SAN FRANCISCO, CA and NEW YORK, NY--(Marketwire - Apr 17, 2012) - Consumers are becoming more engaged in their healthcare and they want to be financially rewarded for their efforts, according to healthcare investment firm Psilos Group. The firm's 2012 Healthcare Economics & Innovation Outlook, which investigated emerging trends in consumer engagement, also found that incentive programs and personalization are critical factors for enticing consumers to be more active in the day-to-day management of their health and wellness, and lowering the overall cost burden.

To date, incentives to promote wellness and prevention have not been tightly connected to consumer-focused health benefit plans. If used at all, they have been more of an afterthought or part of programs operated outside of the health insurance plan. A key finding of the Psilos 2012 Outlook is that wellness incentives, if properly integrated with health benefit plans, can play a critical role in solving today's healthcare crisis.

The 2012 Healthcare Economics & Innovation Outlook was substantiated by a survey, completed in February 2012, and includes responses from 329 healthcare consumers, 25 years of age and older. The 2012 Healthcare Economics & Innovation Outlook is one of the first to shine a light on consumers and their role in the fast-changing healthcare system, especially in the wake of healthcare reform. Though the Patient Protection and Affordable Care Act (PPACA) is now facing a challenge in the Supreme Court, it is clear that personal engagement must be a hallmark of all future healthcare plans and that individuals must take a more proactive role in their personal well‐being if the goals of cost-effectiveness and improved quality are to be achieved.

In the United States, annual healthcare spending now totals $2.6 trillion or $8,402 for every citizen. Despite the uncertainty surrounding PPACA, insurance companies, hospitals and doctors are reshaping their policies and practices to match the new realities of a national economy crushed by healthcare costs and the looming imperatives of healthcare reform. For instance, health insurance companies such as UnitedHealth Group ("UHG"), Humana, Inc. and others are migrating from systems where they pay doctors simply for providing services like office visits or diagnostic tests. Instead, these firms are beginning to compensate their network providers based on performance, offering higher payments for better patient outcomes.

Consumers Take Center Stage

And what of consumers? What if they too were rewarded for leading healthier lives and achieving better outcomes? Historically, consumers have been largely absent from the healthcare discussion. But that's about to change due to a number of convergent factors. First is the devastating human and financial toll of chronic illness. The Centers for Disease Control and Prevention estimates that 50 percent of Americans over 18 have one or more chronic illness. Among respondents to the 2012 Healthcare Economics & Innovation Outlook, 24 percent reported they have been diagnosed with a chronic illness, and another 30.1 percent reported they have a family member with a chronic illness.

The implosion of the national economy is also making it more difficult for consumers -- and their employers -- to ignore the cost of health insurance or the cost of poor health. Indeed, the average cost of an employer‐based family insurance policy is now $15,073, close to the annual earnings of a full-time minimum wage worker, according to the Kaiser Family Foundation. What's more, healthcare costs overall have increased 113 percent over the last 10 years, but employee premiums have risen 134 percent. That represents a major cost shift to individuals. Consumers are becoming restless as a bigger and bigger chunk of their paycheck gets swallowed up by health insurance, and this is driving them to action.

Health insurance reform is also putting the spotlight on consumers and encouraging them to take greater personal and financial accountability for their own health. In fact, the new healthcare law requires that most people buy health insurance by 2014 or pay a tax penalty. In particular, the advent of health insurance exchanges (HIX) -- a key element of health reform -- will usher in a new era in which consumers shop for policies in the same way they buy a car, comparing the prices, benefits and performance of many different health plans. And many will do this on their own, without their employers as intermediaries. In fact, it is estimated that somewhere between 30 and 100 million people will directly purchase their health insurance from a HIX within the next several years. Many believe that HIX's will become the dominant method of purchasing health insurance regardless of whether the PPACA law stands. Already large U.S. corporations are engaging private HIX programs as a means of stepping away from the responsibility of health benefit administration and significantly reducing costs to both beneficiaries and corporate treasuries.

Finally, though it is still evolving, technology is starting to have a profound impact on healthcare. The widespread availability of sensors and smart phones, augmented by the runaway adoption of social media, has made it far more feasible to effectively engage consumers in a cost-effective and widespread manner. This new wave of technology is allowing consumers to track and measure their health data over the short- and long-term and, for those who are motivated, make positive, healthy changes in their daily lives.

Consumers More Engaged in Healthcare

The impact of these converging events was evident in the 2012 Healthcare Economics & Innovation Outlook. When asked if they have become more concerned and/or involved in their own healthcare, 30.1 percent of respondents stated they that have become more engaged over the last 12 months.

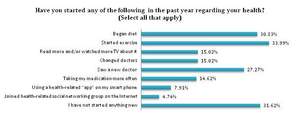

For many people, engagement has translated into direct action. Within the past year, respondents have made changes to their health by starting a new exercise regime (34.0%), beginning to diet (30.8%), or by seeing a new doctor (27.3%). Other common health changes include: reading more or watching more TV programming about health (15.0%), changing doctors (15.0%) and taking medications more often (14.6%). In contrast, some 31.6 percent revealed that they have not started anything new.

Not surprisingly, the 2012 Healthcare Economics & Innovation Outlook found that illness was the number one reason why consumers became more engaged in their healthcare. Some 21.9 percent of respondents stated that they became more concerned and involved with their healthcare in the past year after being diagnosed with a health issue. Another big motivating factor was the influence of family and friends (11.5%) encouraging their loved ones to take action.

The fact that more consumers are actively engaging in their healthcare is positive news because action is often the key to prevention. It is widely understood that if consumers engage earlier in the onset of an illness, they have the opportunity to prevent many of their health problems in the first place. And prevention, of course, is crucial to eliminating conditions that exacerbate chronic illness and which otherwise lead to increased healthcare costs. For instance, in the report The United States of Diabetes, United Health states that through identification of individuals with pre-diabetes and their subsequent enrollment in the lifestyle intervention pioneered by the Diabetes Prevention Program, the United States could achieve a net savings of $105 billion and reduce the number of individuals who move from pre-diabetes to type 2 diabetes by 3 million by the end of the decade.

More Work to Be Done

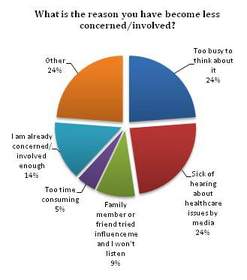

Indeed, there is a growing need for consumers to be more engaged than ever in light of the shifting cost burden of healthcare. And, while progress has been made, the 2012 Healthcare Economics & Innovation Outlook also found that there is still much more work that needs to be done. Some 38.1 percent of respondents stated that they have not become any more concerned or involved in their health in the last year. And 6.4 percent have even become less concerned or involved in the last 12 months, which suggests that the consumer engagement message is not always being received. Among those people, 23.8 percent stated they were too busy to think about their health, and another 23.8 percent said they were sick and tired of hearing about healthcare issues in the media.

It is clear that patient engagement has not had the widespread impact that healthcare professionals know is necessary to change the increasing trajectory of chronic illness and the associated costs. Patients need to learn to proactively think about and manage their own care, but, as the 2012 Healthcare Economics & Innovation Outlook suggests, a significant number haven't yet. Many believe that this is, in part, a function of disconnected incentives -- most consumers get health insurance from their employers, and they simply don't realize how much of their compensation goes towards the payment of health. Among 2012 Healthcare Economics & Innovation Outlook respondents, only 14 percent purchased insurance on their own, without any assistance from an employer or the government.

But, as consumers begin to actively engage in the market of buying health insurance through HIXs, instead of passively receiving health insurance from their employers, they will become far more aware of the impact healthcare costs have on their own pocketbooks. And, once they have that awareness, it is likely that consumer engagement in health and wellness will increase exponentially. Early experiments in consumer-directed health plans, such as those originally brought to market by Definity Health, Inc., demonstrated such impacts in the form of increased use of lower cost generic drugs and fewer unnecessary office visits. With greater buying power and financial responsibility in the hands of the consumer, it is anticipated that greater value-based health care purchasing behavior will result.

Incentives Are Key to Engagement

It is evident from the 2012 Healthcare Economics & Innovation Outlook data that one of the cost-effective ways to engage consumers in their health and keep them engaged is through financial incentives. It is human nature for people to respond positively to rewards and incentives, and these incentives need to become more prevalent, more consistent, and more personalized in the healthcare industry if they are to have a long-term impact. This fact was clearly reflected in the 2012 Healthcare Economics & Innovation Outlook, with 65.4 percent of respondents saying that health care insurers should reduce their premiums if they take actions to improve their health. Additionally, 49.9 percent of respondents believe that employers should pay employees an incentive if they take steps to improve their health.

Increasingly, rewards and incentives are a primary way to achieve engagement. Despite the fact that incentive programs are still fairly new to the healthcare system and most are not well integrated with the health benefit, a significant number of respondents (20.1%) said that a potential reduction in healthcare costs or incentives from a new health plan were motivators for becoming more engaged in their healthcare.

Providing consumers with financial incentives to lose weight, quit smoking, lower blood pressure, reduce pre-diabetes indicators, or engage in other healthy behaviors is steadily becoming the norm. Many corporations have dabbled with various financial incentives for healthy behavior, although most of these have been short-term in nature. The PPACA, for example, goes much further by allowing employers to reward healthy employees with up to a 30 percent discount on their health premiums. It also leaves open the possibility for the discount to rise to 50 percent.

The Rise of Value-Based Health Plans

Companies like Safeway and Wal-Mart are championing health plans that reward healthy behaviors. Safeway employees, for instance, pay premiums based on things like tobacco usage, weight, blood pressure, and cholesterol levels. They are screened for these four measures and receive a discount for each test they pass. At Wal-Mart, workers who use tobacco are charged more for coverage due to their rising healthcare costs.

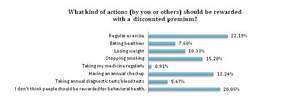

Though some respondents to the Psilos 2012 Outlook were turned off by these tactics -- with 20 percent stating that people should not be rewarded for behavioral health changes -- the majority felt differently. When asked what kind of actions should be rewarded with a discounted premium, 22.2 percent of respondents said regular exercise. Other rewarded activities include: having annual check-ups (18.5%), stopping smoking (15.2%), losing weight (10.3%), eating healthier (7.6%) and taking annual diagnostic tests/blood tests (5.5%).

These results point to the rising importance of value-based health plans that reward consumers for healthy habits. One such provider is SeeChange Health, the first independent value-based health insurance company in the U.S. SeeChange offers personalized health plans that provide financial and other incentives to encourage individuals to play an active role in their health management and improve their quality of life. SeeChange members, who complete a health questionnaire along with annual biometric testing, including cancer screenings and basic lab tests, are rewarded with enhanced benefits such as reduced coinsurance and deductibles along with cash rewards. For those who are identified as having or who are at risk of developing a chronic illness, such as diabetes, congestive heart failure or asthma, ongoing financial incentives are provided in the form of further increases in benefit. For many, 100 percent of the care provided to prevent or effectively manage their chronic illness is covered at no out-of-pocket cost to the consumer. The concept is not to provide coverage only to healthy people, but to encourage healthy behaviors among all people enrolled in value-based plans, regardless of their initial health status at enrollment.

Some argue that wellness incentives fall short because when the incentive stops, old behaviors return. For instance, in a study by Carnegie Mellon University, obese U.S. military veterans were paid to lose a pound per week for 24 weeks. Two months after the incentives ended, the vets had gained back all the weight. But that's precisely why long-term and consistent incentives have to be deeply integrated into health plans, and can't just be a sideshow or afterthought.

"My belief is that you have to provide a financial incentive forever. As soon as the financial piece goes away so does the behavior," says Martin Watson, CEO of SeeChange Health. "I am of the opinion that, in the not too distant future, we will have to pay people for every pill they take, as long as they are working to keep themselves healthier over the long term."

The SeeChange approach makes good sense. After all, one of the most alarming causes of skyrocketing health costs is people not taking their medicine. One-third to one-half of all patients doesn't take medication as prescribed, according to research by the New England Healthcare Institute. And those patients often get sicker, resulting in an estimated $290 billion in avoidable medical spending every year, including unnecessary hospitalizations. Innovative players like SeeChange realize that by paying modest financial incentives up front and over the long term, they can avoid the much larger costs of non-compliance and hospitalization down the road.

Making Personalized Medicine Truly Personal

Another key to patient engagement in the age of consumer-focused healthcare is personalization. Today, personalized medicine has come to mean designer drugs for people with certain genetic profiles. But personalized medicine must go beyond the borders of drug development and into healthcare as a whole. Why? Because the consumerization of healthcare will take many forms depending on a person's health status, age, technical literacy, and personal and financial motivation.

The 2012 Healthcare Economics & Innovation Outlook clearly pointed to the need for more personalization. For instance, when asked if they have started any new behaviors regarding their health in the past year, just 7.9 percent of all respondents said they used a health-related app on a smartphone. But among respondents aged 18 to 35, more than 17 percent had used a health-related app. That's a significant difference between age groups.

The point is that you have to meet consumers where they live. You have to personalize the healthcare experience to their particular wants, needs, and demographics. One company that is doing just that is Click4Care. The company delivers a software platform around chronic care management programs that enable care managers to engage with consumers by phone, in person, via email, or through their provider or whatever means necessary to maximize engagement and optimize care and wellness.

"Radical change in the healthcare industry is underway," says Rob Gillette, CEO of Click4Care. "Social, regulatory and economic influences on healthcare have finally come together to create demand for a healthcare system where costs are reduced and care is optimized for every member. In this era of unprecedented change, healthcare organizations now realize they must leverage new technology to provide the innovation and personalization that healthcare consumers demand."

The healthcare industry is heading into a period of major disruption. Even if the U.S. Supreme Court strikes down the PPACA, the economic stress that healthcare has placed on our system ensures that the way Americans receive and pay for medical services is never going back to the way it was. But with change comes opportunity. There is currently a tremendous opportunity to engage consumers in a meaningful way about their healthcare needs, and keep them engaged. It's not just a matter of doctors trying to convince patients to get more involved in their health. It's a matter of driving consumers to take control themselves, and giving them the tools to stay effectively in control, through a combination of financial incentives, personalization, and technology tools that allow them to actively engage in the business of managing their own health.

About the 2012 Healthcare Economics & Innovation Outlook

This 2012 Healthcare Economics & Innovation Outlook was fielded in February 2012 by Survey Sampling International, the world's leading provider of sampling, data collection and data analytic solutions for survey research. Results include responses from 329 respondents who opted-in from a nationwide U.S. panel. Respondents were 25 years and older. Of the respondents, 79.6 percent had health insurance, and 20.4 percent did not. The 2012 Healthcare Economics & Innovation Outlook asked respondents to answer a number of questions relating to their healthcare, including how concerned/involved they have become in the last 12 months; why they have become more involved or less involved in their healthcare; and whether they believe healthcare insurers and employers should provide incentives to those who take action to improve their health. For more information on the methodology of the 2012 Healthcare Economics & Innovation Outlook, contact: Rob Wyse; 212 920 1470; Rob@WT221.com.

About Psilos Group

Psilos Group Managers, LLC ("Psilos") is a healthcare investment firm focused on providing venture and growth capital to companies operating in the healthcare economy. The firm believes that successful healthcare innovation must reduce cost, improve quality, and align incentives across payers, providers and patients. Founded in 1998, Psilos has $580 million under management and invests across three core healthcare sectors: healthcare services, healthcare information technology and medical technology. Funds managed by Psilos have invested in companies such as ActiveHealth, AngioScore, Definity Health, Extend Health, HealthEdge, OmniGuide, SeeChange Health and VeraLight, among many others, which have played, and continue to play, key roles in the transformation of the U.S. healthcare economy. Psilos has offices in New York, the San Francisco Bay Area, and in Santa Fe, New Mexico. For more information, go to www.psilos.com.

EDITOR'S NOTE: This paper is the fourth Annual Outlook published by healthcare investment firm Psilos Group. The Psilos Annual Outlook is intended to provide investors, analysts, businesses, and policymakers with a guide to the issues and trends that will shape healthcare investing in 2012 and beyond. Since 1998, Psilos has fueled the development of healthcare companies, driving innovations that reduce cost, improve quality, and align incentives across payers, providers, and patients.

Contact Information:

Jennifer Jones

650-529-1416