Dublin, Jan. 12, 2024 (GLOBE NEWSWIRE) -- The "Earthmoving Equipment Market Size, Share & Trends Analysis, 2023-2030" report has been added to ResearchAndMarkets.com's offering.

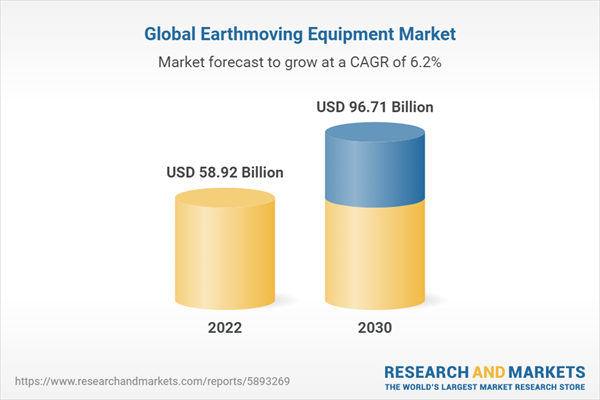

The global earthmoving equipment market is expected to reach USD 96.71 billion by 2030. The market is expected to expand at a CAGR of 6.2% from 2023 to 2030. The global demand for earthmoving equipment is propelled by rapid urbanization and the necessity for modern infrastructure. Governments worldwide are investing substantially in infrastructure projects, including roads, bridges, airports, and railways. For instance, in May 2023, in the U.S. government announced funding of over USD 220 billion for over 32, 000 projects across the U.S. As part of the Investing in America agenda, the administration is rebuilding the bridges & roads, cleaning up legacy pollution, high-speed internet, and replacing lead pipes to provide clean water. Such government initiatives increase the demand for earthmoving equipment in the country. Additionally, the accelerated urbanization and population growth in various regions necessitate the construction of residential and commercial buildings to accommodate the expanding population.

However, the growing popularity of earthmoving equipment rentals presents a significant challenge for Original Equipment Manufacturers (OEMs). Renting provides access to top-notch equipment without significant initial investments, reducing financial risks. Customers prefer flexible rental options that eliminate long-term ownership and maintenance costs. Adapting to these shifting customer preferences is crucial for OEMs to meet evolving market demands. Furthermore, the exorbitant expenses associated with acquiring and upkeeping earthmoving equipment can dissuade potential buyers, particularly Small and Medium-sized Enterprises (SMEs). The industry's capital-intensive nature hampers its expansion and hinders SMEs' access to earthmoving equipment.

Increasing environmental concerns and stricter regulations drive the demand for eco-friendly market. This shift prompts the industry to adopt electric and hybrid-powered equipment, reducing carbon emissions and decreasing noise pollution at construction sites. Manufacturers invest in research and development to improve earthmoving equipment's energy efficiency and sustainability. This trend offers significant opportunities for companies to offer greener alternatives and differentiate themselves in the market. For instance, in February 2023, CNH Industrial N.V. announced an agreement with TOBROCCO-GIANT, a construction equipment company based in the Netherlands. Under the agreement, the TOBROCCO-GIANT's compact and sub-compact wheel loaders will be supplied under CNH Industrial N.V.'s brands: New Holland Construction and CASE Construction Equipment in North America.

Earthmoving Equipment Market Report Highlights

- Amongst the products, loaders segment is expected to register the highest CAGR over the forecast period. The segment includes wheeled, skid-steer loaders, etc. Countries in Asia, Africa, and Latin America are investing heavily in the construction, agriculture, and mining sectors, driving the demand for loaders

- Amongst the engine capacity, up to 250 HP segment is expected to register the highest CAGR over the forecast period. These machines provide the necessary power and versatility to operate in challenging forest environments, improving efficiency and safety

- Amongst the type, the electric segment is anticipated to register the highest CAGR over the forecast period. One of the primary advantages of electric engines is their contribution to environmental sustainability. By replacing ICEs with electric motors, earthmoving equipment can significantly reduce greenhouse gas emissions and air pollution

- Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Asia Pacific is witnessing an extensive surge in infrastructure development, driven by the need to accommodate increasing urban populations and support economic growth

- Companies are undertaking M&A activities to accommodate the changing technological trends in the industry. Further strategic expansions, heavy investments in R&D, and new product development have been adopted to bridge the gap in the geographical constraints, end-use requirements, and product offerings. For instance, in April 2022, Doosan Corporation introduced DX27Z-7 2.8-ton and DX35Z-7 3.9-ton Stage V mini-excavators. These models have a greater operating range than the prior generation equipment, competing mini excavators in the market, and stronger lifting capacity and digging forces. These launches have enabled the company to cover a wide range of applications

Key Attributes

| Report Attribute | Details |

| No. of Pages | 120 |

| Forecast Period | 2022-2030 |

| Estimated Market Value (USD) in 2022 | $58.92 Billion |

| Forecasted Market Value (USD) by 2030 | $96.71 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

Key Topics Covered

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Earthmoving Equipment Market Snapshot, 2022 & 2030

2.2. Product Segment Snapshot, 2022 & 2030

2.3. Engine Capacity Segment Snapshot, 2022 & 2030

2.4. Type Segment Snapshot, 2022 & 2030

2.5. Competitive Landscape Snapshot, 2022 & 2030

Chapter 3. Earthmoving Equipment Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Earthmoving Equipment Market - Value Chain Analysis

3.3. Earthmoving Equipment Market - Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.3.3. Market Opportunity Analysis

3.4. Industry Analysis Tools

3.4.1. Earthmoving Equipment Market - Porter's Analysis

3.4.2. Earthmoving Equipment Market - PESTEL Analysis

3.5. Vendor Landscape: ICE vs EV

3.6. Gap Analysis by Manufacturers

3.7. Top 5 Prominent Markets for Construction Equipment

3.8. Consumer Brand Preferences by Region

Chapter 4. Earthmoving Equipment Market Product Outlook

4.1. Earthmoving Equipment Market Share by Product, 2022 & 2030 (USD Million) (Volume, Units)

4.2. Dozer

4.3. Excavator

4.4. Loader

4.5. Motor Grader

4.6. Dump Truck

Chapter 5. Earthmoving Equipment Market Engine Capacity Outlook

5.1. Earthmoving Equipment Market Share by Engine Capacity, 2022 & 2030 (USD Million)

5.2. Up to 250 HP

5.3. 250-500 HP

5.4. More than 500 HP

Chapter 6. Earthmoving Equipment Market Type Outlook

6.1. Earthmoving Equipment Market Share by Type, 2022 & 2030 (USD Million)

6.2. ICE

6.3. Electric

Chapter 7. Earthmoving Equipment Market: Regional Outlook

7.1. Earthmoving Equipment Market Share by Region, 2022 & 2030 (USD Million)

7.2. North America

7.3. Europe

7.4. Asia Pacific

7.5. Latin America

7.6. Middle East & Africa

Chapter 8. Competitive Landscape

8.1. Company Categorization

8.2. Company Market Ranking/Share Analysis, 2022

8.3. Company Heat Map Analysis

8.4. Strategy Mapping

8.5. Company Profiles (Overview, Financial Performance, Product Overview, Strategic Initiatives)

8.5.1. AB Volvo

8.5.2. BEML Limited

8.5.3. Bobcat Company

8.5.4. Caterpillar

8.5.5. CNH Industrial N.V.

8.5.6. Deere & Company

8.5.7. Doosan Corporation

8.5.8. Hitachi Construction Machinery Co. Ltd.

8.5.9. Hyundai Construction Equipment Co. Ltd.

8.5.10. J C Bamford Excavators Ltd.

8.5.11. Kobelco Construction Machinery Co. Ltd

8.5.12. Komatsu Ltd.

8.5.13. LIEBHERR

8.5.14. SANY Group

8.5.15. Sumitomo Heavy Industries, Ltd.

8.5.16. Terex Corporation

8.5.17. XCMG Group

8.5.18. Zoomlion Heavy Industry Science & Technology Co. Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/99ckri

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment