Dublin, Nov. 17, 2023 (GLOBE NEWSWIRE) -- The "Global Monitoring Tools Market Size, Share & Industry Trends Analysis Report and Forecast, 2023 - 2030" report has been added to ResearchAndMarkets.com's offering.

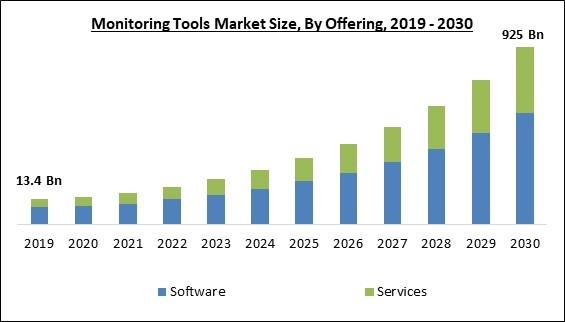

The Global Monitoring Tools Market size is expected to reach $92.5 billion by 2030, rising at a market growth of 21.4% CAGR during the forecast period.

Due to the growing complexity and demands of the healthcare sector, monitoring tools have become indispensable for ensuring efficient patient care delivery, optimizing processes, and maximizing overall operational effectiveness. Hence, the healthcare and life sciences segment would showcase 1/5th share in the market by 2030. Monitoring tools in this industry comprise many solutions and technologies created to monitor multiple aspects of healthcare and life sciences, including patient health, medical devices, drug development, and clinical trials. In the healthcare sector, monitoring tools measure vital signs including heart rate, blood pressure, and oxygen saturation, providing real-time data for accurate diagnosis and treatment decisions.

Market Growth Factors

Rising demand for real-time analytics

Organizations rely significantly on their IT systems to drive operations, provide services, and maintain the satisfaction of customers in the modern business landscape. The capacity to continuously monitor systems and applications has given rise to real-time monitoring, which makes it possible to identify and fix problems before they have a chance to create major disruptions. In several ways, real-time monitoring meets the needs of businesses. It enables proactive issue detection, enabling organizations to identify potential bottlenecks, system failures, or security vulnerabilities in real-time.

Untapped potential in emerging markets

Significant opportunities exist for the market for monitoring tools due to the introduction of new markets and untapped potential in developing regions. As developing regions experience rapid economic development and technological advancements, businesses are adopting digital solutions to drive operations and increase productivity. Business digital transformation is frequently in its infancy in emerging markets and developing regions. They may be transitioning from manual or conventional processes to digital systems, making it imperative that comprehensive monitoring tools be in place.

Market Restraining Factors

Substantial implementation and maintenance expenses

High implementation and maintenance costs describe the expenditures connected with the initial setup and continuous maintenance of a specific system, procedure, or technology within a business. This limitation may significantly impact a corporation's financial resources and general profitability. Implementing new technologies or systems often requires substantial investments in hardware, software, training, and integration with the existing infrastructure.

Type Outlook

Based on type, the market is categorized into infrastructure monitoring, application performance monitoring (APM), security monitoring, and end-user experience monitoring tools. In 2022, application performance monitoring (APM) segment recorded a remarkable revenue share in the market. Application discovery and dependency mapping (ADDM), which locates all servers and apps while notifying users and automating threat response procedures, is made easier with the help of APM. It provides a personalized dashboard and facilitates reporting.

Offering Outlook

By offering, the market is fragmented into software and services. The services segment covered a considerable revenue share in the market in 2022. The services component plays a critical role in infrastructure monitoring. The responsibilities covered by the services span a wide variety of activities that facilitate the established use and maintenance of monitoring systems. Service specialists ensure the system is properly configured, calibrated, and integrated for precise data collection. These monitoring services can enhance operator asset management, safety, and productivity.

Vertical Outlook

By vertical, the market is fragmented into BFSI, retail & ecommerce, healthcare & life Sciences, IT & ITeS, media & entertainment, manufacturing, automotive, transportation & logistics, telecommunications, and others. The BFSI segment acquired a substantial growth rate in the market in 2022. Monitoring tools play a crucial role in the Banking, Financial Services, and Insurance (BFSI) sector by providing real-time insights, security enhancements, compliance adherence, and operational efficiency. Monitoring tools track the performance and compliance of third-party vendors providing services to the BFSI sector.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. North America has significantly influenced the development and expansion of the market for monitoring tools. Monitoring technologies have significantly increased across many industries in North America in recent years. With corporations heavily investing in cutting-edge monitoring solutions to optimize their IT infrastructure, the region's IT sector, particularly the United States and Canada, has been at the forefront of this growth. Due to the growing popularity of cloud services and the growing need to protect digital assets from cyber threats, cloud and security monitoring have gained traction.

Partnerships, Collaborations and Agreements:

- May-2023: IBM Corporation signed a partnership with NASA, a US space agency responsible for space exploration, space technology, Earth and space science, and aeronautics research. Through this partnership, both organizations are planning to create a geospatial foundation model to track natural disasters and climate change using AI technology. In addition, this strategy would make geospatial analysis even faster and help to predict the climate-related risks to crops, buildings, and other infrastructure.

- May-2023: Splunk, Inc. partnered with Tenable, a cybersecurity company and creator of the vulnerability scanning software Nessus. Through this partnership, both companies would provide better guidance to the security teams to detect the flaws and debug them by taking quick actions. Moreover, this partnership would help the enterprises to reduce business risk by providing productive management capacities.

Product Launches and Product Expansions:

- Jun-2023: Amazon Web Services, Inc. announced the launch of AWS AppFabric, a completely managed service for the collection of security data across SaaS applications to make better observability. With AWS AppFabric customers can easily combine Saas applications without creating and making custom code or point-to-point integrations, As Saas applications are permitted and attached the AppFabric ingests the data and makes it simple user activity logs.

Acquisitions and Mergers:

- Jul-2023: Dynatrace, Inc. is acquiring Rookout, a software development company that provides observability platforms to collect data, traces, and logs, etc. Through this acquisition, Dynatrace would be able to provide expanded code-level observability in manufacturing operations. Moreover, this will also attach engagement and command to rectify the problems in the production environments.

- Jun-2023: Cisco Systems, Inc. is acquiring Accedian Networks, a company providing performance analytics and user experience solutions. Through this acquisition, Accedian's experienced network performance and user experience monitoring technologies will be added to Cisco Systems. Moreover, both companies would jointly offer the powerful Analytics platform, for better deployment of network services, spot performance problems, and resolve the problems.

- Jun-2023: Cisco Systems, Inc. signed an agreement to acquire SamKnows, a provider of internet performance solutions that works alongside governments, consumers, ISPs, and manufacturers. Through this acquisition, Cisco aimed to empower its network intelligence firm ThousandEyes by adding SamKnows' technologies and entire infrastructure.

Scope of the Study

By Offering

- Software

- On-premise

- Cloud

- Services

By Type

- Infrastructure Monitoring

- Network Monitoring

- Storage Monitoring

- Server Monitoring

- Cloud Infrastructure Monitoring

- Application Performance Monitoring

- Database Monitoring

- Web Application Monitoring

- Mobile Application Monitoring

- Code-Level Monitoring

- Security Monitoring

- Log Monitoring & Analysis

- Intrusion Detection & Prevention Systems

- Vulnerability Assessment, Management & Others

- End-User Experience Monitoring Tools

- Synthetic Monitoring

- Real User Monitoring

Key Market Players

- Microsoft

- Amazon Web Services

- IBM

- Cisco Systems

- Dynatrace

- Splunk

- SolarWinds

- Nagios Enterprises

- Paessler

For more information about this report visit https://www.researchandmarkets.com/r/qwooei

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment