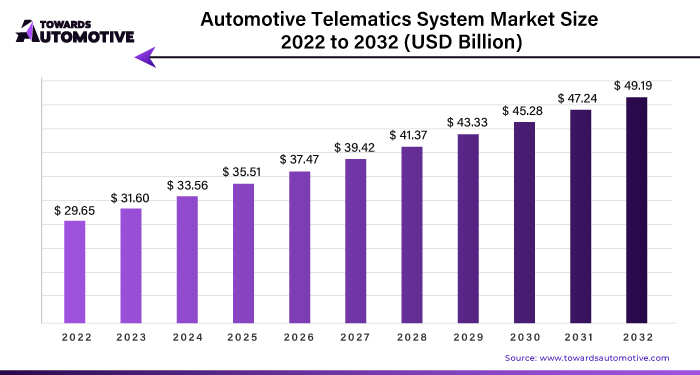

Ottawa, May 03, 2024 (GLOBE NEWSWIRE) -- The global automotive telematics system market size surpassed USD 31.60 billion in 2023 and is predicted to surpass around USD 47.24 billion by 2031, a study published by Towards Automotive a sister firm of Precedence Research.

The automotive industry is experiencing a surge in demand for high-performance, energy-saving vehicles equipped with advanced technology. This trend is driving the integration of remote information systems into vehicles, enabling features such as fleet management, remote diagnostics, and real-time monitoring. Major players in the automotive sector, including Ford Motor Company, are investing heavily in expanding their remote information systems to meet the evolving needs of consumers and businesses.

However, the growth trajectory of the automotive telematics sector faced a significant disruption due to the COVID-19 pandemic in 2019. Global shutdowns and supply chain disruptions led to a downturn in automobile sales, resulting in an annual decrease of approximately 7% in 2020. Despite these challenges, post-pandemic government initiatives aimed at promoting the adoption of new energy vehicles have spurred an increase in sales of electric vehicles. This, in turn, has created a growing demand for tracking devices such as vehicle telematics systems.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1030

The automotive remote marketing industry is increasingly focused on providing fleet management services to meet the needs of emerging transportation trends. For instance, Ford Motor Company initiated the integration of fleet maintenance services for all its future models in April 2021. Through its vehicle management and monitoring service, Ford offers fleet operators the ability to receive alerts and optimize driving behavior, leading to improved efficiency and reduced maintenance costs.

One notable aspect of Ford's telematics system is its compatibility with non-Ford vehicles, made possible through plug-in devices. This feature allows fleet managers to monitor and manage their entire fleet regardless of the vehicle manufacturer, enhancing flexibility and usability. Overall, the automotive remote information systems sector is poised for growth as businesses and consumers alike prioritize efficiency, safety and sustainability in their transportation solutions.

Technology Type Insights

The segmentation of the automotive remote computing market into embedded, connected, and integrated technology types reflects the diverse approaches taken by automakers to integrate telematics into passenger and commercial vehicles. Embedded systems refer to built-in telematics solutions that are seamlessly integrated into the vehicle's onboard systems, offering a comprehensive and streamlined user experience.

On the other hand, connected systems leverage external networks, such as cellular or satellite connections, to enable real-time data transmission and communication between the vehicle and external platforms or devices. This connectivity enables features such as remote diagnostics, over-the-air updates, and vehicle tracking, enhancing the vehicle's functionality and providing added convenience to users.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Integrated systems combine the functionalities of embedded and connected solutions, offering a holistic approach to automotive remote computing. By integrating telematics capabilities directly into the vehicle's existing systems and leveraging external networks for enhanced connectivity, integrated systems provide a seamless and robust solution for vehicle tracking, monitoring, and management.

The growth of the embedded automotive remote computing segment is driven by the increasing adoption of cloud-based remote data processing technologies. These technologies enable vehicle tracking and data analysis from anywhere, facilitating efficient fleet management and enhancing operational productivity.

The unity of the embedded, connected, and integrated segments underscores the importance of telematics in modern vehicles and highlights the diverse approaches taken by automakers to leverage remote computing technologies for enhanced vehicle functionality and user experience.

The connected segment of the automotive telematics market is poised for significant growth, driven by several key factors. The seamless integration of mobile phones with Wi-Fi services, Bluetooth connectivity, and navigation modems is playing a crucial role in accelerating the expansion of this segment. These technologies enable vehicles to connect to external networks and platforms, facilitating real-time data transmission and communication.

The rising demand for connected vehicles equipped with telematics software is fueling the growth of this segment. These connected vehicles are equipped with advanced features that provide alerts to drivers and vehicle owners, enhancing safety and security on the road. Additionally, they offer functionalities such as remote diagnostics, vehicle tracking, and over-the-air updates, contributing to their popularity among consumers.

Government initiatives aimed at improving road safety and developing smart transport systems are also driving growth in the connected segment. By promoting vehicle connectivity and enhancing existing traffic management systems, these initiatives are creating a conducive environment for the adoption of connected vehicle technologies.

Integration of automotive telematics systems into older vehicles is contributing to the growth of the connected segment. As consumers seek to retrofit their vehicles with advanced telematics capabilities, demand for connected solutions is expected to rise significantly.

The connected segment of the automotive telematics market is experiencing robust growth, driven by technological advancements, increasing consumer demand, and supportive government initiatives aimed at enhancing road safety and transportation efficiency.

Technology Type Insights on the Automotive Telematics System Market

Embedded automotive remote information processing systems play a crucial role in modern vehicles by facilitating the transmission and reception of data through communication devices. These systems enable a wide range of functions essential for vehicle operation and safety, including GPS navigation, communication security, emergency assistance, and driver assistance features. As the demand for efficient fleet management solutions continues to rise, there is a growing need for advancements in remote vehicle information settings.

Moreover, the integration of remote transportation information is becoming increasingly prevalent, particularly in the context of connected vehicles and the Internet of Things (IoT). Integrated vehicle information systems allow data to be accessed remotely via smartphone applications, enabling seamless connectivity between vehicles and IoT devices. This integration enhances convenience, efficiency, and accessibility for vehicle owners and operators.

During the forecast period, the study and development of integrated remote transportation information systems are expected to be a key focus area. As automotive technology continues to evolve, manufacturers and developers will prioritize the integration of remote information processing capabilities to enhance the functionality and connectivity of vehicles. This trend aligns with the broader shift towards connected and autonomous vehicles, where remote communication and data exchange play a central role in shaping the future of transportation.

Automotive Industry Development

The automotive industry has been actively developing flexible telematics systems that offer a wide range of services to vehicle owners. These systems enable monitoring of fuel consumption and tracking of internal engine, gas, and electricity data, providing valuable insights into vehicle performance and efficiency. With advancements in telematics technology, automakers are streamlining processes such as vehicle registration, authorization, and maintenance, offering these services at competitive prices.

One of the key drivers of growth in this segment is the integration of telematics technology directly into vehicles. This integration allows for functionalities such as remote locking and unlocking, engine start-stop control, and temperature regulation, enhancing overall vehicle convenience and comfort. As consumers increasingly prioritize convenience and connectivity features in their vehicles, the demand for telematics systems is expected to surge, driving significant revenue growth in this segment.

The versatility of telematics systems enables them to cater to various needs and preferences of vehicle owners, further fueling their adoption. Whether it's monitoring vehicle performance, ensuring security through remote control features, or accessing vehicle data for maintenance purposes, telematics systems offer a comprehensive solution for modern vehicle management.

The combination of advanced features, affordability, and convenience offered by telematics systems is poised to drive substantial growth in this segment, making it a vital component of the automotive industry's evolution towards smarter, connected vehicles.

The adoption of telematics systems in long-haul vehicles and public transport is rapidly increasing, driven by their ability to track location, monitor vehicle interior conditions, and assess speed. These systems play a crucial role in generating valuable data related to driver behavior, fuel economy, working hours, and vehicle performance, thereby facilitating efficient fleet management and promoting safety.

Automakers are increasingly emphasizing the integration of advanced telematics systems into future vehicles to enhance collaboration with premium insurance companies and improve overall safety for drivers and passengers. This strategic approach not only enhances vehicle safety but also aligns with evolving industry standards and consumer expectations.

The ease and speed of installation of automotive telematics systems are key factors driving segment growth. These systems offer tangible benefits such as reduced fuel consumption, lower energy costs, and improved vehicle safety, making them an attractive proposition for fleet operators and individual vehicle owners alike. By leveraging features such as cruise control and route optimization, telematics systems help optimize fuel efficiency by streamlining route planning and minimizing idle time.

Remote information capabilities of telematics systems enable proactive measures to prevent fuel wastage, such as automatically shutting off the vehicle when idle. This proactive approach to fuel management not only reduces operational costs but also contributes to environmental sustainability by minimizing emissions.

Adoption of automotive telematics systems in long-haul vehicles and public transport is poised for significant growth, driven by their ability to enhance operational efficiency, improve safety, and reduce environmental impact. As automakers and fleet operators continue to prioritize these benefits, the telematics market is expected to experience sustained expansion, supporting the evolving needs of the automotive industry and contributing to overall sector growth.

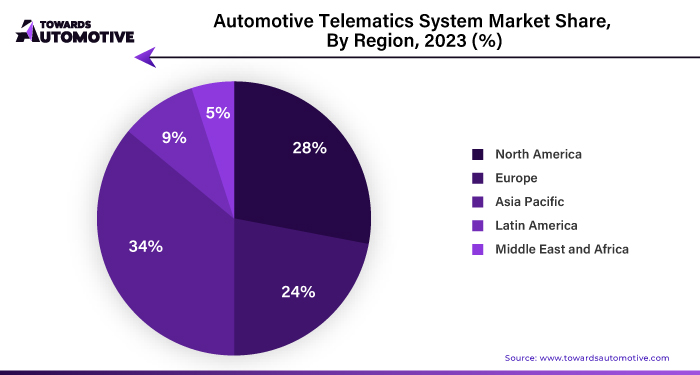

Asia-Pacific Expected to Capture Major Market Share

The Asia Pacific region is experiencing rapid growth in the automotive industry, fueled by increasing demand for fuel-efficient vehicles and the integration of advanced navigation systems such as GPS-based sample selection. This trend reflects a response to various challenges faced by the automotive sector, including rising fuel prices, heightened concerns about road accidents, and a surge in incidents of car theft.

One notable development in this region is the implementation of remote operation and emergency response capabilities in vehicles, in line with the AIS 140 standard for vehicle data. This standard, established based on guidelines issued by the Ministry of Road Transport and Highways (MoRTH) of India in 2016, aims to enhance vehicle safety and security through the adoption of advanced telematics technologies.

Companies operating in the automotive Internet of Things (IoT) sector are actively engaged in research, development, and sales activities targeting the Indian market and Southeast Asia. Their product offerings, which include vehicle infotainment systems (IVI) and telematics control units (TCU) designed for two- and three-wheelers, are equipped with cutting-edge technology embedded in Qualcomm chipsets. This technological advancement is expected to drive rapid adoption of vehicle telematics solutions across the Asia-Pacific region during the forecast period.

Overall, the Asia Pacific automotive market presents significant opportunities for growth and innovation, driven by evolving consumer preferences, regulatory initiatives aimed at improving road safety, and advancements in IoT technology. As companies continue to invest in research and development and expand their product portfolios, the adoption of telematics solutions is poised to accelerate, contributing to the transformation of the automotive landscape in the region.

Automotive Telematics System Market Leaders

- Continental AG

- Robert Bosch GmbH

- Clarion Co. Ltd (Faurecia Clarion Electronics)

- ACTIA Group

- Octo Telematics

- Magnetic Marelli SpA

- Valeo Group

- NavInfo Co. Ltd

- Ficosa International SA

Automotive Telematics System Market News

- In June 2023, Continental AG unveiled its partnership with NVIDIA to develop a next-generation automotive AI platform. This collaboration aims to integrate NVIDIA's powerful AI computing technology into Continental's automotive systems, enabling advanced driver assistance features and autonomous driving capabilities.

- In June 2023, Volvo Trucks announced its collaboration with Ericsson to develop and deploy 5G-enabled connectivity solutions for Volvo's fleet of commercial vehicles. This partnership will enhance vehicle-to-vehicle communication, real-time data transfer, and remote diagnostics, improving overall fleet management and efficiency.

- In June 2023, Bosch announced the launch of its new automotive cloud platform, designed to provide seamless connectivity and data management for connected vehicles. This platform will enable automakers to integrate various digital services, such as over-the-air updates, predictive maintenance, and personalized driver assistance features, into their vehicles.

- In July 2023, Daimler Trucks announced its partnership with Waymo to integrate Waymo's self-driving technology into Daimler's freight-hauling trucks. This collaboration aims to develop autonomous trucks capable of operating on public roads, improving safety, efficiency, and environmental sustainability in freight transportation.

- In July 2023, Aptiv PLC unveiled its collaboration with Hyundai Motor Group to develop a new generation of electric vehicle platforms. This partnership will leverage Aptiv's expertise in electric propulsion systems and Hyundai's manufacturing capabilities to accelerate the development and production of electric vehicles for global markets.

- In August 2023, Qualcomm Technologies, Inc. announced its collaboration with Ford Motor Company to develop a new automotive connectivity platform based on Qualcomm's Snapdragon Automotive Cockpit Platform. This platform will power Ford's next-generation infotainment systems, vehicle-to-everything (V2X) communication, and advanced driver assistance features.

Browse More Insights of Towards Automotive:

- The traffic signal recognition market size is projected to rise from USD 36.22 billion in 2023 to expand to USD 51.49 billion by 2032, reflecting 4.54% CAGR between 2023 and 2032.

- The low-emission vehicle market size to surge from USD 167.97 billion in 2023 and is expected to reach USD 488.08 billion by 2032, expanding at a CAGR of 12.58% during the forecast period.

- The off-highway vehicle engine market size was calculated at USD 43.31 billion in 2023 and is projected to achieve USD 78.18 billion by 2032, with a CAGR of 6.78% during the forecast period.

- The automotive lighting market size is estimated at USD 39.25 billion in 2024 to calculate USD 58.25 billion by 2032, growing at a CAGR of 5.21% during the forecast period.

- The vehicle security systems market size was valued at USD 11.40 billion in 2023 and is expected to reach USD 18.74 billion by 2032, growing at CAGR of 4.86% during the forecast period.

- The automotive alternator market size is was at USD 26.89 billion in 2024 and is expected to reach USD 46.46 billion by 2032, growing at a CAGR of 7.40% during the forecast period.

- The automotive relay market size is expected to grow from USD 16.62 billion in 2023 to USD 34.29 billion in 2032, expanding at a CAGR of 8.38% during the forecast period.

- The automotive fault circuit controller market size was projected USD 1.85 billion in 2022 and is expected to reach USD 6.33 billion in 2032, increasing at CAGR of 11.92% from 2023 to 2032.

- The automotive torque converter market size to rise from USD 3.72 billion in 2023 to reach USD 6.11 billion by 2032, increasing at CAGR above 5.56% between 2023 and 2032.

- The automotive gears market size to rise from USD 5.79 billion in 2023 and predicted to hit USD 10.27 billion by 2032, expanding at 6.58% CAGR during the forecast period.

Market Segmentation

By Technology Type

- Embedded

- Tethered

- Integrated

By Solution

- Component

- Service

By Vehicle Type

- Passenger

- Commercial

By Sales Channel

- OEM

- Aftermarket

By Application Type

- Information & Navigation

- Safety & Security

- Fleet Management

- Insurance Telematics

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1030

Please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Web: https://www.precedenceresearch.com

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive