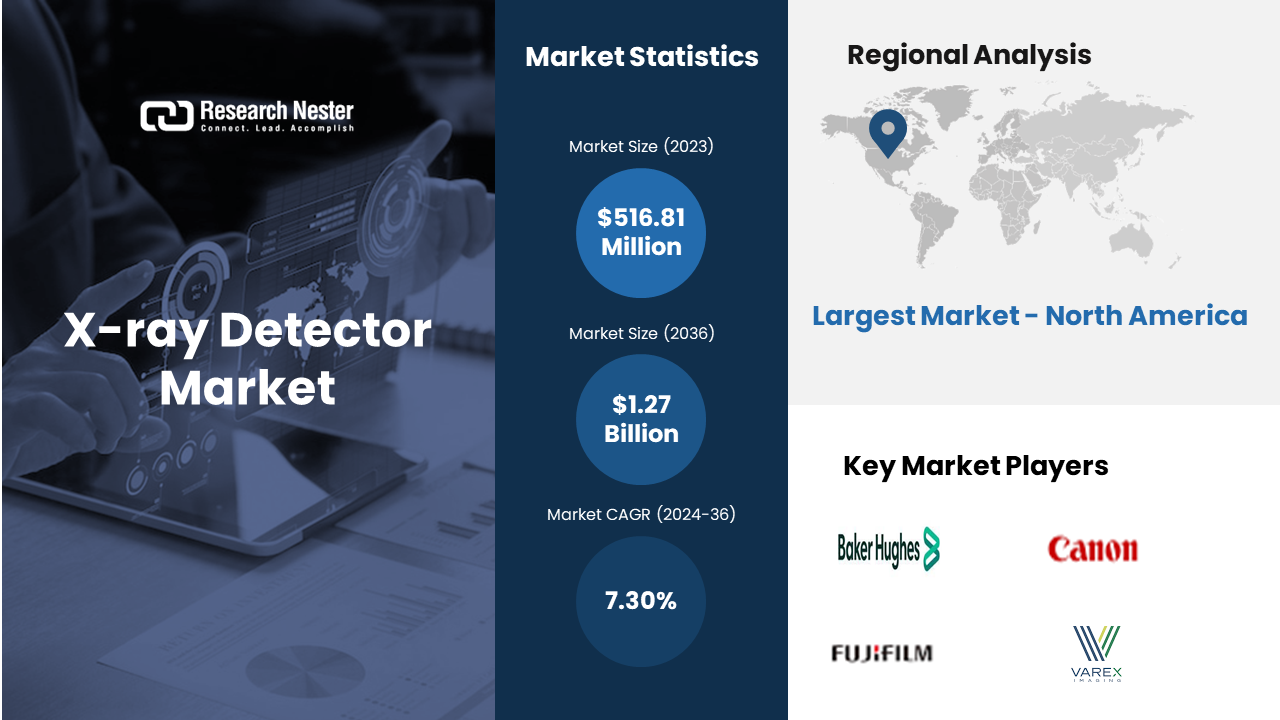

New York, Feb. 13, 2024 (GLOBE NEWSWIRE) -- The global x-ray detector market size is projected to grow at a CAGR of over ~7.30% from 2024 to 2036. The market is expected to garner a revenue of USD 1.27 billion by the end of 2036, up from a revenue of ~USD 516.81 million in the year 2023.The market's expansion is thought to be due to X-ray detectors due to ongoing technological advancements and rising demand for improved imaging in the anticipated timeframes. An estimated 3.6 billion diagnostic medical exams, including X-rays, are carried out annually throughout the world. The figure is still rising as more people seek out medical attention. Of these, 350 million are carried out on minors younger than 15 years old. In addition to these, due to its large-area, flat-panel detectors made of a thin-film transistor array, the most recent generation of X-ray detectors can offer quick access to digital images.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-5453

Radiologists should have easier access to a wealth of information regarding a wide variety of large-area and flat-panel electronic detectors due to the rapid technological advancements in digital radiography. This discovery has forced the creation of extremely sensitive X-ray detectors that will reduce radiation exposure for numerous key stakeholders. X-ray photon energy is a crucial component of X-ray detectors since the various components of the system primarily depend on it for their X-ray absorption coefficients.

Increasing Demand within the Automotive Sector across the Globe to Boost Market Growth

The automotive sector uses this technology to meet the growing demand for quality assurance and product traceability, which lowers liability and improves product quality. An X-ray scan can often eliminate the need for inspection stations since it can provide a last quality check after packaging instead of at key points during the production process. The best way to inspect automotive castings for faults like cracks and welding issues is with an X-ray detector. However, a wide range of applications, such as suspension parts, braking systems, suspension parts, coolant hoses, engine mounts, intercoolers, coatings, heat exchangers, and features within catalytic converters, exhaust systems, fuel injection systems, suspension assemblies, complex assemblies, and micro-electromechanical systems, are also served by 2D and 3D X-ray inspection in the automotive industry. In 2021, there was a 3% year-over-year growth in the production of motor cars, with around 80 million vehicles produced worldwide. X-ray inspection of electronic components is now standard practice for all companies in the electronics industry. The most widely used applications are process verification, quality assurance, and failure analysis. Because X-ray examination is so versatile, the user can complete all of these activities with just one equipment. Destructive testing is very beneficial for many applications, but it takes time, effort, and expensive equipment.

X-ray Detector Market: Regional Overview

The market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa region.

Technological Advancements in Healthcare Imaging to Drive the Market Growth in North America Region

The x-ray detector market in North America region is estimated to garner the largest revenue by the end of 2036. Continuous advancements in X-ray detector technologies, such as the widespread adoption of amorphous selenium and direct conversion detectors, have significantly enhanced image quality, diagnostic accuracy, and overall patient care. The integration of these advanced detectors has streamlined radiography processes, reduced examination times and enabling healthcare providers to make more informed decisions promptly. According to a study by the National Center for Biotechnology Information (NCBI), the adoption of digital X-ray detectors in North American healthcare facilities increased by 50% between 2017 and 2020. The growing incidence of chronic diseases necessitates frequent diagnostic imaging, driving the demand for X-ray detectors in healthcare settings. These detectors facilitate early and accurate disease detection, aiding in timely intervention and treatment. As the burden of chronic conditions continues to rise, the healthcare industry in North America relies on advanced X-ray detectors to meet the escalating demand for diagnostic imaging services.

Make an Inquiry Before Buying this Report @ https://www.researchnester.com/inquiries-before-buying-5453

Advancements in Healthcare Infrastructure to Propel the Growth in the Europe Region

The Europe x-ray detector market is estimated to garner the highest CAGR by the end of 2036. The substantial rise in healthcare spending reflects a commitment to upgrading medical infrastructure, including the adoption of advanced diagnostic technologies like digital X-ray detectors. European healthcare providers are increasingly investing in state-of-the-art X-ray systems to enhance diagnostic capabilities, reduce examination times, and improve patient outcomes. This strategic investment in healthcare infrastructure acts as a significant catalyst for the growth of the X-ray detector market. The European Union (EU) has witnessed a 30% increase in public healthcare spending between 2010 and 2020. Stringent regulations regarding radiation exposure in medical imaging drive the adoption of digital X-ray detectors with lower radiation doses. European healthcare facilities prioritize patient safety, and the continual adherence to evolving regulatory standards propels the demand for advanced X-ray detectors. These detectors not only contribute to enhanced diagnostic accuracy but also align with the region's commitment to minimizing radiation risks in medical imaging.

X-ray Detector, Segmentation by Type

- Flat Panel Detectors

- Compound Radiography Detectors

- Line Scan Detectors

- Charge-Coupled Device Detectors

Amongst these segments, the flat panel detectors segment in x-ray detector market is anticipated to hold the largest share over the forecast period. he use of flat panel detectors for non-destructive testing (NDT) applications has increased significantly in the industrial sector. They usually have benefits like improved sensitivity to identify material faults, real-time data collecting, and high-resolution imaging. Flat panel detectors are widely used in quality control applications such as manufacturing, aerospace, and automotive to guarantee the integrity of components and materials. During the fiscal year 2022, the manufacturing industry's yearly production growth rate was 11.4%. Flat panel detectors are predicted to continue growing in popularity in the industrial sectors as long as technology progresses and more people become aware of their advantages.

X-ray Detector, Segmentation by End-Use Application

- Aerospace & Defense

- Automotive

- Electronics & Semiconductors

- Heavy Industrial & Manufacturing

- Oil & Gas

- Construction

- Others

Amongst these segments, the oil & gas segment in x-ray detector market is anticipated to hold a significant share over the forecast period. Sustained investments in both upstream exploration and downstream infrastructure, including refineries and distribution networks, are critical for the oil and gas sector's growth. These investments ensure the industry's capacity to meet rising demand, enhance operational efficiency, and adapt to evolving market dynamics. The World Energy Investment report by the IEA notes a 5% increase in global oil and gas investments in 2021 compared to the previous year. Beyond energy, the oil and gas industry play a crucial role in supplying feedstock for the production of petrochemicals. As global demand for petrochemical products, including plastics, fertilizers, and chemicals, continues to rise, the oil and gas sector stands to benefit from sustained growth in this downstream segment. As the global population grows and economies develop, there is an escalating need for energy. Oil and gas remain integral components of the energy mix, supplying a significant portion of the world's power. The projected increase in energy demand underscores the enduring relevance and growth potential of the oil and gas sector.

Few of the well-known industry leaders in x-ray detector market that are profiled by Research Nester are Canon Inc., FUJIFILM Holdings Corporation, Hamamatsu Photonics K.K., iRay Technology, Varex Imaging, Vieworks Co., Ltd., CareRay Digital Medical Technology, DRTECH, Teledyne DALSA, Thales Group, and other key market players.

Recent Development in the X-ray Detector Market

- FUJIFILM Cellular Dynamics, Inc. announced a non-exclusive license agreement with global healthcare company Novo Nordisk A/S to use FUJIFILM Cellular Dynamics' iPSC platform for the development and commercialization of iPSC-derived cell therapies with a focus on serious chronic diseases. Novo Nordisk will have a non-exclusive license to use the iPSC cell lines for research and development, as well as to use GMP-grade cell lines for clinical and commercial manufacture and commercialization of iPSC-derived cell therapies, under the terms of the agreement.

- Thales engaged in an exclusive negotiation to acquire Cobham Aerospace Communications, a leading supplier of advanced, ultra-reliable novel safety cockpit communication systems, for USD 1.1 billion. Thales intends to pursue its objective of strengthening its Avionics portfolio with this acquisition. Avionics employs 690 people, including 190 engineers, throughout a well-invested footprint in France, South Africa, the United States/Canada, and Denmark. It is estimated to earn USD 200 million in revenue by 2023.

Read our insightful Blogs and Data-driven Case Studies:

-

- Gaming Monitors - A Guide to Next-Generation Gaming Monitors

The write-up is a descriptive analysis of the next-generation gaming experience. As virtual reality is getting highly popular amongst the users, developers are bringing more intriguing gaming experiences.

- How is a Technology Company tackling New Competition?

Know how with the help of Research Nester’s expertise, a technology company gained string market position. Our analysts provided the company with a detailed study of other companies’ business portfolio to gain insights.

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.