms of CAGR during the forecast period. This growth is attributed to the recognized health benefits and the unique taste of herbs such as basil, garlic, oregano, and fennel. Garlic, in particular, is noted for its distinct flavor and medicinal properties, including its effectiveness in treating flu, hypertension, and cardiovascular diseases.

Form Analysis

By 2023, the global market is anticipated to be predominantly led by the powder segment, maintaining its dominance in revenue share. Food service establishments increasingly favor powdered spices to enhance the taste, color, and flavor of prepared foods. Kalsec, a leading global provider of innovative spice and herb flavor extractions, discovered that over half of consumers prefer spicy foods, driving the widespread use of powdered spices and seasonings by food processors, restaurants, hotels, cafes, and other manufacturers.

While the entire seasoning and spice segment is poised for substantial growth, the powder category is expected to exhibit the second-highest Compound Annual Growth Rate (CAGR) during the forecast period. Whole spices continue to be integral in various dishes, elevating the overall flavor and aroma of food. Their versatility is evident in main courses, appetizers, dips, sauces, condiments, and snacks. The popularity of spicy desserts and drinks featuring whole spices such as rosemary, clove, garlic, and parsley further cements their widespread appeal in the food industry.

By Application

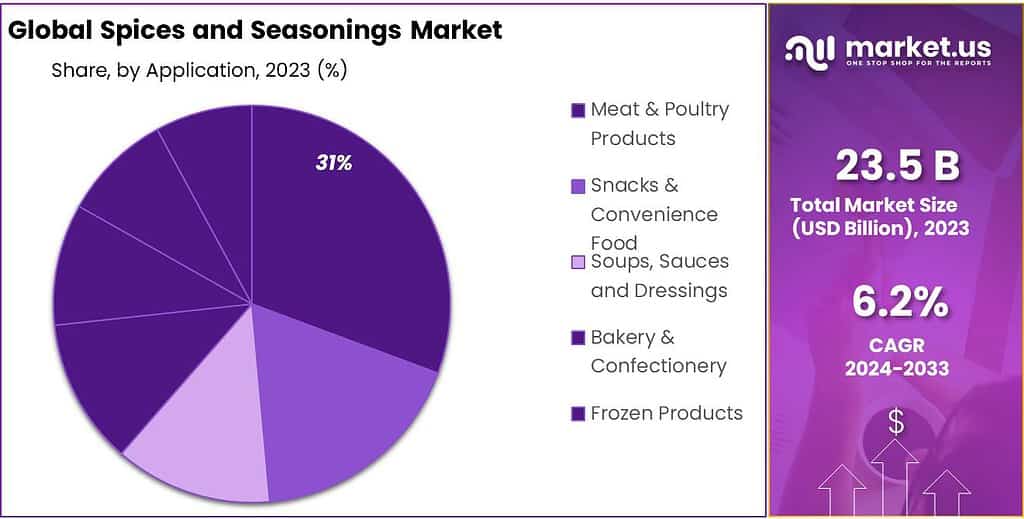

In 2023, Meat & Poultry Products emerged as the frontrunner in the Spices and Seasonings Market, commanding a substantial market share exceeding 31%. These seasonings played a pivotal role in enhancing the flavor of meats and poultry. Following closely, Snacks and Convenience Food secured a significant share of approximately 28%, with spices and seasonings contributing substantially to the taste of these convenient food options.

Soups, Sauces, and Dressings held a notable position, accounting for around 18% of the market, relying on spices for product flavoring. Bakery and Confectionery comprised approximately 15% of the market, incorporating spices and seasonings into a variety of sweet treats and baked goods. The remaining market share was distributed among Frozen Products, Beverages, and Other applications, each representing potential growth areas within the spices and seasonings market.

Distribution Channel Analysis

In 2023, the food service sector played a predominant role in generating a significant portion of global revenue for seasonings and spices. Cafes, restaurants, hotels, and Quick Service Restaurants (QSRs) stood out as key contributors, incorporating diverse seasonings and spices into their dishes, given the increasing trend of dining out among consumers. The pandemic-induced closures of many food service outlets significantly impacted this sector, but as restrictions on crowd size eased, consumers are gradually returning to dining out.

Looking ahead to 2032, retail channels are expected to experience accelerated growth, with several large spice processing and marketing firms globally grinding and packaging seasonings and spices from both domestic and imported sources. These products are then sold at retailers under the companies' brands or private labels, reflecting a dynamic shift in consumer preferences toward retail channels.

Кеу Маrkеt Ѕеgmеnts

By Product Type

- Spices

- Pepper

- Ginger

- Cinnamon

- Others

- Herbs

- Garlic

- Oregano

- Others

- Salt & Salt Substitutes

By Form

- Whole

- Powder

- Crushed

By Application

- Meat and Poultry Products

- Snacks and Convenience Food

- Soups, Sauces and Dressings

- Bakery and Confectionery

- Frozen Products

- Beverages

- Others

By Distribution Channel

- Foodservice

- Retail

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 23.5 Billion |

| Forecast Revenue 2033 | USD 42.9 Billion |

| CAGR (2024 to 2033) | 6.2% |

| North America Revenue Share | 38.9% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Explore essential market insights, including key trends, drivers, and challenges, empowering clients to enhance their strategies and maintain a competitive edge. Access a sample PDF report @ https://market.us/report/spices-and-seasonings-market/request-sample

Market Drivers

The global food market is witnessing a prominent trend towards clean labels, driven by the escalating demand for healthy food products among modern consumers. This surge in interest stems from consumers' desire to understand the origins of ingredients used in their food. Preference is shifting towards natural and clean-label flavors and ingredients, as individuals actively seek nutrition that is perceived as "natural," "fresh," "wholesome," and balanced.

The term "clean label" is widely associated with products that boast natural flavors and colors, aligning with the overarching trend of embracing inherent nutritional qualities. This shift in consumer preferences is prompting food manufacturers to explore and create formulations that cater to the increasing demand for healthier options.

Market restraints

While spices and seasonings enhance the flavor of various dishes, their excessive consumption can have adverse health effects. Overindulging in spicy foods rich in capsaicin may result in heartburn or acid reflux, causing discomfort due to stomach acid moving into the esophagus.

This can slow down digestion and elevate the risk of heartburn. Moreover, an excess of spicy foods may irritate the stomach and intestines, potentially leading to a laxative effect or acute gastritis, characterized by symptoms like nausea, vomiting, and upper abdominal fullness. Therefore, moderation in spice consumption is advised to avoid these digestive issues.

Opportunities

In recent years, the utilization of encapsulation technology for food products and ingredients has experienced a notable upswing. This advancement has gained widespread traction in the food and beverage industry, particularly in the flavor and fragrance sector, where major manufacturers are introducing encapsulated versions of spices.

One example is TasteTech, a UK-based company that has developed an innovative encapsulation method for processing paprika and turmeric spices. Their controlled-release technique involves extracting oleoresins and essential oils from spices and enveloping them within an invisible microfilm of hardened vegetable oil. The result is a user-friendly, free-flowing powder that enhances both flavor and color compared to untreated spices.

Challenges

Spices and seasoning ingredients, being perishable, are prone to microbial contamination, particularly from fungal and bacterial sources. Preserving their quality, encompassing flavor, taste, and aroma, necessitates proper storage and maintenance. Unfortunately, the insufficient availability of storage facilities exacerbates the challenge of microbial contamination, hindering market growth. India, the largest global spice producer, grapples with this issue due to a shortage of adequate storage, contributing to a decline in spice quality.

Regional Analysis

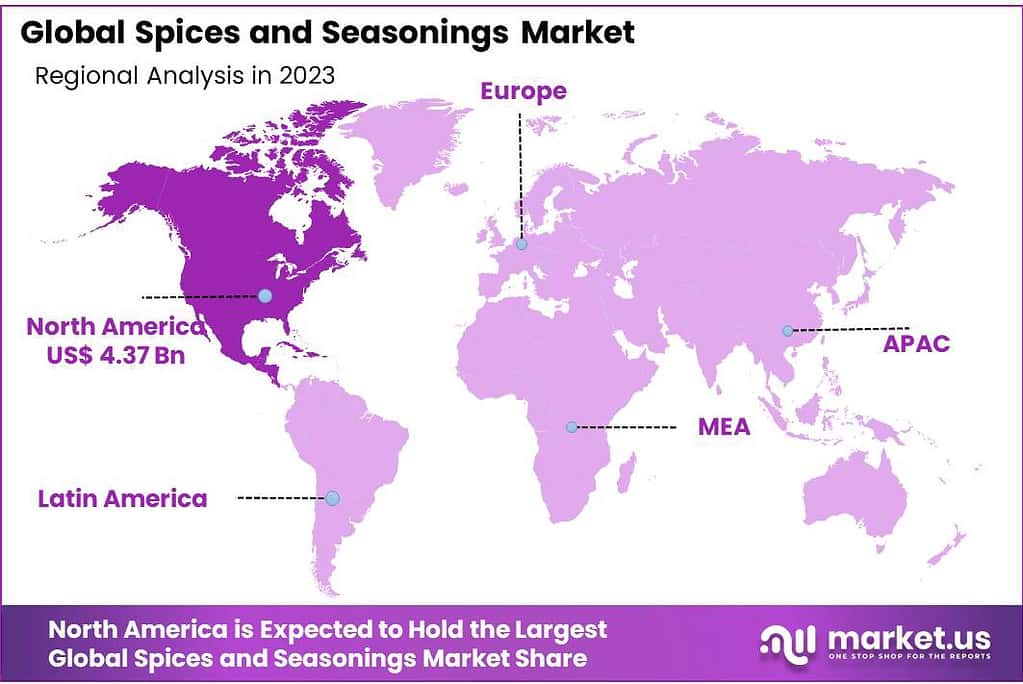

In 2023, the North america emerged as the leading market for Spices and Seasonings, contributing 38.9% to the total market share. The region's growing seasoning consumption is linked to factors such as rising disposable income, the development of domestic spice and herb brands, and increased marketing efforts. Asia Pacific countries like India, Vietnam, and China, being major producers, contribute to the region's status as one of the world's largest exporters of spices and herbs.

Globalization and migration have further influenced food preferences, allowing food service outlets to offer diverse seasonings. Looking ahead to 2032, North America closely follows the Asia Pacific, driven by consumer openness to new flavors and high demand from Asian immigrants in the United States interested in exploring ethnic tastes. The North American Seasonings and Spices market experiences significant growth due to the popularity of Indian, Asian, Western, and ethnic cuisines, along with a surge in the consumption of cooked food.

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Seasonings and Spices market is dominated by major players such as Ajinomoto Co, Inc., Ariake Japan Co., Ltd., SHS Group, Kerry Group plc, EVEREST Food Products Pvt. Ltd., Baria Pepper Co. Ltd., Associated British Foods plc, Kikkoman Corporation, Moguntia Food Group AG, Ariake Japan Company, and McCormick & Company Inc.

These key players collectively hold the majority of the market share. In this competitive landscape, manufacturers are actively employing diverse strategies, including product launches, expanding their product portfolios, and engaging in mergers and acquisitions to maintain and enhance their market presence.

Маrkеt Кеу Рlауеrѕ

- Ajinomoto Co, Inc.

- ARIAKE JAPAN CO, LTD.

- Associated British Foods plc

- Baria Pepper Co. Ltd.

- Döhler GmbH

- DS Group

- EVEREST Food Products Pvt. Ltd.

- The Kraft Heinz Company

- Kerry Group plc

- McCormick & Company

- Olam International

- Sensient Technologies Corporation

- SHS Group

- Spice Hunter (Sauer Brands Inc.)

- Unilever plc

- Worlée-Chemie GmbH

Explore More Food And Beverages Market Research Reports

- Halal Meat Market was valued at USD 265.9 Billion and is expected to reach USD 723.7 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 9.7%.

- Rye Market was valued at USD 1.6 billion and is expected to reach USD 2.0 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 2.2%.

- Cookies Market size was valued at USD 37.8 billion. Between 2023 and 2032, this market is estimated to register the highest CAGR of 5.2%. It is expected to reach USD 62.2 billion in the forecast period of 2023-2032.

- Edible Insects Market is anticipated to be USD 15.3 billion by 2032. It is estimated to record a steady CAGR of 18.1% in the Forecast period 2022 to 2032. It is likely to total USD 3.4 billion in 2023.

- Pet Food Ingredients market size is expected to be worth around USD 96.1 billion by 2033, from USD 60.15 billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

- Protein Ingredients market size is expected to be worth around USD 134.0 billion by 2033, from USD 74.1 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

- Breakfast Cereals market size is expected to be worth around USD 132.7 billion by 2033, from USD 78.6 billion in 2023, growing at a CAGR of 6.0% during the forecast period from 2023 to 2033.

- Gluten-Free Products market size is expected to be worth around USD 18.8 billion by 2033, from USD 8.1 billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2023 to 2033.

- Castor Oil Market was valued at USD 1.4 Billion and is expected to reach USD 2.4 Billion in 2032 from 2023 to 2032, this market is estimated to register a CAGR of 5.8%.

- Potato Starch Market was valued at USD 4.7 billion, and is expected to reach USD 7.5 Billion in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 4.9%.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn

Our Blog: