Contact Information: Contact Information: Dan Mahoney CSG|PR (http://www.csg-pr.com) 970-405-8060

Tailspin Continues for U.S. Housing Market -- 3.5% Drop in January the Worst Yet According to Latest IAS360 Data

| Source: Integrated Asset Services

DENVER, CO--(Marketwire - March 10, 2009) - Integrated Asset Services®, LLC (IAS®)

(www.iasreo.com), a leader in default management and residential collateral

valuation, today released its latest IAS360™ House Price

Index. Based on the timeliest and most granular data available in the

industry, the index showed a staggering 3.5% plunge in house prices for

January, the worst single-month decline since its peak in November of 2006.

January's drop by itself represents more than $610 billion in reduced value

of U.S. housing stock and brings the total loss from the start of the

economic meltdown last September to roughly $2.4 trillion. Following a 1.1%

decline in December, the national housing index has now fallen 24.7% from

its peak in November of 2006.

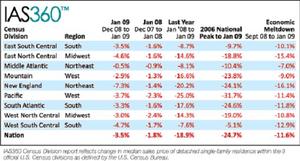

At the U.S. Census region level, the Midwest, which has been particularly

impacted by the economic turmoil, fell another 4.5% in January, bringing

the region's total decline since September 2008 to 12.4%. The other three

census regions were down in line with the national drop of 3.5% for the

month, though the West, not too surprisingly, far outpaces the rest of the

country with what is now a 23.4% decline for the last 12 months.

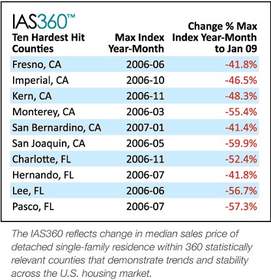

IAS 360's granular data indicates the areas that experienced the largest

gains during the housing bubble, California and Florida in particular, are

continuing to be hit the hardest. Three counties in Florida -- Charlotte

(Punta Gorda), Hernando (Spring Hill), and Pasco (New Port Richey) -- are

now down more than 50% from their highs in 2006.

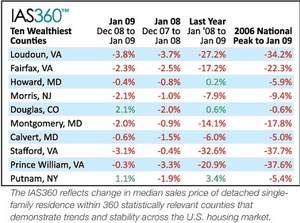

The January IAS360 report also reveals the nation's wealthiest counties

have not at all been insulated from the national decline. Three Virginia

counties -- Loudoun, Stafford, and Prince William have each fallen more

than 30% from their respective peaks.

"These are unprecedented times to say the least," said Dave McCarthy, President

and CEO of Integrated Asset Services. "We're seeing house prices plummet at

a rapid pace throughout the country. We'll be keeping a close eye on the

data for signs of a bottoming out."

At the MSA (Metropolitan Statistical Areas) level, while no area moved into

positive territory in January, only San Francisco and Miami declined

noticeably more than the national average, falling 6.4% and 5.4%

respectively.

The IAS360 House Price Index is a comprehensive housing index tracking

monthly change in the median sales price of detached single-family

residences across the U.S. The index, based on all arms-length

transactions, tracks data of 15,000 "neighborhoods," which is rolled-up to

report on the changes in 360 counties, nine census divisions, four regions,

and the nation overall. The IAS360 House Price Index is delivered on a

monthly basis.

Leveraging real time data and nationwide resources, Integrated Asset

Services' high-tech and high-touch product lines, (www.iasreo.com/iseries.html),

offer an unmatched level of detail in a rapidly changing housing

environment. IAS reports on "neighborhood" level house price trends,

residential market climate and collateral valuation. Integrated Asset

Services also provides traditional valuation products and full service REO Management and Disposition.

Editor's Note: Additional IAS360 data, charts and

interviews are available upon request. Data for full year 2008, since the

peak of 2006 at levels from national to MSA to neighborhood level are

available.

About Integrated Asset Services, LLC

IAS (www.iasreo.com) is a privately-held Colorado-based corporation

specializing in default mortgage services including valuation,

reconciliation and full cycle REO disposition. The Company's advanced

valuation and volatility technology combined with its expert professional

services help its clients reduce exposure while expediting the entire asset

management process. Founded by REO industry experts, IAS provides services

that go beyond industry expectations; from the level of integrity of its

employees to the measurably better service it routinely provides.

This press release contains various forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 regarding

future results of operations and market opportunities that are based on

IntelliReal and IAS' current expectations, assumptions, estimates and

projections about the company and its industry. Investors are cautioned

that actual results could differ materially from those anticipated by the

forward-looking statements as a result of the success of IAS' branding and

consumer awareness campaign and other marketing efforts; competition from

existing and potential competitors; and IAS's ability to continue to

develop and integrate new products, services and technologies. Due to the

timeliness of the data, the IAS360 House Price Index is subject to

revisions on a monthly basis.