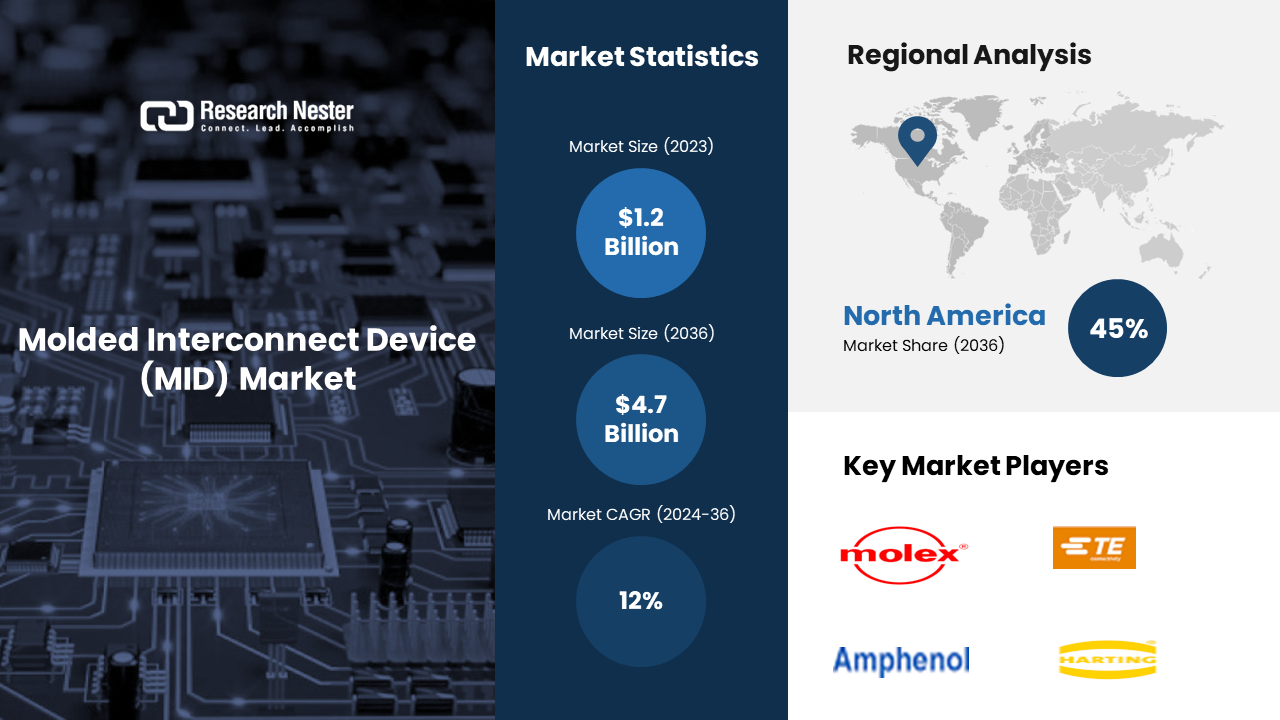

New York, Feb. 13, 2024 (GLOBE NEWSWIRE) -- The global molded interconnect device (MID) market size is expected to expand at ~12% CAGR from 2024 to 2036. The market is anticipated to garner a revenue of USD 4.7 billion by the end of 2036, up from a revenue of ~USD 1.2 billion in the year 2023.As the Internet of Things (IoT) continues to grow, there is an increasing demand for devices that are interconnected and have smaller footprints. This is where Molded Interconnect Device (MIDs) come in. MIDs allow electronic components to be integrated directly into 3D shapes, which enables the creation of smart devices that are more compact and interconnected. With MIDs, designers can create complex geometries, optimize space, and improve functionality. Continuous advancements in manufacturing technologies, such as laser direct structuring (LDS) and 3D printing, have enhanced the production efficiency and flexibility of MID.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-5506

These techniques enable rapid prototyping and customization, catering to diverse industry needs. The demand for smaller, sleeker, and more functional consumer electric devices (smartphones, wearables, etc.) drives the need for MIDs. These devices require intricate circuitry and functional design integration, which MIDs facilitate efficiently. In total, the consumer electronics sector brought in around USD 987 billion in revenue in 2022. This propelled opportunities for the mold interconnect device market.

Increasing Advancements in Automotive Industry across the Globe to Boost Market Growth

The automotive sector heavily relies on MIDs for various applications such as automotive sensors, lighting, and control systems. As per estimates, it is anticipated that the global automotive sensor industry will surpass USD 55 billion by 2025. With the rise of electric vehicles (EVs), autonomous driving technology, and the need for more compact and lightweight components, MIDs are becoming increasingly indispensable in this sector. As electronic devices continue to shrink in size while increasing in functionality, there’s a growing demand for compact, MIDs that enable the integration of multiple functionalities into smaller spaces, aligning with the miniaturization trend. The healthcare industry leverages MIDs for various applications, including wearable medical devices, monitoring systems, and implantable devices. The need for smaller, more reliable, and customized solutions in the medical field fuels the growth of MID. For instance, Pacemaker makers, including Boston Scientific and Medtronic, were among the first in the medical field to adopt C-MOS technology to integrate digital and analog signals into a single-chip device. This enhanced the device's analysis and control capabilities while decreasing its size and weight. Soon, chip design methods akin to those employed in the creation of compact, lightweight, and potent consumer and military goods were applied to the design of digital medical devices, ranging from defibrillators to stethoscopes.

Molded Interconnect Device (MID) Market: Regional Overview

The market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa region.

Strong presence in key sectors to Drive the Market Growth in North America Region

The molded interconnect device (MID) market in North America region is estimated to garner the largest revenue by the end of 2036. With a strong presence in key sectors like automotive, healthcare, aerospace, and consumer electronics, the region showcases a robust demand for sophisticated, miniaturized, and integrated electronic solutions. The automotive industry, in particular, embraces MID technology for advanced functionalities in sensors, control systems, and compact electronic components, driving innovation within the sector, Additionally, North America’s emphasis on technological prowess and R&D investments fosters the development of cutting-edge materials and manufacturing techniques crucial for MID production. Collaborations between leading tech firms, research institutions, and manufacturers fuel the region’s MID market growth, contributing to the creation of versatile and high-performance solutions. The market’s focus on quality, compliance with stringent regulations, and a penchant for eco-friendly manufacturing processes further solidifies North America’s position as a pivotal hub for MID innovation and market expansion. The automotive industry in North America has been a major driver for MID adoption, leveraging these devices for innovative solutions in vehicle electronics.

Supporting Stat: According to a report by the Society of Automotive Engineers (SAE), the use of MIDs in automotive applications has shown a steady increase, with a notable surge of 15% in adoption across North American automotive manufacturers from 2019 to 2021.

Make an Inquiry Before Buying this Report @ https://www.researchnester.com/inquiries-before-buying-5506

Consumer Electronics Boom to Propel the Growth in the Asia Pacific Region

The Asia Pacific molded interconnect device (MID) market is estimated to garner the highest CAGR by the end of 2036. The rapid expansion of the consumer electronics industry in the Asia Pacific region has been a significant driver for MID adoption, fueled by the demand for smaller and more efficient electronic devices. A study highlighted a 25% increase in the adoption of MIDs by major consumer electronics manufacturers in Asia Pacific between 2019 and 2021. With the Asia Pacific region being a manufacturing hub for consumer electronics, MIDs offer a solution to the demand for miniaturization. The ability to integrate complex circuits into three-dimensional structures has allowed manufacturers to produce sleek and feature-rich devices, meeting the preferences of tech-savvy consumers. The automotive sector’s evolution towards electric and autonomous vehicles, coupled with the surge in demand for IoT devices and wearables, propels the MID market’s expansion. Further, Collaborations between global players and local manufacturers, combined with a focus on sustainability and regulatory compliance, bolster the Asia Pacific molded Interconnect Device market’s growth trajectory, shaping it into a pivotal region for MID innovation and adoption.

Molded Interconnect Device (MID), Segmentation by Product Type

- Antennae & Connectivity Modules

- Sensors

- Connectors & Switches

- Lighting Systems

Amongst these segments, the sensors segment is anticipated to hold the largest share over the forecast period. Sensors play a crucial role in various industries, including industrial and automotive. The use of temperature sensors, pressure sensors, and other types of sensors is extensive in industrial applications. In totality, the sensor segment garnered USD 22.4 billion in the year 2022. In the automotive sector, sensors are used in adaptive cruise control systems and climate control-related applications. Moreover, the increasing use of Molded Interconnect Device (MIDs) in these applications is driving up the demand for MID sensors during the forecast period. The integration of sensors in these sectors is improving performance, efficiency, and safety. All these factors are cumulatively provided for the market’s growth.

Molded Interconnect Device (MID), Segmentation by Application

- Telecommunications & Computing.

- Consumer Electronics

- Automotive

- Medical

- Industrial

- Military & Aerospace

Amongst these segments, the telecommunication and computing segment is anticipated to hold a significant share over the forecast period. The strong need for sophisticated electronic circuits that enable the development of 5G devices with low signal loss is attributed to the segment's growth. Electronic businesses, such as Cicor Group, have been working to create MID gear that uses liquid crystal polymers in order to facilitate the high-frequency transmission of 5G signals. 5G had 1.1 billion subscriptions worldwide as of June 2024; 125 million more had been added in just the first quarter. Thirty-five service providers have introduced 5G Standalone (SA) networks, while about 240 service providers have built 5G networks. There are more than 700 5G smartphone models available to consumers as of early 2024, this has a prospective effect on the segment’s growth. The demand for faster and more reliable connections to support emerging technologies like IoT, augmented reality (AR), and autonomous vehicles is propelling the deployment of 5G networks globally. Telecommunication companies are investing in infrastructure upgrades to meet the growing data demands.

Few of the well-known industry leaders in molded interconnect device (MID) market that are profiled by Research Nester are Molex, TE Connectivity, Amphenol Corporation, LPKF Laser & Electronics, Taoglas®, HARTING Technology Group, Arlington Plating Company, M.I.D Solutions Pty Ltd, 2E mechatronic GmbH & Co. KG, DuPont, and other key market players.

Recent Development in the Molded Interconnect Device (MID) Market

- In partnership with SOTECH Health, Philips-Medisize, a Molex company, has created a breath sensor system that can identify COVID-19 in under 30 seconds. With its experience in end-to-end production, quick prototyping, and human-centric product design, Philips-Medisize will be of assistance.

- Expanding its SURLOK Plus Series to accommodate energy storage and high-power connection and transfer needs, Amphenol Corporation now offers 8.3 mm and 10.3 mm right-angle connectors with a 1500 voltage range.

Read our insightful Blogs and Data-driven Case Studies:

- The Future of Growing Semiconductor Technologies

Get insight of the developments and trends in the semiconductor technologies by this post. Read our guide to know the advancements from nanotechnology to quantum computing that have significant impact on the industry.

https://www.researchnester.com/blog/technology/semiconductors/growing-semiconductor-technologies

- Semiconductor Chip Manufacturer upgraded itself with the Latest Innovations

This case study uncovers how a semiconductor chip manufacturer increased its market share by help of our experts. Our analysts provided them with trend analysis strategy to help the company get latest trend insights.

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.