Dublin, Feb. 08, 2024 (GLOBE NEWSWIRE) -- The "Personal Loan Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028" report has been added to ResearchAndMarkets.com's offering.

The world's financial landscape is witnessing a marked upswing in the personal loan market, with expectations of significant growth on the horizon. Recent analysis suggests that the inclining global economy has had a favorable impact on this sector, driven by a robust rise in both demand and diverse application for personal loans. Industry growth is further accelerated by the increasing prevalence of loans for purposes such as debt consolidation, home improvements, and relocation among modern consumers.

Personal loans, characterized by their unsecured nature and fixed repayment terms, are breaking ground as one of the fastest-growing consumer debt products. As of the third quarter of 2022, the outstanding balance on personal loans stood at an impressive $209.6 billion, reflecting a resurgence in positive growth rates following the impacts of the COVID-19 pandemic.

Digital Transformation Empowers Asia Pacific Market Expansion

Within the Asia Pacific region, the personal loan market is experiencing a dynamic expansion, with predictions indicating that Asian consumers could account for around half of the global consumption growth in the coming decades. This signifies a monumental USD 10 trillion opportunity for lenders. Countries such as India, China, Malaysia, and South Korea emerge as key players, driving forward the demand for personal loans with their burgeoning populations and heightened purchasing power.

The pandemic-induced economic uncertainty initially led lenders to heighten loan requirements, but later, a trend reversal saw an easing of these constraints. As a relaxation of lending standards commenced to attract new borrowers, a substantial increase in loan originations from subprime borrowers marked the market's adaptability. However, 2022's climb in inflation rates brings attention to the growing delinquencies among consumers with fragile credit, highlighting the need for vigilant credit management.

Fintech Revolution and Consumer Credit Accessibility

The transformational role of financial technology — commonly known as FinTech — is undeniable in the field of lending. Leveraging vast troves of financial data, FinTech lenders employ sophisticated credit scoring metrics to refine their underwriting processes, democratizing credit access and reducing loan origination costs. Through the ease of digital platforms, the customer experience in accessing personal loans has vastly improved, underpinning the market's vigorous expansion.

Nonetheless, the market's trajectory is not without its challenges. The recovery of loans remains a concern, and the application of excessive fees and penalties by certain loan providers casts a shadow on the industry's reputation. Borrowers' wariness towards hidden costs in loan arrangements calls for enhanced transparency from lenders to sustain market growth.

Key Market Segmentation

- Purpose: The market spans various loan purposes, including debt consolidation, home improvement, and relocation, among others.

- End User: Catering to a wide range of borrowers, from employed individuals and professionals to students and entrepreneurs.

- Tenure: Personal loan agreements vary from less than two years to over four years.

- Geographic Reach: The market extends across diverse regions, including North America, Europe, and the pivotal Asia-Pacific market.

This comprehensive market analysis delves into these segments to paint a holistic picture of the global personal loan landscape. The study also includes competitive insights, providing profiles of key market players who are shaping this financial niche.

The global personal loan market continues to grow and evolve as economic conditions, technological advancements, and consumer behaviors converge to shape this essential aspect of the financial services industry.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 188 |

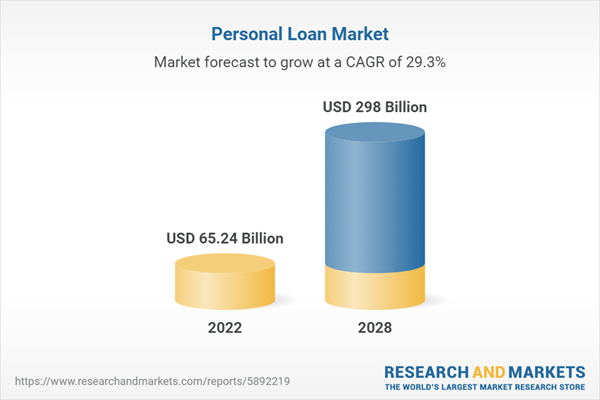

| Forecast Period | 2022-2028 |

| Estimated Market Value (USD) in 2022 | $65.24 Billion |

| Forecasted Market Value (USD) by 2028 | $298 Billion |

| Compound Annual Growth Rate | 29.2% |

| Regions Covered | Global |

A selection of companies mentioned in this report includes:

- Avant, LLC

- Goldman Sachs (Marcus)

- Wells Fargo & Co.

- Barclays PLC

- DBS Bank Ltd.

- American Express Company

- Citigroup, Inc.

- Truist Financial Corporation

- Social Finance, Inc.

- LendingClub Bank

For more information about this report visit https://www.researchandmarkets.com/r/7qrlq8

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment