Dublin, March 20, 2024 (GLOBE NEWSWIRE) -- The "United States Processed Meat Market, Size, Forecast 2024-2030, Industry Trends, Share, Growth, Insight, Impact of Inflation, Company Analysis" report has been added to ResearchAndMarkets.com's offering.

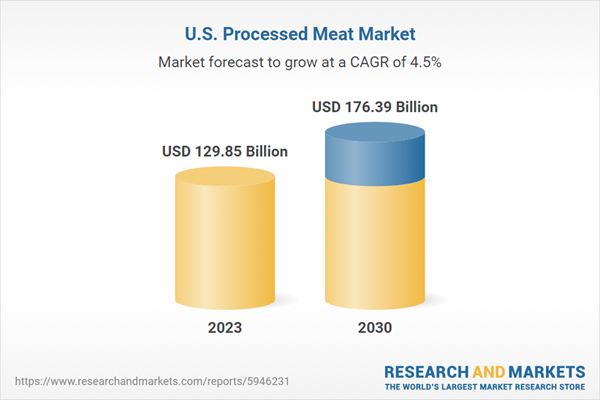

United States Processed Meat Market is anticipated to reach US$ 176.39 Billion by 2030 from US$ 129.85 Billion in 2023.

In the United States, processed meat holds vast significance in modern-day diets. Its comfort and flexibility make it a staple in American families, catering to busy lives and presenting quick meal solutions. Processed meat merchandise is also outstanding in American culinary traditions, from classic deli sandwiches to backyard barbecues. Despite ongoing health debates, processed meat stays deeply ingrained in the American way of life and delicacies, symbolizing comfort, culture, and convenience in the modern, fast-paced world.

United States Processed Meat Market is expected to increase at a CAGR of 4.47% from 2024 to 2030

The increasing emphasis on protein consumption has driven the demand for protein-rich processed meats in the United States. This trend aligns with a developing attention to healthier dietary alternatives, contributing to the general enlargement of the processed meat market in the United States. According to the USDA, the ordinary American consumes approximately 224.6 pounds of meat yearly, encompassing beef, pork, broilers, and turkey. Consumers' heightened cognizance of the significance of protein has led to the recognition of processed meat merchandise, signaling a broader shift towards a more fitness-aware consumption pattern in the United States.

Moreover, the processed meat sector undergoes continuous innovation, constantly introducing various iterations of current products. This enterprise's growing demand for clean-label and all-natural items is a dominant trend. Consumers are increasingly searching for processed meats with labels highlighting attributes that include low-sodium, low-fat, low-calorie, and free from components, preservatives, and MSG. These possibilities replicate a growing inclination towards healthier and more obvious meal selections. This is compelling producers to adjust their services to satisfy evolving customer demands, thereby driving the growth of the processed meat market in the United States.

The United States stands among the leading international meat manufacturers, notably in beef production. According to the USDA, the country generates around 11.4 million tons of beef yearly and imports large volumes from Canada, Australia, Mexico, and New Zealand. Further, the increasing favor for manufacturers like Tyson, Gardein, and Hormel, alongside the surging interest in grass-fed beef items for their dietary advantages, is expected to propel this sector. Frozen ground pork in boneless form remains a popular processed pork product among consumers.

Anticipated United States processed meat market growth is also driven by inventive product releases, exemplified by Benny's Original Meat Straws. Manufacturers are tailoring products to specific demographics to enhance appeal, as seen in Tillamook Country Smoker's All Natural Cranberry Turkey Jerky, designed for female consumers, and Kerry Foods' barbecue-flavored meatballs catering to the adult male demographic. This strategic approach to product development aims to attract targeted customer segments, reflecting the industry's adaptability to diverse consumer preferences and fostering sustained processed meat market expansion.

Beef can potentially emerge as a predominant meat type in the United States processed meat market

By meat type, the United States processed meat market is fragmented into poultry, beef, pork, and others. Beef could be a dominant meat type in the U.S. processed meat market. This is because of its enormous reputation and adaptable utilization. With a wealthy flavor profile and diverse applications, beef merchandise attracts a broad purchaser base. Its adaptability in various processed meat forms, such as sausages, burgers, and deli meats, makes it a staple in American diets. Further, the established beef enterprise infrastructure ensures steady supply and quality, further solidifying beef's prominent role in the United States processed meat market.

Chilled processed meat might claim the most significant portion of the processed meat market in the United States

By processed type, the United States processed meat market is segmented into frozen, chilled, and canned. Chilled processed meat holds the potential for the largest share of the United States processed meat. This is because of its freshness, enchantment, and convenience. With purchasers increasingly prioritizing convenience without compromising quality, chilled processed meat products provide stability in shelf life and freshness. These merchandise undergo minimal processing, retaining natural flavors and textures, which resonates nicely with health-aware consumers. Further, the extensive availability of refrigeration infrastructure guarantees the accessibility and preservation of chilled processed meat. This is contributing to its dominance in the U.S. processed meat market.

Hypermarkets and supermarkets are among the prominent segments within the United States processed meat market

By distribution channel, the United States processed meat market is categorized into Hypermarkets and supermarkets, Convenience Stores, Online Retail Stores, and Others. Hypermarkets and supermarkets are among the leading sections of the United States processed meat market. This is because of their massive reach and various product offerings.

These retail giants offer a wide selection of processed meat products under one roof, imparting comfort and range to purchasers. Also, their strategic locations and efficient supply chain control ensure regular availability and competitive pricing. The extensive client base and promotional activities further bolster their dominance, making hypermarkets and supermarkets the preferred destination for processed meat purchases in the U.S.Key Attributes:

| Report Attribute | Details |

| No. of Pages | 100 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value (USD) in 2023 | $129.85 Billion |

| Forecasted Market Value (USD) by 2030 | $176.39 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | United States |

Company Analysis: Overview, Recent Developments, Revenue Analysis

- Hormel Foods

- Tyson Foods

- Conagra Brands Inc.

- General Mills

- Kraft Heinz Company

- Cargill, Incorporated,

- Pilgrim's Pride Corp.

For more information about this report visit https://www.researchandmarkets.com/r/9utudg

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment