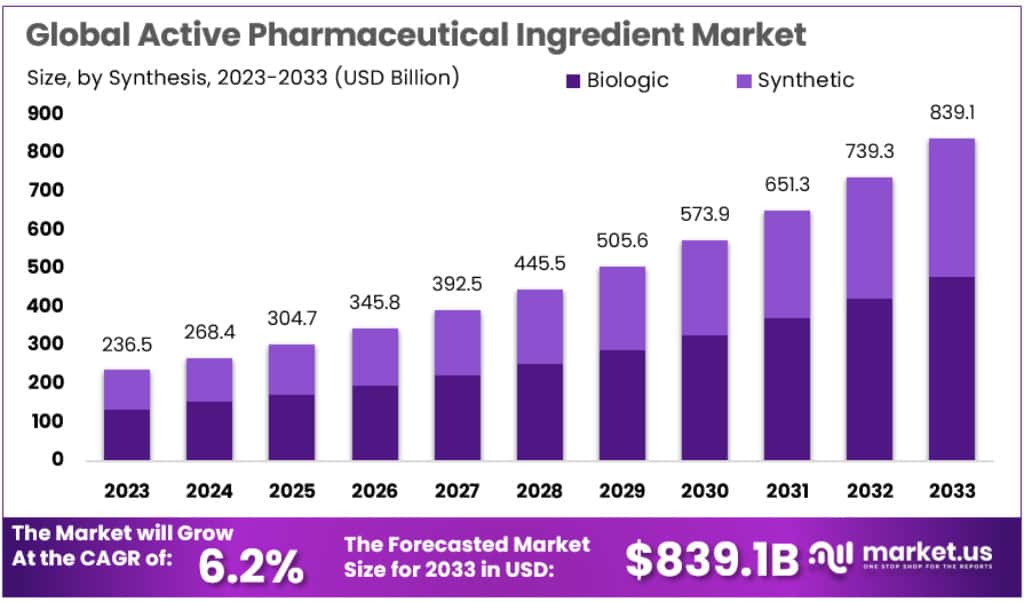

New York, Jan. 23, 2024 (GLOBE NEWSWIRE) -- According to Market.us, the global Active Pharmaceutical Ingredient market size is forecasted to exceed USD 839.1 Billion by 2033, with a promising CAGR of 6.2% from 2024 to 2033.

An Active Pharmaceutical Ingredient (API) refers to any component that induces a biological or direct impact in diagnosing, curing, alleviating, treating, or preventing diseases, or influencing the structure or function of the human or animal body. It serves as the primary element in a pharmaceutical drug responsible for achieving the desired effects.

The report provides a full list of key companies, their strategies, and the latest developments. Download a PDF Sample before buying @ https://market.us/report/active-pharmaceutical-ingredient-market/request-sample/

Key Takeaway:

- The Active Pharmaceutical Ingredient (API) market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 6.2% from 2023 to 2033.

- As of 2023, Synthetic APIs dominate the market, accounting for a significant 68.9% share. Despite having a smaller market share, Biologic APIs are experiencing robust growth.

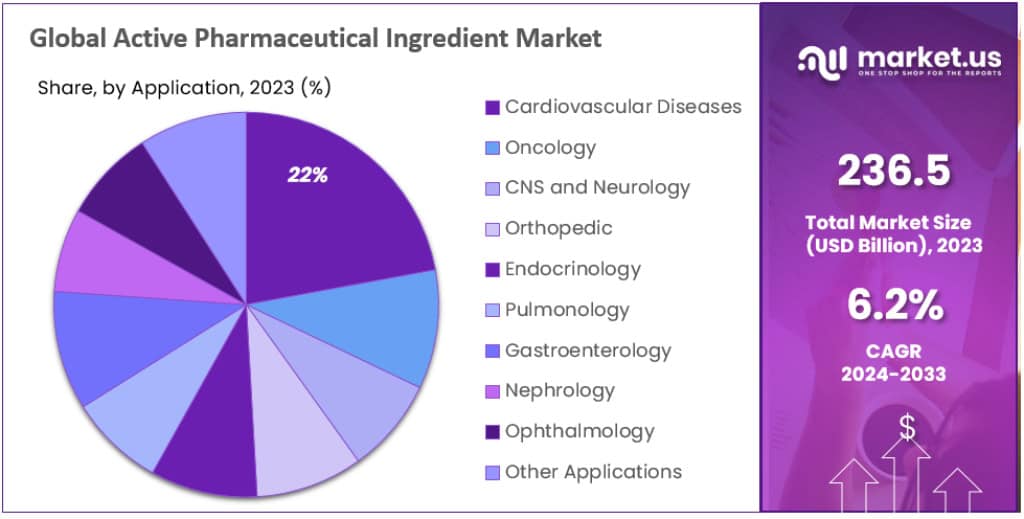

- In terms of API applications, the cardiovascular diseases segment leads with a substantial 22.1% market share in 2023.

- Innovative APIs constitute more than 54% of the market share in 2023, indicating a substantial presence of cutting-edge pharmaceutical developments.

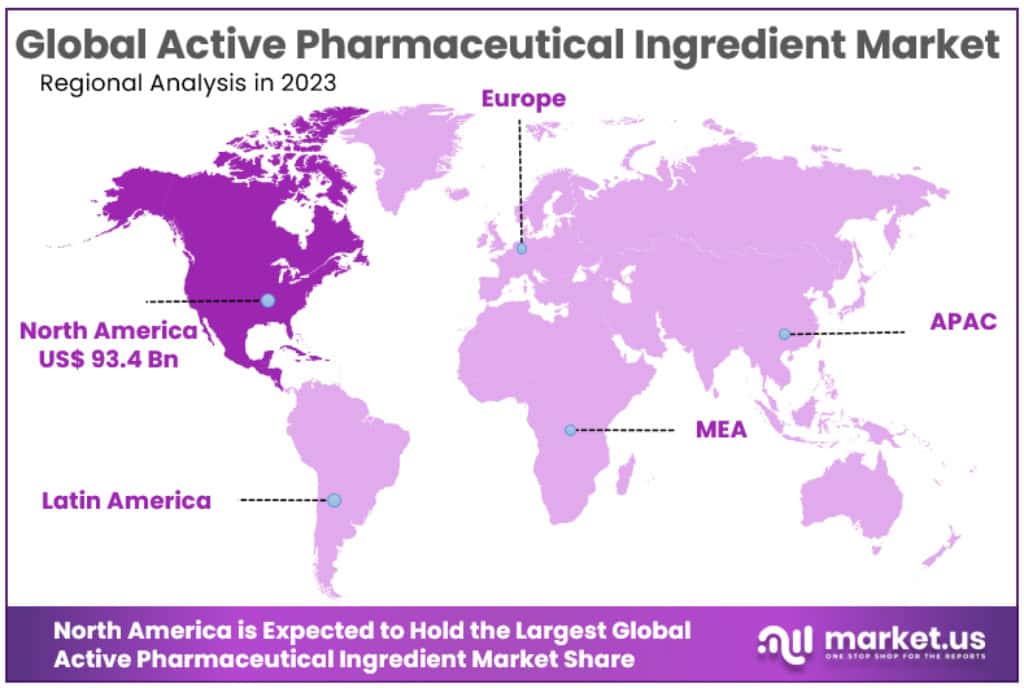

- North America emerges as the leader in market revenue share, holding 39.5% in 2023. Meanwhile, Asia Pacific is projected to experience the fastest growth rate, boasting a CAGR of 8.4%.

Factors affecting the growth of the Active Pharmaceutical Ingredient market

- The increasing demand for innovative and effective medicine has assisted in the growth of the market. with the rising prevalence of health issues, the API market will be propelled into a period of exponential growth.

- With the increasing ANDA approvals have created a demand for APIs, which has fueled the process of market expansion for the API market.

- With Synthetic API gaining popularity, the market of Active Pharmaceutical Ingredients is sure to grow at an unmatched rate.

- Additionally, pharmaceutical companies are seeking powerful ingredients that retain their efficacy even in small doses. This has boosted the growth of the market.

- The tedious approval processes have had a major negative influence on the market growth.

Top Trends in the Global Active Pharmaceutical Ingredient Market:

- The global Active Pharmaceutical Ingredient (API) market is witnessing several prominent trends. There is a growing emphasis on personalized medicine and biopharmaceuticals, leading to increased demand for biologic APIs.

- The industry is experiencing a surge in the development of high-potency APIs (HPAPIs) to address complex diseases. Third, there is a notable shift towards green and sustainable manufacturing practices, aligning with environmental concerns and regulatory expectations.

- Additionally, the market is witnessing strategic collaborations and partnerships among pharmaceutical companies to enhance research capabilities and expand product portfolios. Furthermore, the rising prevalence of chronic diseases is driving the demand for APIs, especially in regions with aging populations.

- Overall, these trends underscore the evolving landscape of the API market, marked by innovation, sustainability, and adaptability to emerging healthcare needs.

Market Growth

The Active Pharmaceutical Ingredient (API) market is experiencing substantial growth propelled by a rising global prevalence of chronic diseases, necessitating an increased demand for pharmaceutical treatments. The continuous emergence of new diseases further intensifies this demand. Regulatory approvals, notably Abbreviated New Drug Applications (ANDA) for generic drugs, play a pivotal role in fueling the market by expanding opportunities for the production of generic medications. However, growth is occasionally hindered by the delayed availability of drugs due to patent expiration, which can impede the market's overall expansion. Moreover, the complexity and cost associated with producing APIs create challenges, particularly for less economically developed countries, emphasizing the need for affordable alternatives to address healthcare needs worldwide. Overall, the API market is shaped by a dynamic interplay of factors, including disease prevalence, regulatory dynamics, and global economic considerations.

Macroeconomic Factors

The Active Pharmaceutical Ingredient (API) market is significantly influenced by various macroeconomic factors. Economic conditions, such as overall GDP growth, inflation rates, and currency exchange rates, play a pivotal role in shaping the market dynamics. Government policies and regulatory frameworks, both domestically and internationally, impact the API market by influencing manufacturing practices, pricing, and market access. Additionally, population demographics, including aging populations and changing disease patterns, contribute to the demand for pharmaceuticals and subsequently affect the API market. Global trade policies, geopolitical stability, and the overall investment climate also shape the industry's trajectory. Furthermore, advancements in technology and research and development funding, influenced by macroeconomic trends, impact the innovation and competitiveness of API manufacturers. Overall, the API market is intricately connected to broader economic factors that influence healthcare spending, research investments, and the ability of pharmaceutical companies to adapt to evolving market conditions.

Regional Analysis

In the year 2023, North America dominated the Active Pharmaceutical Ingredient market, accounting for the largest share of the revenue at 39.5%. It is projected to uphold this leading position throughout the forecast period, maintaining a market value of 93.4 billion USD. The driving force behind this is the increasing incidence of diseases such as cancer and lifestyle-induced illnesses, leading to a surge in Pharmaceutical Research and Development (R&D) investments, consequently bolstering the market.

The Asia Pacific region is expected to witness the highest Compound Annual Growth Rate (CAGR) at 8.4% over the forecast period. This is attributed to the presence of economies like India and China, capable of producing APIs at lower costs. The Active Pharmaceutical Ingredient market is poised for growth due to the escalating healthcare spending in the product segment within the region.

Gain a deeper understanding of how our report can elevate your business strategy. Inquire here: https://market.us/report/active-pharmaceutical-ingredient-market/#inquiry

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 236.5 Billion |

| Forecast Revenue 2033 | USD 839.1 Billion |

| CAGR (2024 to 2033) | 6.2% |

| North America Revenue Share | 39.5% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The global surge in the prevalence of chronic illnesses has led to an increased demand for pharmaceuticals to address these health concerns. As more diseases emerge and the number of individuals with chronic conditions rises, there is a growing need for effective treatments. This heightened demand is a key driver behind the expanding Active Pharmaceutical Ingredient (API) market. APIs, as essential components in drug formulation, play a crucial role in the development of medications to treat a diverse range of health conditions.

Furthermore, the approval of Abbreviated New Drug Applications (ANDA) for generic drugs significantly contributes to the rising demand for APIs. When a generic drug receives the green light through an ANDA, it indicates that it is nearly identical to the brand-name drug and is ready for market entry. The increasing number of these approvals signifies a growing market for generic drugs, subsequently amplifying the demand for the active ingredients, or APIs, that form the backbone of these pharmaceutical formulations. This trend underscores the interdependence between regulatory approvals and the flourishing API market.

Market Restraints

The growth of the pharmaceutical market is often hindered by the delayed availability of drugs due to the expiration of patents. Drug manufacturers are typically required to wait until a drug's patent expires before they can produce generic versions, creating a bottleneck in the market's expansion. This waiting period can impede the introduction of more affordable alternatives and slow down overall market growth. Additionally, the production of Active Pharmaceutical Ingredients (APIs) involves significant financial investments and adherence to stringent regulatory requirements, posing challenges for some countries that may struggle to meet these demands. Consequently, there is an increased demand for cost-effective alternatives, especially in less affluent nations where accessibility to essential treatments remains a critical concern.

Market Opportunities

The pharmaceutical landscape is witnessing a notable surge in the popularity of synthetic Active Pharmaceutical Ingredients (APIs), crucial components in drug manufacturing processes. There is a distinct emphasis on producing safe medications for pediatric use, aligning with a broader focus on "small molecule" drugs. Regulators have consistently expressed approval for these smaller-scale drug formulations, indicating a favorable trend likely to persist. Concurrently, pharmaceutical companies are seeking potent APIs that demonstrate efficacy at low doses, ensuring not only enhanced therapeutic performance but also precise targeting within the body. The high demand for such powerful APIs presents a significant opportunity for API manufacturers to distinguish themselves in the competitive pharmaceutical market.

Get Immediate Delivery | Secure Your Copy of This High-Quality Research Report Now https://market.us/purchase-report/?report_id=22857

Report Segmentation of the Active Pharmaceutical Ingredient Market

Synthesis Insight

In 2023, Synthetic APIs secured a significant market dominance, comprising over 68.9% of the market share. This dominance is attributed to the broad range of generics available and the advanced level of chemical synthesis technology. The production of synthetic APIs is advantaged by efficient regulatory pathways and cost-efficient manufacturing processes, contributing to their robust presence in the market.

Application Insight

In 2023, the cardiovascular segment emerged as a leading force in the Active Pharmaceutical Ingredient (API) sector, commanding over a 22.1% market share. This dominance is driven by the widespread occurrence of cardiovascular diseases globally, supported by the continual introduction of cutting-edge therapies for cardiac conditions. The significance of producing and advancing APIs for cardiovascular ailments remains crucial, addressing the ongoing demand for efficacious treatment alternatives.

Type Insight

In 2023, Innovative APIs established a prominent position in the market, securing over a 54% share. This segment thrives on robust patent protections and substantial investments in the development of new drugs, showcasing the pharmaceutical industry's dedication to pioneering treatments. The demand for innovative APIs is driven by the imperative for advanced therapeutics in addressing complex diseases.

To understand Geography Trends, Download Sample Report Here @ https://market.us/report/active-pharmaceutical-ingredient-market/request-sample/

Recent Development of the Active Pharmaceutical Ingredient Market:

- In December 2023, Pfizer and Acuitas Therapeutics form a partnership to develop a lipid nanoparticle delivery system for mRNA vaccines, with the goal of expanding the global distribution of Pfizer's mRNA vaccines.

- In January 2023, Sanofi and IGM Biosciences establish a strategic collaboration to advance the development and commercialization of IgM antibody agonists, potentially leading to improved treatments in the fields of oncology, immunology, and inflammation.

- In February 2023, Merck discloses positive outcomes from the Phase 1 clinical trial of MK-3201 in patients with advanced solid tumors, indicating favorable tolerance and promising efficacy for this innovative cancer therapy.

- In March 2023, Novartis unveils encouraging Phase 3 results for Canakinumab, demonstrating its effectiveness and safety in preventing angioedema attacks in individuals with Hereditary Angioedema.

- In April 2023, Eli Lilly releases data from Phase 3 trials for Verzenio in advanced HER2-Positive breast cancer patients, showcasing its potential as an effective and well-tolerated treatment option.

Market Segmentation

By Synthesis

- Biologic

- Synthetic

By Application

- Cardiovascular Diseases

- Oncology

- CNS and Neurology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

- Other Applications

By Type

- Generic

- Innovative

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The market for highly potent active pharmaceutical ingredients (APIs) is characterized by high complexity. The active Teva pharmaceutical ingredients segment, within the API market, faces intricate challenges. Factors contributing to this complexity include the imminent expiration of patents for blockbuster drugs, leading to increased outsourcing activities driven by elevated manufacturing costs. Additionally, stringent regulations governing API production contribute to a competitive landscape throughout the forecast period.

To sustain their market positions, key players with advantages are concentrating on introducing new features within product segments. Notably, Teva pharmaceutical companies and MEDinCell received approval from the U.S. FDA in 2021 for a novel medication designed to treat schizophrenia. However, the establishment of new API facilities encounters obstacles, including legal issues that impede progress.

Market Key Players

- Merck & Co., Inc.

- AbbVie, Inc.

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Cipla, Inc.

- Teva Pharmaceutical Industries Ltd.

- Albemarle Corporation

- Viatris Inc.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

- Reddy’s Laboratories Ltd.

- Other Key Players

Browse More Related Reports

- Asia-Pacific Active Pharmaceutical Ingredient Market is projected to be US$ 7,781.1 Mn in 2021 to reach US$ 12,335.1 Mn by 2030 at a CAGR of 5.3%.

- Pharmaceutical Excipients Market size is expected to be worth around USD 11.8 bn by 2032 from USD 6.8 bn in 2022, with growing CAGR of 5.8%

- Biopharmaceutical CMO Market size is expected to be worth around USD 53.08 bn by 2032 from USD 16.2 bn in 2022, CAGR of 12.6%

- Radiopharmaceuticals market size is expected to be worth around US$ 10.3 Bn by 2032 from US$ 4.5 Bn in 2022 at a CAGR of 8.85%.

- Pharmaceutical Cartridges Market size is estimated to reach around USD 3.4 Bn by 2032 from USD 1.7 Bn in 2022, at a CAGR of 7.5% (2023-2032).

- HLA Typing Market size is expected to be worth around USD 2.2 Billion by 2032 from USD 1.2 Billion in 2022, growing at a CAGR of 6.4%

- Implantable Cardioverter Defibrillator Market Size Is Expected To Be Worth Around USD 7.7 Bn By 2032 From USD 4.1 Bn In 2022

- Minimally Invasive Surgical Instruments Market is expected to be worth around USD 86.8 Bn by 2032, from USD 35.1 Bn in 2023

- Cosmetic Dentistry Market size is expected to be worth around USD 145.3 Billion by 2033, from USD 38.5 Billion in 2023

- Cancer Diagnostics Market is expected to grow at a CAGR of 7% over the next ten years and will reach US$ 332.4 Bn in 2032

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn

Our Blog: