Hamilton Square, April 15, 2024 (GLOBE NEWSWIRE) -- Overview

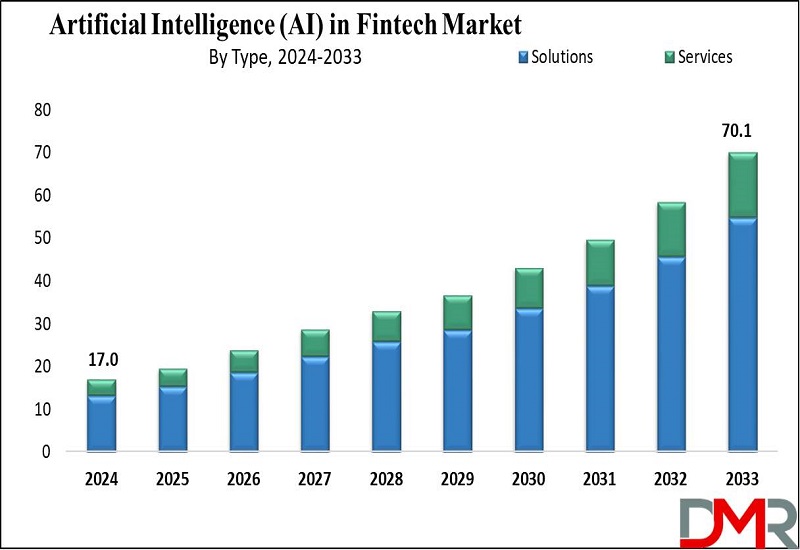

Artificial Intelligence (AI) in Fintech Market is expected to reach USD 17.0 Bn by 2024, surging to USD 70.1 Bn by 2033, with a CAGR of 17.0%. Fintech is now using artificial intelligence to automate financial services, like it’s one of the most noteworthy uses is in fraud detection. Generative AI often helps to simplify activities by accessing data and generating suitable content, for instance, in the insurance sector. Fintech firms are adopting AI technologies such as ML and big data analytics in order to be more effective in data analyses through computational skills and data processing efficiencies.

Important Insights

- Market Size: Artificial Intelligence (AI) in Fintech Market size is expected to reach USD 17.0 billion by 2024 and is further anticipated to reach USD 70.1 billion by 2033 according to Dimension Market Research. The market is anticipated to register a CAGR of 17.0% from 2024 to 2033.

- By Type Segment Analysis: Solutions are expected to lead with 78.1% market share in 2024. Their dominance stems from tailored, ready-to-implement frameworks like RPA, ML algorithms, NLP tools, and predictive analytics software, addressing various financial needs efficiently.

- Deployment Segment Analysis: On-premise solutions lead due to their advantages in security, regulatory compliance, compatibility with legacy systems, and customization flexibility, meeting stringent organizational requirements.

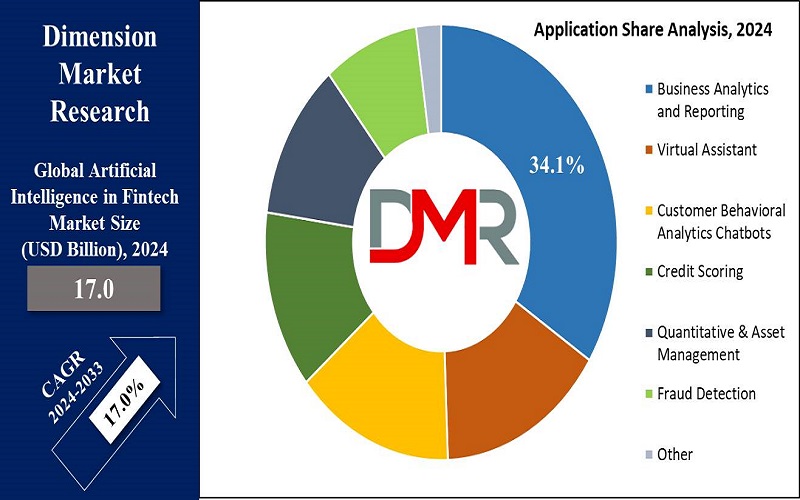

- Application Segment Analysis: Business analytics and reporting lead the application segment of the global AI in fintech market with a 34.1% market share in 2024. They drive informed decision-making, optimize efficiency, and ensure regulatory compliance.

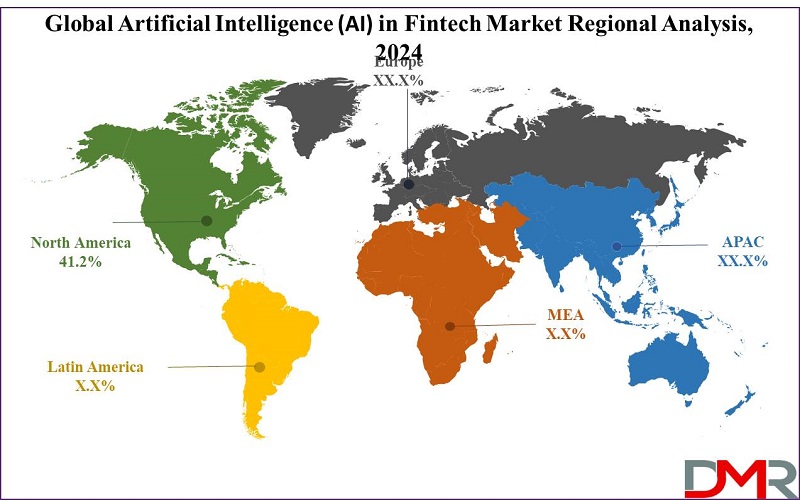

- Regional Analysis: North America's dominance in the global AI fintech market stems from its exceptional fintech ecosystem, advanced financial institutions, and strong integration of AI, driving efficiency and customer experiences.

Experience Growth: Request Your Sample Copy of the Report Now! - https://dimensionmarketresearch.com/report/artificial-intelligence-in-fintech-market/request-sample

Latest Trends

- Hyper-Personalization: AI allows tailored financial services and products, improving customer engagement and satisfaction through personalized suggestions and offerings, using market competitiveness.

- Explainable AI (XAI): Increasing attention to transparency and compliance necessitates AI systems to offer comprehensible insights, fostering trust and regulatory adherence in financial decision-making processes.

- AI-Powered Risk Management: Advanced AI algorithms examine big datasets in real-time, permitting proactive risk identification and mitigation techniques, enhancing financial stability and regulatory compliance for institutions.

- Voice and Conversational AI: Integration of voice-enabled AI assistants and chatbots revolutionizes consumer interactions, providing seamless, intuitive banking stability by driving efficiency and customer satisfaction in fintech services.

- The Rise in Digital Banking: Growing consumer preference for digital-first banking experiences fuels the adoption of AI-powered fintech solutions.

Artificial Intelligence (AI) in Fintech Market: Competitive Landscape

- Established industry giants in the AI in fintech market like IBM, Microsoft, Google, Amazon Web Services (AWS), and Oracle compete with each other to gain a competitive edge, leveraging their resources and technological capabilities to offer tailored solutions spanning predictive analytics, risk control, and customer service automation.

- Emerging fintech startups introduce competition, that specializes in niche segments and agile, consumer-centric solutions, pushing established players to innovate further. Regulatory evolution and shifting consumer preferences towards digital financial services and solutions will continue to shape the competitive landscape, leading to heavy investments in research, strategic partnerships, and acquisitions to stay ahead.

Some of the prominent market players:

- Microsoft

- Google LLC

- Salesforce Inc.

- IBM Corporation

- Amelia US LLC

- Nuance Communications Inc.

- Complyadvantage.com

- Narrative Science

- Affirm Inc.

- Upstart Network Inc.

- Intel

- Instructure Inc.

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! - https://dimensionmarketresearch.com/report/artificial-intelligence-in-fintech-market/download-reports-excerpt/

Artificial Intelligence (AI) in Fintech Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 17.0 Bn |

| Forecast Value (2033) | USD 70.1 Bn |

| CAGR (2024-2033) | 17.0% |

| North America Revenue Share | 41.2% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Type, By Deployment, By Application, By End User |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Analysis

The global AI in the fintech market is expected to be led by solutions based on type, with a total market share of 78.1% in 2024 which is partly due to them having affordable service models that have a large number of software (robotic process automation (RPA), machine learning algorithms, natural language processing tools and predictive analytics, risk management and personalization), some of which has been tailored to wide array of unique financial needs ranging from using RPA systems to data analytics.

Business analytics and reporting remain the driving force of global AI in the fintech market in the context of application with a 34.1% share of the market size in 2024. Data analytics has become an integral part of the business, by providing descriptive, diagnostic, predictive, and prescriptive analytics that drive informed decision-making, hence turning them into the cornerstone of data-driven strategies and optimizing resource allocation. These options empower organizations to dissect, extract, and extract value from enormous and complex datasets, thus improving the companies' efficiency and obtaining a competitive advantage.

Growth Drivers

- Rise in Consumer Demand for Online Solutions: Consumer preference for advanced, quick, and convenient financial services drives demand for prompt online solutions, especially in markets dealing with small transactions. AI in fintech meets this demand by offering instant, secure, and user-friendly banking experiences.

- Competition Driving Mobile Banking Innovation: Intense competition in the Banking, Financial Services, and Insurance (BFSI) sector encourages market players to innovate, particularly in mobile banking. AI-backed mobile banking services enhance customer satisfaction and retention, contributing to market growth.

- Technological Advancements Driven by R&D: Continuous research and development efforts driven by market competition lead to technological advancements in fintech. AI enables companies to develop better features and provide secure, user-friendly interfaces, fostering market expansion and customer satisfaction.

- AI integration for Enhanced Services: Integration of AI into fintech services improves service delivery by increasing remediation speed and enabling personalized customer experiences. Examples like iris by YES BANK demonstrate how AI enhances accessibility, innovation, and security in banking services, driving market growth.

- Security Measures Addressing Fraud and Regulatory Concerns: Rising incidents of fraud and regulatory concerns necessitate sophisticated security measures in fintech applications. Market players respond by implementing advanced security technologies to address consumer fears, thereby promoting market growth.

Restraints

- Data Privacy Concerns: Increasing scrutiny over data usage and privacy guidelines pose challenges in securely handling sensitive economic information, hindering AI adoption and innovation in the fintech market.

- Bias and Fairness Issues: AI algorithms can also perpetuate biases in decision-making, leading to unfair consequences in lending, coverage, and other financial services, elevating ethical and regulatory concerns.

- Lack of Skilled Talent: A shortage of experts with knowledge in both AI and finance limits the improvement and implementation of AI solutions in fintech, slowing the market growth.

- Integration Challenges: Legacy systems and complicated infrastructures in financial institutions pose obstacles in seamlessly integrating AI technologies, delaying adoption and scalability in fintech applications.

Growth Opportunity

- Enhanced Customer Experience: AI streamlines processes, offering personalized services, boosting consumer satisfaction, and retention, and driving market growth.

- Cost Efficiency: Automation of tasks reduces operational costs, increasing profitability and scalability for fintech companies, fostering market expansion and competitiveness.

- Risk Management Optimization: AI analyzes big datasets for real-time risk assessment, improving decision-making and regulatory compliance, and improving financial stability.

- Market Competition and Innovation: Intense competition drives continuous innovation in AI technologies, fostering market growth by enabling companies to offer cutting-edge fintech solutions and gain a competitive edge.

Secure Your Copy Instantly | Obtain This High-Quality Research Report: https://dimensionmarketresearch.com/checkout/artificial-intelligence-in-fintech-market/

Artificial Intelligence (AI) in Fintech Market Segmentation

By Type

Solutions

- Robotic Process Automation (RPA)

- Machine Learning Algorithms

- Natural Language Processing (NLP) Tools

- Predictive Analytics Software

- Risk Management Solutions

- Personalization Tools

Services

- Managed

- Data Management and Integration

- Training and Support Services

- Implementation Services

- Professional

- Consulting Services

- System Integration Services

- Customization Services

- Maintenance and Upgradation Services

By Deployment

- On-premise

- Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- Business Analytics and Reporting

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

- Virtual Assistant (Chatbots)

- Customer Service Chatbots

- Sales and Marketing Chatbots

- HR and Internal Support Chatbots

- Customer Behavioral Analytics Chatbots

- Credit Scoring

- Traditional Credit Scoring Models

- Alternative Credit Scoring Models

- Quantitative & Asset Management

- Algorithmic Trading

- Portfolio Optimization

- Risk Assessment

- Market Forecasting

- Fraud Detection

- Identity Verification

- Transaction Monitoring

- Anomaly Detection

- Anti-Money Laundering

- Other

By End User

- Banking Institutions

- Financial Services Companies

- Insurance Companies

- Investment Firms

- Wealth Management Firms

- Mortgage Lenders

- Fintech Startups

- Payment Service Providers

- Asset Management Firms

- Credit Unions

- Other

Regional Analysis

North America is projected to dominate the global AI in fintech market with a projected 41.2% market share in 2024. This dominance stems from its advanced fintech ecosystem, blending technology and finance seamlessly. With established financial institutions and startups, North America leads in AI and machine learning adoption, driving efficiency and customer experiences. Heavy investments in R&D and supportive regulations further accelerate innovation, aided by a large consumer market and rising demand for digital financial services.

Experience Growth: Request Your Sample Copy of the Report Now! : https://dimensionmarketresearch.com/report/artificial-intelligence-in-fintech-market/request-sample

By Region and Countries

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Browse More Related Reports

- Artificial Intelligence in Oil and Gas Market is expected to reach a value of USD 6.2 billion in 2023, and it is further anticipated to reach a market value of USD 21.0 billion by 2032 at a CAGR of 14.5%.

- Artificial Intelligence in Transportation Market is expected to reach a value of USD 4.0 billion in 2023, and it is further anticipated to reach a market value of USD 26.6 billion by 2032 at a CAGR of 23.5%.

- Artificial Insemination Market is expected to have a value of USD 2.4 billion in 2023, and it is further predicted to reach a market value of USD 5.0 billion by 2032 at a CAGR of 8.5%.

- Artificial Intelligence in Telecommunication Market is expected to reach a value of USD 3.6 billion in 2023, and it is further anticipated to reach a market value of USD 82.3 billion by 2032 at a CAGR of 41.7%

- Intelligent Virtual Assistant Market is expected to reach a value of USD 3.3 billion in 2023, and it is further anticipated to reach a market value of USD 24.7 billion by 2032 at a CAGR of 25.2%.

- Artificial Intelligence in E-commerce Market is expected to reach a value of USD 7.1 billion in 2023, and it is further anticipated to reach a market value of USD 25.1 billion by 2032 at a CAGR of 15.1%.

- Artificial Intelligence in Telecommunication Market is expected to reach a value of USD 3.6 billion in 2023, and it is further anticipated to reach a market value of USD 82.3 billion by 2032 at a CAGR of 41.7%.

- AdTech Market is expected to reach a value of USD 1,066.8 billion in 2023, and it is further anticipated to reach a market value of USD 3,528.4 billion by 2032 at a CAGR of 14.2%.

Recent Developments in Artificial Intelligence (AI) in Fintech Market

- December 2023: The Hong Kong government earmarked USD 25.6 billion to bolster fintech and AI, aiming to attract global firms, foster innovation, and support startups, advancing Hong Kong's status as a fintech hub.

- November 2023: Black Ore, an AI fintech startup, raised USD 60.0 million, led by Andreessen Horowitz. Emerging from stealth, it joins other AI startups with substantial early-stage funding.

- October 2023: Deutsche Bank's Corporate Venture Capital invested in Berlin-based Kodex AI, specializing in Large Language Models for financial services, which is aimed to enhance efficiency and support innovation in the banking industry.

- July 2023: TIFIN.AI, a new venture by TIFIN and J.P. Morgan, aims to accelerate fintech innovation with AI in wealth management, drawing on past successes and industry collaboration.

- January 2023: Encora acquired Excellarate, bolstering expertise in AI, analytics, and automation, enhancing capabilities in HealthTech, FinTech, and InsurTech, and expanding the global talent pool to over 9,000 engineers.

- May 2022: Tifin secures USD 109.0 million in Series D funding, led by Franklin Resources and Motive Partners, enhancing AI-driven investment platforms for personalized wealth management and expansion.

- April 2022: Gupshup, based in Singapore, acquired Active.Ai, a conversational AI platform serving BFSI clients in 43 countries, expanding its offerings in digital banking.

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts’ work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world. We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.