New York, NY, March 15, 2024 (GLOBE NEWSWIRE) -- The global embedded finance market size and share was valued at USD 82.48 billion in 2023 and is anticipated to generate an estimated revenue of USD 1,029.02 billion by 2032, with a CAGR of 32.4% from 2024 to 2032.

Embedded finance is the incorporation of financial services, such as payment processing, lending, and insurance, into the infrastructures of nonfinancial organizations without the need to route them through traditional financial institutions. Businesses are embracing embedded finance more and more as consumer behavior and technology change. Embedded finance refers to methods of preserving payment alternatives that facilitate clients' access to financial services.

Moreover, the embedded finance market benefits from the growing acceptance of digital mobile-based financial services, which is facilitated by the increasing ubiquity of internet access and smartphone adoption. Also, the continuous digitalization of several sectors of the economy, most notably banking and finance, is anticipated to propel the growth of the embedded finance industry.

Download Free Sample PDF Copy of the Report: https://www.polarismarketresearch.com/industry-analysis/embedded-finance-market/request-for-sample

Fundamental Stats from the Report

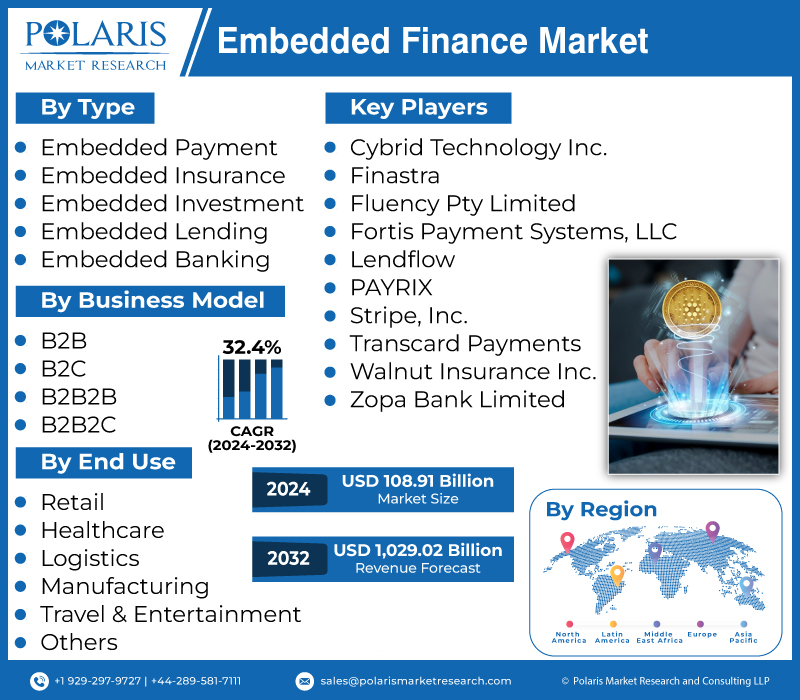

- The global market for embedded finance was valued at USD 82.48 billion in 2023.

- The market is expected to grow at a 32.4% compound annual growth rate (CAGR) during the forecast period of 2024-2032.

- The embedded finance market size is anticipated to grow to 1,029.02 billion by 2032.

Key Findings from the Report

- The market for embedded finance is expanding due to several factors, including increased lending to SMEs and consumers, acceptance of UPI payments, and growing digitization across several industries.

- The market is mainly segmented on the basis of business model, end-use, type, and region.

- North America dominated the market with the largest embedded finance market share in 2023.

Embedded Finance Market Companies

- Cybrid Technology Inc.

- Finastra

- Fluency Pty Limited

- Fortis Payment Systems, LLC

- Lendflow

- PAYRIX

- Stripe, Inc.

- Transcard Payments

- Walnut Insurance Inc.

- Zopa Bank Limited

Purchase a Full Copy of the Report @ https://www.polarismarketresearch.com/buy/3638/2

| Report Attributes | Details |

| Market value in 2024 | USD 108.91 Billion |

| Market value in 2032 | USD 1,029.02 Billion |

| CAGR | 32.4% from 2024 – 2032 |

| Base year | 2023 |

| Historical data | 2019-2022 |

| Forecast period | 2024-2032 |

Important Market Developments

Growth Drivers:

- One of the main factors driving the embedded finance market growth is the integration of finance into non-financial platforms. This strategic fusion, which smoothly integrates financial services into the ecosystem of non-financial platforms, radically changes the way that consumers and businesses access and use financial tools.

- The embedded finance industry takes advantage of this desire by integrating financial features where customers already interact with services as they look for more seamless, one-stop solutions.

Trends:

- The forecast period will witness substantial growth in the embedded finance market demand, mostly because of the progress made in Artificial Intelligence (AI). By using AI in embedded finance, service providers may provide their clients with more advanced and customized services, which boosts client retention and income.

Challenges:

- Although the embedded finance sector is expected to experience growth during the projection period, a number of obstacles could prevent it from doing so. Among these difficulties are the need for compliance and reliance on financial institutions. Also, embedded finance may involve clients in a different direct manner than typical banks do with shops or service providers.

Request for a Discount on this Report Before Purchase @ https://www.polarismarketresearch.com/industry-analysis/embedded-finance-market/request-for-discount-pricing

Regional Insights

North America: The embedded finance market in North America is expected to increase due to the dominance of major firms. To hasten the adoption of embedded finance, several regional businesses are also actively participating in fundraising campaigns.

Asia Pacific: The Asia Pacific will grow at a significant rate. This expected growth can be attributed to the proactive initiatives launched by different market players.

Browse the Detail Report “Embedded Finance Market Share, Size, Trends, Industry Analysis Report, By Type (Embedded Payment, Embedded Insurance); By Business Model; By End-use; By Region; Segment Forecasts, 2024 - 2032” with in-depth TOC: https://www.polarismarketresearch.com/industry-analysis/embedded-finance-market

For Additional Information OR Media Enquiry, Please Mail At: sales@polarismarketresearch.com

Polaris Market Research has segmented the embedded finance market report based on type, business model, end-use, and region:

By Type Outlook

- Embedded Payment

- Embedded Insurance

- Embedded Investment

- Embedded Lending

- Embedded Banking

By Business Model Outlook

- B2B

- B2C

- B2B2B

- B2B2C

By End Use Outlook

- Retail

- Healthcare

- Logistics

- Manufacturing

- Travel & Entertainment

- Others

By Region Outlook

- North America (U.S., Canada)

- Europe (France, Germany, UK, Italy, Netherlands, Spain, Russia)

- Asia Pacific (Japan, China, India, Malaysia, Indonesia. South Korea)

- Latin America (Brazil, Mexico, Argentina)

- Middle East & Africa (Saudi Arabia, UAE, Israel, South Africa)

About Polaris Market Research:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR’s clientele spread across different enterprises. We at Polaris are obliged to serve PMR’s diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR’s customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR’s customers.

Contact:

Likhil G

30 Wall Street

8th Floor,

New York City, NY 10005,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Follow Us: LinkedIn | Twitter

Blog: https://polarismarketresearch.medium.com