PALO ALTO, Calif., July 26, 2022 (GLOBE NEWSWIRE) -- With the red flags for detecting financial crime scattered across vast, disparate stores of data, the emerging field of "name science" is crucial for preventing global money laundering and fraud. Quantifind's Graphyte platform aids Tier 1 financial institutions with its leading name science algorithms and a patented distributed query and storage engine that automates investigations, reducing false negatives and positives and increasing efficiency by more than 40%.

Banks' efforts to prevent financial crimes rely on transaction analysis, which has been facilitated by advances in machine learning. However, banks' investigations also depend on the context provided by external data from sources like regulatory proceedings, company data and enforcement actions, as well as non-standard and unstructured items like online news and the famous Panama Papers.

Interpreting that data is a painstaking and laborious process, and even with large investigative teams, the work can cause alert backlogs, delayed onboardings and surveillance gaps. Financial institutions' anti-money laundering (AML) and know-your-customer (KYC) costs are growing 20% annually, leading them to explore artificial intelligence solutions for analyzing contextual data.

That makes "name science" foundational to AML and fraud investigations. Banks need to be able to quickly and accurately conduct "contextual monitoring" - ensuring that when they find data linked to a person's name, that name is the person in question. They also must be sure that the data is relevant to the context of the investigation, in order to assess risk.

Being able to automate the process with precision reduces false positives and negatives, saving teams time and money and allowing them to spend time on the most high-risk cases. Automation and better alignment of staff increases efficiency by 40%, Quantifind found.

"Applying name science through machine learning can enhance financial institutions' ability to detect and prevent financial crimes, and help them reduce costs at the same time," said Quantifind CEO Ari Tuchman. "There are opportunities to improve and streamline the entire KYC/AML workflow, from screening, onboarding, due diligence, and surveillance, to alerts triage and investigations."

A closer look at names and name science demonstrates the need for powerful search algorithms. Only 20% of the 7.85 billion people on earth possess a unique name; 40% share a name with at least 100 other people. In the United States, some 3,000 people share the name "Michael Hamilton" and worldwide, 730,000 have the name "Maria Garcia." In India, 280,000 go by "Vijay Singh," while in China, 2.8 million people go by the name "Wang Yan."

And where modern languages follow relatively consistent rules of spelling and grammar, names follow fragmented sets of rules that differ geographically and change over time. With naming structures, conventions and standards driven by culture and society, it is extremely difficult to analyze and interpret names manually.

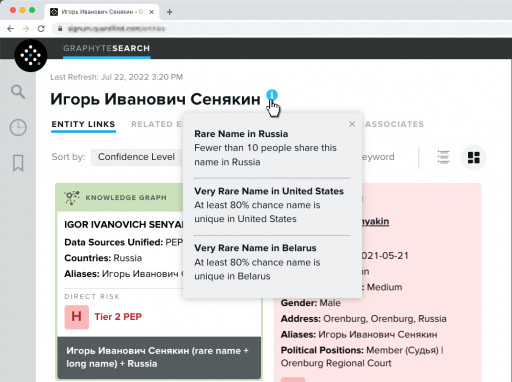

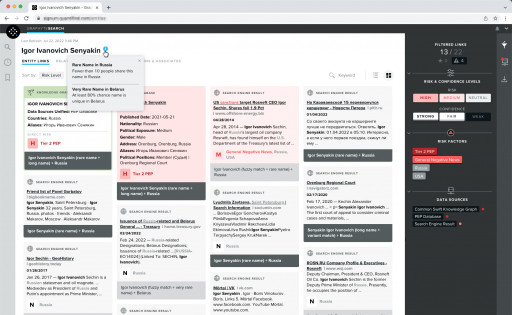

Quantifind's Graphyte platform understands names as data and is built to leverage these factors to derive better insights and information, Tuchman said. For example, Graphyte understands linguistic groups and applies that data-driven ability to processes like global name parsing, breaking a name into its components. It employs phonetic algorithms to assess variations in how a name is spelled. It also utilizes associated metadata like birth year, location or employer in the name-entity linking process.

Quantifind couples its best-in-class name science with algorithms that perform relationship analysis, looking for links between known bad actors, and that assess the assigned risk, essential aspects for AML and KYC investigations.

Graphyte's "Real Time Cluster" (RTC) is a purpose-built distributed query and storage engine that implements name science for speed and scale, giving it the ability to rapidly search billions of documents in real time. The RTC is the core of Quantifind's patented in-memory data management techniques, optimized for efficient storage, search, and retrieval across disparate unstructured data sources - the result of years of research and testing.

"We've developed these technologies through more than a decade of R&D and partnership with U.S. government agencies and Fortune 500 companies, making Graphyte purpose-built for AML investigation teams," Tuchman said.

For more information regarding Quantifind's AI-powered platform, please visit https://www.quantifind.com/.

About Quantifind

Quantifind is a data science technology company whose AI platform uncovers signals of risk across disparate and unstructured text sources. In financial crimes risk management, Quantifind's solution uniquely combines internal financial institution data with public domain data to assess risk in the context of Know Your Customer (KYC), Customer Due Diligence (CDD), Fraud Risk Management, and Anti-Money Laundering (AML) processes. Today these compliance processes are burdened by ever-increasing regulatory responsibilities and an expectation of frictionless transactions. Legacy technologies demand increasingly more human resources as the operations expand; Quantifind's solution offers a way to cut through the inefficiency and enhance effectiveness simultaneously.

Contact Information

Mike Albanese

mike.albanese@newswire.com

Related Images

Image 1: Quantifind

Quantifind

Image 2: Quantifind

Quantifind

Image 3: Quantifind

Quantifind

This content was issued through the press release distribution service at Newswire.com.

Attachment