Dublin, Jan. 15, 2024 (GLOBE NEWSWIRE) -- The "Europe Data Protection-as-a-Service Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)" report has been added to ResearchAndMarkets.com's offering.

According to recent market analysis, the burgeoning sector of Data Protection-as-a-Service (DPaaS) in Europe is on a trajectory for significant expansion, expected to double its current valuation of USD 5.22 billion in 2023 to USD 10.32 billion by 2028. Industry experts attribute this growth to a compound annual growth rate (CAGR) of 14.60% during the predictive period of 2023-2028.

The uptake of DPaaS solutions in Europe is fuelled by an intensifying emphasis on third-party risk management, combined with rigorous regulations such as the General Data Protection Regulation (GDPR), pushing enterprises toward robust data protection mechanisms. GDPR compliance and the increasing adoption of cloud technologies multiply the demand for advanced data safeguards.

In the wake of the COVID-19 pandemic, the need for secure data exchange between public entities and healthcare sectors has never been more evident, further propelling the market dynamic for data protection services.

The UK stands at the forefront of this uptrend, with increasing integration of big data and blockchain technologies seen as pivotal factors in advancing DPaaS market penetration. With numerous cyber threats plaguing the region, the need for efficient data protection services has become paramount to preserving data integrity and security.

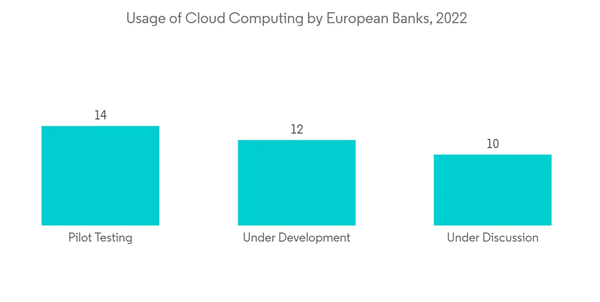

BFSI Industry to Make Significant Strides in Europe's DPaaS Market

- The financial sector's progress in digital transformations necessitates a critical look at data security.

- Innovative solutions, such as Eurobits, facilitate secure banking applications, serving as exemplary cases of industry-specific advancements.

- Major US cloud providers being chosen by European banks bring regional regulations and security demands into sharp focus.

On the competition front, the European DPaaS market exhibits moderate competitiveness with leading players engaged in strategic mergers, acquisitions, and continuous innovation to enhance their offerings. Recent market activities, including acquisitions by top technology companies to strengthen their edge-to-cloud security solutions, are indicative of the market's dynamic environment and its readiness to meet sophisticated cybersecurity challenges.

Key Market Trends

- GDPR's extensive influence in shaping cloud adoption and data protection strategies.

- Heightened awareness and adoption rate across the BFSI Industry and Government Sectors.

- Rise in cyber threats contributes to the amplified need for DPaaS solutions.

- Growing involvement of AI and machine learning to enhance DPaaS features.

The comprehensive report delivers an in-depth assessment of the European DPaaS market, including vital industry trends, current market scenarios, and potential areas of growth. This forward-looking analysis comes as a resourceful guide for industry stakeholders to navigate the complex landscape of data protection.

A selection of companies mentioned in this report includes

- IBM Corporation

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Company

- Dell Technologies

- Cisco Inc.

- Oracle Corporation

- VMware Inc.

- Commvault Systems Inc.

- Veritas Technologies UK Ltd

- Quantum Corporation

- Quest Software UK Ltd

- Hitachi Vantara Corporation

For more information about this report visit https://www.researchandmarkets.com/r/lew57g

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment