Dublin, Feb. 22, 2024 (GLOBE NEWSWIRE) -- The "Global and Asia-Pacific Unmanned Aerial System (UAS) Market - A Global and Regional Analysis: Focus on Application, Drone Type, Mode of Operation, Infrastructure, Range, Component, and Country - Analysis and Forecast, 2023-2033" report has been added to ResearchAndMarkets.com's offering.

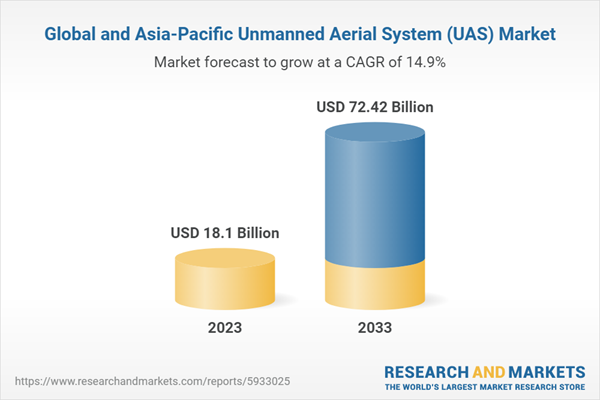

Global and Asia-Pacific Unmanned Aerial System (UAS) to reach a value of $72.42 billion by 2033 from $18.1 billion in 2023, growing at a CAGR of 14.8%

The emergence of unmanned aerial systems (UAS), occasionally known as drones, represents a significant technological advancement, changing operations in a variety of commercial and government sectors. These systems, distinguished by their remote piloting capabilities and adaptable architecture, have spread beyond military applications to industries including agriculture, real estate, infrastructure, and emergency services.

In agriculture, UAS is transforming precision farming by delivering comprehensive aerial images that allow farmers to check crop health, monitor irrigation, and optimize pesticide distribution. The real estate business uses UAS for aerial photography, which provides immersive property views and improves marketing methods. Drones play an important role in infrastructure inspections, damage assessments, and construction progress monitoring, providing a safer and more cost-effective alternative to traditional techniques.

Nowadays, unmanned drones are characterized by fast technical progress and rising use across a wide range of industries, including commercial, environmental, and public service activities. Cutting-edge breakthroughs in AI, machine learning, and sensor technologies are greatly improving UAS's autonomy, dependability, and adaptability. Companies such as DJI and Parrot are constantly developing and producing drones with advanced features such as real-time data processing, obstacle avoidance, and extended flying endurance.

The sector is also seeing an increase in strategic partnerships between tech giants and drone start-ups, with a focus on developing integrated solutions for precision agriculture, infrastructure inspection, disaster management, and delivery services, demonstrating the UAS industry's robust growth and pivotal role in shaping the future of autonomous technology and aerial operations.

Industrial Impacts

The introduction of unmanned aerial systems (UAS) has signaled a transformational period in a variety of industrial sectors, characterized by higher efficiency, improved data collecting, and a fundamental shift in operating paradigms. UAS technology has transformed traditional agricultural methods, allowing precision agriculture by providing high-resolution airborne imagery for crop monitoring, health evaluation, and land management.

This detailed level of data enables educated decision-making, optimizes resource allocation, and considerably increases agricultural yields while reducing environmental effects. Furthermore, in the field of infrastructure and construction, UAS have proven useful in conducting extensive inspections of difficult-to-access buildings such as bridges, skyscrapers, and wind turbines. This not only assures greater safety standards by allowing early detection of structural flaws, but it also results in significant cost savings by decreasing the need for manual inspections and minimizing the danger of workplace accidents.

Simultaneously, UAV system technology is at the forefront of altering emergency response and catastrophe management procedures. In situations when every second counts, UAS provides quick, real-time observation and evaluation of disaster-stricken areas without exposing people to dangerous conditions. This feature facilitates the quick and efficient deployment of emergency services, which improves the efficacy of rescue operations.

Furthermore, in environmental monitoring and conservation activities, unmanned aerial system (UAS) or unmanned aerial vehicle (UAV) provides an unprecedented platform for large-scale data collecting and habitat monitoring, enabling insights into patterns and changes that are invisible at ground level. This high-level overview provides a more thorough and proactive approach to environmental stewardship, which helps to preserve biodiversity and manage natural resources sustainably. As these systems mature and include powerful AI and machine learning algorithms, UAS's potential to promote innovation and operational excellence across sectors is likely to grow, ushering in a new era of industrial efficiency and environmental awareness.

Market Segmentation

Commercial Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Application)

The global and Asia-Pacific unmanned aerial system (UAS) market is led by the commercial application segment, which held a 98.11% share in 2022. The growing emphasis on technological advancement, shifting consumer preferences, and favorable economic conditions are expected to create demand and opportunities for expansion. For instance, in February 2023, Zipline International, Inc. received authorization from the FAA to use drones for commercial package deliveries in the vicinity of Salt Lake City. These drones are permitted to operate beyond the operator's visual line of sight without the need for visual observers.

Rotary Wing Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Drone Type)

The global and Asia-Pacific unmanned aerial system (UAS) market is led by the rotary wing drone type segment, which held a 78.88% share in 2022. The growing demand within the segment is propelled by technological advancements such as advanced imaging technologies, such as light detection and ranging (LiDAR) and high-resolution cameras, commercial adoption, and supportive regulatory environments.

Remotely Piloted Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Mode of Operation)

The global and Asia-Pacific unmanned aerial system (UAS) market is led by the remotely piloted mode of operation segment, which held a 64.83% share in 2022. The segment's growth is driven by the increased adoption of remotely piloted UAVs for diverse applications, including surveillance, reconnaissance, border patrolling, and monitoring, and the surge in demand for advanced technologies in UAVs.

Drone Receptacle Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Infrastructure)

The global and Asia-Pacific unmanned aerial system (UAS) market was led by the drone receptacle infrastructure segment in 2022. The segment's expansion is driven by the rising number of UAVs and UASs and their increasing applications across various sectors, including agriculture, logistics, surveillance, and transportation

Visual-Line-of-Sight (VLOS) Segment to Dominate the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Range)

The global and Asia-Pacific unmanned aerial system (UAS) market is led by the visual-line-of-sight (VLOS) range segment, which held a 65.12% share in 2022. The advanced autonomous VLOS drones with enhanced capabilities for various applications in both military and commercial sectors present in the market have been experiencing robust growth due to the increasing adoption of these technologies in various industries and the continuous development of advanced drones.

Airframe Segment to Witness the Highest Growth between 2023 and 2033 in the Global and Asia-Pacific Unmanned Aerial System (UAS) Market (by Component)

The airframe component segment dominated the global and Asia-Pacific unmanned aerial system (UAS) market (by component) in 2022. Being the essential component of the body of the UAV, the demand for this component is everlasting.

North America, Europe, and Rest-of-the-World were the highest-growing markets among all the regions, registering a CAGR of 14.87%.

The regions are anticipated to gain traction in terms of UAS adoption owing to technological advancements, favorable economic conditions, and different consumer preferences. Moreover, favorable government policies are also expected to support the growth of the UAS market in North America, Europe, and Rest-of-the-World during the forecast period.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 129 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value (USD) in 2023 | $18.1 Billion |

| Forecasted Market Value (USD) by 2033 | $72.42 Billion |

| Compound Annual Growth Rate | 14.8% |

| Regions Covered | Asia Pacific, Global |

Industry Outlook

- Overview: Global and Asia-Pacific Unmanned Aerial System (UAS) Market

- Expansion of Drone Delivery Networks

- Automated UAS Captured Data Management/Usage

- Integration of Drone-as-a-Service (DaaS) with Cloud-Based Infrastructure and Services

- Growing Need for Drones Integrated with AI/ML, Enhanced Sensors, and Advanced Communications

- Key Players

- Start-Ups and Investment Landscape

Some prominent names established in this market are:

- Draganfly Innovations Inc.

- Skydio, Inc.

- EHang

- DJI

- Elbit Systems Ltd.

- Adani Group

- AiviewGroup

- HighEye

- MMC

- Hanwha Group

- Terra Drone

- Raptor Maps, Inc.

For more information about this report visit https://www.researchandmarkets.com/r/2xwk24

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment