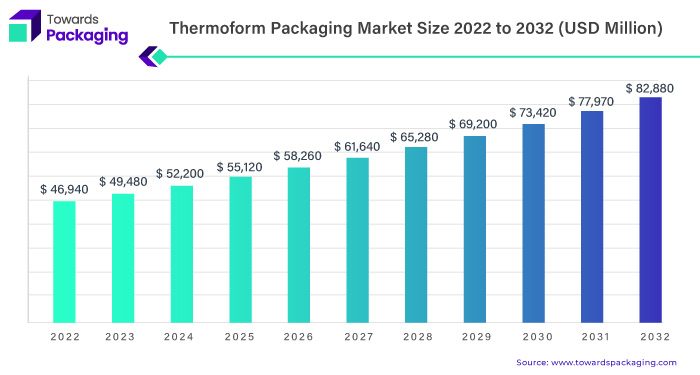

Ottawa, Jan. 05, 2024 (GLOBE NEWSWIRE) -- The global thermoform packaging market size stood at USD 49,480 million in 2023, grew to USD 52,200 million in 2024, and is expanding at a CAGR of 5.9% between 2023 and 2032.

Report Highlights: Important Revelations

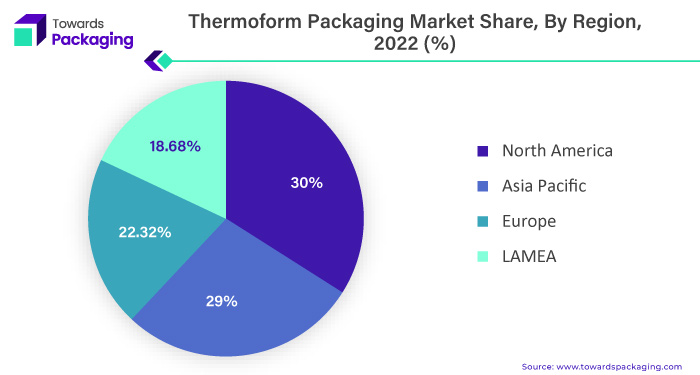

- North America's strategic stance in thermoform packaging market evolution by 30%.

- Asia Pacific emerges as a key player in thermoform packaging to reach an estimated 29%.

- Innovations driving pet thermoform packaging evolution.

- Dynamics of food packaging in the thermoform packaging market.

The thermoform packaging market is a thriving segment within the broader packaging industry, characterized by utilizing a specialized manufacturing process known as thermoforming. A plastic sheet is heated to a malleable forming temperature, shaped inside a mould, and then cooled to produce the finished product. The market encompasses a diverse range of packaging solutions, including blister packs, clamshells, trays, and various containers, catering to the needs of food and beverage, pharmaceuticals, electronics, and retail industries. One of the key drivers of the thermoform packaging market is its adaptability and versatility. Thermoforming allows the creation of custom-designed packaging with a wide range of plastic materials, such as polyethene, polypropylene, and polystyrene. This flexibility makes it a preferred choice for manufacturers looking to achieve specific design requirements and ensure product visibility. Furthermore, the ability to integrate advanced technologies, such as robotics and automation, has enhanced the thermoforming process's precision, speed, and efficiency, contributing to the market's growth.

For the Short Version of this Report - https://www.towardspackaging.com/personalized-scope/5089

The market has recently witnessed a trend towards sustainability and lightweight packaging. With increasing awareness of environmental concerns, thermoform packaging manufacturers are exploring eco-friendly materials and adopting practices that minimize the environmental impact of their products. The European plastics industry has goals and strategies to support the plastics industry, including developing novel solutions for packaging procedures. Up to 60% more plastic recycling and reusing are the goals of new solutions through 2030.

Moreover, the thermoform packaging market is characterized by ongoing innovations in design and graphics. Advanced tools and technologies, including 3D modelling and virtual prototyping, are being employed to create visually appealing and functional packaging solutions. This emphasis on design enhances the aesthetic appeal of products and contributes to brand differentiation in a competitive market landscape. As the demand for efficient and visually appealing packaging solutions grows across various industries, the thermoform packaging market is poised for further expansion, driven by technological advancements, sustainability considerations, and the continual pursuit of enhanced packaging design and functionality.

Thermoform Packaging Market Trends

| Trends | |

| Robotics Integration for Efficiency | The thermoform packaging industry is witnessing a notable trend towards integrating robotics and automation. Companies are increasingly adopting robotic systems in various stages of the thermoforming process, from material handling to packaging assembly. This enhances operational efficiency and ensures precision and consistency in the production of thermoformed packaging. Robotics is particularly valuable in tasks requiring high repeatability and speed, contributing to cost-effectiveness and improved production workflows. |

| Inventory Control Optimization | In response to the dynamic market demands, thermoform packaging companies optimize inventory control through advanced technologies. Implementing sophisticated inventory management systems enables better control over raw materials and finished goods, reducing waste, and ensuring timely production. This trend emphasizes the importance of real-time data analytics and intelligent inventory tracking systems to streamline supply chain processes and respond promptly to market fluctuations, enhancing business agility and competitiveness. |

| Improved Tools in Packaging Design and Graphics | Thermoform packaging design is evolving with the integration of advanced tools and technologies. Designers leverage innovative tools from 3D modelling to virtual prototyping to create visually appealing and functional packaging solutions. Enhanced graphics and printing technologies further contribute to brand differentiation and consumer engagement. This trend signifies a shift towards more collaborative and creative design processes, enabling companies to deliver customized and aesthetically pleasing thermoformed packaging solutions that align with evolving market preferences |

| Lightweight Packaging and Sustainability Focus | Sustainability is a critical driver in the thermoform packaging market, leading to a significant trend towards lightweight materials and eco-friendly practices. Manufacturers are exploring alternative materials with reduced environmental impact while maintaining the integrity and functionality of packaging. This shift aligns with consumer preferences for sustainable products and contributes to companies meeting their corporate social responsibility goals. As sustainability becomes a more significant factor in purchasing decisions, thermoform packaging businesses are adopting practices prioritizing environmental responsibility, including recycling initiatives and developing biodegradable packaging options. |

Customize this study as per your requirement @ https://www.towardspackaging.com/customization/5089

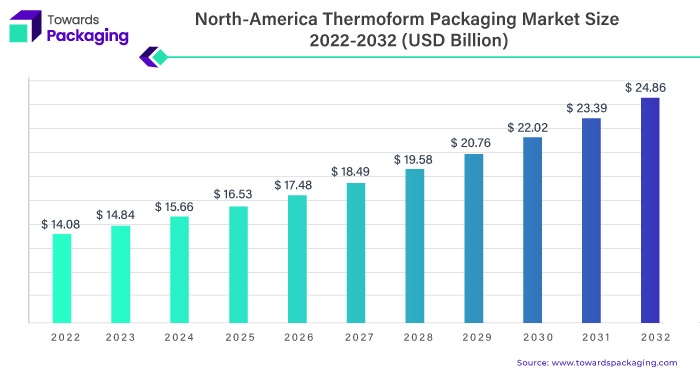

North America's Strategic Stance in Thermoform Packaging Market Evolution

North America emerges as a stronghold in the ever-evolving landscape of thermoform packaging, playing a pivotal role as a primary end market for thermoforms. The packaging sector within the region has become a dynamic arena, constantly shaped by factors such as changing retail environments, an increased emphasis on health and safety precautions, and, most significantly, the ever-changing preferences of consumers. In response, the thermoform packaging industry in North America has undergone substantial technical evolution, continually adapting packaging designs and materials to meet the market's evolving needs while providing enduring value to consumers.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Despite its relatively modest footprint within the plastics processing sector, North America has witnessed remarkable strides in the thermoforming process. Tooling, machinery, and materials improvements have transformed thermoforming into a viable alternative for applications that might have been overlooked. This transformation underscores the industry's commitment to innovation and its determination to deliver value by staying responsive to consumer demands. Flexpak holds the 81st position in Plastics News' North American thermoforms ranking, reporting sales amounting to $11 million. Nelipak secures the 42nd spot on the list, with estimated sales in North America reaching $30 million.

A notable trend amplifying North America's influence is the resurgence of manufacturing, known as reshoring. The United States, in particular, is experiencing a revival in manufacturing activities, with work returning to the region from Asia. This reshoring phenomenon significantly impacts the thermoform packaging market, contributing to its growth and dynamics. A prime example is Direct Pack, Inc. (DPI), a sustainability-focused leader in thermoformed plastic packaging, expanding its North American manufacturing operations with the opening of Direct Pack Baja in Mexicali, Mexico. This strategic move positions the company to better serve its North American customer base by providing products manufactured in the region, enhancing resilience in the face of current global supply chain challenges. The expansion exemplifies the industry's adaptability and responsiveness to market demands, reinforcing North America's pivotal role in the evolution of thermoform packaging.

For Instance,

- In July 2021, Ecoflex mono-material was launched by North America's AR Packaging for thermoformed applications.

The Asia Pacific region has witnessed a remarkable ascent as a prominent player in the thermoform packaging market, showcasing substantial growth and a burgeoning market presence. The region's economic dynamism, burgeoning population, and evolving consumer preferences have fueled the demand for advanced packaging solutions, driving the adoption of thermoform packaging methodologies. China, in particular, is spearheading advancements in packaging technologies and embracing sustainable material science, thereby elevating the standards within the region.

The Asia Pacific thermoform packaging market has experienced significant expansion in recent years, fueled by increased industrialization, urbanization, and a robust manufacturing sector. The demand for diverse and innovative packaging solutions, especially in the food and healthcare industries, has driven the adoption of thermoformed packaging technologies. Moreover, the region's responsiveness to global sustainability trends has led to a growing emphasis on eco-friendly and recyclable packaging materials, aligning with the broader shift towards environmentally conscious practices.

As the Asia Pacific region embraces modern packaging solutions, it has become a focal point for key industry players and investors seeking strategic opportunities. Countries within the region, such as China and India, are emerging as significant contributors to the thermoform packaging market, leveraging their manufacturing capabilities and expanding consumer markets. While the North American market remains a leader in thermoform packaging, the Asia Pacific region is establishing itself as a formidable second leader, offering market potential, technological advancement, and a growing commitment to sustainable packaging practices. The evolving landscape in the Asia Pacific signifies a dynamic market poised for continued growth and innovation in the thermoform packaging sector.

For Instance,

- In November 2023, Coveris, an Austrian packaging firm, created and introduced MonoFlex Thermoform, a new recyclable thermoforming film packaging solution. The solution aims to provide a sustainable substitute for the conventional, non-recyclable materials used in thermoforming packaging in the food business.

Innovations Driving PET Thermoform Packaging Evolution

The PET thermoform packaging market has ascended as a dominant force on the global stage, driven by the widespread adoption of post-consumer recycled PET in both food and non-food packaging applications. Over the past five years, the momentum in recycling PET thermoforms has gained substantial traction, exemplified by the U.S. achieving a milestone of recycling 139 million pounds of PET thermoform packaging. This underscores the industry's commitment to sustainable practices and circular economy principles.

One of the key factors propelling the prominence of PET thermoforms is their ability to provide higher value at a lower cost, coupled with reduced greenhouse gas emissions compared to alternative packaging materials such as laminated cartons, bagasse (pulp), and paper- and wood-fibre moulded materials. The thin yet durable sidewalls of PET thermoform contribute to material efficiency and result in lightweight packaging. Moreover, these thermoforms are thoughtfully designed with user-friendly features such as easy-to-open and tamper-evident attributes, streamlining the recycling process.

For Instance,

- In January 2021, KPL Cirrus was a new thermoformed lightweight concept by Kingsmoor Packaging. The change, which has been in the works for a year, continues the company's efforts to make its plastic products as recyclable and sustainable as possible.

As an end-user of post-consumer recycled PET, PET thermoforms play a crucial part in sustainable packaging practices. Annually, more than 139 million pounds of post-consumer recycled PET is channelled into producing new thermoforms in the U.S., serving as protective packaging for a diverse range of products, including food items. The PET thermoform market has fostered a comprehensive value chain from package manufacturers and retailers to recycling collectors, Material Recovery Facility (MRF) operators, PET reclaimers, and recycled PET end-users.

The sustainability focus within the PET thermoform industry is further underscored by a remarkable 68% growth in collections for recycling. Reclaimers, representing the majority of U.S. capacity, consistently process PET thermoforms alongside PET bottles, highlighting the industry's commitment to maximizing the use of recycled materials. As the global demand for sustainable packaging solutions intensifies, the PET thermoform market is poised to continue its trajectory of growth and innovation, solidifying its position as a frontrunner in the packaging industry.

PP materials are growing in demand in the market due to their significance and easy availability. The fundamentals of PP, its modifications, and its advancements are demonstrated using a drinking cup. Furthermore, the conversation will cover all significant influences on the properties of PP film and its thermoformability because it covers the various processing settings used in the PP film production process. Over 30 million tonnes of PP are needed globally, with typical annual growth rates of 6% to 7%. Western Europe, North America, and Asia meet seventy per cent of this demand. The three primary industries using these applications are consumer goods, the food sector, and the automobile industry.

Browse More Insights of Towards Packaging:

- The global seafood packaging market size is estimated to grow from USD 13.95 billion in 2022 to reach an estimated USD 24.31 billion by 2032, at a 5.7% CAGR from 2023 to 2032.

- The global glass packaging market size is estimated to grow from USD 60.96 billion in 2022 to reach an estimated USD 98.82 billion by 2032, at a 5% CAGR from 2023 to 2032.

- The global green packaging market size is estimated to grow from USD 303.83 billion in 2022 to reach an estimated USD 510.93 billion by 2032, at a 5.3% CAGR from 2023 to 2032.

- The global pet food packaging market size is estimated to grow from USD 11.38 billion in 2022 to reach an estimated USD 22.08 billion by 2032, at a 6.9% CAGR from 2023 to 2032.

- The global corrugated packaging market size is expected to grow from USD 276 billion in 2022 and it is predicted to hit around USD 410.50 billion by 2032, at 4.10% CAGR from 2023 to 2032.

For Instance,

- In November 2023, iPac, a thermoforming packaging specialist, launched a new innovative and improved packaging range, iZorb, in their sustainable product range.

Dynamics of Food Packaging in the Thermoform Packaging Market

The food and beverage industry stands as a paramount end-user, focusing on delivering consistent and high-quality packaging solutions. Thermoform fill-and-sealing machines play a pivotal role in manufacturing packages, such as cups and bowls, catering specifically to the discerning needs of the food industry. The consumer expectation for reliably superior packaging quality necessitates seamless machinability of the diverse range of films employed in these thermoforming processes. Many plastic films are currently in use, each chosen based on its suitability for specific applications and products. For Instance, the production of yoghurt cups predominantly relies on PET (polyethene terephthalate), PS (polystyrene), and PP (polypropylene) films. These materials are selected for their unique properties that contribute to the packaging's durability, transparency, and overall appeal.

When delicate food products requiring an extended shelf life are in question, using multilayer films becomes imperative. These films incorporate a barrier layer to shield the contents primarily from ambient oxygen. Products such as coffee cream, condensed milk, soups, convenience foods, and baby food benefit from the protective properties of these specialized films, ensuring the preservation of freshness and quality.

For Instance,

- In December 2023, GEA introduced thermoforming technology for products up to 100 mm in height. For processors of diced items, such as hard cheese, this allows for high-capacity packing of goods up to 100 mm high, extending up to 50 mm above the height of the packaging tray.

The thermoform packaging market's dedication to meeting the specific requirements of the food industry underscores its commitment to innovation and adaptability. By continually optimizing the machinability of various plastic films and tailoring packaging solutions to the unique needs of different food products, thermoform packaging remains a critical driver in enhancing the efficiency and quality of food packaging within the broader food and beverage sector of plastic films and the incorporation of advanced packaging technologies ensure that the thermoform packaging market continues to meet and exceed consumer expectations in terms of consistency, quality, and adaptability across a wide array of food products.

For Instance,

- In September 2021, new biocomponents for thermoforming and extrusion were launched by Bio-Fed. The uniform wall thickness profile of the extruded sheets makes thermoforming simple, and their mechanical qualities are on par with traditional plastics.

Competitive Landscape

The market for thermoform packaging marker is characterized by intense competition because there are several key players such as Amcor, Placon Corp., Sonoco Products Company, Dart Container Corp., Pactiv LLC, Tray-Pak Corp., Constantia, Lacerta Group, Inc., D&W Fine Pack, Silgan Holdings, Inc., RPC Group Plc, Rompa Group, Display Pack Inc. and others. This market has a medium level of market concentration, and several major players are present, using tactics such as product innovation, acquisitions, and mergers to obtain a competitive edge. The market players are significantly impacting environmental development by adopting sustainable packaging and creating consumer awareness through innovative packaging materials.

Market Players

- Amcor

- Placon Corp.

- Sonoco Products Company

- Dart Container Corp.

- Pactiv LLC

- Tray-Pak Corp.

- Constantia

- Lacerta Group, Inc.

- D&W Fine Pack

- Silgan Holdings, Inc.

- RPC Group Plc

- Rompa Group

- Display Pack, Inc.

Recent Developments

- In February 2023, the goal of the strategic alliance between ILLIG and Nestle used demonstration cases to promote the use of more environmentally friendly processes in the manufacture of thermoformed plastic packaging.

- In December 2022, At Pharmapack, SÜDPACK Medica showcased an appealing range of products and services. Creating environmentally friendly film solutions is one of the SÜDPACK Group's primary strategic goals. Among its ground-breaking inventions is a thermoforming film made of PP that is used to create blister packaging.

- In August 2021, Fedrigoni purchased 70% of a NewCo that makes gift cases and inner trays for boxes of high-end merchandise out of thermoformed, ecologically friendly cellulose that degrades naturally.

- In October 2021, Reflex packaging, a supplier of eco-friendly thermoformed cushioning, has been acquired by Swedish industrial packaging producer Nefab. Using only 100% recycled plastic, reflex packaging offers high-performance thermoformed cushioning to replace conventional packaging.

- In March 2022, The MULTIVAC Group unveiled the new R3 thermoforming packaging machine, a modular, sustainable, and low-maintenance custom suit for every occasion.

Explore the statistics and insights concerning the packaging industry and its segmentation: Get a Subscription

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal@ https://www.towardshealthcare.com/

Browse our Consulting Website@ https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/