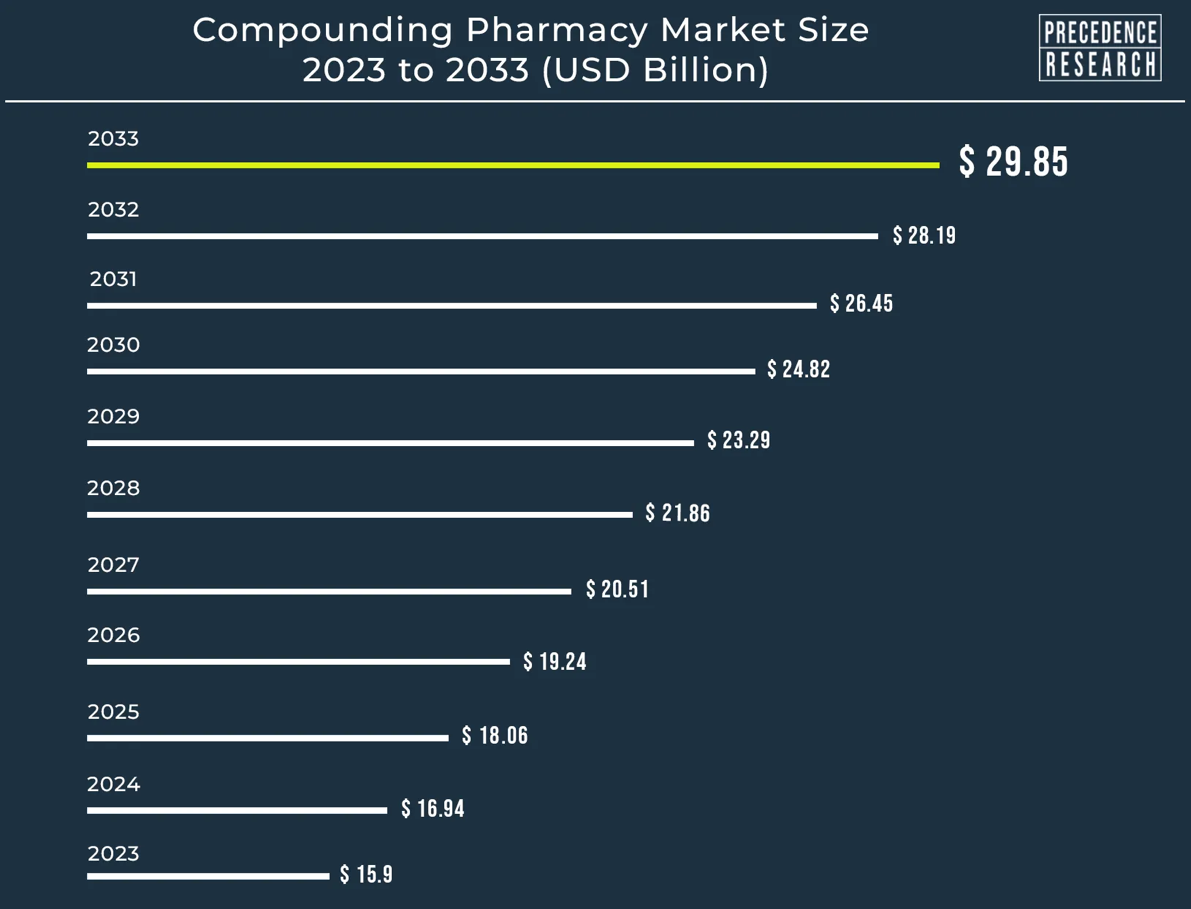

Ottawa, April 15, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global compounding pharmacy market size was valued USD 15.9 billion in 2023 and is projected to hit around USD 28.19 billion by 2032. The compounding pharmacy market is driven by increasing chronic diseases, personalized medication, and advanced technology.

Market Overview

The compounding pharmacy market refers to the industry involved in the preparation, mixing, and customization of medications based on individual patient needs. Compounding pharmacies provide a remedy to chronic pain patients' restricted dosage options by formulating medications from raw components in quantities as tiny or large as the doctor prescribes. They also make prescriptions easier to swallow, allowing patients who have difficulty swallowing to take their prescribed medications.

Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3185

Compounding pharmacies can also flavor medicines, which encourages children and pets to take their medications and stay healthy. Compounding pharmacies can also prescribe innovative medicines, such as topical finasteride for hair loss treatment, which avoids the negative effects associated with oral finasteride use. They can assist with unavailable or back-ordered prescriptions because they manufacture prescription drugs in-house. Compounding pharmacies guarantee that the formula is correct, as each patient has a unique sensitivity to active components and others.

Key Pointers:

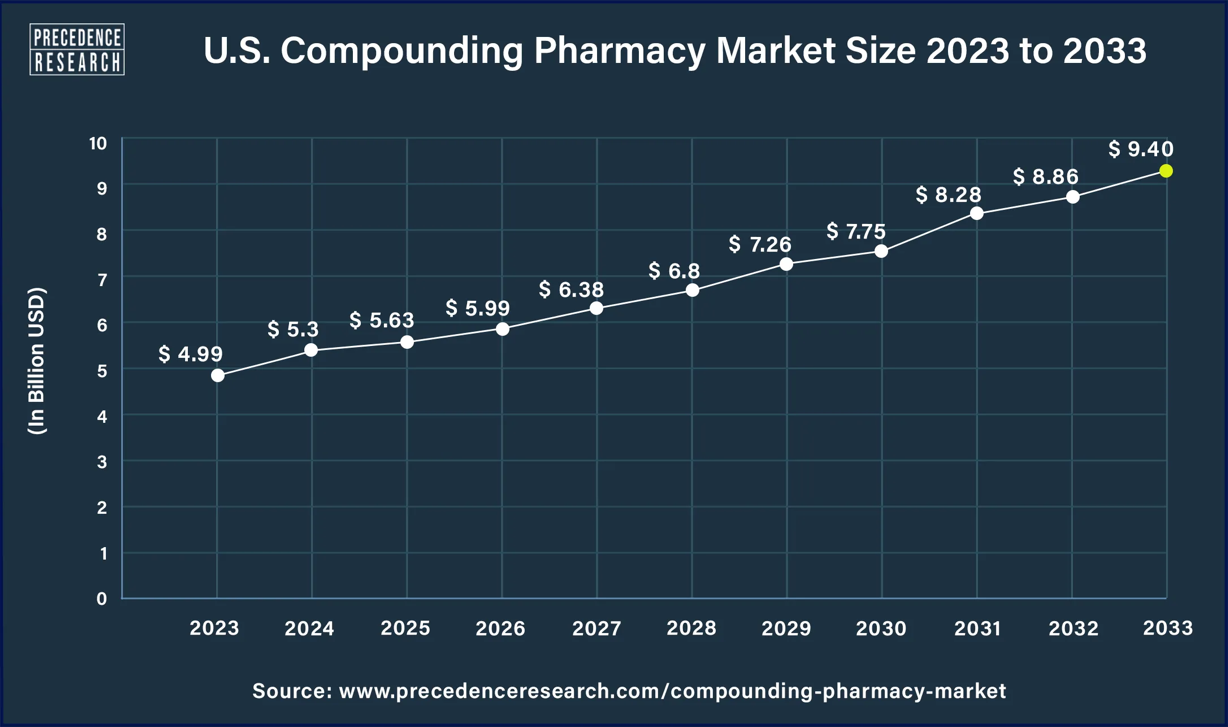

- North America region has dominated the market with revenue share of 44% in 2023.

- Based on compounding types, the PIA segment has dominated the market with revenue share of 38% in 2023.

- Based on sterility, the sterile segment has garnered revenue share of around 58.8% in 2023.

- Based on age, the adult segment has captured highest revenue share of 44.5% in 2023.

- Based on therapeutic area, the pain management segment has accounted revenue share of around 33.6% in 2023.

- By compounding types, the PIA segment has held revenue share of 38% in 2023.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3185

Regional Stance

North America dominated the compounding pharmacy market because of its emphasis on patient-centered treatment and stringent regulations. These pharmacies serve a wide spectrum of patients, including individuals with allergies, sensitivities, children, the elderly, and rare or complex medical disorders. Regulatory agencies like the FDA and Health Canada provide rules and oversight to ensure that appropriate compounding procedures are followed, which is projected to support regional market growth.

- In January 2024, after 12 years of development, the United States Pharmacopeia (USP) issued amended compounding criteria, which will go into effect on November 1, 2023. The new standards reflect scientific advances, stakeholder feedback, and a risk-based approach to assigning beyond-use dates. They also provide more specific rules for facilities, equipment, and cleaning. The USP Compounding Compendium, a tool for pharmacists and healthcare professionals, provides quality assurance for compounding processes, preparations, and procedures. It also includes the National Formulary (USP-NF) for medications sold in the United States.

Asia-Pacific is expected to grow at the fastest rate during the forecast period. The growing

senior population in Japan and China, together with higher awareness of compounded drugs, the development of healthcare services, and rising healthcare costs, will fuel the expansion of the APAC compounding pharmacy industry. China's market is valued at the highest in the Asia-Pacific region. The Chinese government is increasingly regulating this market, ensuring product security and compliance with shipping and processing protocols. Online outlets are expected to indicate if they are licensed manufacturers, wholesalers, or chain retailers.

Personalized your customization here: https://www.precedenceresearch.com/customization/3185

Report Highlights

Therapeutic Area Insights

The pain management segment dominated the compounding pharmacy market in 2023. Pain management compounding is the process of customizing medications to address a patient's unique pain needs. This involves combining different strengths, dosage forms, and strengths to suit the patient's condition and tolerance levels. Consultation with a compounding pharmacist is essential to determine the most suitable dosage form. Compounding specialists make compounded pain creams from a variety of pharmacological substances, such as analgesics, anti-inflammatories, neuropathic pain relievers, and muscle relaxers. These personalized topical pain relief creams are safer alternatives to oral drugs, with fewer side effects. Compounding pharmacy provides comprehensive pharmacological pain care with an emphasis on improving functionality, restoring comfort, and allowing people to live full lives. Their experience in pain management compounding is focused on your well-being.

Route of Administration Insights

The oral segment dominated the compounding pharmacy market in 2023. The oral route of drug delivery is a straightforward, easy, and safe approach available with a prescription. It can be self-administered with or without water and is compatible with a wide range of medications. It can be formulated with various varieties to adjust the pace and duration of active medicinal component release. Patients can take the medicine without any particular skills or expertise. It is a cost-effective approach to self-administration that is painless and has a lower medication reaction rate than other methods. The pharmaceutical business can make oral pills in a variety of colors, styles, and sizes to make them more appealing.

Distribution Channel Insights

The hospital pharmacy segment dominated the compounding pharmacy market in 2023. Hospital pharmacies frequently treat complex patients with special treatment requirements, relying on compounding pharmacies to deliver customized drugs, dose modifications, and formulations. They also see pediatric patients who require non-commercialized drugs or flavoring to ensure compliance. This segment's growth is fueled by the ability to create pediatric-specific formulations while assuring proper dose and administration.

Related Reports

- ePharmacy Market - The global ePharmacy market size was valued at US$ 82.25 billion in 2023 and it is expected to hit around US$ 345.79 billion by 2032 with a CAGR of 17.30% from 2023 to 2032.

- U.S. Compounding Pharmacies Market - The U.S. compounding pharmacies market size was accounted for USD 5.78 billion in 2023 and is predicted to hit around USD 9.75 billion by 2032 with a CAGR of 6% from 2023 to 2032.

Market Dynamics

Driver

Rising demand for personalized medicine

Personalized medicine is a key driver for compounding pharmacy market growth. Pain is a frequent symptom that can progress to chronic illnesses, making treatment challenging. Common pain relievers can induce drowsiness, dizziness, and stomach upset. Pharmacy compounding provides tailored pain alleviation by creating unique drugs for patients. This method allows individuals to properly manage their discomfort while minimizing adverse effects. Pharmacy compounding can give alternative dose forms, such as topical gel, cream, spray, custom-flavored troche, nasal spray, or suppository, that bypass the gastrointestinal tract and aid patients who have difficulties ingesting tablets. Combined formulations can combine various drugs into a single dose, increasing convenience. Strength variants can also be tailored to the specific demands of each patient. Pharmacy compounding can enhance a patient's quality of life by offering relief with fewer negative effects.

Restraint

Poor compounding practice

Compounded medications are necessary medical therapies, but they do not have the same safety, quality, and efficacy guarantees as authorized drugs. The FDA does not verify the safety, efficacy, or quality of compounded pharmaceuticals before they are launched, posing health hazards. Poor compounding techniques can lead to drug quality issues, such as contamination or excessive active component content, resulting in serious patient damage or death. The FDA has found unsanitary conditions in compounding plants, such as sterilizing equipment, pet beds, and operators who handle sterile items with exposed skin. Large-scale, non-patient-specific compounding and distribution could cause significant patient harm. The FDA may be unaware of these compounders, and certain states may lack the necessary resources to regulate them.

Opportunities

Research and Development

The evolving human DNA, biology, and clinical pharmacology will drive the expanding importance of customized medicine in healthcare. Compounding pharmacies, which can adapt pharmaceuticals to the human genome, are particularly positioned to meet this need by developing bespoke therapeutics that address each patient's distinct treatment needs. This could include tweaking the dosage, changing the form, or adding tastes to the medication to improve its effectiveness and acceptability to the general public. Compounding pharmacies help to prevent disease and improve treatment outcomes by adapting drugs to the exact needs of each condition and patient, increasing treatment effectiveness and lowering the risk of side effects. This not only improves patient health outcomes but also raises the overall quality of care for the entire public. Furthermore, compounding pharmacies can improve patient satisfaction by making medication easier to swallow, making the medication-taking experience more enjoyable, and enhancing adherence to treatment plans. As biomedical research continues to investigate the complexity of disease control and pharmaceutical response, personalized medicine is expected to play an increasingly essential role in healthcare. Compounding pharmacies will play an important part in this shift, resulting in better treatment outcomes and more patient satisfaction.

Harnessing AI to reduce human error in compounding pharmacy market

The incorporation of AI technology into pharmacy compounding operations has various advantages, including precision and consistency in drug components, real-time monitoring, and data analysis. AI algorithms can precisely measure and dispense medicinal components, lowering the possibility of dose errors reaching patients. Real-time monitoring enables the detection and correction of problems before they jeopardize patient safety. AI can also examine historical data to discover trends, allowing for continual development and minimizing future errors. However, its potential in pharmacy remains untapped. Future improvements may see AI automate increasingly sophisticated operations, decreasing the pressure on human pharmacists and reducing errors. By implementing AI-driven automation, pharmacies may eliminate human error, resulting in safer and more efficient compounding procedures. Integrating CSTDs with AI-driven automation systems can offer comprehensive protection against dosage errors and contamination risks.

Recent Developments

- In March 2024, JBS entered the compounding pharmacy industry with Genu-in, a collagen peptide and gelatin brand, and had an exclusive partnership with Galena Farmacêutica to sell its collagen. Executive director Ricardo Gelain expressed excitement about the relationship, adding that it represents an essential market entry for Genu-in and would drive the company's future growth.

- In February 2024, Empower Pharmacy plans to buy Eugia's East Windsor site, following the FDA's citation of the site with ten observations in a Form 483 write-up. The 170,000-square-foot plant will be acquired by Empower, which will also take over its workforce and establish a "contract manufacturing relationship."

- In June 2023, Wedgewood Pharmacy, the largest veterinary compounding pharmacy in the United States, merged with Blue Rabbit, a top provider of veterinary prescription administration and pharmacy solutions. The merger, managed by CEO Marcy Bliss, seeks to supply rapid, high-quality drugs to over 70,000 veterinary consumers via a larger network of licensed and recognized pharmacies. The transaction would expand Wedgewood's existing facilities to include small-animal dispensing centers in Novato, NC, as well as horse pharmacies in Lexington, KY, and Bakersfield, CA.

Compounding Pharmacy Market Companies

- Fresenius Kabi

- Fagron NV

- B. Braun Medical Inc.

- Rx3 Compounding Pharmacy

- Clinigen Group PLC

- Dougherty's Pharmacy, Inc.

- Lorraine's Pharmacy

- Wedgewood Pharmacy

- Institutional Pharmacy Solutions

- Mcguff compounding pharmacy services

Segments Covered in the Report

By Therapeutic Area

- Pain Management

- Hormone Replacement

- Dermal Disorders

- Nutritional Supplements

- Others

By Route of Administration

- Oral

- Topical

- Parenteral

- Others

By Application

- Pediatric

- Geriatric

- Adult

- Veterinary

By Compounding Type

- Pharmaceutical Dosage Alteration (PDA)

- Pharmaceutical Ingredient Alteration (PIA)

- Currently Unavailable Pharmaceutical Manufacturing (CUPM)

- Others

By Sterility

- Sterile

- Non-sterile

By Distribution Channel

- Compounding Pharmacy

- Hospital Pharmacy

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3185

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

Access our Premium Real Time Data Intelligence Tool, Visit: www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us:

Linkedin | Facebook | Twitter